Recovery Rebate Credit Tax Offset Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 15 mars 2021 nbsp 0183 32 Unlike the advance payments issued to individuals last spring and in early January the credit claimed on a 2020 tax return will be reduced to pay off certain Web The Recovery Rebate Credit is authorized by the Coronavirus Aid Relief and Economic Security CARES Act signed into law on March 27 2020 and the COVID related Tax

Recovery Rebate Credit Tax Offset

Recovery Rebate Credit Tax Offset

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

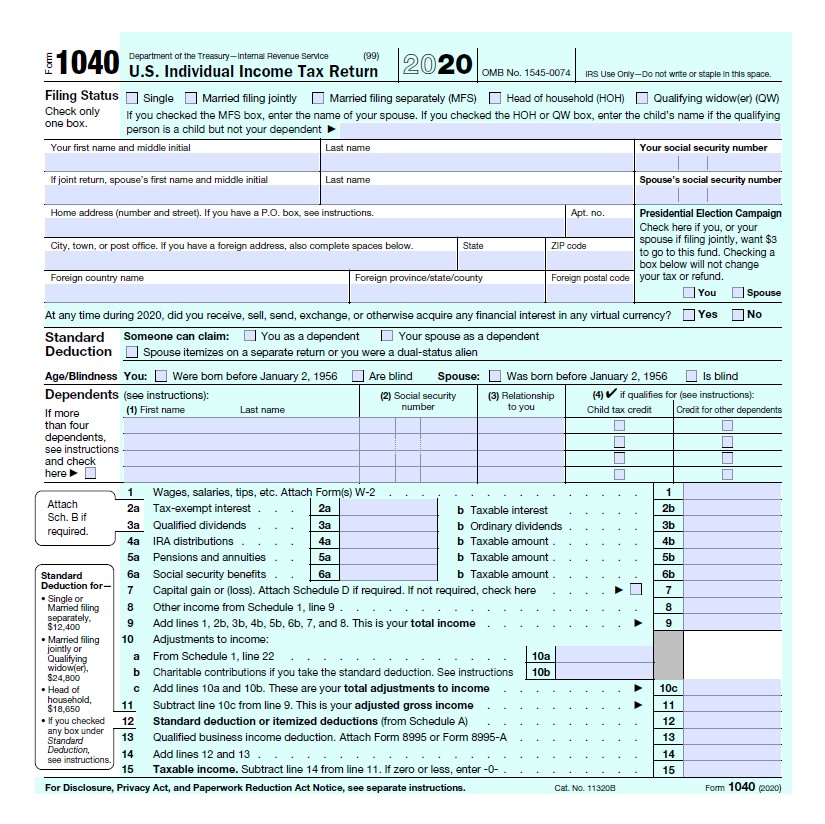

Recovery Credit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

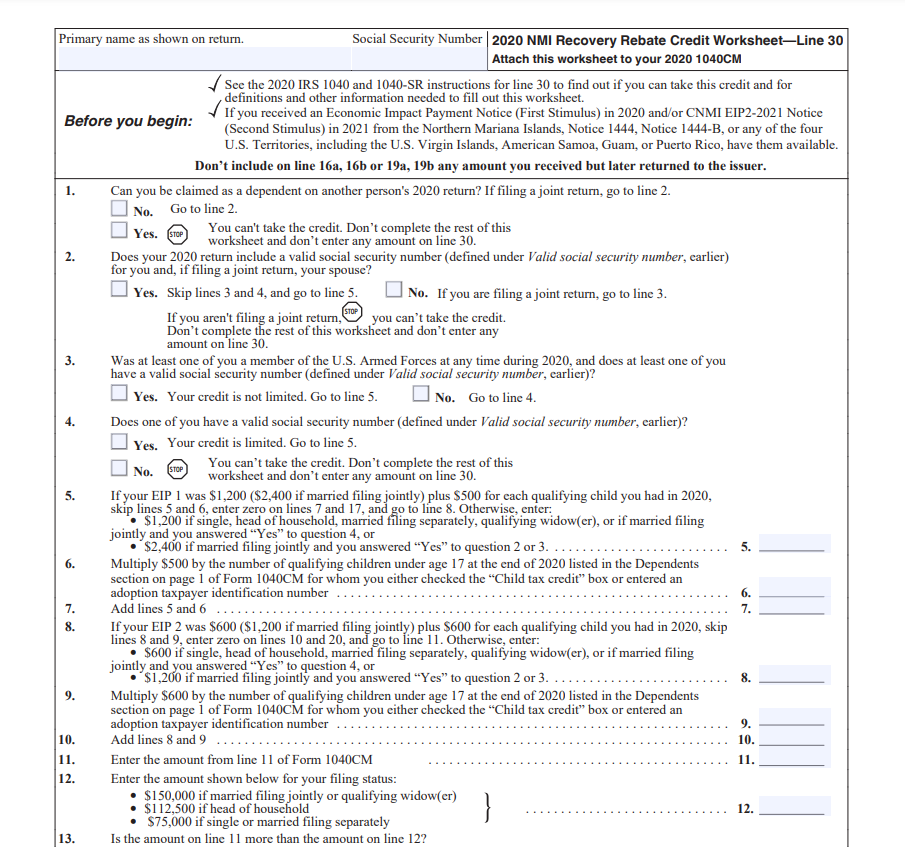

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

Web 13 avr 2022 nbsp 0183 32 Your 2020 Recovery Rebate Credit will reduce the amount of tax you owe for 2020 or if the credit is more than the tax you owe it will be included as part of your Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic

Web 8 f 233 vr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information from Web 24 ao 251 t 2023 nbsp 0183 32 Taxpayers who claim the Recovery Rebate Credit on their Tax Year 2021 returns must reduce the credit by any advance payment they received Impact on Tax

Download Recovery Rebate Credit Tax Offset

More picture related to Recovery Rebate Credit Tax Offset

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/lh5.googleusercontent.com/proxy/lGA90iOjY_1LO-OBBI3qmZMyKEj47RMisqIykTyVbIbO-V2GqH4xUV92z9Uq0pojRygogoMZtKIKKsqfiqET_2bvfJQoMviJq-wHNdbSR8ZyQ-ukMly2632ZZ7bKcCkHDaCeogT6Skm16tenIHu_TkBU8w=w1200-h630-p-k-no-nu

Recovery Rebate Credit Worksheet 2020 Ideas 2022

https://i2.wp.com/le-cdn.hibuwebsites.com/6795e9d01eed4352a64d15f170ad49ae/dms3rep/multi/opt/Recovery+Rebate2020-1920w.jpeg

Web 15 avr 2021 nbsp 0183 32 Keep in mind that the credit is part of your tax refund and your tax refund is subject to any offset However see the National Taxpayer Advocate s blog dated March Web This offset creates an inconsistency between the treatment of the advance payments and the treatment of RRCs claimed on 2020 tax returns where the RRC will be reduced by

Web 26 janv 2021 nbsp 0183 32 Typically the IRS may reduce a taxpayer s refund to offset past due tax debt child support and other federal liabilities such as for student loans A refund can also be garnished for state Web 1 janv 2021 nbsp 0183 32 All eligible individuals are entitled to a payment or credit of up to 1 200 for individuals or 2 400 for married couples filing jointly Eligible individuals also receive

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-f...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.taxpayeradvocate.irs.gov/news/nta-blog-update-on-offset-of...

Web 15 mars 2021 nbsp 0183 32 Unlike the advance payments issued to individuals last spring and in early January the credit claimed on a 2020 tax return will be reduced to pay off certain

Recovery Rebate Credit Line 30 Instructions Recovery Rebate

1040 Recovery Rebate Credit Drake20

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

1040 Line 30 Recovery Rebate Credit Recovery Rebate

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Cares Act Recovery Rebate Credit Recovery Rebate

Child Tax Credit Worksheet Claiming The Recovery Rebate Credit

Recovery Rebate Credit Tax Offset - Web 8 f 233 vr 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit can reduce any taxes owed or be included in the tax refund for the 2021 tax year Filers must ensure to not mix information from