Recovery Rebate Credit Application Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

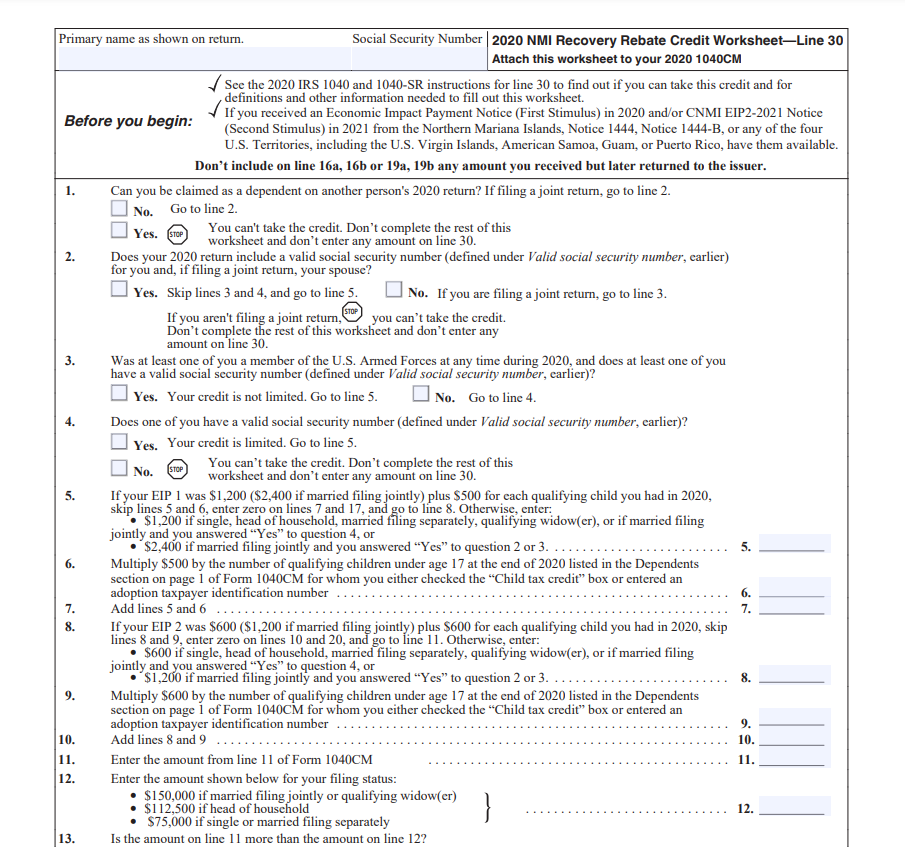

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Recovery Rebate Credit Application

Recovery Rebate Credit Application

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

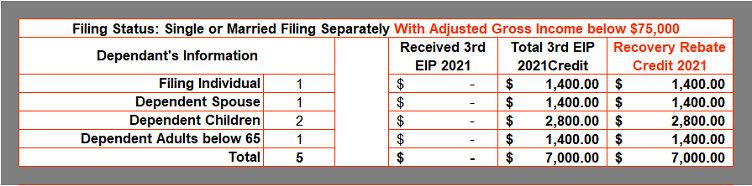

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/the-recovery-rebate-credit-calculator-shauntelraya-2.png?resize=768%2C472&ssl=1

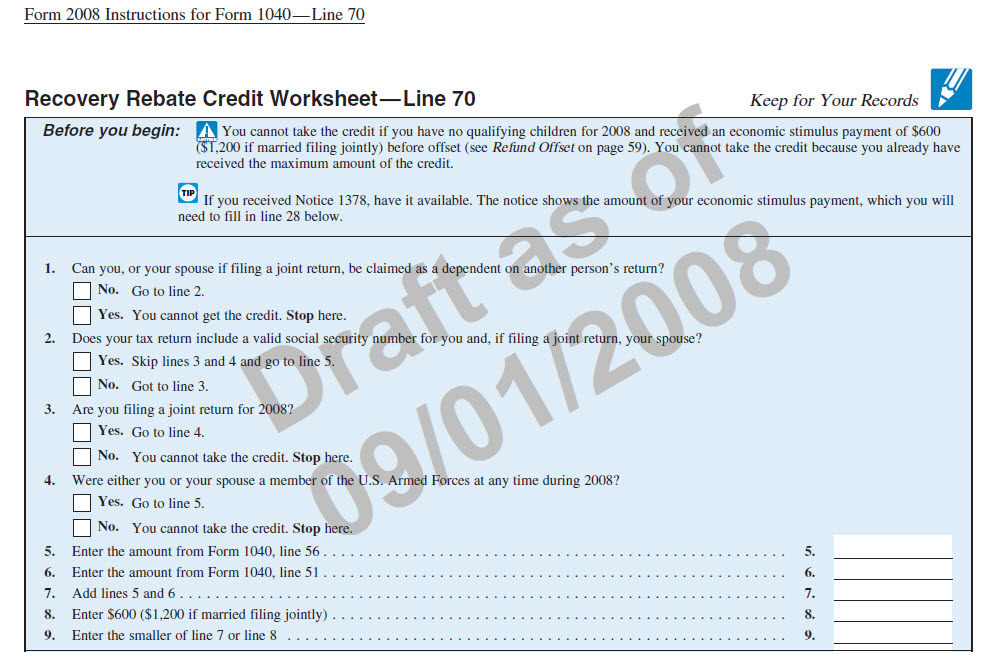

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/kb.erosupport.com/assets/img_5ffe32d18d56f.png

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the Web 22 mars 2023 nbsp 0183 32 You can no longer use the Get My Payment application to check your payment status How to Claim a Missing Payment You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021

Web 15 janv 2021 nbsp 0183 32 IR 2021 15 January 15 2021 WASHINGTON IRS Free File online tax preparation products available at no charge launched today giving taxpayers an early Web 31 janv 2023 nbsp 0183 32 This letter helps EIP recipients determine if they re eligible to claim the Recovery Rebate Credit on their 2021 tax year returns This letter provides the total

Download Recovery Rebate Credit Application

More picture related to Recovery Rebate Credit Application

Irs Form 1040 Recovery Rebate Credit IRSUKA Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-form-1040-recovery-rebate-credit-irsuka-8.png?fit=1060%2C795&ssl=1

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

Recovery Rebate Credit Worksheet 2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-worksheet-youtube.jpg

Web 17 ao 251 t 2022 nbsp 0183 32 What Was the Recovery Rebate Credit The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim

Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 Web 27 avr 2023 nbsp 0183 32 You can claim missing or partial first and second round stimulus payments only on your 2020 federal tax return Any missing or partial third round stimulus

Irs gov Recovery Rebate 1040 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-1040-form-recovery-rebate-credit-irs-releases-draft-of-form-1040.png?w=486&h=629&ssl=1

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Firestone Rebates 2023 Printable Rebate Form Recovery Rebate

Irs gov Recovery Rebate 1040 Recovery Rebate

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

1040 Line 30 Recovery Rebate Credit Recovery Rebate

2023 Recovery Rebate Form Recovery Rebate

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Recovery Rebate Credit H And R Block Recovery Rebate

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Worksheet Pdf Recovery Rebate

Recovery Rebate Credit Application - Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that