Recovery Rebate Credit 2024 Taxes The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

Recovery Rebate Credit 2024 Taxes

Recovery Rebate Credit 2024 Taxes

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Blog Taxes Check Your Recovery Rebate Credit Eligibility Edward Z Estrin CPA

https://www.edwardzestrincpa.com/static/18f39a9f0691e25dbc35fecf07d5734b/de8d1/recovery-rebate-2-hero.jpg

Recovery Rebate Credit On The 2020 Tax Return

https://www.taxgroupcenter.com/wp-content/uploads/2021/05/Recovery-rebate-credit.jpg

The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner The IRS has issued a reminder to those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money before the deadline I know what you re thinking wasn t

Download Recovery Rebate Credit 2024 Taxes

More picture related to Recovery Rebate Credit 2024 Taxes

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

FAQs And Answers For 2021 Recovery Rebate Credit

https://selectstudentservices.com/wp-content/uploads/2022/02/pexels-pixabay-534229.jpg

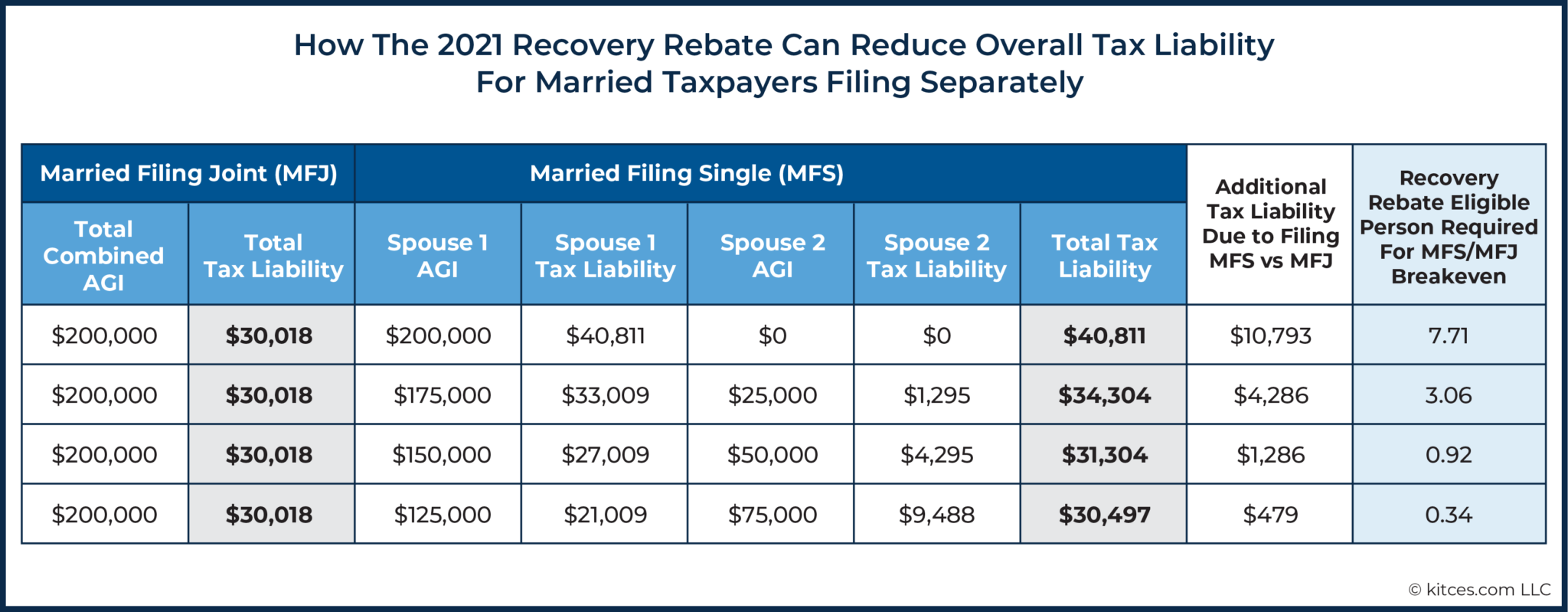

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

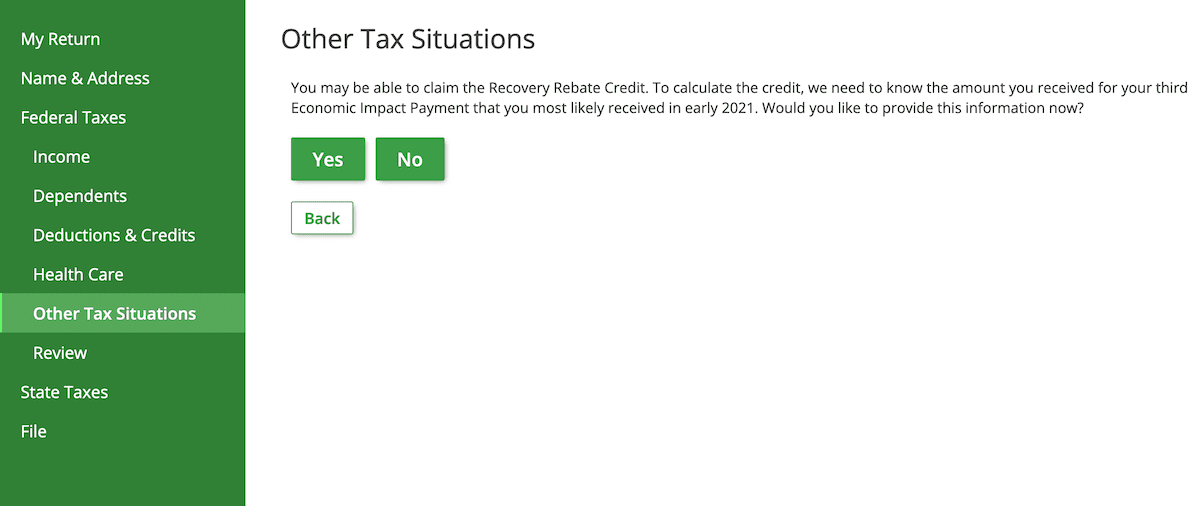

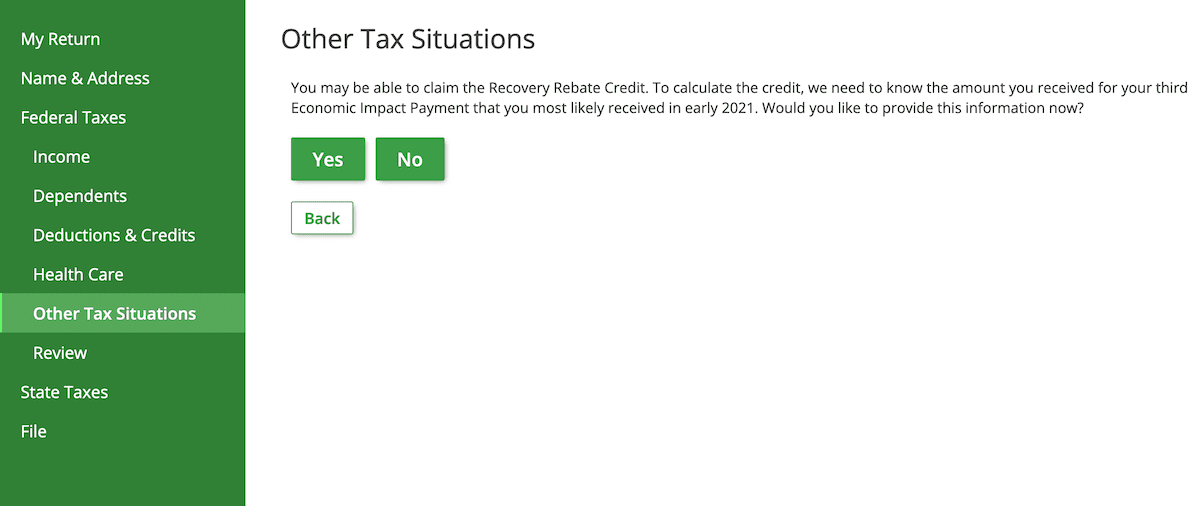

Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments For 2023 taxes filed in 2024 the

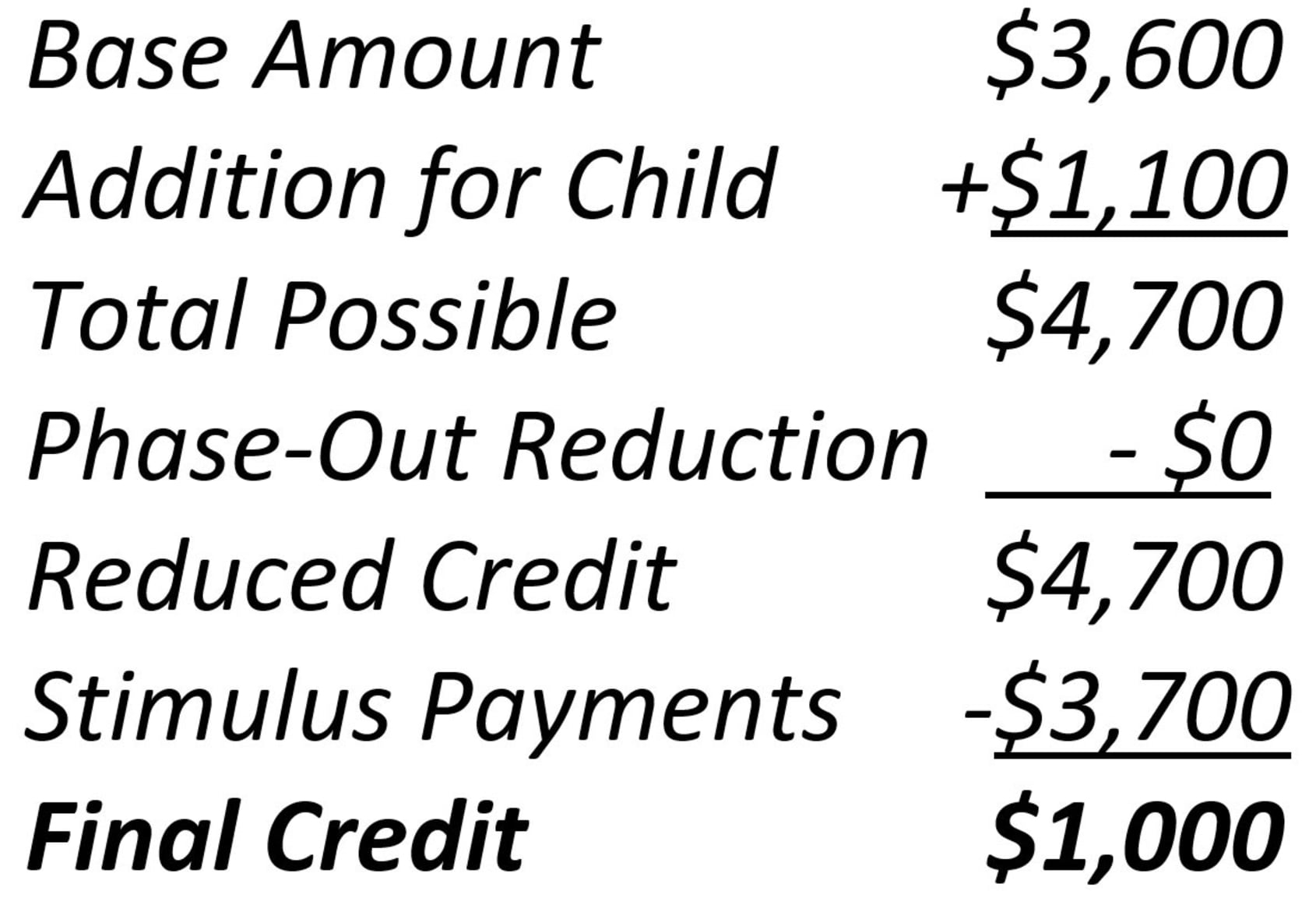

Scenario 3 Recovery Rebate Credit and a new baby Jo and Nic married in January 2020 and had a baby in October 2020 They were both single on their 2019 returns and they each received 1 200 in first round of stimulus checks in 2020 When they file their 2020 return they will claim their child on the return and determine they should Dependent care tax credits and made changes to the Earned Income Tax Credits 3Excludes Recovery Rebate Credits associated with all Economic Impact Payments FY 2021 Budget Authority 38 512M of which 23 4 03M was obligated in FY 2021 12 673M was obligated in FY 2022 2 236M is estimated to be obligated in FY 2023 and 200M estimate d in FY

Recovery Rebate Credit 2021 Tax Return

https://www.efile.com/image/other-taxes-2.png

Recovery Rebate Credit Form Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2022/04/Recovery-Rebate-Credit-Form-2023.png

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

https://tax.thomsonreuters.com/blog/understanding-the-tax-relief-for-american-families-and-workers-act-of-2024/

On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

IRS Issues Information For 2021 Recovery Rebate Credit

Recovery Rebate Credit 2021 Tax Return

Missing Stimulus Check Money How To Claim The Recovery Rebate Credit On Your Taxes CBNC

The Recovery Rebate Credit Calculator ShauntelRaya

Can I Claim Recovery Rebate Credit In 2023 Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit How To Get It Taxes For Expats US Expat Tax Service

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

Recovery Rebate Credit 2024 Taxes - The proposal would increase the 1 600 limit on refundability to 1 800 for tax year 2023 1 900 in 2024 and 2 000 in 2025 as well as apply an inflation adjustment in 2025 that would make the cap match the credit maximum of 2 100 It would also quicken the phase in for taxpayers with multiple children and allow taxpayers an election to use