Recovery Rebate Credit Error 2023 IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Millions of taxpayers have received math error notices adjusting their returns including the amount of recovery rebate credit RRC child tax credit or other

Recovery Rebate Credit Error 2023

Recovery Rebate Credit Error 2023

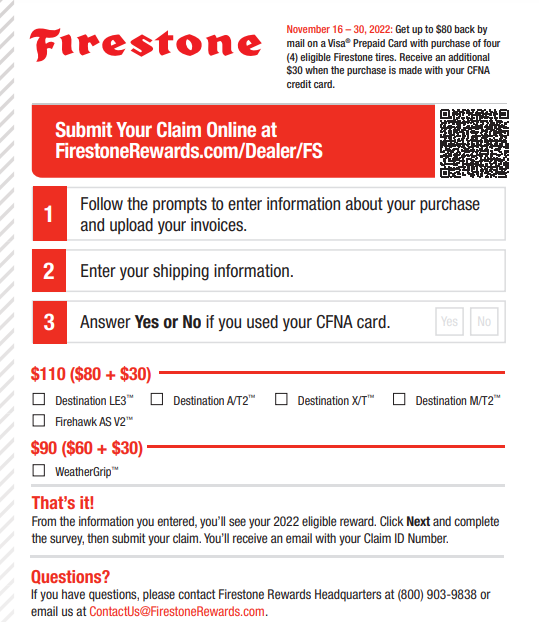

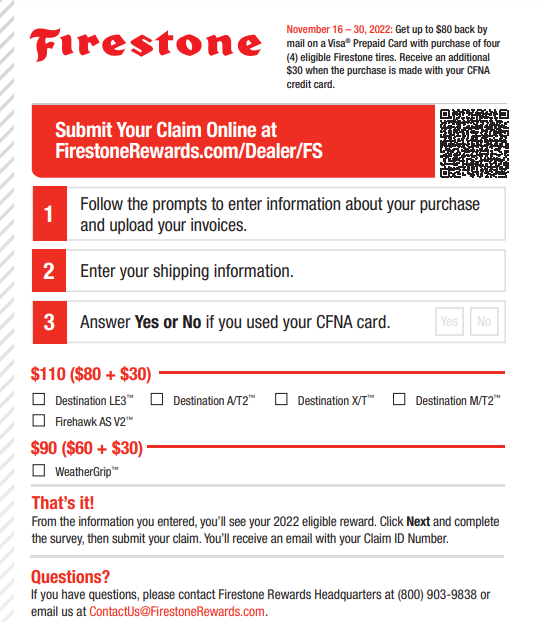

https://www.recoveryrebate.net/wp-content/uploads/2023/02/firestone-rebates-2023-printable-rebate-form.png

Recovery Rebate Credit 2023 Married Filing Separately Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/strategies-to-maximize-the-2021-recovery-rebate-credit-18.png

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2023/02/solved-recovery-rebate-credit-error-on-1040-instructions-6.png

The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021

If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form 1040 U S Individual Income Tax The IRS is mailing letters to some taxpayers who claimed the 2020 Recovery Rebate Credit and may be getting less stimulus than expected Here s why

Download Recovery Rebate Credit Error 2023

More picture related to Recovery Rebate Credit Error 2023

2023 Recovery Rebate Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/recovery-rebate-credit-2023.jpg?resize=980%2C551&ssl=1

Recovery Rebate Credit Error Letter 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/08/12-the-best-ways-how-to-calculate-recovery-rebate-credit-7.png

Claim Recovery Rebate Credit In Error Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/when-will-we-get-our-stimulus-checks-stimulusprotalk.jpeg

If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on your 2021 tax return to make up the difference The recovery rebate credit should be included when you file your 2020 tax return When you work with a tax pro or file with H R Block Online we ll get you your maximum refund guaranteed Want to

You may have received a second letter in 2021 from the IRS about the math or clerical error made when computing your 2020 Recovery Rebate Credit If you Economic Impact Payments EIPs are considered advanced payments against a new credit called the Recovery Rebate Credit RRC that can be claimed

Irs Recovery Rebate Credit Error Scam Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-pdf-20.jpg

2023 Recovery Rebate Credi Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-2022-2023-credits-zrivo-5.jpg

https://www.irs.gov › newsroom

IR 2023 217 Nov 17 2023 The Internal Revenue Service is reminding those who may be entitled to the Recovery Rebate Credit to file a tax return and claim their money

https://www.irs.gov › newsroom

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Irs Cp11 Recovery Rebate Credit 2023 Recovery Rebate

Irs Recovery Rebate Credit Error Scam Recovery Rebate

Recovery Rebate Credit Qualifications 2023 Recovery Rebate

8 Ways What Is Recovery Rebate Credit 2021 Heartsforhoundsrescue

Recovery Rebate Credit Married In 2023 Recovery Rebate

IRS Stimulus Update Recovery Rebate Credit Error Letter s Understanding

IRS Stimulus Update Recovery Rebate Credit Error Letter s Understanding

Intoxalock Rebate Form 2023 Printable Rebate Form Rebate2022

Recovery Credit Printable Rebate Form

Recovery Rebate Worksheet 2023 Form Recovery Rebate

Recovery Rebate Credit Error 2023 - You can still claim your due using the Recovery Rebate Credit How Do I Claim the Recovery Rebate Credit To claim the Recovery Rebate Credit you must file