Recovery Rebate Credit Delaying Tax Refund Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 6 avr 2021 nbsp 0183 32 The Internal Revenue Service is correcting plenty of mistakes that are being made after people plug in the wrong number for the Recovery Rebate Credit on their Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic

Recovery Rebate Credit Delaying Tax Refund

Recovery Rebate Credit Delaying Tax Refund

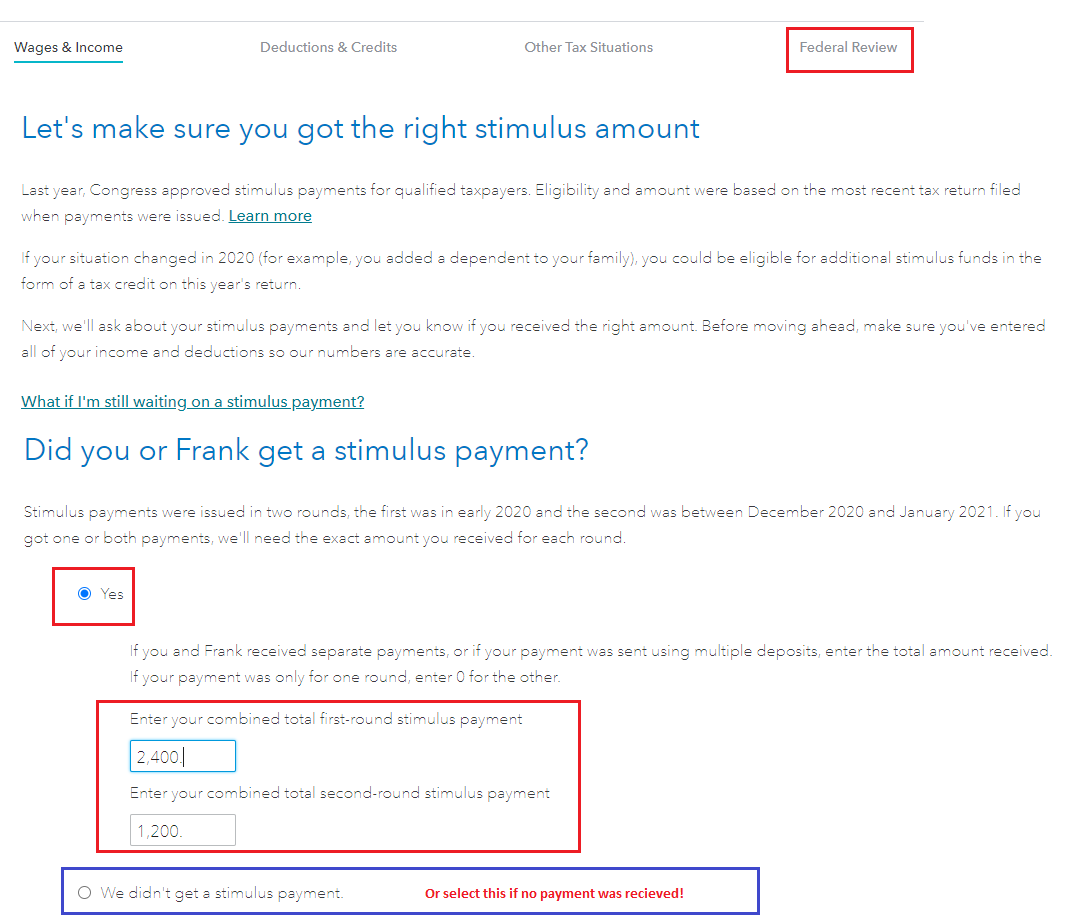

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

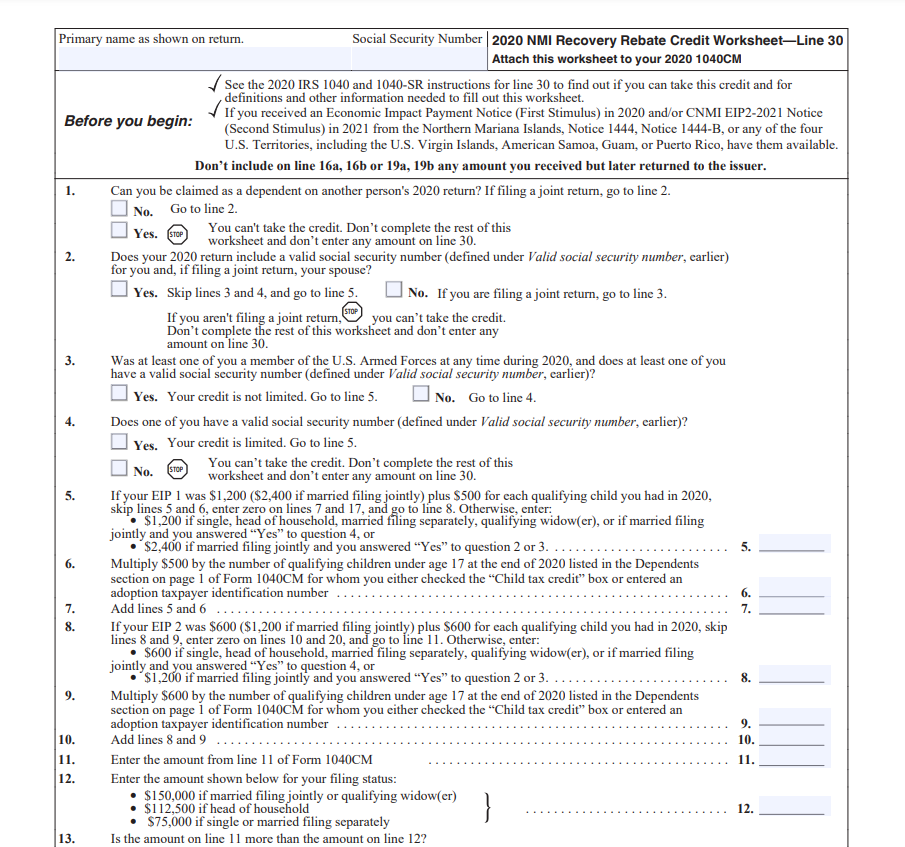

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

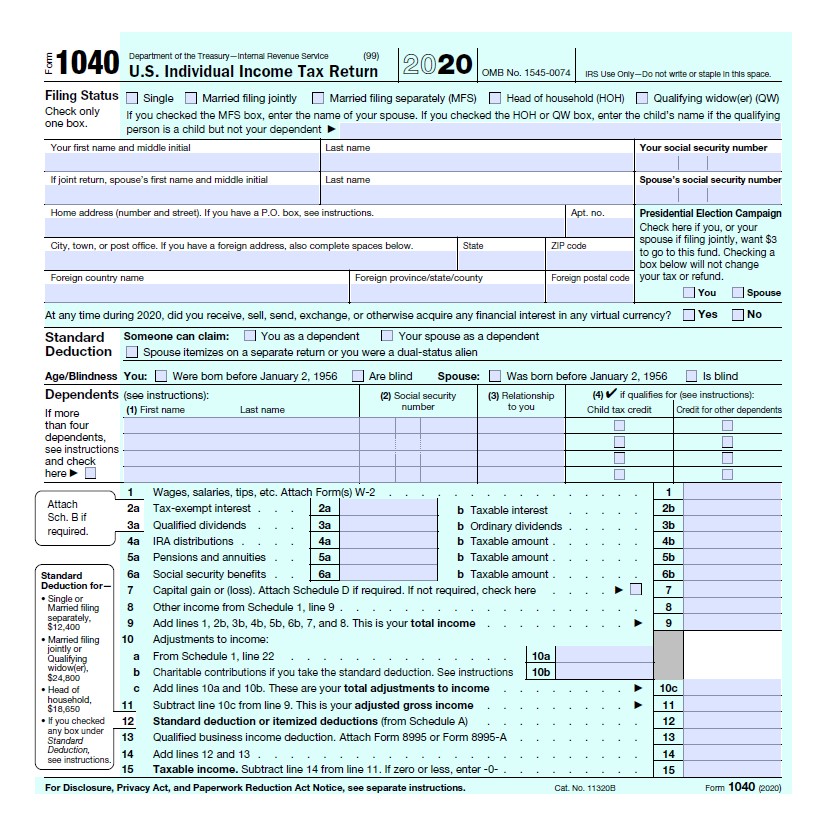

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Web Rebate Credit and must file a 2021 tax return even if you don t usually file taxes to claim it Your 2021 Recovery Your 2021 Recovery Rebate Credit will reduce any tax you Web 6 mai 2021 nbsp 0183 32 May 6 2021 6 49 AM MoneyWatch The IRS is holding 29 million tax returns for manual processing delaying tax refunds for many Americans according to the

Web 24 f 233 vr 2023 nbsp 0183 32 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction Web 19 oct 2021 nbsp 0183 32 Many people are filing tax returns using the Recovery Rebate Credit RRC stating that they never received either payment The RRC then is supposed to be baked

Download Recovery Rebate Credit Delaying Tax Refund

More picture related to Recovery Rebate Credit Delaying Tax Refund

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

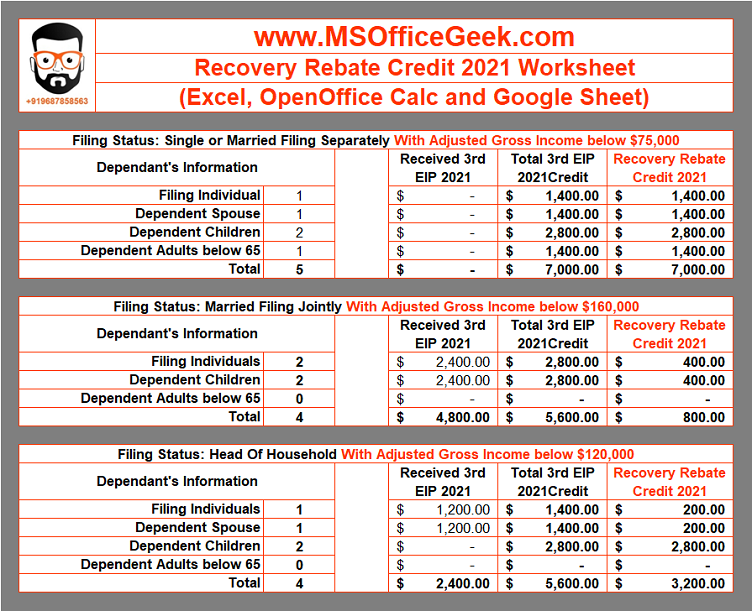

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Web 1 janv 2021 nbsp 0183 32 To claim a recovery rebate credit taxpayers will need to reconcile their economic impact payment with any recovery rebate credit amount for which they are Web 13 janv 2022 nbsp 0183 32 One of the most common hiccups during processing last year was taxpayers claiming the Recovery Rebate Credit in order to receive their stimulus money Even if

Web You are here Home News amp Announcements Expect Refund Delays if You News amp Announcements Tax Services Taxpayers who did not receive their first or second Web 19 f 233 vr 2021 nbsp 0183 32 February 19 2021 No income Or you usually don t have to file If you didn t get any Economic Impact Payments or got less than the full amounts you may be

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.freep.com/.../irs-tax-return-recovery-rebate-credit/7095670002

Web 6 avr 2021 nbsp 0183 32 The Internal Revenue Service is correcting plenty of mistakes that are being made after people plug in the wrong number for the Recovery Rebate Credit on their

1040 Recovery Rebate Credit Drake20

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Track Your Recovery Rebate With This Worksheet Style Worksheets

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

When To Anticipate My Tax Refund The 2023 Refund Calendar MicroTechr

When To Anticipate My Tax Refund The 2023 Refund Calendar MicroTechr

What Is The Recovery Rebate Credit CD Tax Financial

30 Recovery Rebate Worksheet Worksheets Decoomo

10 Recovery Rebate Credit Worksheet

Recovery Rebate Credit Delaying Tax Refund - Web 18 d 233 c 2022 nbsp 0183 32 Recovery Rebate Credit Refund Delay December 18 2022 by tamble Recovery Rebate Credit Refund Delay The Recovery Rebate offers taxpayers the