Recovery Rebate Credit Income Limits Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate Web Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return

Recovery Rebate Credit Income Limits

Recovery Rebate Credit Income Limits

https://specials-images.forbesimg.com/imageserve/5f3ed6a781053fc5c2f9ef85/960x0.jpg?fit=scale

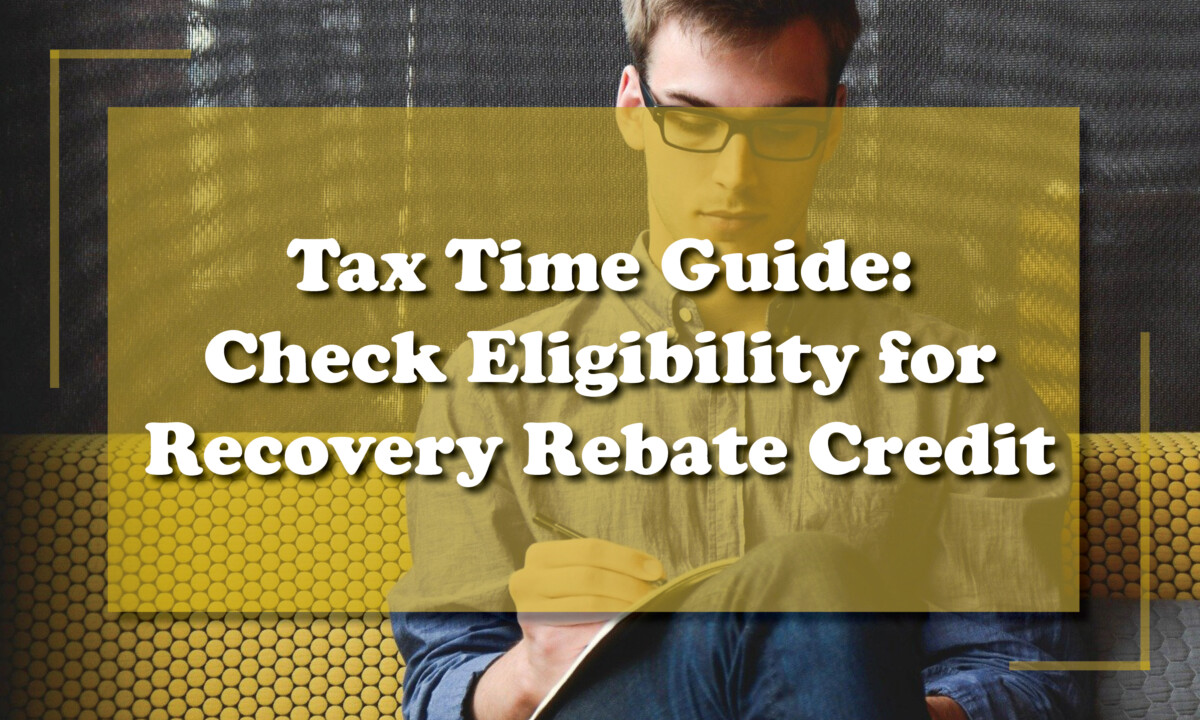

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

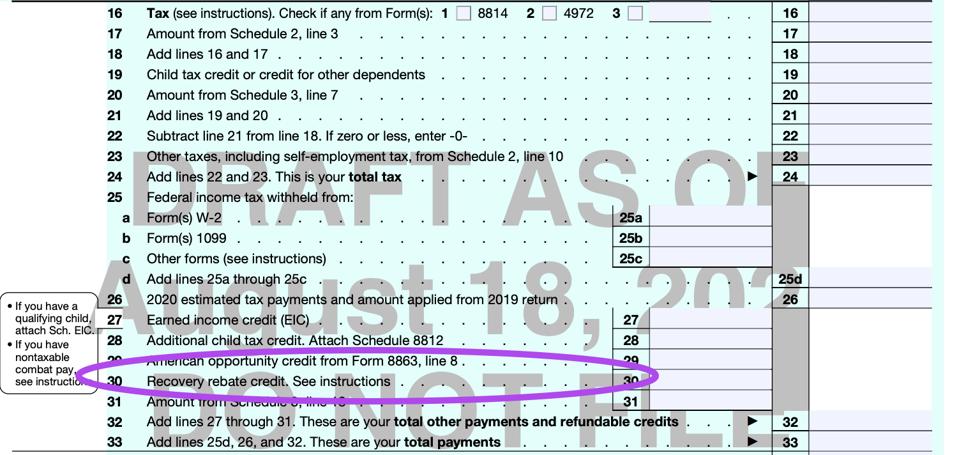

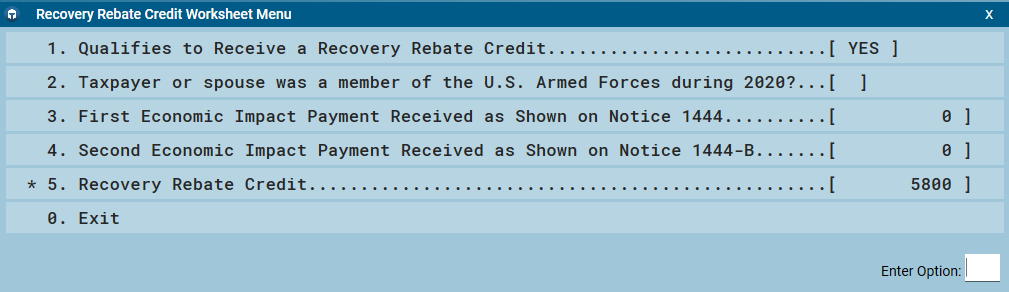

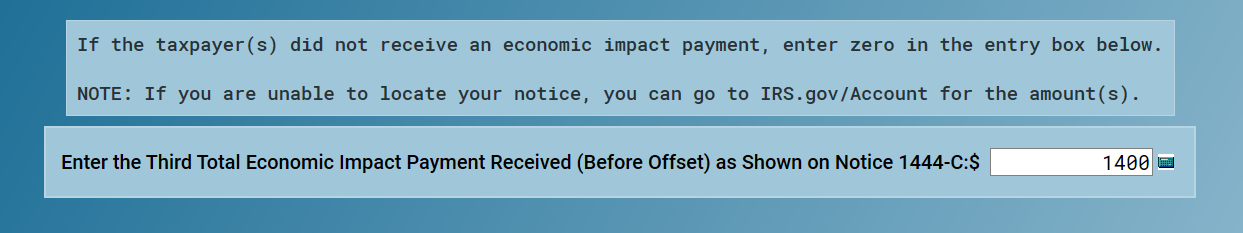

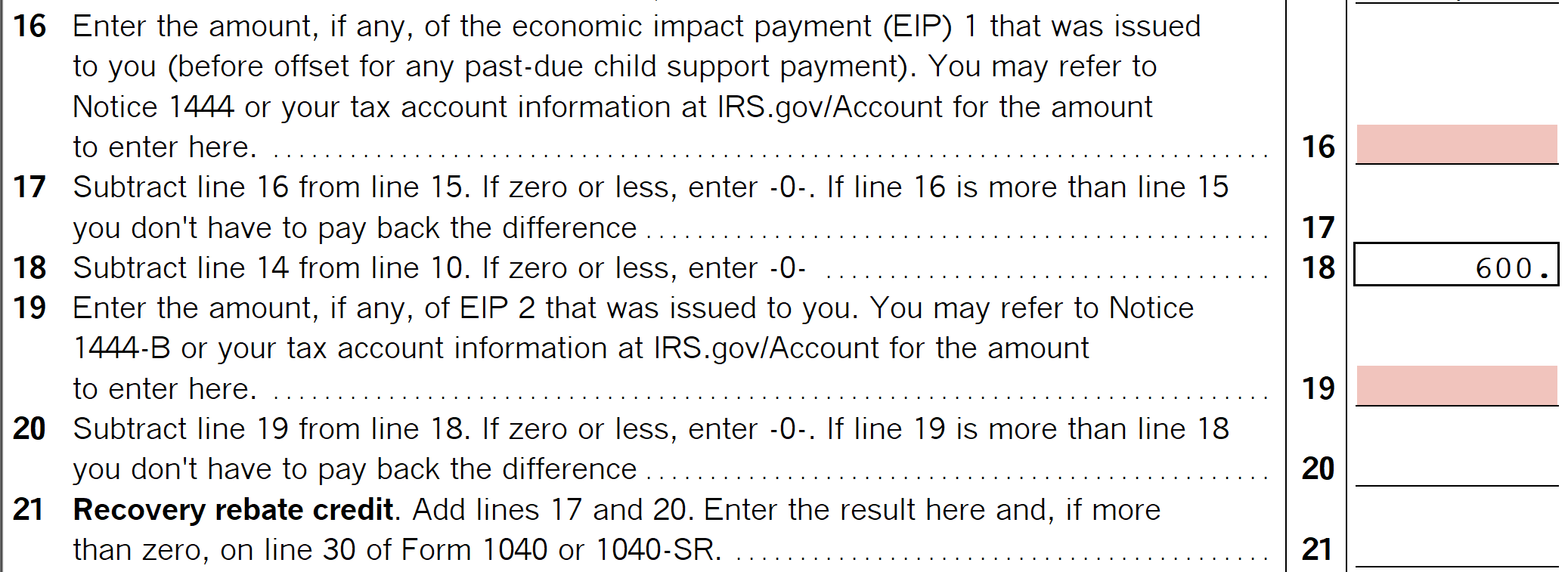

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Web 10 d 233 c 2021 nbsp 0183 32 Even though your adjusted gross income for 2020 is less than 150 000 you are not entitled to the Recovery Rebate Credit for your qualifying child born in 2020 Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

Web 17 ao 251 t 2022 nbsp 0183 32 The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult based on household adjusted gross income AGI plus Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for

Download Recovery Rebate Credit Income Limits

More picture related to Recovery Rebate Credit Income Limits

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

https://media.cbs19.tv/assets/KYTX/images/3ca89be7-1360-4b18-a5ba-3c6279cb9539/3ca89be7-1360-4b18-a5ba-3c6279cb9539_1140x641.png

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit-1024x538.jpg

Web 12 oct 2022 nbsp 0183 32 By Rocky Mengle last updated October 12 2022 If you didn t get a third stimulus check or you only got a partial check then you certainly want to check out Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

Web 1 janv 2021 nbsp 0183 32 All eligible individuals are entitled to a payment or credit of up to 1 200 for individuals or 2 400 for married couples filing jointly Eligible individuals also receive Web Income limitations changed this year s Recovery Rebate Credit fully reduces to 0 more quickly once your adjusted gross income AGI exceeds the income threshold How do I

Learn About The Recovery Rebate Credit ATC Income Tax

https://www.atcincometax.com/wp-content/uploads/2021/01/Picture1-1.png

IRS Letters Explain Why Some 2020 Recovery Rebate Credits Are Different

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate

Desktop 2020 Recovery Rebate Credit Support

Learn About The Recovery Rebate Credit ATC Income Tax

Desktop 2021 Recovery Rebate Credit Support

Recovery Rebate Credit On The 2020 Tax Return

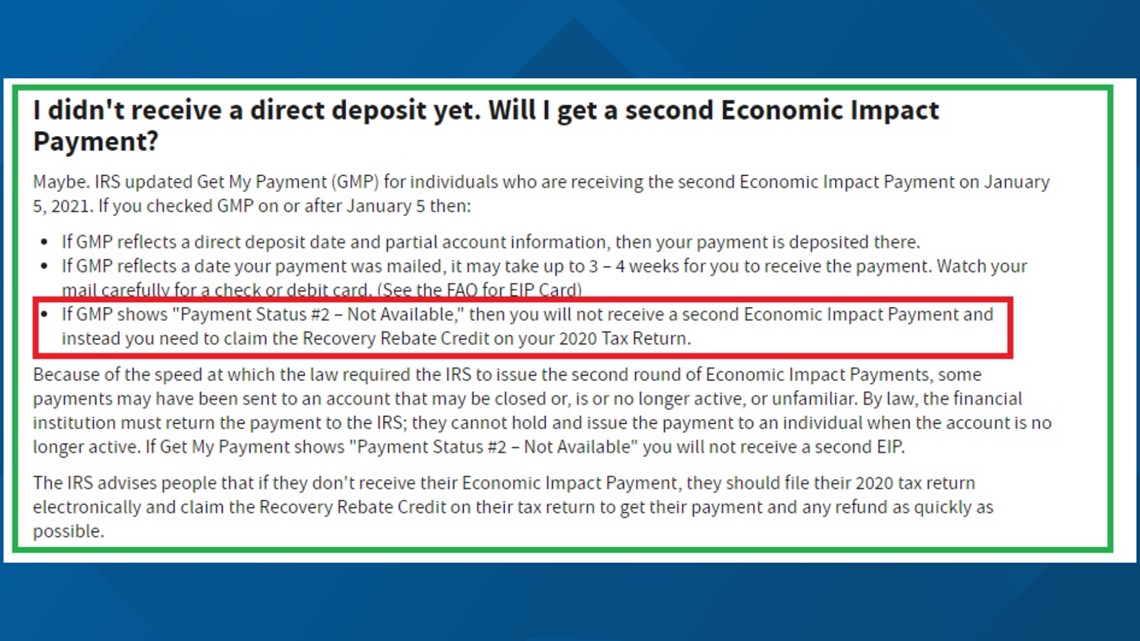

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

Recovery Rebate Credit 2022 2023 Credits Zrivo

Recovery Rebate Credit 2022 2023 Credits Zrivo

Eligibility For Recovery Rebate Credit Ft Myers Naples Markham Norton

How To Enter Stimulus Payments And Figure The Reco Intuit

Payment Status not Available On IRS Tracker Sorry Your Stimulus

Recovery Rebate Credit Income Limits - Web 10 d 233 c 2021 nbsp 0183 32 Even though your adjusted gross income for 2020 is less than 150 000 you are not entitled to the Recovery Rebate Credit for your qualifying child born in 2020