Recovery Rebate Credit See Instructions Web 8 f 233 vr 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and Web 13 d 233 c 2022 nbsp 0183 32 December 13 2022 by tamble Recovery Rebate Credit See Instructions The Recovery Rebate gives taxpayers an possibility of receiving an income tax refund

Recovery Rebate Credit See Instructions

Recovery Rebate Credit See Instructions

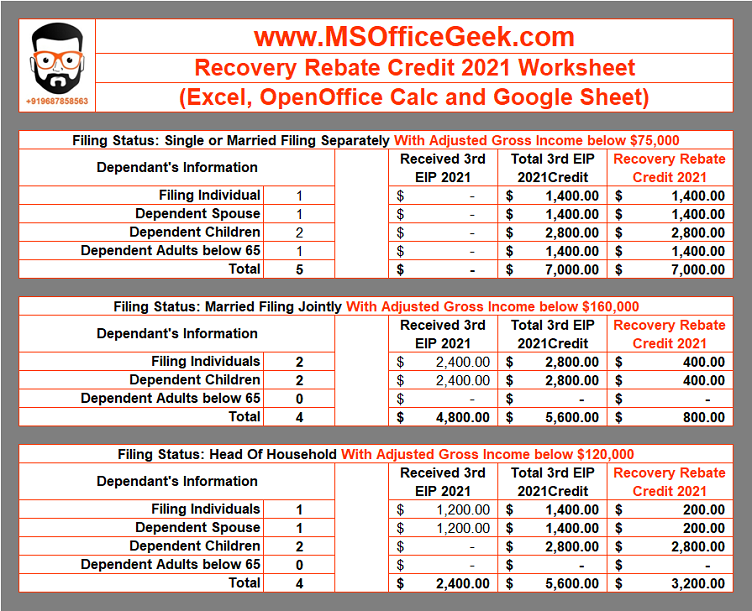

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Web 6 f 233 vr 2023 nbsp 0183 32 The Recovery Rebate is available for federal income tax returns through 2021 You can receive up to 1 400 per qualifying tax dependent married couple with Web 17 janv 2023 nbsp 0183 32 Your income could affect how much you receive a recovery credit Your credit score can be reduced to zero for people who earn over 75 000 Joint filers

Web 23 avr 2023 nbsp 0183 32 In accordance with your earnings however the recovery credits could be reduced Your credit score could drop to zero if your earnings exceeds 75 000 Joint Web Generally you are eligible to claim the Recovery Rebate Credit if You were a U S citizen or U S resident alien in 2021 You are not a dependent of another taxpayer for tax

Download Recovery Rebate Credit See Instructions

More picture related to Recovery Rebate Credit See Instructions

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

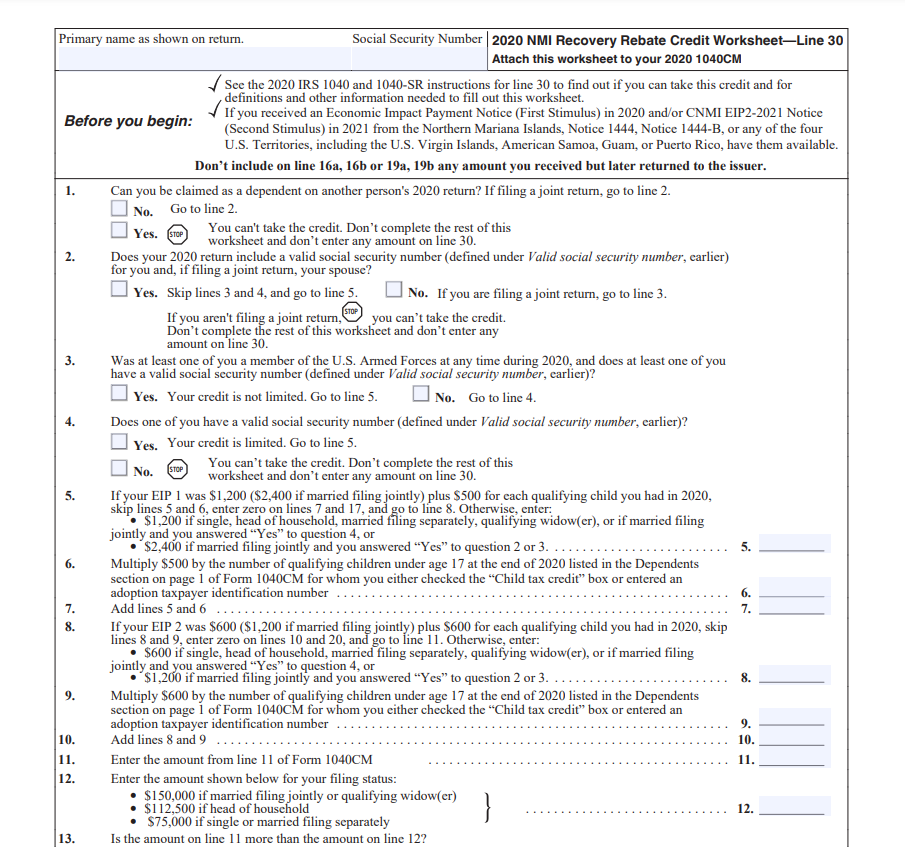

Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2020 2020 Form 1040 and Form 1040 SR instructions PDF can also help determine if you are eligible for the Web 28 avr 2023 nbsp 0183 32 See Instructions The Recovery Rebate offers taxpayers the possibility of receiving a tax return with no tax return adjusted The program is offered by the IRS It is

Web 10 d 233 c 2021 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2020 Form 1040 and Form 1040 SR instructions PDF can help determine if you are eligible for the credit The Web 3 mars 2023 nbsp 0183 32 Your income will affect the amount of your recovery rebate credit Your credit will be reduced to zero if the earnings you earn are greater than 75k Joint filers

Recovery Rebate Credit Worksheet Explained Support

https://support.taxslayer.com/hc/article_attachments/4415864484109/mceclip1.png

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Web 8 f 233 vr 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

What Is The Recovery Rebate Credit CD Tax Financial

Recovery Rebate Credit Worksheet Explained Support

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

1040 EF Message 0006 Recovery Rebate Credit Drake20

How To Use The Recovery Rebate Credit Worksheet TY2020 Print View

How To Use The Recovery Rebate Credit Worksheet TY2020 Print View

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

What Does It Mean To Claim The Recovery Rebate Credit Leia Aqui Who

Recovery Rebate Credit See Instructions - Web 10 d 233 c 2021 nbsp 0183 32 If you must file an amended return to claim the Recovery Rebate Credit use the worksheet on page 59 of the 2020 instructions for Form 1040 and Form 1040 SR