Recovery Rebate Credit Letter Web 5 avr 2021 nbsp 0183 32 IR 2021 76 April 5 2021 WASHINGTON As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC The

Web This letter helps EIP recipients determine if they re eligible to claim the Recovery Rebate Credit on their 2021 tax year returns It provided the total amount of the third Economic Web 25 juil 2023 nbsp 0183 32 This letter provides more information about your right to appeal a change we made to the amount of the Recovery Rebate Credit on your 2020 tax return The

Recovery Rebate Credit Letter

Recovery Rebate Credit Letter

https://i1.wp.com/i.pinimg.com/736x/c3/94/0a/c3940a59fd831b4f8791ab4c5f3d2f90.jpg

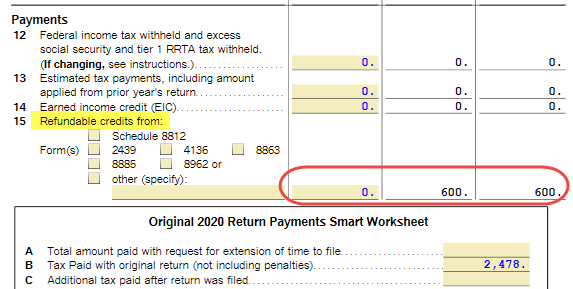

IRS CP 12R Recovery Rebate Credit Overpayment

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Web Individuals who did not qualify for or did not receive the full amount of the third Economic Impact Payment may be eligible to claim the 2021 Recovery Rebate Credit based on Web 10 d 233 c 2021 nbsp 0183 32 You may have received a second letter in 2021 from the IRS about the math or clerical error made when computing your 2020 Recovery Rebate Credit If you

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 1 f 233 vr 2022 nbsp 0183 32 The IRS letter can help tax filers determine whether they are owed more money and if they are eligible to claim the Recovery Rebate Credit on their 2021 tax return when they file a return

Download Recovery Rebate Credit Letter

More picture related to Recovery Rebate Credit Letter

10 Recovery Rebate Credit Worksheet

https://i2.wp.com/db-excel.com/wp-content/uploads/2019/09/recovery-rebate-credit-worksheet-tax-guru-kertetter-letter.jpg

1040 EF Message 0006 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/16934 image 3.jpg

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 31 janv 2022 nbsp 0183 32 The maximum Recovery Rebate Credit on 2021 returns amounts to 1 400 per person including all qualifying dependents claimed on a tax return A married couple Web 2 juin 2021 nbsp 0183 32 IRS Will Send Recovery Rebate Credit Letters to Some Taxpayers The IRS announced that they will begin sending letters to taxpayers who claimed the Recovery

Web 5 ao 251 t 2021 nbsp 0183 32 IRS Letters Due to the 2020 Recovery Rebate Credit August 5 2021 By Grace Kvantas Recently the Internal Revenue Service has been sending out a lot of Web 6 avr 2021 nbsp 0183 32 The IRS is mailing letters to some taxpayers who claimed the 2020 Recovery Rebate Credit and may be getting less stimulus than expected Here s why

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/recovery-rebate-credit-third-stimulus-stimulusinfoclub.png?w=1370&ssl=1

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

https://www.irs.gov/newsroom/irs-letters-explain-why-some-2020...

Web 5 avr 2021 nbsp 0183 32 IR 2021 76 April 5 2021 WASHINGTON As people across the country file their 2020 tax returns some are claiming the 2020 Recovery Rebate Credit RRC The

https://www.taxpayeradvocate.irs.gov/covid-19-home/3rd-eip-and-2021-rrc

Web This letter helps EIP recipients determine if they re eligible to claim the Recovery Rebate Credit on their 2021 tax year returns It provided the total amount of the third Economic

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Third Stimulus StimulusInfoClub Recovery Rebate

Recovery Rebate Credit Form Printable Rebate Form

How To Figure The Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit Worksheet Tax Guru Ker Tetter Letter Recovery

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

2022 Irs Recovery Rebate Credit Worksheet Rebate2022 Rebate2022

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Recovery Rebate Credit Letter - Web 17 ao 251 t 2022 nbsp 0183 32 Key Takeaways The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received