Recovery Rebate Credit Tax Act Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 20 d 233 c 2022 nbsp 0183 32 It is critical that eligible individuals claiming a Recovery Rebate Credit understand that the advance payments applied to different tax years Depending on

Recovery Rebate Credit Tax Act

Recovery Rebate Credit Tax Act

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-3.png?w=696&h=696&crop=1&ssl=1

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

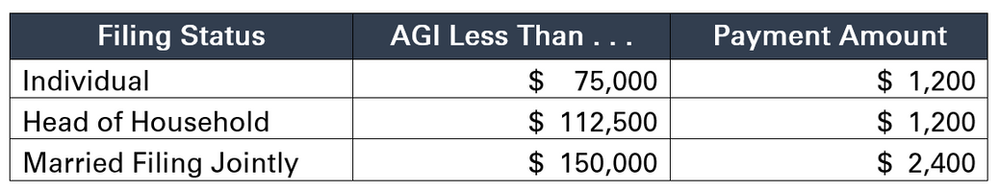

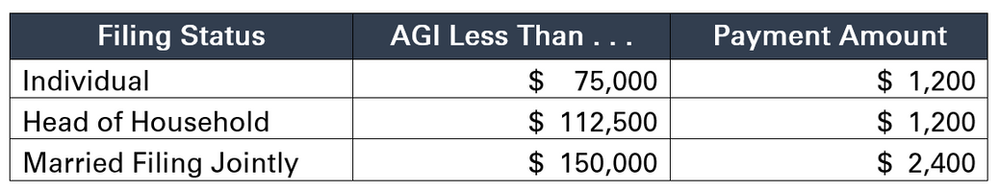

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web 17 ao 251 t 2022 nbsp 0183 32 What Was the Recovery Rebate Credit The Recovery Rebate Credit was authorized by the Coronavirus Aid Relief and Economic Security CARES Act and paid in advance to most eligible

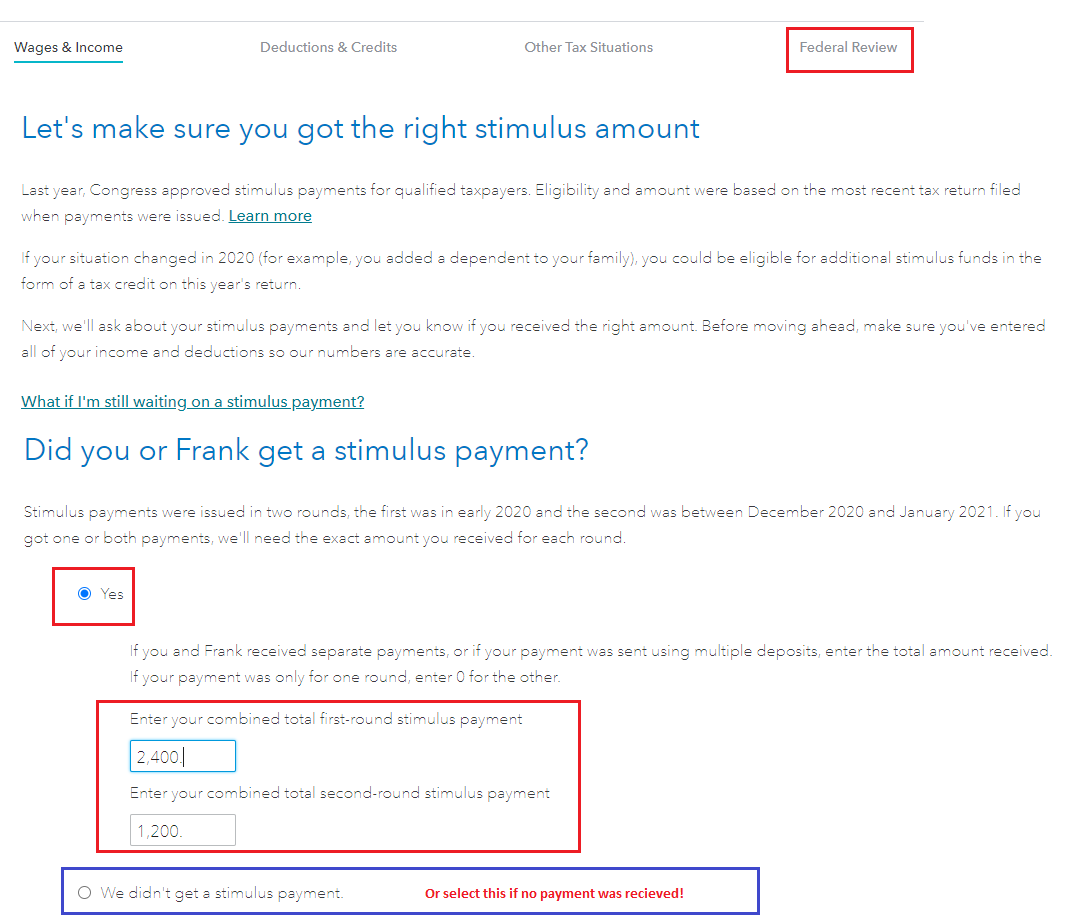

Web To enter or review your Recovery Rebate information in TaxAct From within your TaxAct return Online or Desktop click Federal On smaller devices click in the upper left Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return

Download Recovery Rebate Credit Tax Act

More picture related to Recovery Rebate Credit Tax Act

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Cares Act Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/cares-act-recovery-rebates-distributions-rmd-waivers-student-loan.png

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Web If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you Web The Recovery Rebate Credit is a new tax credit added to the 2020 IRS Form 1040 The stimulus payments were an advance or pre payment of this credit Credits even when

Web If you are missing all or part of your third stimulus payment you can claim the amount as a Recovery Rebate Credit on your 2021 income tax return How is the 2021 Recovery Rebate Credit different from 2020 The third Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840

10 Recovery Rebate Credit Worksheet

https://i2.wp.com/www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

IRSnews On Twitter Share IRS Information About The Recovery Rebate

https://pbs.twimg.com/media/Ft8kx5BXsAA6KQg.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

9 Easy Ways What Is The Recovery Rebate Credit 2021 Alproject

10 Recovery Rebate Credit Worksheet

Cp11 Recovery Rebate Credit 2022 Rebate2022

1040 Line 30 Recovery Rebate Credit Recovery Rebate

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Check Status Of Recovery Rebate Recovery Rebate

Check Status Of Recovery Rebate Recovery Rebate

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

Recovery Rebates Threshold Recovery Rebate

Recovery Rebate Credit Tax Act - Web 24 ao 251 t 2023 nbsp 0183 32 The American Rescue Plan Act of 2021 created a third Recovery Rebate Credit of up to 1 400 per eligible individual for Tax Year 2021 The legislation also