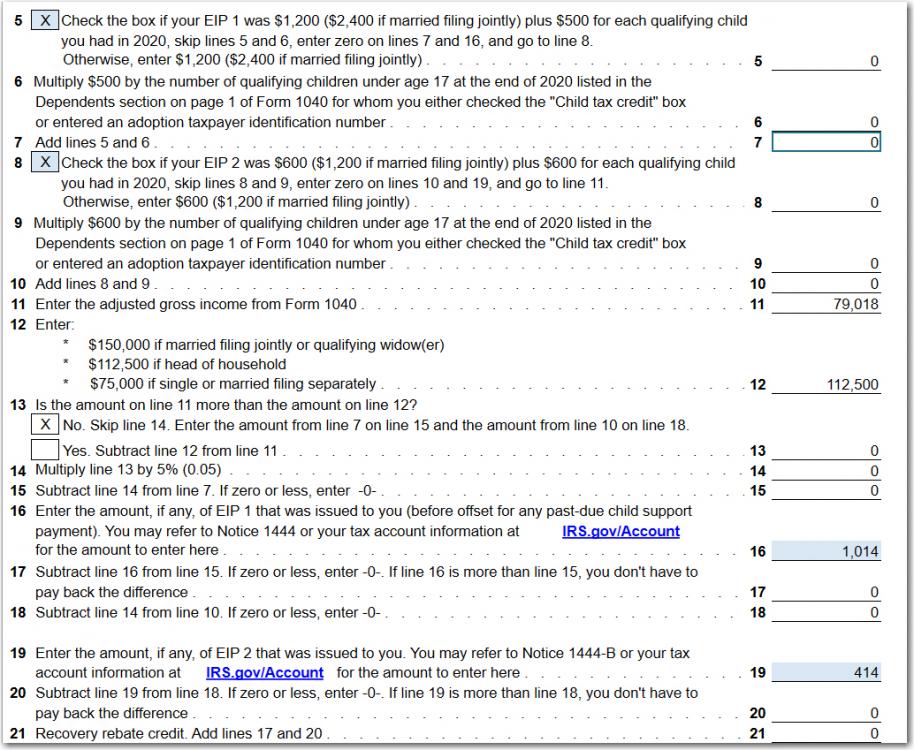

Recovery Rebate Credit Eip Web 17 f 233 vr 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim Web 20 d 233 c 2022 nbsp 0183 32 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax

Recovery Rebate Credit Eip

Recovery Rebate Credit Eip

https://stimulusmag.com/wp-content/uploads/2022/12/what-is-the-irs-recovery-rebate-credit.jpg

Get To Know Your IRS Account And Know Your EIP Recovery Rebate Credit

https://i.ytimg.com/vi/5d5VfQXE4oE/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGBMgTyh_MA8=&rs=AOn4CLDsaYXSnUIC1S--76DGZxVf9RK4Qw

Eip Recovery Rebate Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/economic-impact-payment-eip-recovery-rebate-credit-rrc-tax.jpg

Web 15 mars 2023 nbsp 0183 32 Didn t Get the Full Third Payment Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the Web 14 janv 2022 nbsp 0183 32 On Thursday the IRS posted a new FAQ page that delves further into the Recovery Rebate Credit Taxpayers who didn t qualify for or didn t receive the full

Web 16 nov 2022 nbsp 0183 32 Taxpayers who received the full amounts of both Economic Impact Payments won t claim the Recovery Rebate Credit or include any information about the Web 18 d 233 c 2022 nbsp 0183 32 December 18 2022 by tamble Eip Recovery Rebate Credit The Recovery Rebate allows taxpayers to get a tax refund without the need to alter the

Download Recovery Rebate Credit Eip

More picture related to Recovery Rebate Credit Eip

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/the-recovery-rebate-credit-calculator-shauntelraya-2.png?resize=768%2C472&ssl=1

EIP Payment 3 And Recovery Rebate Credit 2021 Taxes ARPA CrossLink

https://support.crosslinktaxtech.com/hc/article_attachments/9480836803991

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/kb.erosupport.com/assets/img_5ffe32d18d56f.png

Web 2 sept 2022 nbsp 0183 32 Your income will affect the amount of your recovery rebate credit Your credit rating will decrease to zero if the income exceeds 75 000 Joint filers credit will Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit includes up to an additional 1 400 for each qualifying dependent you claim on your 2021 tax return A qualifying dependent is

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 15 avr 2021 nbsp 0183 32 Economic Impact Payments EIPs also known as stimulus payments and the related Recovery Rebate Credits RRCs are essentially divided into two tax years

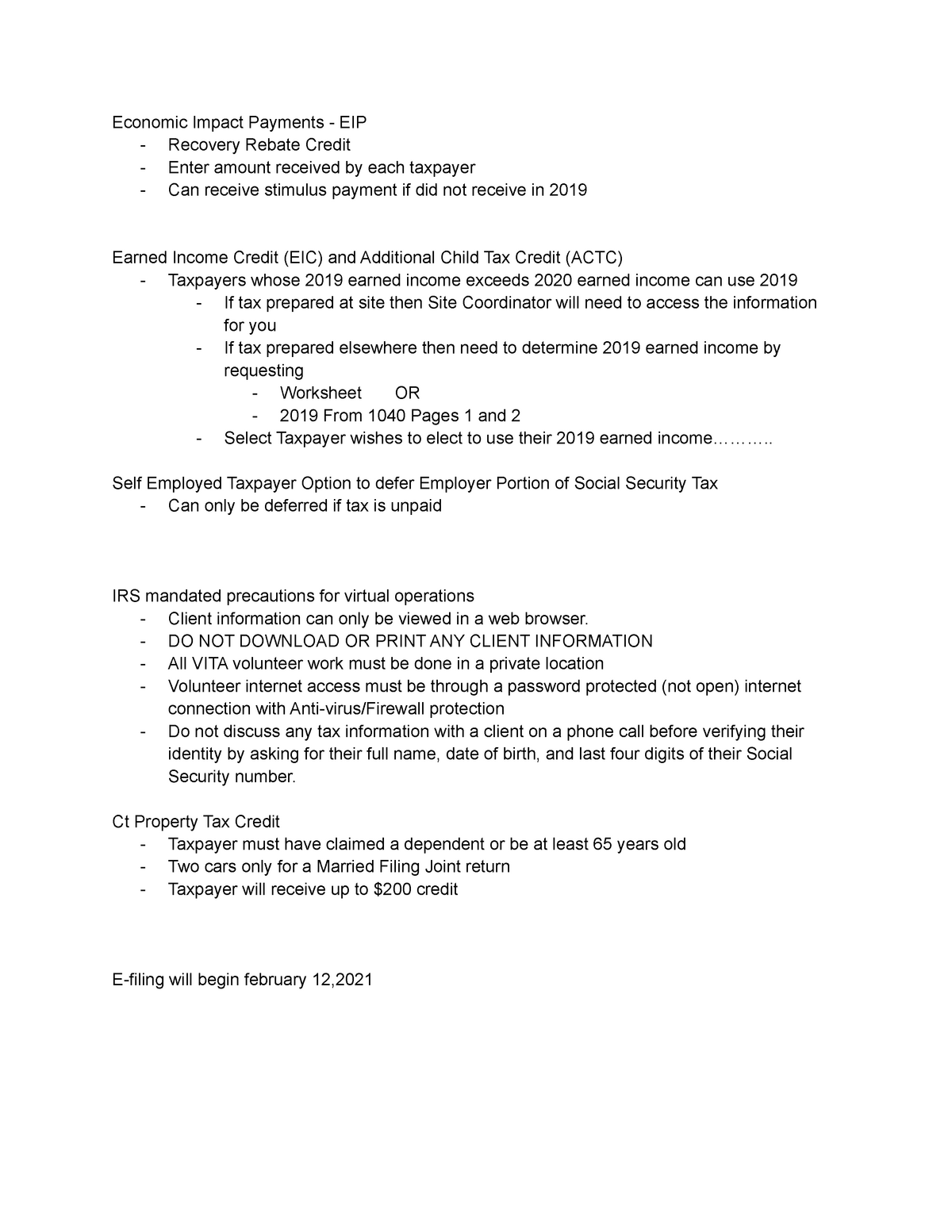

Tax Law Updates Note Economic Impact Payments EIP Recovery

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/a7a1d36c8e79624f7c4f25558711973b/thumb_1200_1553.png

EIP Payments 1 And 2 And Recovery Rebate Credit 2020 Taxes CARES ACT

https://support.crosslinktaxtech.com/hc/article_attachments/9459177594263

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-g...

Web 17 f 233 vr 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your

https://www.taxpayeradvocate.irs.gov/covid-19-home/2020-rrc-and-eip-1...

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Tax Law Updates Note Economic Impact Payments EIP Recovery

Recovery Rebate Credit Form Printable Rebate Form

Eip Recovery Rebate Credit Recovery Rebate

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

2023 Recovery Rebate Credit Calculator Recovery Rebate

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Recovery Rebate Credit Eip - Web 16 nov 2022 nbsp 0183 32 Taxpayers who received the full amounts of both Economic Impact Payments won t claim the Recovery Rebate Credit or include any information about the