Recovery Rebate Credit Form Pdf Web The 2021 Recovery Rebate Credit will reduce any tax owed for 2021 or be included in an Letter 6475 to the address on file confirming the individual s tax refund and can be direct

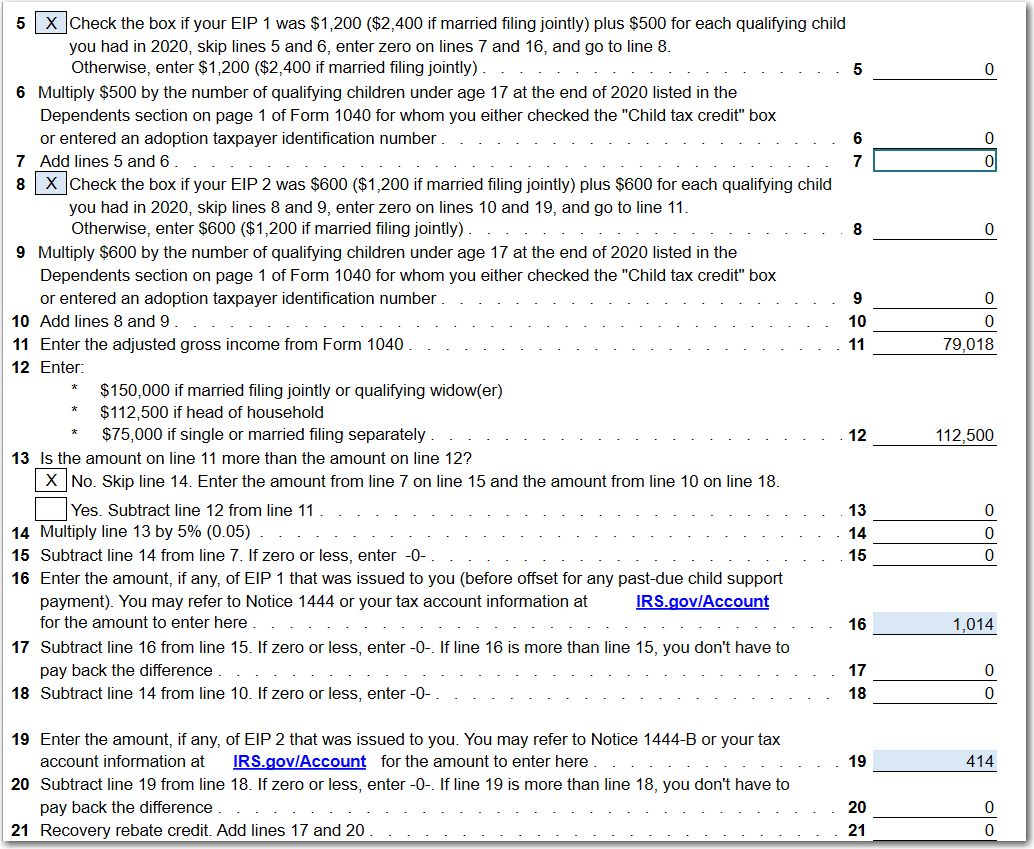

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit The fastest way

Recovery Rebate Credit Form Pdf

Recovery Rebate Credit Form Pdf

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/fill-free-fillable-thetaxbook-pdf-forms.png?w=600&ssl=1

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

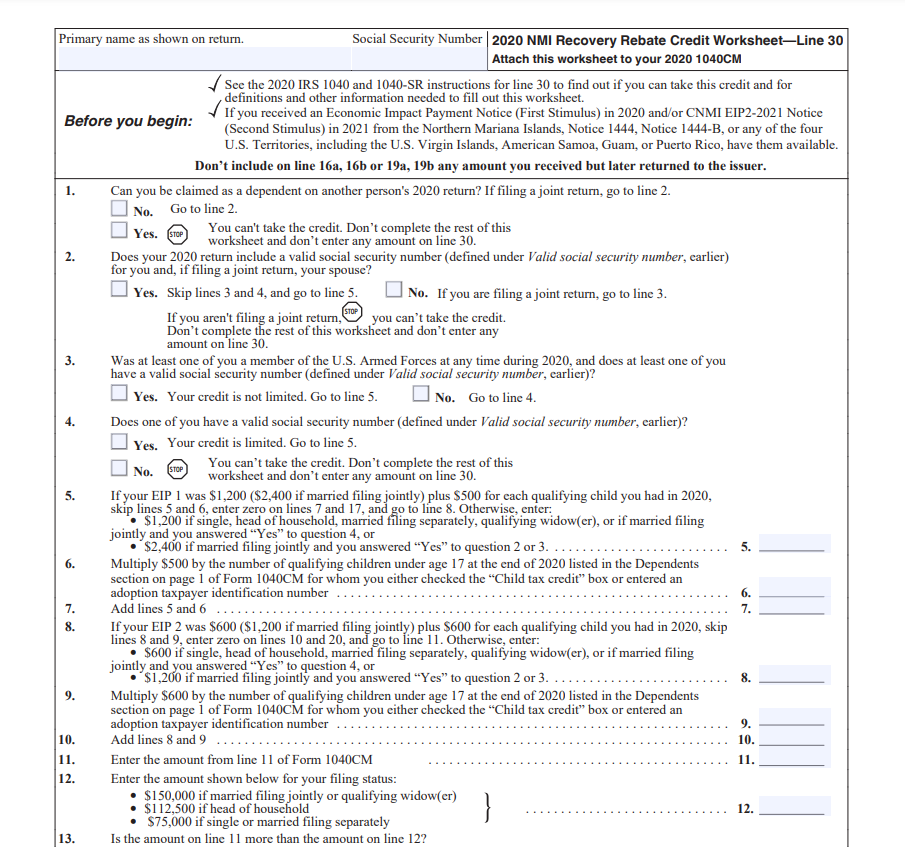

Web 13 avr 2022 nbsp 0183 32 2021 Recovery Rebate Credit Questions and Answers These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Web duce your recovery rebate credit Recovery rebate credit This credit is figured like last year s eco nomic impact payment except eli gibility and the amount of the credit are Web This Fact Sheet updates frequently asked questions FAQs for the 2021 Recovery Rebate Credit Individuals who did not qualify for or did not receive the full amount of the third

Download Recovery Rebate Credit Form Pdf

More picture related to Recovery Rebate Credit Form Pdf

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

https://www.atxcommunity.com/uploads/monthly_2021_02/2077495236_Line30JF.jpg.5cf61402ed45b71039c02279dc1b0758.jpg

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Web 15 janv 2021 nbsp 0183 32 Recovery Rebate Credit and other benefits IRS Free File is all taxpayers need to claim the Recovery Rebate Credit and other tax benefits such as the Earned Web As the IRS indicated they are reconciling refunds with stimulus payments and the Recovery Rebate Credit claimed on your return If you do not know the amounts of your stimulus

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 2020 RECOVERY REBATE CREDIT WORKSHEET LINE 30 Before you begin See the instructions for line 30 to find out if you can take this credit and for definitions and other

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

Hurricane Recovery Rebate Form Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/free-7-sample-rent-rebate-forms-in-pdf.jpg

https://www.irs.gov/pub/irs-pdf/p5486b.pdf

Web The 2021 Recovery Rebate Credit will reduce any tax owed for 2021 or be included in an Letter 6475 to the address on file confirming the individual s tax refund and can be direct

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-b...

Web 13 janv 2022 nbsp 0183 32 No matter how you file you will need to do the following to claim the 2021 Recovery Rebate Credit Compute the 2021 Recovery Rebate Credit amount using

How To Calculate Recovery Rebate Credit 2022 Rebate2022 Recovery Rebate

Recovery Rebate Credit Form Printable Rebate Form

Taxes Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit 2020 Calculator KwameDawson

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

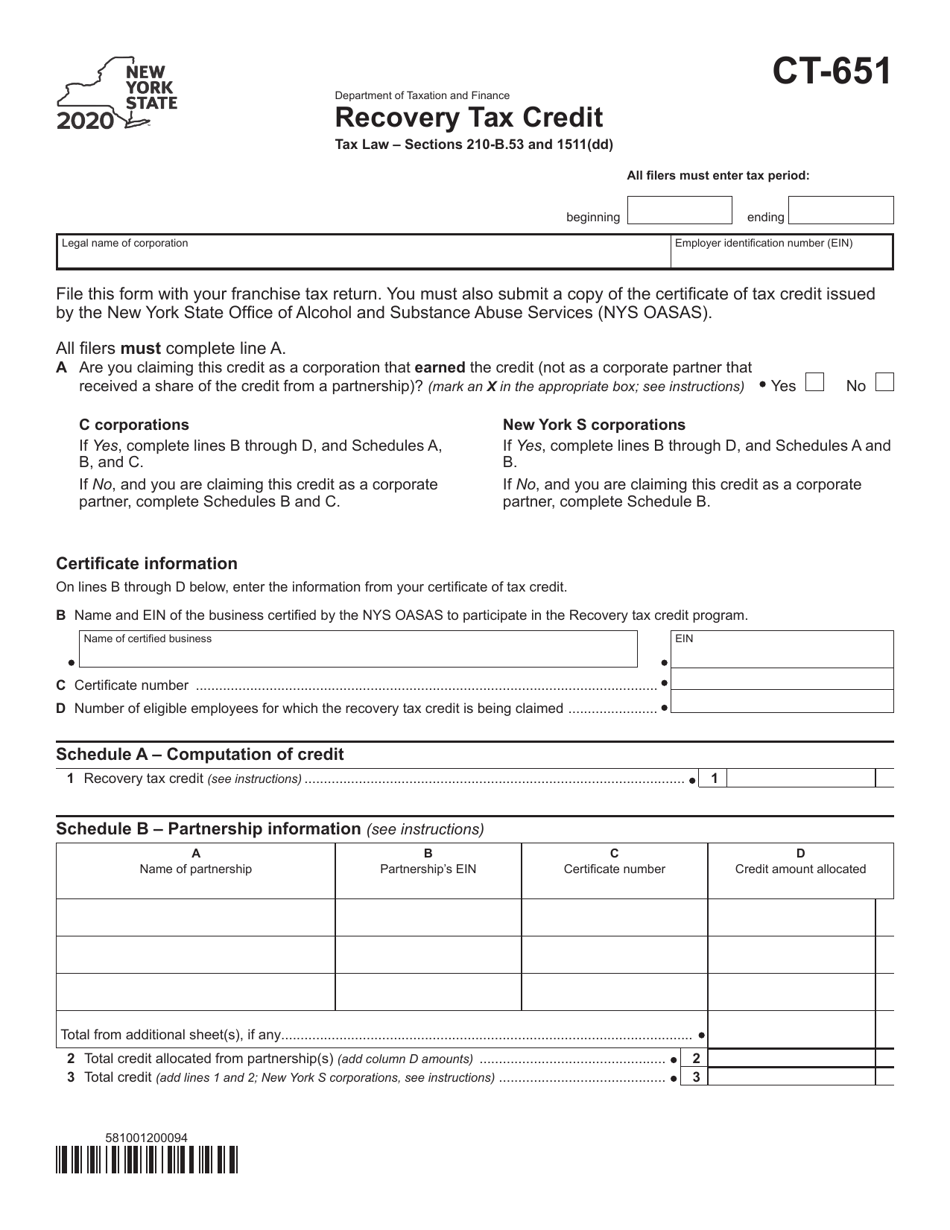

Form Ct 651 Download Printable Pdf Or Fill Online Recovery Tax Credit

Recovery Rebate Credit For Non Filers Form Recovery Rebate

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

Recovery Rebate Credit Form Pdf - Web 13 avr 2022 nbsp 0183 32 2021 Recovery Rebate Credit Questions and Answers These updated FAQs were released to the public in Fact Sheet 2022 27 PDF April 13 2022 If you