Recovery Rebate Credit H R Block Web 24 janv 2022 nbsp 0183 32 Recovery Rebate Credit Those who changed jobs or had a baby in 2021 may be eligible for more stimulus money or an even bigger tax refund Plus filing correctly will help avoid processing delays For more information on all of the ways to receive help

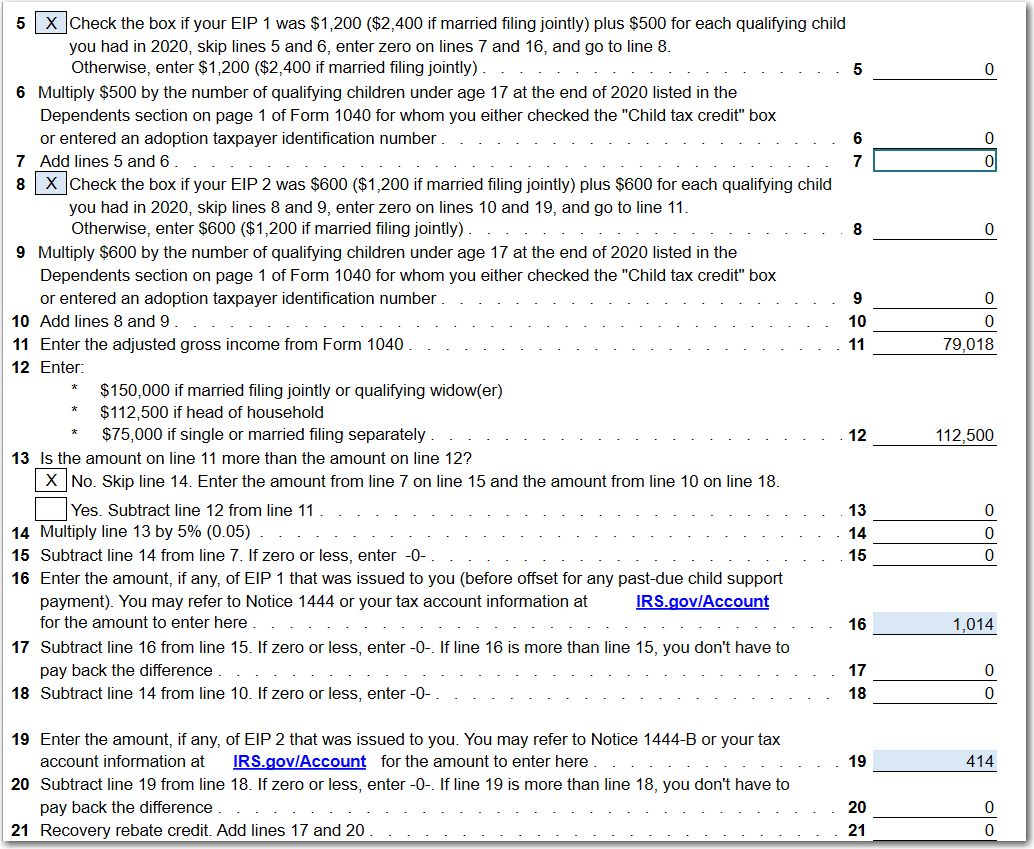

Web If your EIP 1 was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 skip lines 5 and 6 enter zero on lines 7 and 16 and go to line 8 Web 26 mars 2022 nbsp 0183 32 Recovery Rebate Credit I m using H amp R Block program to prepare 2021 tax Got question as to whether I received third stimulus check Answered quot No quot and got a 2800 credit for my wife amp I IRS rejected this amount when evaluating my return Can t

Recovery Rebate Credit H R Block

Recovery Rebate Credit H R Block

https://www.recoveryrebate.net/wp-content/uploads/2022/11/recovery-rebate-credit-h-r-block-in-2021-hr-block-rebates-3.jpg

Turbo Tax And H R Block Customer Waiting On Stimulus Payment 9news

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/turbo-tax-and-h-r-block-customer-waiting-on-stimulus-payment-9news.jpg?w=1140&ssl=1

Recovery Rebate Credit H R Block Rebate2022

https://www.rebate2022.com/wp-content/uploads/2023/05/recovery-rebate-credit-h-r-block.jpg

Web 13 avr 2022 nbsp 0183 32 Below are frequently asked questions about the 2021 Recovery Rebate Credit separated by topic Please do not call the IRS Topic A General Information Topic B Claiming the Recovery Rebate Credit if you aren t required to file a 2021 tax return Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

Web 24 janv 2022 nbsp 0183 32 Recovery Rebate Credit Those who changed jobs or had a baby in 2021 may be eligible for more stimulus money or an even bigger tax refund Plus filing correctly will help avoid processing delays For more information on all of the ways to receive help Web 18 sept 2022 nbsp 0183 32 Recovery Rebate Credit H And R Block The Recovery Rebate offers taxpayers the opportunity to receive an income tax return without having their tax returns adjusted This program is administered by the IRS It is crucial to be familiar

Download Recovery Rebate Credit H R Block

More picture related to Recovery Rebate Credit H R Block

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

1040 Line 30 Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/irs-1040-form-line-30-solved-complete-the-schedule-a-form-1040-for-1.png

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Web 6 avr 2023 nbsp 0183 32 Your income will influence the amount of your recovery rebate credit If you earn more than 75k your credit will be reduced to zero Joint filers who have spouses will drop to 150 000 Heads of households will begin to receive their rebates for recovery Web 25 f 233 vr 2021 nbsp 0183 32 What s New Tax Information Center Filing Credits A recovery rebate credit is your way of getting missed stimulus money 6 min read February 25 2021 H amp R Boundary Part Editor s Note These article was originally publicly on December 31

Web 12 oct 2022 nbsp 0183 32 H amp r Block Recovery Rebate Credit The Recovery Rebate allows taxpayers to get a tax refund without the need to alter their tax returns This program is run by the IRS It s free However before filing it is crucial to know the rules and regulations Web 6 janv 2023 nbsp 0183 32 H amp R Block Recovery Rebate Credit Taxpayers are eligible for a tax rebate through the Recovery Rebate program This lets them get a refund on their taxes without having to amend the tax return This program is administered by the IRS It is

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

https://www.hrblock.com/tax-center/newsroom/around-block/about-us/tax...

Web 24 janv 2022 nbsp 0183 32 Recovery Rebate Credit Those who changed jobs or had a baby in 2021 may be eligible for more stimulus money or an even bigger tax refund Plus filing correctly will help avoid processing delays For more information on all of the ways to receive help

https://media.hrblock.com/.../Recovery_Rebate_Worksheet…

Web If your EIP 1 was 1 200 2 400 if married filing jointly plus 500 for each qualifying child you had in 2020 skip lines 5 and 6 enter zero on lines 7 and 16 and go to line 8

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

What Is A Recovery Rebate Credit Here s What To Do If You Haven t

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator MollieAilie

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Is The Recovery Rebate Credit The Same As The Stimulus Leia Aqui Is

Recovery Rebate Credit H R Block - Web The good news is that H amp R Block has got you covered Check out the need to know 2022 tax law changes below Get help navigating 2022 tax law changes No matter if you file taxes online or with an H amp R Block tax pro we re here to help you get your maximum