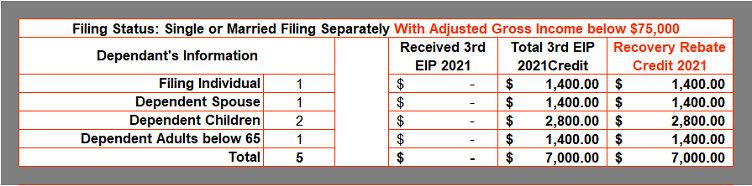

Recovery Rebate Credit Married Filing Separately Web 10 d 233 c 2021 nbsp 0183 32 75 000 if filing as a single or as married filing separately Your payment will be reduced by 5 of the amount by which your AGI exceeds the applicable threshold

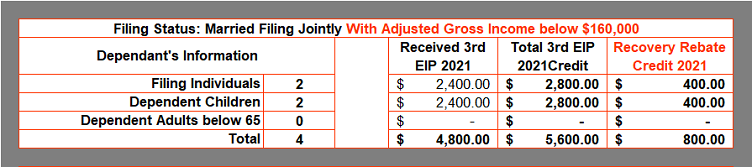

Web 17 f 233 vr 2022 nbsp 0183 32 You were issued the full amount of the Recovery Rebate Credit if your third Economic Impact Payment was 1 400 2 800 if married filing jointly for 2021 plus Web 2020 Recovery Rebate Credits for example with adjusted gross income of more than 75 000 if filing as single or 150 000 if filing as married filing jointly However the 2021

Recovery Rebate Credit Married Filing Separately

Recovery Rebate Credit Married Filing Separately

https://msofficegeek.com/wp-content/uploads/2022/01/RRC-2021-Married-Filing-Jointly.png

Filled Out Amended Return To Claim Recovery Rebate Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/filled-out-amended-return-to-claim-recovery-rebate.png

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/RRC-2021-Single-or-Married-Filing-Separately.png?is-pending-load=1

Web 1 juil 2020 nbsp 0183 32 Married filing separately may be an option In most situations it is better for a married couple to file a joint return rather than file Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

Web 18 janv 2022 nbsp 0183 32 At first glance it looks like filing Married Filing Separately will result in an additional 877 in taxes for the couple However Michelle s return will also contain an Recovery Rebate Credit of 4 200 meaning Web 12 oct 2022 nbsp 0183 32 Image credit Getty Images By Rocky Mengle last updated October 12 2022 If you didn t get a third stimulus check or you only got a partial check then you

Download Recovery Rebate Credit Married Filing Separately

More picture related to Recovery Rebate Credit Married Filing Separately

Recovery Rebate Credit Married In 2023 Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/missing-stimulus-payments-irs-offers-details-to-receive-recovery-2.jpg

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

The Recovery Rebate Credit Calculator ShauntelRaya

https://www.efile.com/image/recovery-rebate-3.png

Web 27 nov 2022 nbsp 0183 32 I am married filing separately and claimed the recovery rebate credit in 2021 IRS disallowed and and had to repay it Why would this be I met the income Web 3 mars 2022 nbsp 0183 32 Your first Economic Impact Payment was 1 200 2 400 if married filing jointly for 2020 plus 500 for each qualifying child you had in 2020 Your second

Web 28 avr 2021 nbsp 0183 32 Finally married couples in separate property states can explore whether filing separate returns and stuffing the lower earning spouse s income with all available Web 30 avr 2021 nbsp 0183 32 The recovery rebate round 1 is a refundable tax credit on the 2020 tax return equal to 1 200 2 400 on a joint return plus 500 for each dependent under

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 75 000 if filing as a single or as married filing separately Your payment will be reduced by 5 of the amount by which your AGI exceeds the applicable threshold

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-g...

Web 17 f 233 vr 2022 nbsp 0183 32 You were issued the full amount of the Recovery Rebate Credit if your third Economic Impact Payment was 1 400 2 800 if married filing jointly for 2021 plus

Recovery Credit Printable Rebate Form

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Cares Act Recovery Rebate Credit Recovery Rebate

Fillable Online Claiming The Recovery Rebate Credit If Your Filing

Recovery Rebate Credit Form Printable Rebate Form

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Recovery Rebate Credit Married Filing Separately - Web 19 janv 2023 nbsp 0183 32 The Recovery Rebate is available for federal income tax returns up to 2021 If you re a married couple with two kids and are tax dependent taxpayer you may get as