Recovery Rebate Credit Worksheet 2024 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help How to enter stimulus payments and figure the Recovery Rebate Credit in ProSeries Sign In Lacerte ProConnect ProSeries EasyACCT Quickbooks Online Accountant Intuit Tax Advisor Practice Management eSignature Hosting for Desktop Intuit Link Pay by Refund Quickbooks Discounts Learn support Account management E File Get ready for next year

Recovery Rebate Credit Worksheet 2024

Recovery Rebate Credit Worksheet 2024

https://i0.wp.com/southernmarylandchronicle.com/wp-content/uploads/2021/04/Recovery-Rebate-Credit.png?fit=1200%2C675&ssl=1

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/who-could-qualify-for-2nd-stimulus.jpeg

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

https://www.atxcommunity.com/uploads/monthly_2021_02/199195342_Line30JF.thumb.jpg.e31662de98fd0de6ecee8a30cd267c75.jpg

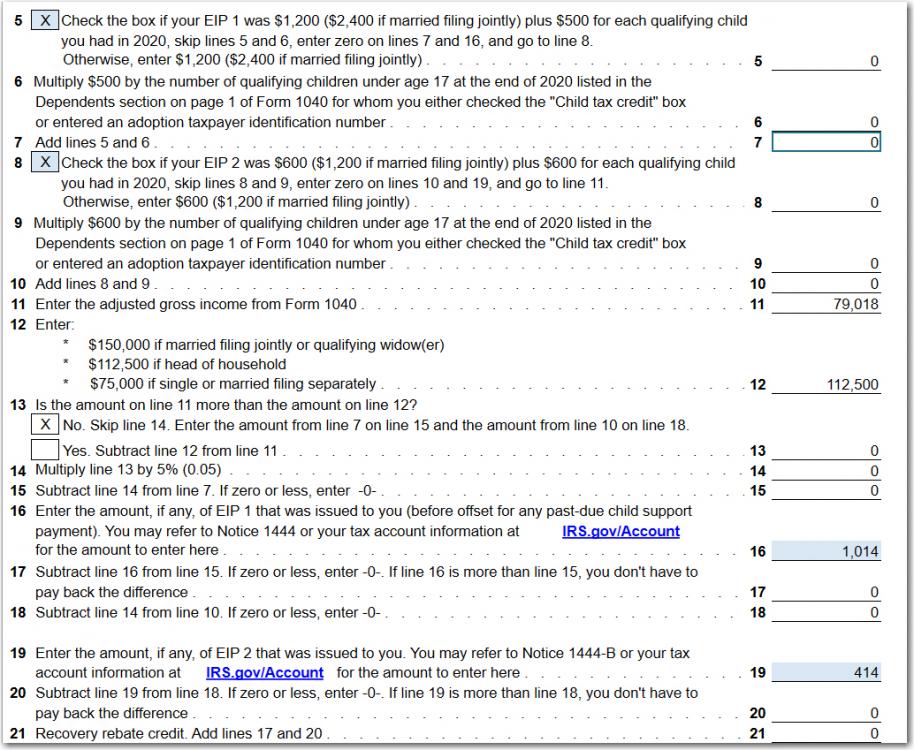

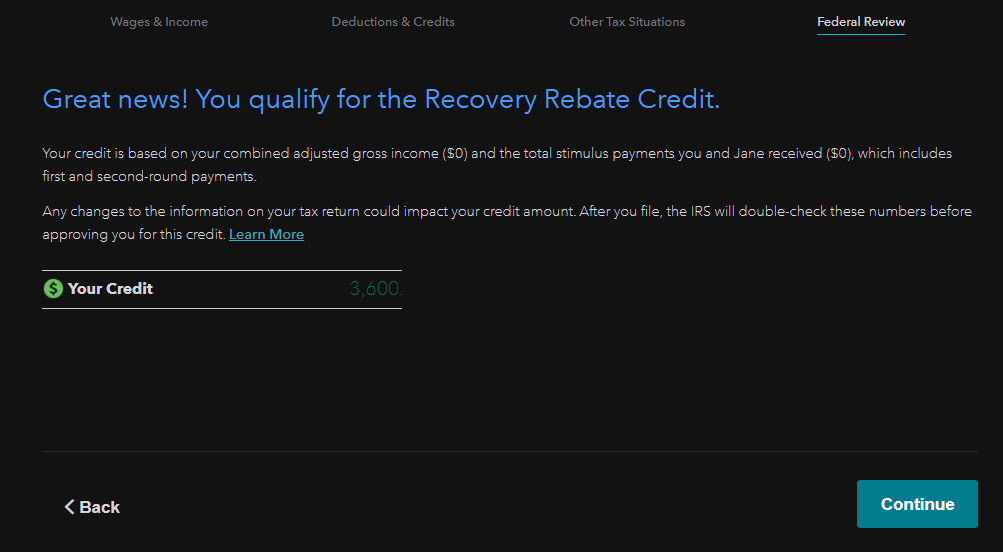

The Recovery Rebate Credit is a tax credit designed to provide financial assistance to eligible individuals affected by the economic downturn caused by the COVID 19 pandemic The credit is based on the taxpayer s 2023 tax return and aims to help those who did not receive the full amount of stimulus payments they were entitled to during that year Recovery Rebate Credit Worksheet Explained As the IRS indicated they are reconciling refunds with stimulus payments and the Recovery Rebate Credit claimed on your return If you do not know the amounts of your stimulus payment refer to notice 1444 C or visit the IRS website

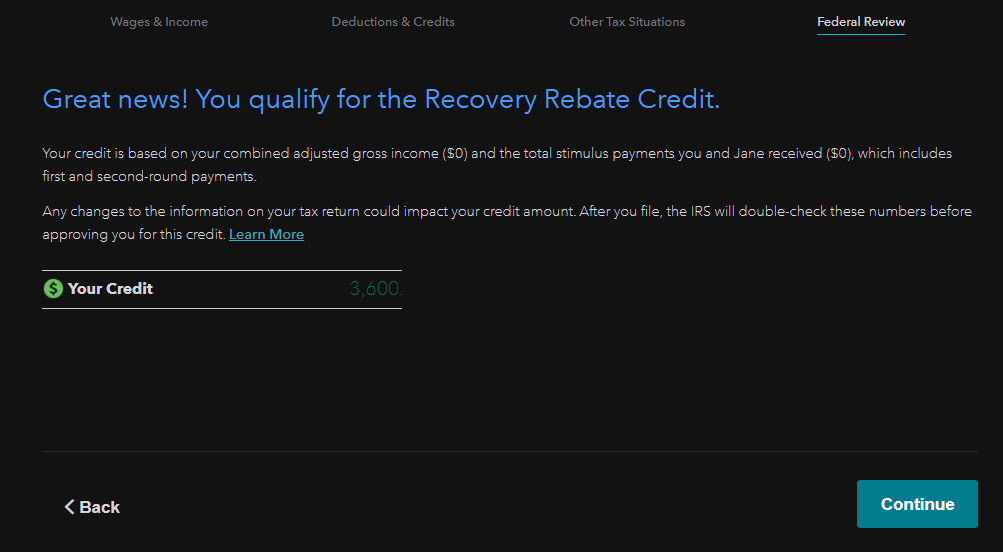

1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing Fee 0 3 OVERVIEW Many Americans may be eligible for the Recovery Rebate Credit commonly referred to as the COVID stimulus payment The credit is for the 2020 tax year even though the last payments came in 2021 for many recipients TABLE OF CONTENTS What is the 2020 Recovery Rebate Credit Who is eligible for the 2020 Recovery Rebate Credit

Download Recovery Rebate Credit Worksheet 2024

More picture related to Recovery Rebate Credit Worksheet 2024

What You Need To Know About Filling Out Your Recovery Rebate Credit Worksheet The East County

https://theeastcountygazette.com/wp-content/uploads/2022/02/2-20-2-1024x683.jpg

Recovery Rebate Credit How Does It Work Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/how-to-use-the-recovery-rebate-credit-worksheet-ty2020-print-view.png

How To Complete Your Recovery Rebate Credit Worksheet For The Stimulus Package The East County

https://theeastcountygazette.com/wp-content/uploads/2022/02/Featured-Image-Templet-2022-02-21T222007.911-2.png

You ll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit This is the case if you received a partial amount less than the The IRS included a Recovery Rebate Credit Worksheet in the instructions for Form 1040 If you are owed money look for the Recovery Rebate Credit that is listed on Line 30 of the 1040 Form for the

As with the stimulus checks calculating the amount of your recovery rebate credit starts with a base amount For most people the base amount for the 2021 credit is 1 400 For married couples If you re eligible to claim the 2021 Recovery Rebate credit you must file a tax return by April 15 2025 to claim the credit IRS Volunteer Income Tax Assistance VITA is a great option for people who are only filing a tax return to claim the Recovery Rebate Credit

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

https://www.irsofficesearch.org/wp-content/uploads/2021/02/recovery-rebate-credit.png

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e-calculating-the-2021-recovery-rebate-credit

Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program

https://www.irs.gov/newsroom/irs-reminds-eligible-2020-and-2021-non-filers-to-claim-recovery-rebate-credit-before-time-runs-out

The 2020 RRC can be claimed for someone who died in 2020 The 2020 RRC and 2021 RRC can be claimed for someone who died in 2021 or later Filing deadlines if you haven t yet filed a tax return To claim the 2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help

Form 1040 Recovery Rebate Credit Worksheet 2022 Recovery Rebate

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery Rebate

Recovery Rebate Credit 2022 Worksheet Recovery Rebate

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery Rebate

Recovery Rebate Credit Worksheet Federal Tax Credits TaxUni Recovery Rebate

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Worksheet Turbotax Studying Worksheets Recovery Rebate

Stimulus Checks New Updates Complete Your Worksheet For The Recovery Rebate Credit

Recovery Rebate Credit Worksheet 2024 - Generally you are eligible to claim the Recovery Rebate Credit if You were a U S citizen or U S resident alien in 2021 You are not a dependent of another taxpayer for tax year 2021 You have a Social Security Number valid for employment that is issued before the due date of your 2021 tax return including extensions