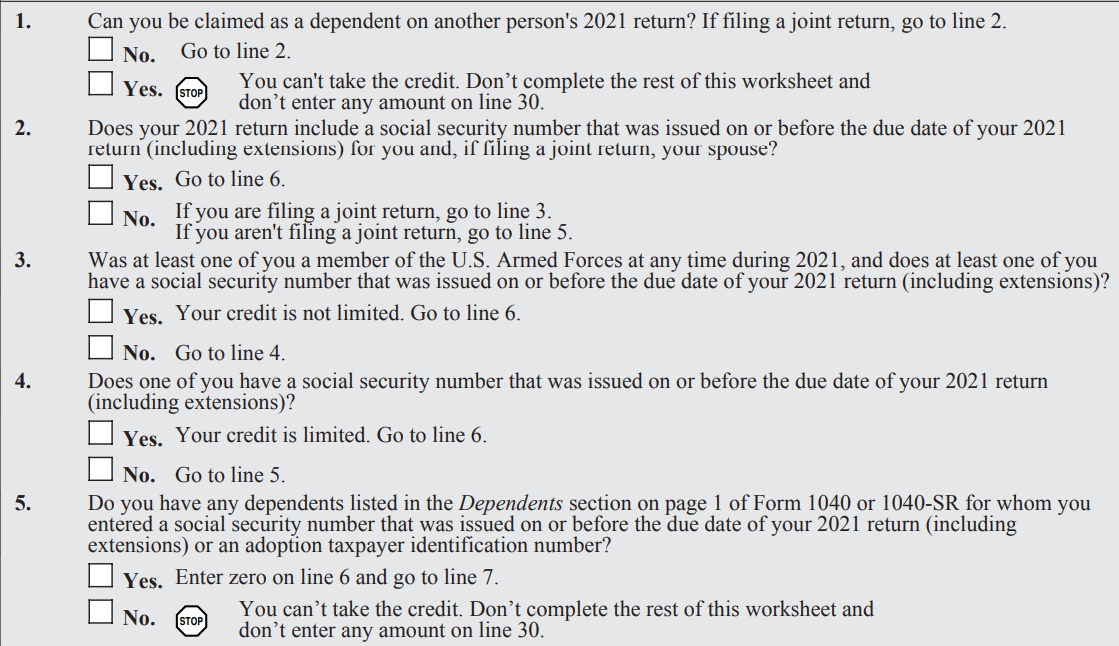

Recovery Rebate Credit For Married Filing Jointly Web 13 janv 2022 nbsp 0183 32 Married persons who didn t receive the third Economic Impact Payment should determine their eligibility for the Recovery Rebate Credit when filing their 2021

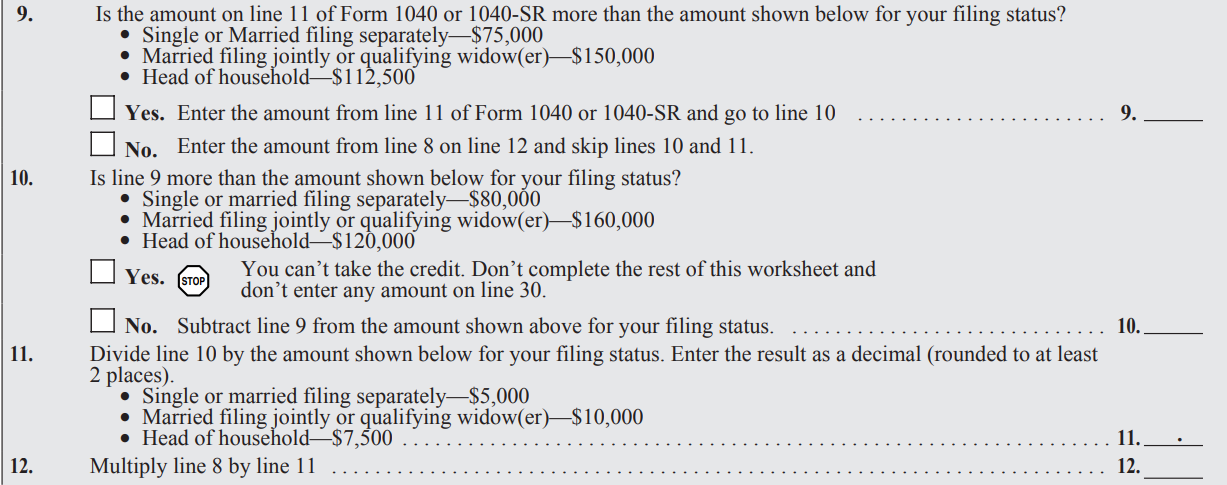

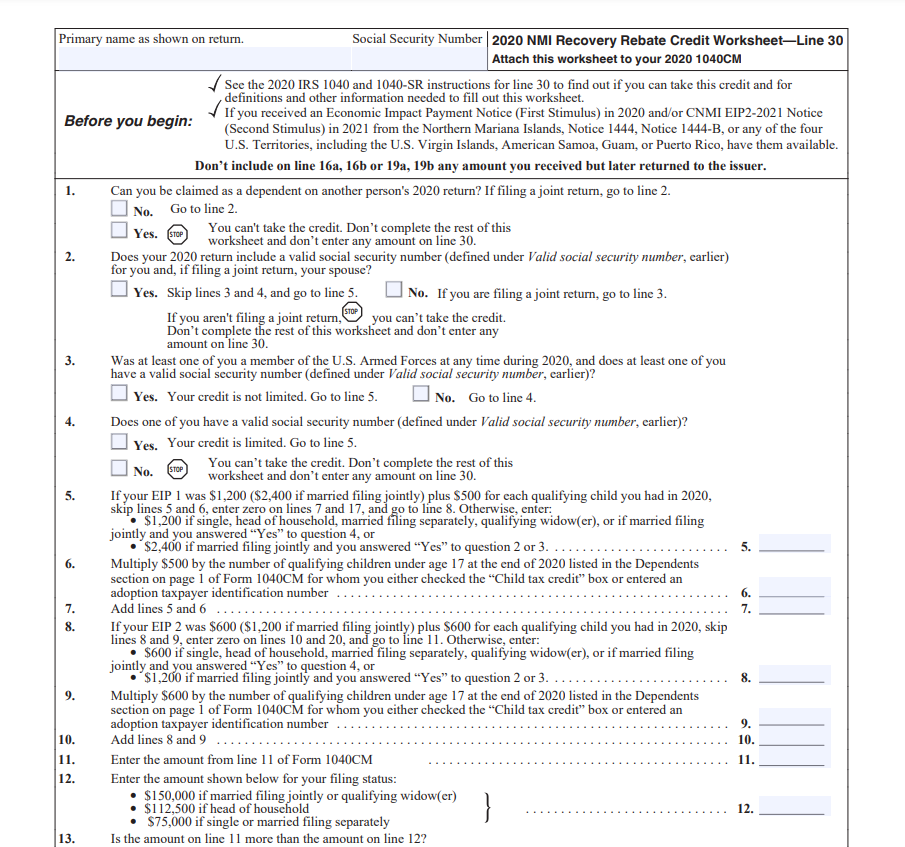

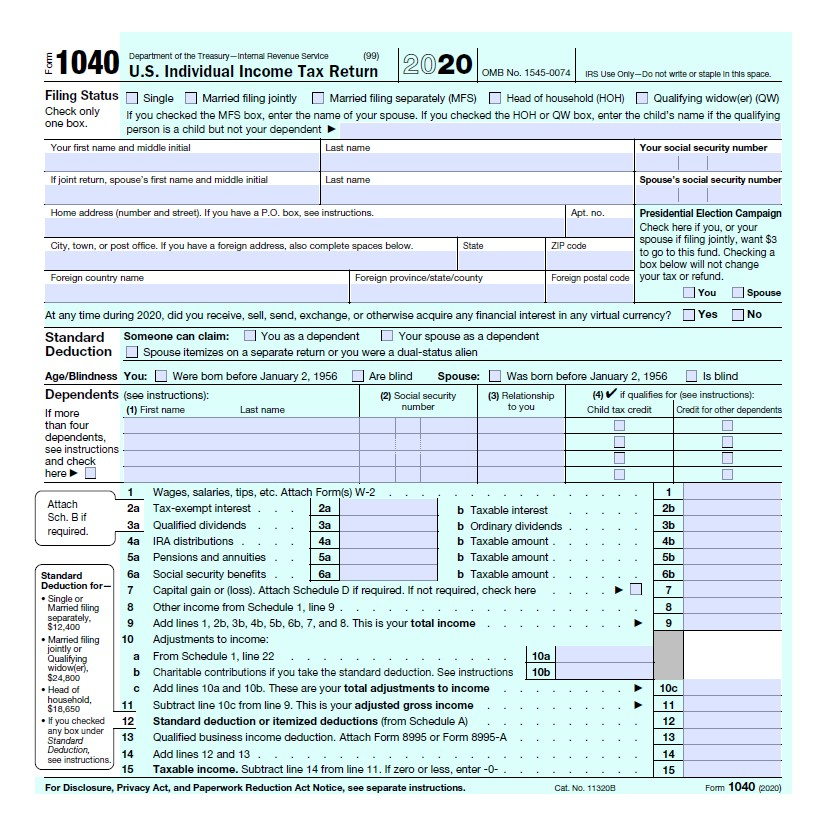

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more Web 10 d 233 c 2021 nbsp 0183 32 Your first Economic Impact Payment was 1 200 2 400 if married filing jointly plus 500 for each qualifying child and Your second Economic Impact Payment

Recovery Rebate Credit For Married Filing Jointly

Recovery Rebate Credit For Married Filing Jointly

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

The Recovery Rebate Credit Calculator ShauntelRaya

https://www.efile.com/image/recovery-rebate-3.png

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

https://www.pdffiller.com/preview/571/170/571170365/large.png

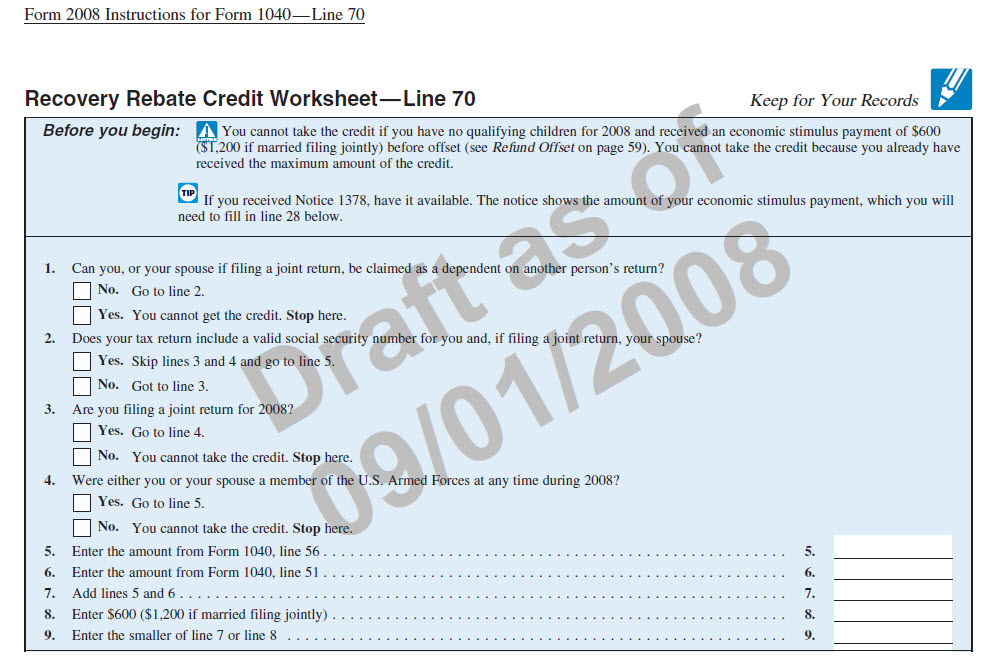

Web 10 d 233 c 2021 nbsp 0183 32 A7 If you are filing your 2020 return with your deceased spouse as married filing jointly you should enter 2 400 on line 5 of the worksheet and 1 200 on line 8 of Web 2020 Recovery Rebate Credits for example with adjusted gross income of more than 75 000 if filing as single or 150 000 if filing as married filing jointly However the

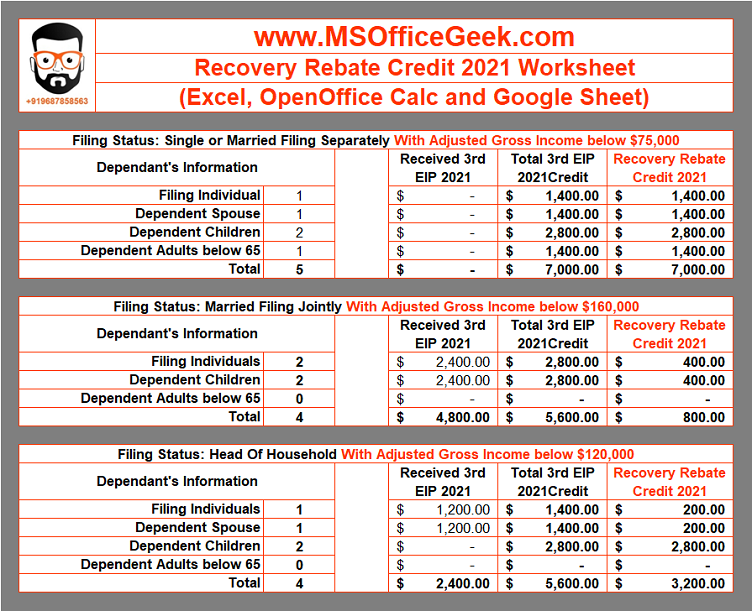

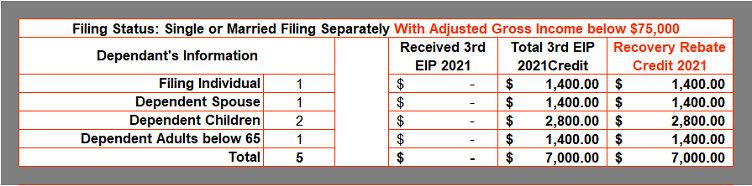

Web 14 janv 2022 nbsp 0183 32 In most cases the 2021 EIP or recovery rebate credit amount is 1 400 for each eligible individual or double that amount for married couples filing jointly where Web 31 janv 2023 nbsp 0183 32 This letter helps EIP recipients determine if they re eligible to claim the Recovery Rebate Credit on their 2021 tax year returns This letter provides the total

Download Recovery Rebate Credit For Married Filing Jointly

More picture related to Recovery Rebate Credit For Married Filing Jointly

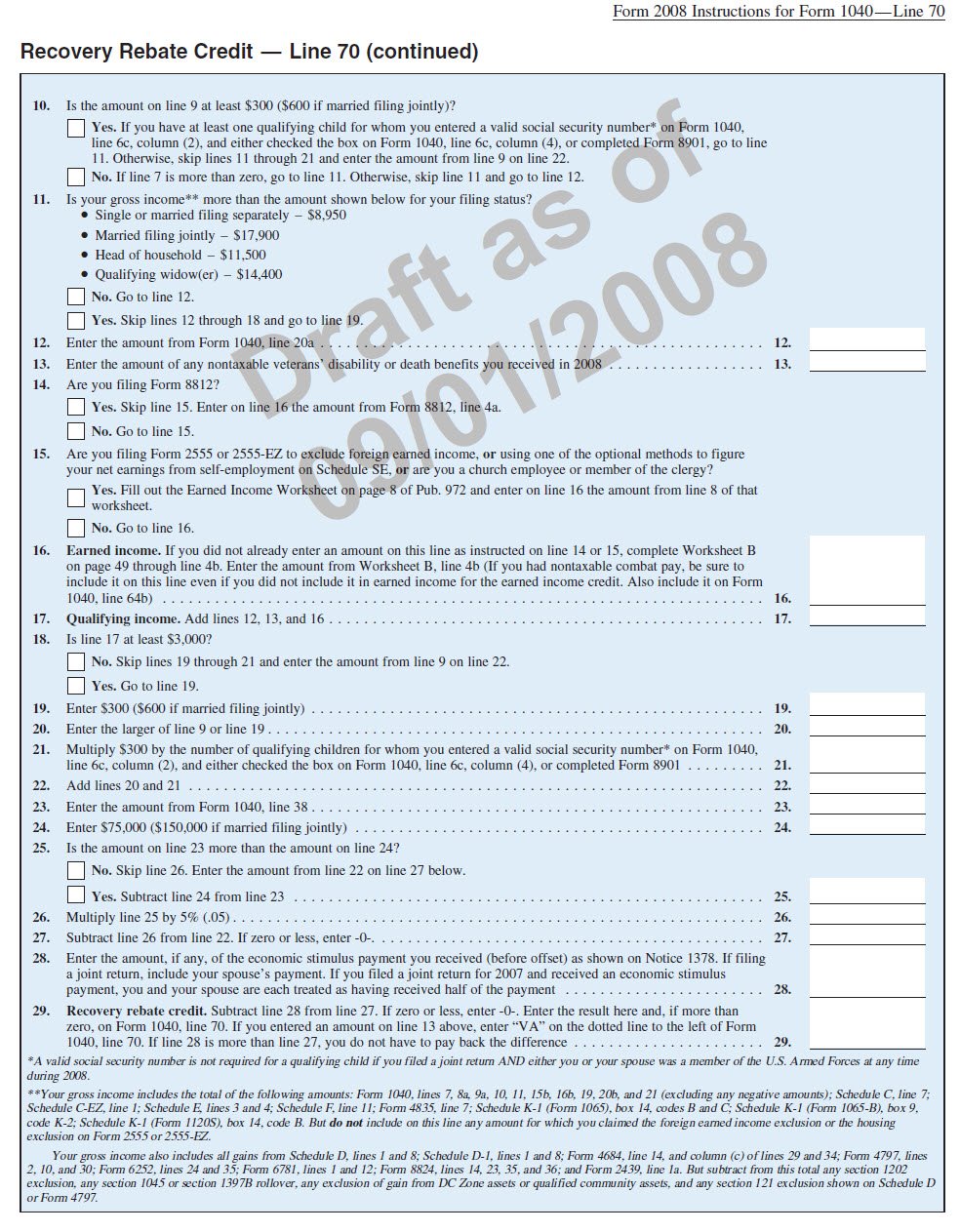

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

Web 1 janv 2021 nbsp 0183 32 All eligible individuals are entitled to a payment or credit of up to 1 200 for individuals or 2 400 for married couples filing jointly Eligible individuals also receive Web 150 000 if married and filing a joint return or if filing as a qualifying widow or widower 112 500 if filing as head of household or 75 000 for eligible individuals using any

Web 150 000 if married and filing a joint return or if filing as a qualifying widow or widower 112 500 if filing as head of household or 75 000 for eligible individuals using any Web 3 mars 2022 nbsp 0183 32 Your second Economic Impact Payment was 600 1 200 if married filing jointly for 2020 plus 600 for each qualifying child you had in 2020 Your third Economic

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

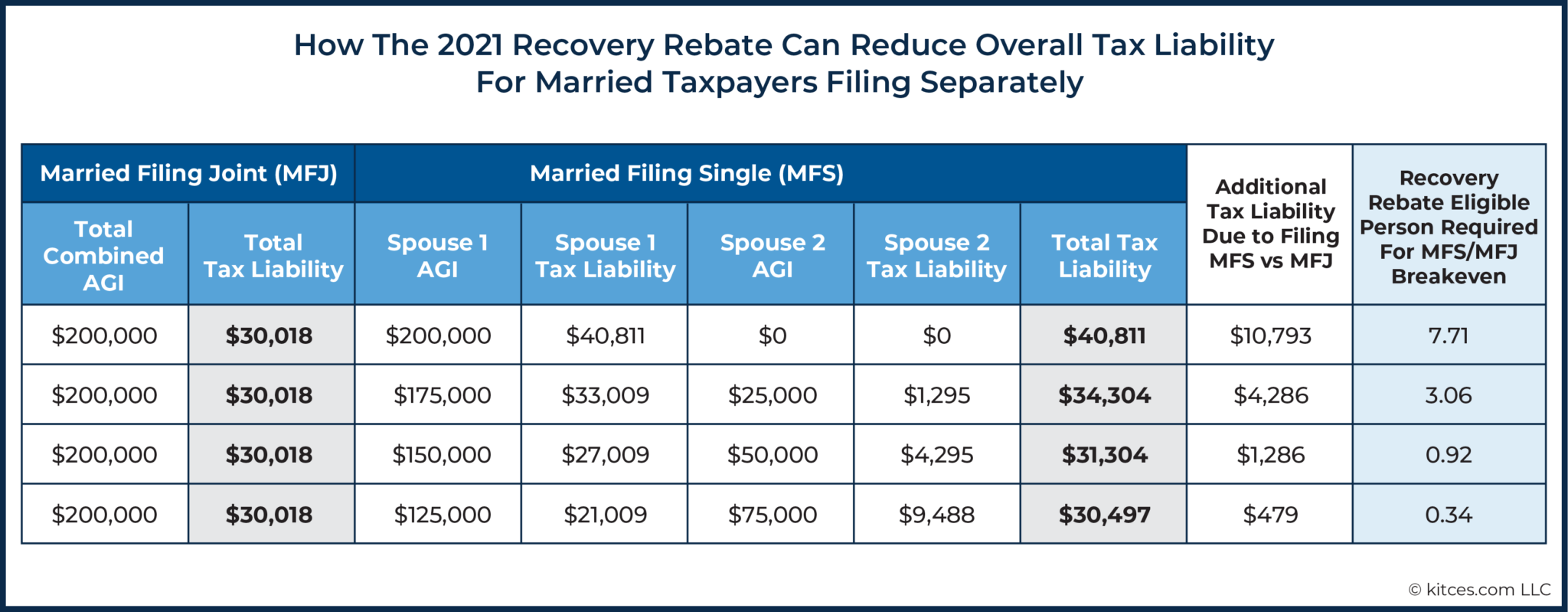

Strategies To Maximize The 2021 Recovery Rebate Credit

https://www.kitces.com/wp-content/uploads/2021/04/03-How-The-2021-Recovery-Rebate-Can-Reduce-Overall-Tax-Liability-For-Married-Taxpayers-Filing-Separately-2048x799.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Married persons who didn t receive the third Economic Impact Payment should determine their eligibility for the Recovery Rebate Credit when filing their 2021

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-a...

Web 17 f 233 vr 2022 nbsp 0183 32 The credit amount begins to be reduced at the same income thresholds as the 2020 Recovery Rebate Credits for example with adjusted gross income of more

1040 Recovery Rebate Credit Drake20

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Recovery Credit Printable Rebate Form

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit 2022 What Is It Rebate2022

Recovery Rebate Credit 2022 What Is It Rebate2022

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

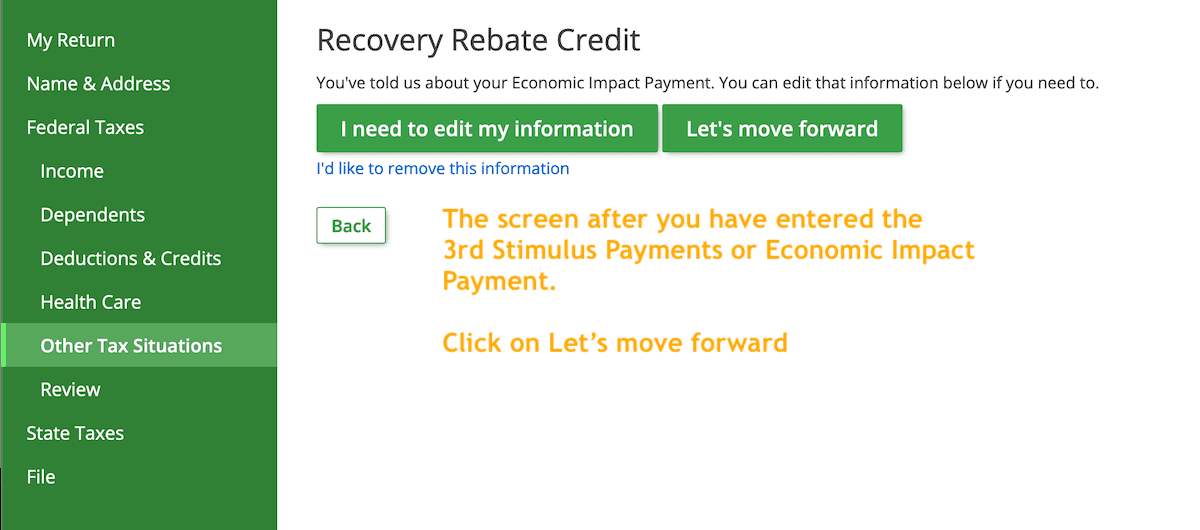

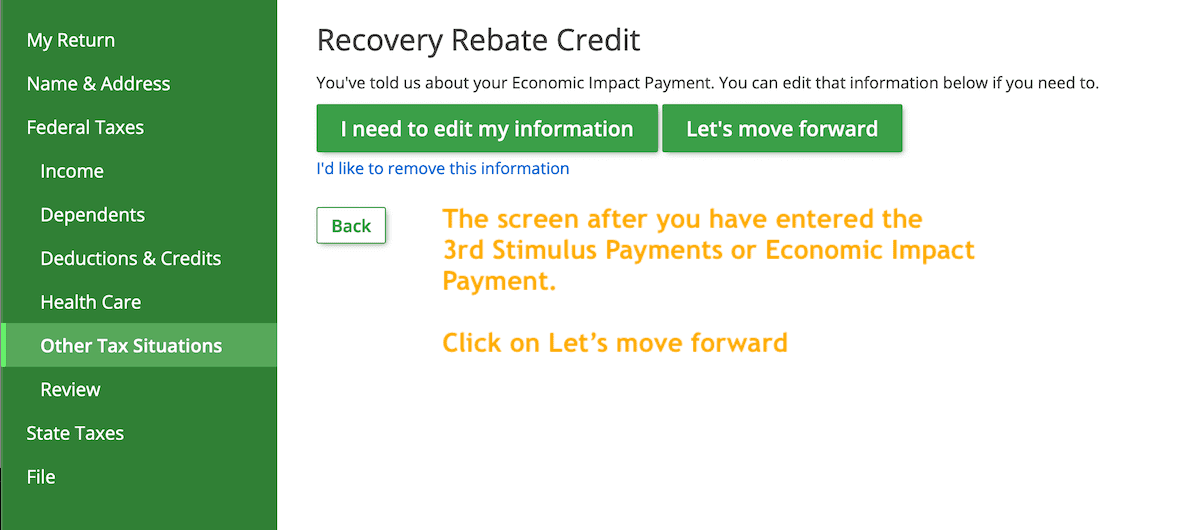

Recovery Rebate Credit Worksheet Explained Support

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit For Married Filing Jointly - Web 16 nov 2022 nbsp 0183 32 198 000 if filing married filing jointly For individuals with qualifying children these total phaseout amounts increase by 10 000 for each qualifying child For