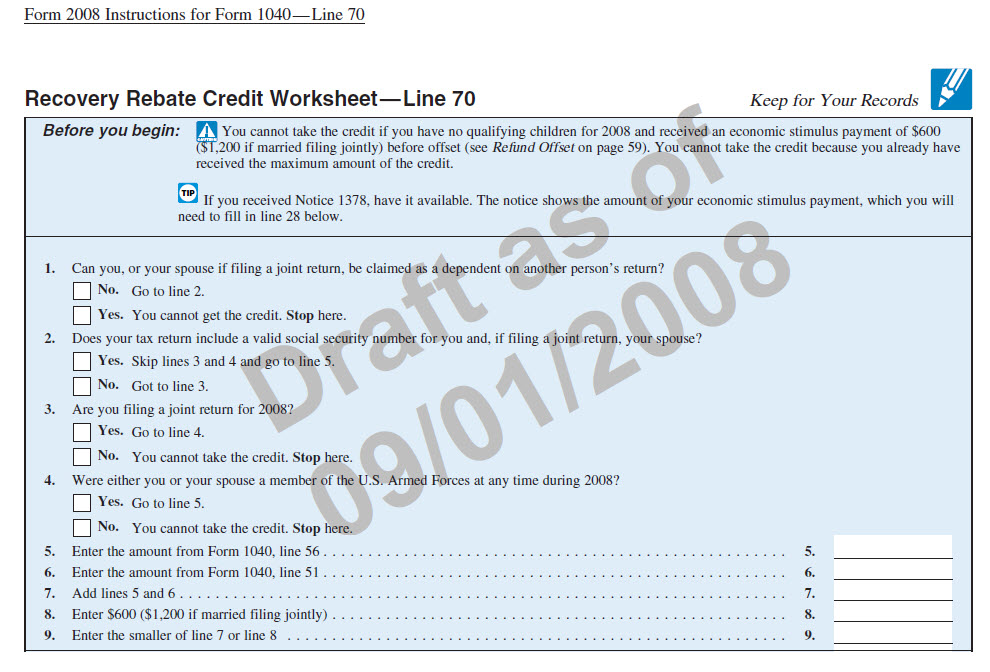

Recovery Rebate Credit Taxable Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic

Recovery Rebate Credit Taxable

Recovery Rebate Credit Taxable

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

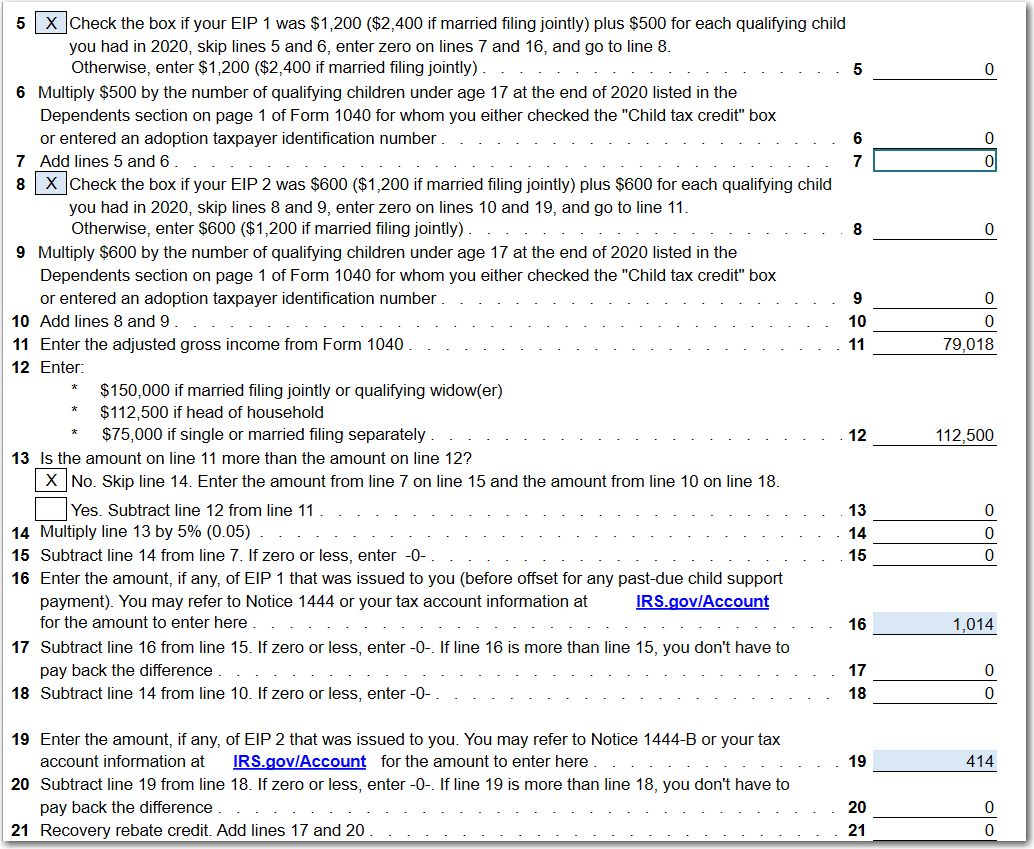

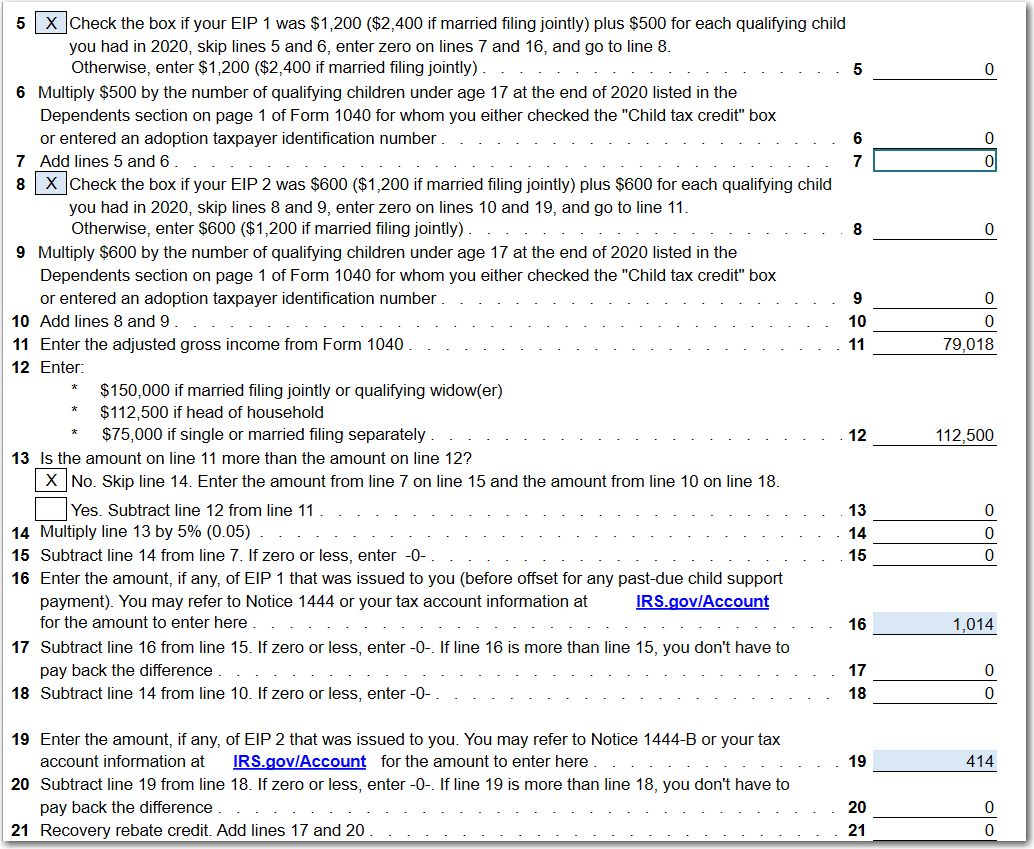

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108Part2-764112.jpg

Web 2020 Recovery Rebate Credit Must file a 2020 tax return to claim if eligible Get My Payment When your Third Economic Impact Payment is scheduled find when and how Web 17 ao 251 t 2022 nbsp 0183 32 The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021

Web The law also provided for an advanced payment of the Recovery Rebate Credit RRC in calendar year 2020 These payments were referred to as Economic Impact Payments Web 30 d 233 c 2020 nbsp 0183 32 For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received

Download Recovery Rebate Credit Taxable

More picture related to Recovery Rebate Credit Taxable

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/proconnect.intuit.com/community/image/serverpage/image-id/2609i6F2345BD501809A1/image-size/large?v=1.0&px=999

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

Web 3 avr 2021 nbsp 0183 32 Such a person can claim a Recovery Rebate Credit for the payment during tax season this year It will come in the form of a tax refund They must file a 2020 tax Web 5 d 233 c 2022 nbsp 0183 32 The Recovery Rebate Credit amount is figured just like the first and second economic impact stimulus payments except that it uses your client s tax year 2020

Web 1 d 233 c 2022 nbsp 0183 32 The 2020 Recovery Rebate Credit is actually a tax year 2020 tax credit The government sent payments beginning in April of 2020 and a second round beginning in Web The Recovery Rebate Credit is a new tax credit added to the 2020 IRS Form 1040 The stimulus payments were an advance or pre payment of this credit Credits even when

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Rebate Credit Worksheet Example Studying Worksheets Recovery

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Solved Amend 2020 Tax Forms For The Recovery Rebate Credit Recovery

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

Recovery Rebate Credit Taxable - Web 30 d 233 c 2020 nbsp 0183 32 For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received