Recovery Rebate Credit 2024 Tax Return 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified taxpayers can also find free one on one tax preparation help nationwide through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs

SOLVED by TurboTax 716 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax Currently for 2023 if the child tax credit exceeds a taxpayer s tax liability they may receive up to 1 600 of the credit as a refund based on an earned income formula calculated as 15 percent of earned income above 2 500 The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000

Recovery Rebate Credit 2024 Tax Return

Recovery Rebate Credit 2024 Tax Return

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

Tax Credits In 2022 How To Claim The Recovery Rebate Credit

https://www.greenbacktaxservices.com/wp-content/uploads/2022/03/Recovery-Rebate-Credit-for-US-expats.jpg

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit.jpg

IRS gov rrc It s Not Too Late to Claim the 2020 2021 Recovery Rebate Credit When You Don t Normally File a Tax Return Most eligible people already received their stimulus payments and are not eligible to claim a credit If you re eligible and didn t receive the full 2020 or 2021 Economic Impact Payments you may be eligible to claim the How To Claim A Missing Stimulus Check Using The Recovery Rebate Credit Kemberley Washington Editor Reviewed By Korrena Bailie editor Updated Apr 27 2023 9 36am Editorial Note We earn a

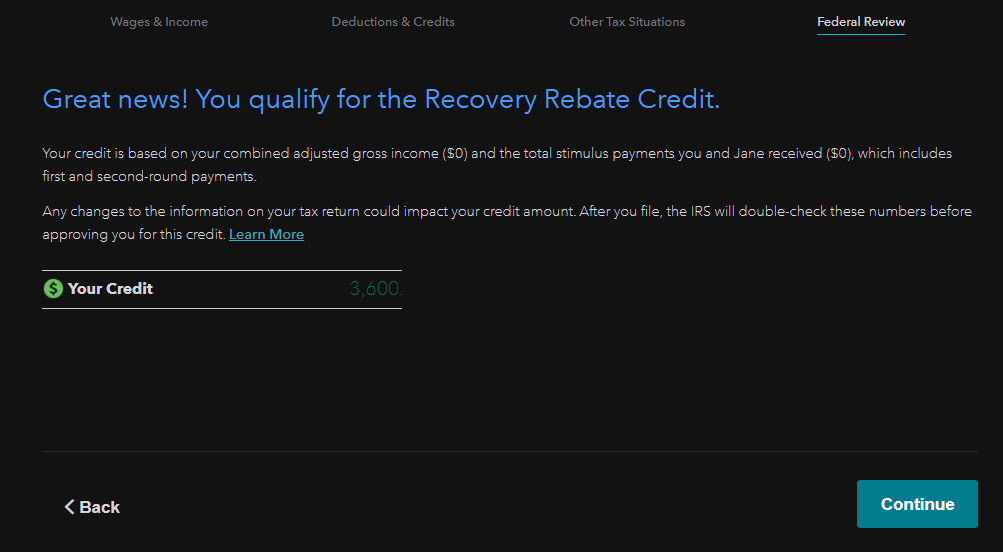

Flexible Income Lookback Taxpayers can choose to use either current or prior year income to calculate the child tax credit in 2024 and 2025 providing flexibility in determining eligibility Inflation Adjustment Starting in 2024 the child tax credit will be adjusted for inflation to keep up with the rising cost of living Business tax relief Features What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax

Download Recovery Rebate Credit 2024 Tax Return

More picture related to Recovery Rebate Credit 2024 Tax Return

Recovery Rebate Credit Line 30 Form 1040 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Recovery Rebate Credit 2021 Tax Return

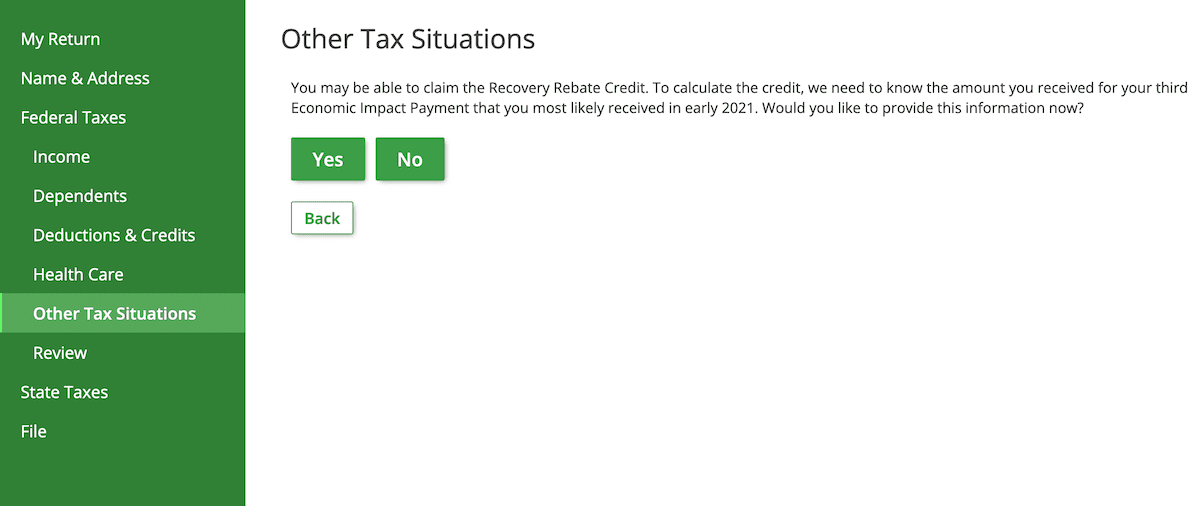

https://www.efile.com/image/other-taxes-2.png

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/it-s-not-too-late-claim-a-recovery-rebate-credit-to-get-your-27.png

Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return The American Rescue Plan Act of 2021 enacted March 11 2021 provides a 2021 Recovery Rebate Credit RRC which can be claimed on 2021 Individual Income Tax Returns It also provides for an advanced payment of the RRC in calendar year 2021 through payments that are referred to as Economic Impact Payments EIP3 similar to what was done in

If you re one of the many U S expats who are owed stimulus money you can still claim it through Recovery Rebate Credit As the matter of fact 2024 is the last year to get all the stimulus checks you might have missed It will either boost the amount of your tax refund or reduce the taxes you owe to A Guide To Recovery Rebate Credit For U S Expats You May Still Be Able To Claim This Credit Scenario 3 Recovery Rebate Credit and a new baby Jo and Nic married in January 2020 and had a baby in October 2020 They were both single on their 2019 returns and they each received 1 200 in first round of stimulus checks in 2020 When they file their 2020 return they will claim their child on the return and determine they should

2020 Recovery Rebate Credit FAQs Updated Jensen Tax Accounting LLC

https://jensentax.net/wp-content/uploads/2021/12/2020-recovery-rebate-credit-faqs-updated.png

What Is A Recovery Rebate Tax Credit The TurboTax Blog

https://blog.turbotax.intuit.com/wp-content/uploads/2020/12/what-is-a-recovery-rebate-tax-credit.jpg?w=600&h=1068&crop=1

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified taxpayers can also find free one on one tax preparation help nationwide through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs

https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-credits-deductions/refund-adjusted-claiming-recovery-rebate-credit/L6nvkjniG_US_en_US

SOLVED by TurboTax 716 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax

Recovery Rebate Credit Cg Tax Audit Advisory

2020 Recovery Rebate Credit FAQs Updated Jensen Tax Accounting LLC

Recovery Rebate Credit How To Get It Taxes For Expats US Expat Tax Service

How To Claim Stimulus Recovery Rebate Credit On TurboTax

How To Claim The 2021 Recovery Rebate Credit On Tax Return

What Is The Recovery Rebate Credit 2023 Detailed Information

What Is The Recovery Rebate Credit 2023 Detailed Information

The Recovery Rebate Tax Credit Are You Eligible Silver Tax Group

Stimulus Check Recovery Rebate Credit And More How To File Your 2020 Tax Return Online To Get

Military Journal Ri Child Tax Rebate Child Tax Credits Are One Of The Most Important Ways

Recovery Rebate Credit 2024 Tax Return - Generally you are eligible to claim the Recovery Rebate Credit if You were a U S citizen or U S resident alien in 2021 You are not a dependent of another taxpayer for tax year 2021 You have a Social Security Number valid for employment that is issued before the due date of your 2021 tax return including extensions