Recovery Rebate Credit No Income Web 13 janv 2022 nbsp 0183 32 Also estates trusts and individuals who died before January 1 2021 do not qualify for the 2021 Recovery Rebate Credit If your income is 73 000 or less you can

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 13 janv 2022 nbsp 0183 32 If you have no taxable income simply answer the questions including those requesting information needed to compute the 2021 Recovery Rebate Credit Complete

Recovery Rebate Credit No Income

Recovery Rebate Credit No Income

https://www.usatoday.com/gcdn/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?width=1320&height=990&fit=crop&format=pjpg&auto=webp

IT S NOT TOO LATE Claim A Recovery Rebate Credit To Get Your

https://media.cbs19.tv/assets/KYTX/images/3ca89be7-1360-4b18-a5ba-3c6279cb9539/3ca89be7-1360-4b18-a5ba-3c6279cb9539_1140x641.png

Learn About The Recovery Rebate Credit ATC Income Tax

https://www.atcincometax.com/wp-content/uploads/2021/01/Picture1-1.png

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 16 nov 2022 nbsp 0183 32 Taxpayers who have no taxable income but are filing a return to receive the Recovery Rebate Credit should look for several of the Free File products that have no

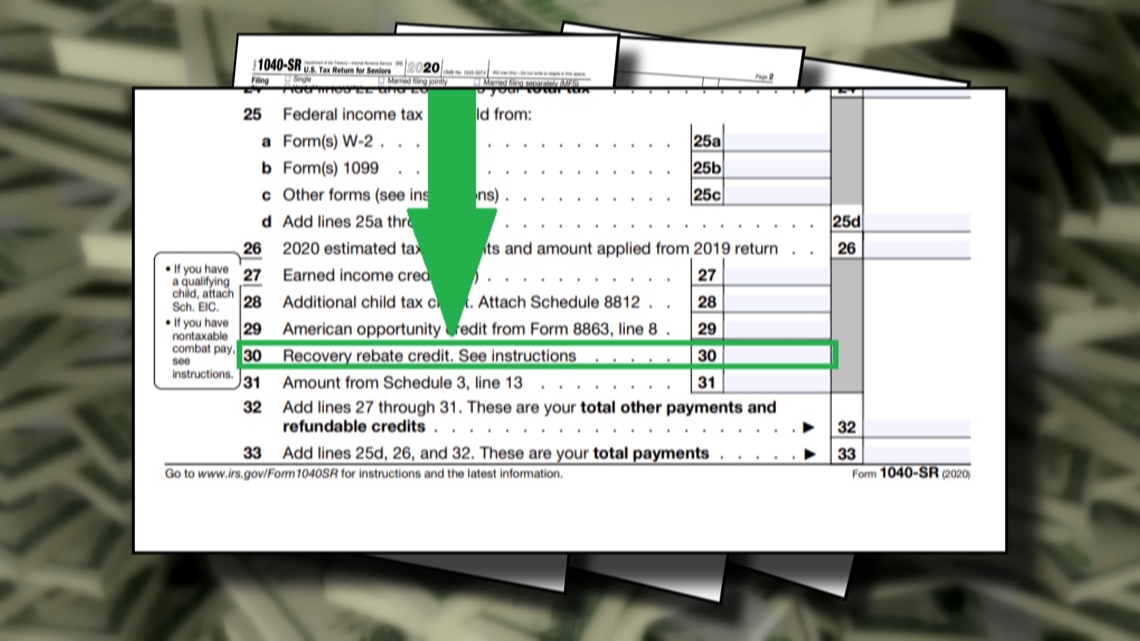

Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate Web 17 ao 251 t 2022 nbsp 0183 32 If you filed your 2020 and or 2021 taxes and failed to claim a Recovery Rebate Credit you can still try to file an Amended Tax Return 1040 X The IRS will not calculate your Recovery Rebate

Download Recovery Rebate Credit No Income

More picture related to Recovery Rebate Credit No Income

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Recovery Rebate Credit Won t Be Applied To Past due Federal Income Tax

https://ctbk.com/wp-content/uploads/2021/03/1040-treasury-1536x1024.jpg

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic Web 10 d 233 c 2021 nbsp 0183 32 Q A1 I used the Non Filers Enter Payment Info Here tool in 2020 and don t usually file a tax return How can I claim a 2020 Recovery Rebate Credit updated

Web 1 f 233 vr 2022 nbsp 0183 32 The maximum Recovery Rebate Credit on 2021 returns amounts to 1 400 per person including all qualifying dependents claimed on a tax return A married couple Web 27 avr 2023 nbsp 0183 32 The income requirements for the recovery rebate tax credit are the same as for the stimulus payments So if a stimulus check missed you or you received a partial payment you may be

Recovery Rebate Credit Santa Barbara Tax Products Group

https://www.sbtpg.com/wp-content/uploads/2021/01/recovery-rebate-credit-768x403.jpg

Recovery Rebate Credit On The 2020 Tax Return

https://www.taxgroupcenter.com/wp-content/uploads/2021/05/Recovery-rebate-credit.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Also estates trusts and individuals who died before January 1 2021 do not qualify for the 2021 Recovery Rebate Credit If your income is 73 000 or less you can

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

What Is The IRS Recovery Rebate Credit MidSouth Community Federal

Recovery Rebate Credit Santa Barbara Tax Products Group

Recovery Rebate Credit 2022 2023 Credits Zrivo

What s The Recovery Rebate Credit Kiplinger

Eligibility For Recovery Rebate Credit Ft Myers Naples Markham Norton

IRS Letters Due To The 2020 Recovery Rebate Credit Financial Symmetry

IRS Letters Due To The 2020 Recovery Rebate Credit Financial Symmetry

The Recovery Rebate Credit Explained Expat US Tax

How To Claim The Recovery Rebate Credit FAQs Charlotte Center For

Bland Garvey CPA Recovery Rebate Credit Richardson TX

Recovery Rebate Credit No Income - Web 10 d 233 c 2021 nbsp 0183 32 If you either didn t receive any first or second Economic Impact Payments or received less than these full amounts you may be eligible to claim the Recovery Rebate