Recovery Rebate Credit For Dependents Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 Note Qualifying dependents expanded for 2021 Recovery Rebate Credit Unlike the 2020 Recovery Rebate Credit the 2021 credit includes additional amounts Web 10 d 233 c 2021 nbsp 0183 32 Frequently asked questions about the Recovery Rebate Credit These updated FAQs were released to the public in Fact Sheet 2022 26PDF April 13 2022

Recovery Rebate Credit For Dependents

Recovery Rebate Credit For Dependents

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

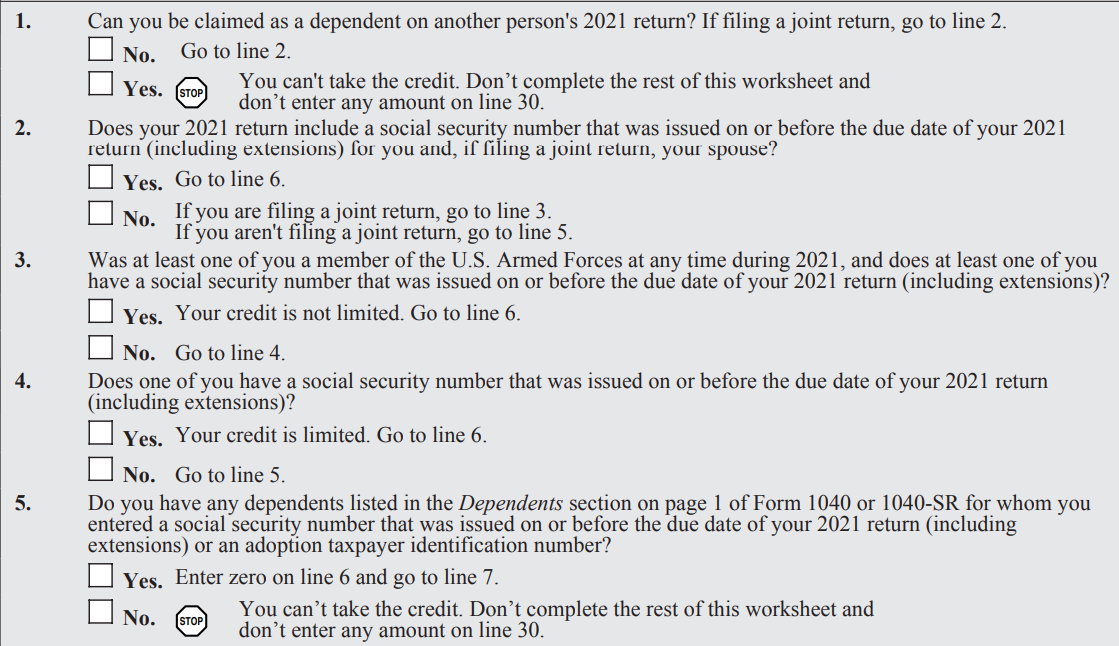

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

Web 14 janv 2022 nbsp 0183 32 The definition of qualifying dependents for the 2021 EIP recovery rebate credit includes all properly claimed dependents such as college students parents and Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

Web The Recovery Rebate Credit which you can claim as part of your 2020 tax return will recoup that missing stimulus money which totals up to 1 100 for qualifying babies Web updated December 10 2021 A1 If you re eligible you must file a 2020 tax return to claim the 2020 Recovery Rebate Credit even if you usually don t file a tax return You will

Download Recovery Rebate Credit For Dependents

More picture related to Recovery Rebate Credit For Dependents

Recovery Rebate Credit Taking Forever Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-credit-printable-rebate-form-4.png?w=670&h=627&ssl=1

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Web 23 avr 2020 nbsp 0183 32 An estimated 17 of dependents were older children 17 23 years old and an estimated 8 were adults including 2 who were seniors These estimates Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments

Web 12 oct 2022 nbsp 0183 32 After adding up the base amount and any additional amount for your dependents you then need to determine if your recovery rebate credit is reduced Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that was signed into law in March of 2020

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Note Qualifying dependents expanded for 2021 Recovery Rebate Credit Unlike the 2020 Recovery Rebate Credit the 2021 credit includes additional amounts

8 Ways What Is Recovery Rebate Credit 2021 Heartsforhoundsrescue

Recovery Rebate Credit Worksheet 2020 Ideas 2022

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

Recovery Rebate Credit Calculator EireneIgnacy

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Strategies To Maximize The 2021 Recovery Rebate Credit

Strategies To Maximize The 2021 Recovery Rebate Credit

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit For Dependents - Web Recovery Rebate Credit Section The Recovery Rebate Credit did not calculate a credit for my child born in 2021 According to the IRS quot Unlike the first two payments the third