Recovery Rebate Credit 2024 Turbotax TurboTax Taxes Tax reports Why was my refund adjusted after claiming the Recovery Rebate Credit TurboTax Help Intuit Why was my refund adjusted after claiming the Recovery Rebate Credit SOLVED by TurboTax 716 Updated November 23 2023

IRS Statements and Announcements Page Last Reviewed or Updated 05 Dec 2023 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received less than the full amount you may be eligible for the 2020 Recovery Rebate Credit RRC Generally the credit can increase your refund amount or lower the taxes you may owe

Recovery Rebate Credit 2024 Turbotax

Recovery Rebate Credit 2024 Turbotax

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

https://www.irsofficesearch.org/wp-content/uploads/2021/02/recovery-rebate-credit.png

Recovery Rebate Credit With this option enabled the Recovery Rebate Credit Worksheet won t be added to your returns automatically During final review a diagnostic will generate informing you that stimulus payments should be entered if the client didn t receive all EIP they were entitled to You can always add the worksheet to a return If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

The 2021 Child Tax Credit is up to 3 600 for each qualifying child Eligible families including families in Puerto Rico can claim the credit through April 15 2025 by filing a federal tax return even if they don t normally file and have little or no income 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3

Download Recovery Rebate Credit 2024 Turbotax

More picture related to Recovery Rebate Credit 2024 Turbotax

What Section Is The Recovery Rebate Credit On Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-30.png?fit=924%2C568&ssl=1

Recovery Rebate Credit On The 2022 Tax Return Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/turbotax-recovery-rebate-credit-form-printable-rebate-form-14.jpg

What Is The 2020 Recovery Rebate Credit And Am I Eligible TurboTax Tax Tips Videos

https://digitalasset.intuit.com/content/dam/intuit/cg/en_us/turbotax/tax-tips/images/general/what_is_the_recovery_rebate_credit_and_am_i_eligible.jpg

Even if you don t file taxes you can still file for the recovery rebate credit with the 1040 form but at this point the filing lines for the IRS aren t even open yet As your AGI increases over 75 000 150 000 married filing jointly the stimulus amount will go down The stimulus check rebate will completely phase out at 87 000 for single filers with no qualifying dependents and 174 000 for those married filing jointly with no dependents The same eligibility rules apply to the second stimulus payment

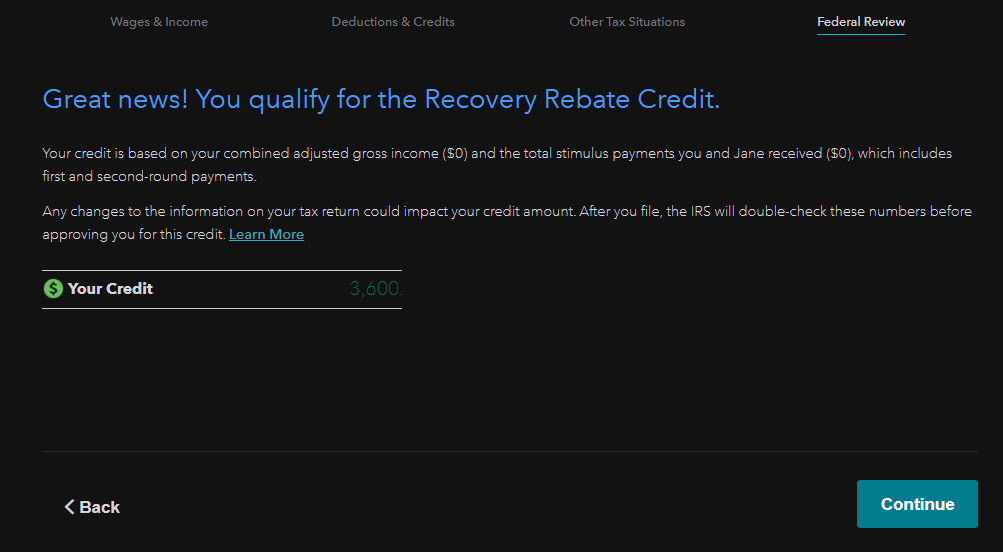

In TurboTax Online to claim the Recovery Rebate credit please do the following Sign into your account and continue from where you left off Click on Federal in the left hand column then on Federal Review on the top of the screen On the next page titled Let s make sure you got the right stimulus amount click on Continue If a correction is needed the IRS will calculate the correct amount of the 2020 or 2021 Recovery Rebate Credit make the correction to the tax return and continue processing it There s no need at this point to amend your return unless you didn t claim the Rebate Recovery Credit at all and were entitled to claim it

Recovery Rebate Credit Form Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/2022-tax-form-1040es.jpg

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

https://ttlc.intuit.com/turbotax-support/en-us/help-article/tax-credits-deductions/refund-adjusted-claiming-recovery-rebate-credit/L6nvkjniG_US_en_US

TurboTax Taxes Tax reports Why was my refund adjusted after claiming the Recovery Rebate Credit TurboTax Help Intuit Why was my refund adjusted after claiming the Recovery Rebate Credit SOLVED by TurboTax 716 Updated November 23 2023

https://www.irs.gov/newsroom/recovery-rebate-credit

IRS Statements and Announcements Page Last Reviewed or Updated 05 Dec 2023 Eligible individuals can claim the Recovery Rebate Credit on their Form 1040 or 1040 SR These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit

Where To Enter Recovery Rebate Credit In Turbotax Recovery Rebate

Recovery Rebate Credit Form Turbotax Recovery Rebate

Recovery Rebate Credit 2023 2024 Credits Zrivo

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

What Is The Recovery Rebate Credit 2023 Detailed Information

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style Worksheets

Recovery Rebate 2023 Turbotax Recovery Rebate

Recovery Rebate Credit 2024 Turbotax - As with the stimulus checks calculating the amount of your recovery rebate credit starts with a base amount For most people the base amount for the 2021 credit is 1 400 For married couples