Recovery Rebate Credit Instructions 2021 Turbotax Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Impact payment and any plus up payments to claim the 2021 Recovery Rebate Credit

OVERVIEW Many Americans may be eligible for the Recovery Rebate Credit commonly referred to as the COVID stimulus payment The credit is for the 2020 tax year even though the last payments came in 2021 for many recipients TABLE OF CONTENTS What is the 2020 Recovery Rebate Credit Who is eligible for the 2020 Recovery Rebate Credit If you did not receive the additional 1 400 per qualifying in your third stimulus check you can claim the additional stimulus amounts in the form of a Recovery Rebate Credit on your 2021 tax return filed in 2022

Recovery Rebate Credit Instructions 2021 Turbotax

Recovery Rebate Credit Instructions 2021 Turbotax

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

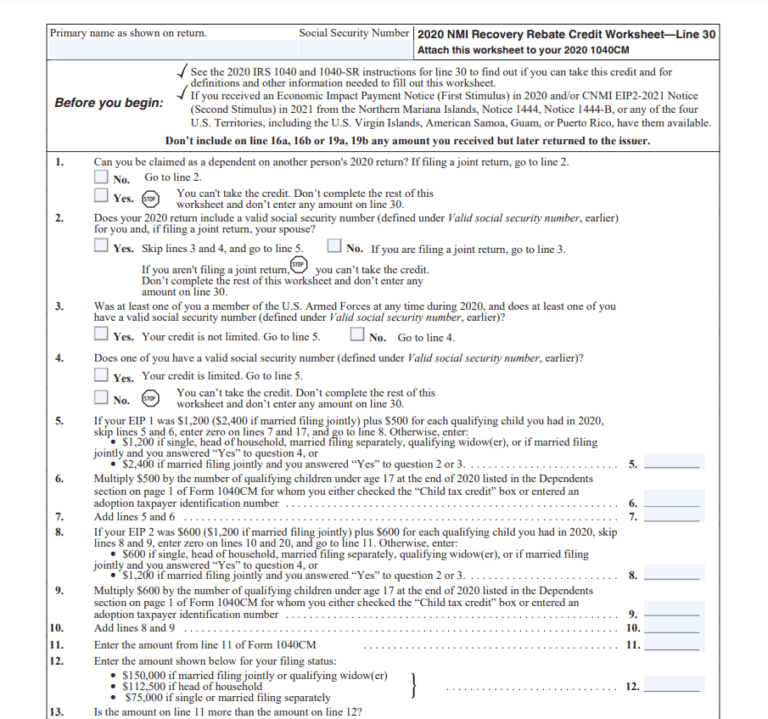

Bravecto Online Rebate 2022 Rebate2022 Recovery Rebate

https://www.recoveryrebate.net/wp-content/uploads/2022/11/bravecto-online-rebate-2022-rebate2022-2.png

How To File Recovery Rebate Credit Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

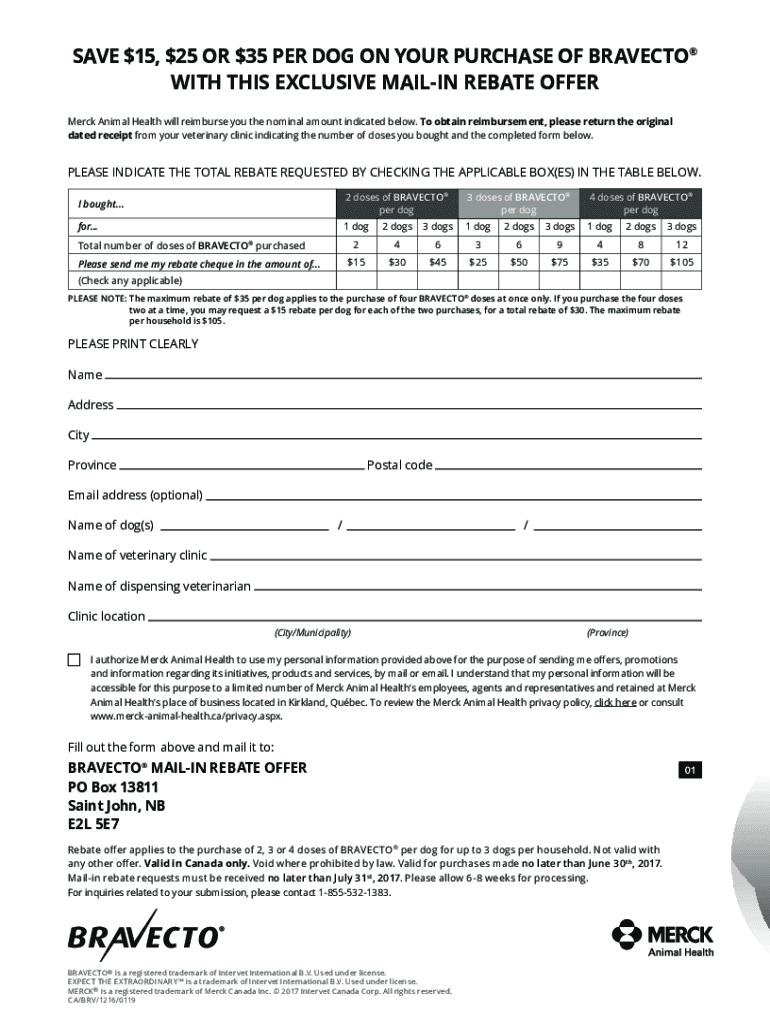

Learn how to claim the Recovery Rebate Credit on your tax return using TurboTax This tutorial provides step by step instructions on checking eligibility reporting missing payments and This article will help you complete the Recovery Rebate Credit Worksheet and ensure your clients get the full amount of stimulus payment they re eligible for For answers to frequently asked questions about the Recovery Rebate Credit and economic impact payments also referred to as EIP or stimulus click here

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program If you were eligible for the third stimulus payment and did not receive that payment when you file your 2021 tax return you will be able to reconcile any third stimulus payment that you were eligible for in the form of a Recovery Rebate Credit on

Download Recovery Rebate Credit Instructions 2021 Turbotax

More picture related to Recovery Rebate Credit Instructions 2021 Turbotax

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/the-recovery-rebate-credit-get-your-full-stimulus-check-payment-with-1.jpg

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

For tax year 2021 your clients may be eligible to claim the Recovery Rebate Credit on their tax returns This credit is available for clients who didn t previously receive the full third economic impact payment sometimes referred to as EIP 3 or stimulus that they were entitled to under the American Rescue Plan Act You can get to the Recovery Rebate Credit in TurboTax for 2021 by typing stimulus without the quotes in the Search box then clicking the link that says Jump to stimulus However this will not work if you are not eligible for the credit either because you can be claimed as a dependent or because your AGI is over the maximum for your

TurboTax will calculate the amount of Recovery Rebate Credit you should have received based on the information you are entered into your 2021 return The IRS issued a Recovery Rebate Credit based on the information from your 2020 return How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable

Recovery Rebate Worksheet 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-7.png?fit=530%2C696&ssl=1

Recovery Rebate Credit Stimulus Check 2022 Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-claim-stimulus-recovery-rebate-credit-on-turbotax-7.png?fit=1003%2C552&ssl=1

https://www.irs.gov/newsroom/recovery-rebate-credit

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Impact payment and any plus up payments to claim the 2021 Recovery Rebate Credit

https://turbotax.intuit.com/tax-tips/tax-relief/...

OVERVIEW Many Americans may be eligible for the Recovery Rebate Credit commonly referred to as the COVID stimulus payment The credit is for the 2020 tax year even though the last payments came in 2021 for many recipients TABLE OF CONTENTS What is the 2020 Recovery Rebate Credit Who is eligible for the 2020 Recovery Rebate Credit

10 FAQs About Claiming The 2021 Recovery Rebate Credit TaxAct

Recovery Rebate Worksheet 2023 Recovery Rebate

Recovery Credit PrintableRebateForm

1040 Recovery Rebate Credit Instructions Recovery Rebate

Recovery Rebate Credit Form Printable Rebate Form

Qu Es Un Cr dito De Recuperaci n De Reembolso TurboTax Blog Espa ol

Qu Es Un Cr dito De Recuperaci n De Reembolso TurboTax Blog Espa ol

Recovery Rebate Credit Questions Answers

What Is Recovery Rebate Credit 2021 Commons credit portal

Turbotax Recovery Rebate Credit Error 2023 Recovery Rebate

Recovery Rebate Credit Instructions 2021 Turbotax - This article will help you complete the Recovery Rebate Credit Worksheet and ensure your clients get the full amount of stimulus payment they re eligible for For answers to frequently asked questions about the Recovery Rebate Credit and economic impact payments also referred to as EIP or stimulus click here