Recovery Rebate Credit Turbotax 2024 People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020 and early 2021

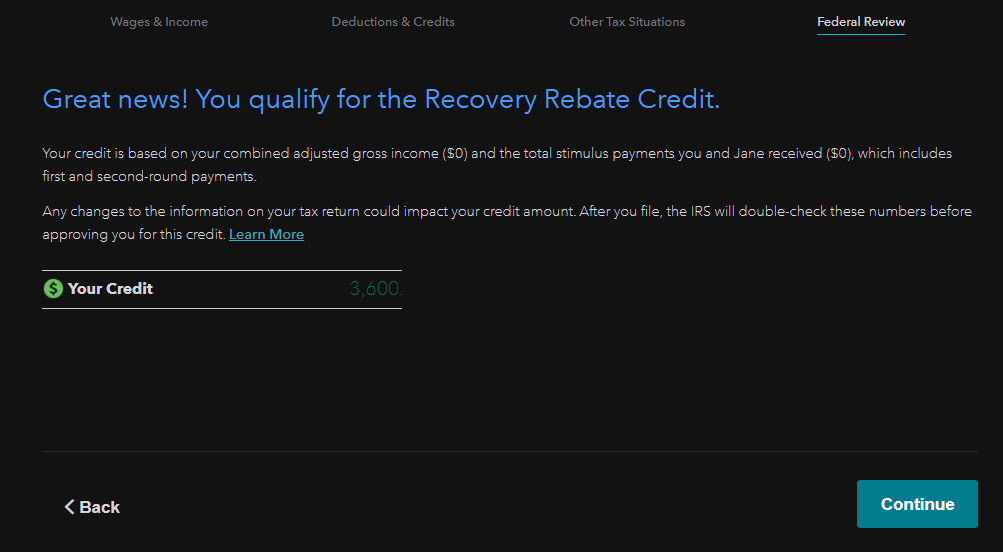

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit TurboTax will ask you upfront if you received a stimulus payment and help you claim the Recovery Rebate Credit and other tax deductions and credits you re eligible for based on your entries your tax expert will amend your 2023 tax return for you through 11 15 2024 After 11 15 2024 TurboTax Live Full Service customers will be able to

Recovery Rebate Credit Turbotax 2024

Recovery Rebate Credit Turbotax 2024

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-1.png

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

https://www.irsofficesearch.org/wp-content/uploads/2021/02/recovery-rebate-credit.png

What Section Is The Recovery Rebate Credit On Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/recovery-rebate-credit-worksheet-turbotax-studying-worksheets-30.png?fit=924%2C568&ssl=1

SOLVED by TurboTax 716 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received less than the full amount you may be eligible for the 2020 Recovery Rebate Credit RRC Generally the credit can increase your refund amount or lower the taxes you may owe On January 19 2024 the Ways and Means Committee made a significant bipartisan move by approving the Tax Relief for American Families and Workers Act of 2024 This legislation is designed to provide crucial support to American job creators small businesses and working families By accelerating the end of the COVID era Employee Retention Tax

Download Recovery Rebate Credit Turbotax 2024

More picture related to Recovery Rebate Credit Turbotax 2024

Recovery Rebate Credit Form Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/2022-tax-form-1040es.jpg

Recovery Rebate Credit On The 2022 Tax Return Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/turbotax-recovery-rebate-credit-form-printable-rebate-form-14.jpg

What Is The 2020 Recovery Rebate Credit And Am I Eligible TurboTax Tax Tips Videos

https://digitalasset.intuit.com/content/dam/intuit/cg/en_us/turbotax/tax-tips/images/general/what_is_the_recovery_rebate_credit_and_am_i_eligible.jpg

If you re one of the many who are owed stimulus money you may be able to claim the amount as a recovery rebate tax credit on your 2020 or 2021 federal tax return Featured Partner Offers The maximum credit for the 2023 tax year is 7 430 up from 6 935 the prior year But Social Security beneficiaries may get hit with higher taxes Jaeger warned

Even if you don t file taxes you can still file for the recovery rebate credit with the 1040 form but at this point the filing lines for the IRS aren t even open yet The age requirements revert back and taxpayers with no kids have to be 25 or under 65 to claim the credit In addition previous year income cannot be used to help you qualify for the Earned Income Tax Credit The Recovery Rebate Credit is not available for this tax year Learn more File an IRS tax extension Tax calculators tools

Where To Enter Recovery Rebate Credit In Turbotax Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/does-turbotax-give-the-irs-my-direct-deposit-information-trending-now.jpg

Recovery Rebate Credit 2023 2024 Credits Zrivo

https://www.zrivo.com/wp-content/uploads/2022/05/Recovery-Rebate-Credit-zrivo-1.jpg

https://www.irs.gov/newsroom/recovery-rebate-credit

People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return The first and second rounds of Economic Impact Payments were advance payments of the 2020 Recovery Rebate Credit claimed on a 2020 tax return They were issued in 2020 and early 2021

https://www.irs.gov/pub/irs-pdf/p5486a.pdf

If you re eligible to claim the 2020 Recovery Rebate Credit you must file a tax return by May 17 2024 to claim the credit If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

Where To Enter Recovery Rebate Credit In Turbotax Recovery Rebate

How To Claim Recovery Rebate Credit With No Income Recovery Rebate

20 2020 Recovery Rebate Credit Worksheet Worksheets Decoomo

What Is The Recovery Rebate Credit 2023 Detailed Information

Recovery Rebate 2023 Turbotax Recovery Rebate

Recovery Rebate 2023 Turbotax Recovery Rebate

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style Worksheets

How To Claim Stimulus Check 2021 Turbotax It S Not Too Late Claim A Recovery Rebate

What Is A Recovery Rebate Tax Credit The TurboTax Blog

Recovery Rebate Credit Turbotax 2024 - SOLVED by TurboTax 716 Updated November 23 2023 The IRS will adjust your refund if you claimed the Recovery Rebate Credit but didn t qualify or overestimated the amount you should have received If a correction is needed the IRS will calculate the correct amount of the Recovery Rebate Credit make the correction to the tax