Recovery Rebate Credit Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Recovery Rebate Credit

Recovery Rebate Credit

https://www.atxcommunity.com/uploads/monthly_2021_02/199195342_Line30JF.thumb.jpg.e31662de98fd0de6ecee8a30cd267c75.jpg

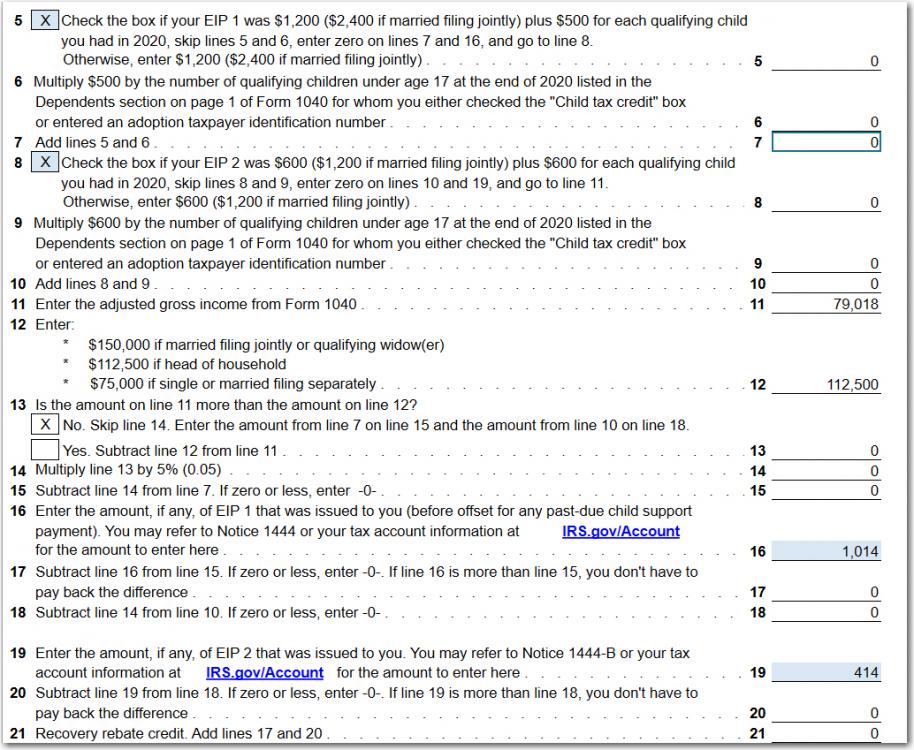

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

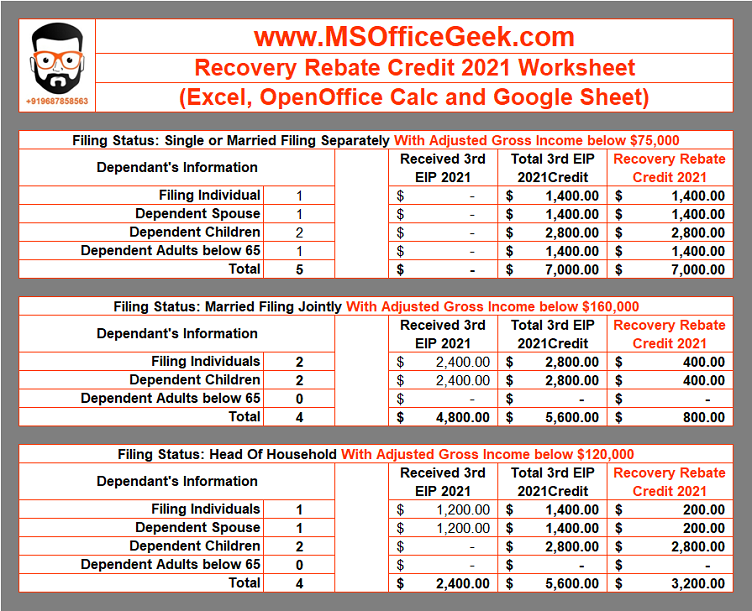

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840 Web 17 ao 251 t 2022 nbsp 0183 32 The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or 2021

Web 15 mars 2023 nbsp 0183 32 Claim the 2021 Recovery Rebate Credit You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return Individuals can view the total amount of their third Economic Web 30 d 233 c 2020 nbsp 0183 32 For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received

Download Recovery Rebate Credit

More picture related to Recovery Rebate Credit

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

http://www.taxguru.net/uploaded_images/IRSRebateRecoveryWorksheet9108-780101.jpg

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

Web 19 janv 2022 nbsp 0183 32 The IRS states that your recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund This means you will either shave off the top Web 27 avr 2023 nbsp 0183 32 The recovery rebate credit is considered a refundable credit meaning it can reduce the amount of taxes you owe or generate a refund to you

Web 2020 Recovery Rebate Credits for example with adjusted gross income of more than 75 000 if filing as single or 150 000 if filing as married filing jointly However the 2021 Web 15 d 233 c 2021 nbsp 0183 32 Everything you need to know about the Recovery Rebate Credit December 15 2021 by Jerry Zeigler Taxes The Recovery Rebate Credit is back for our 2022 tax

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

http://www.consumerismcommentary.com/wp-content/uploads/2009/01/recovery-rebate-credit-1040.jpg

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021.jpg

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit Your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Recovery Credit Printable Rebate Form

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

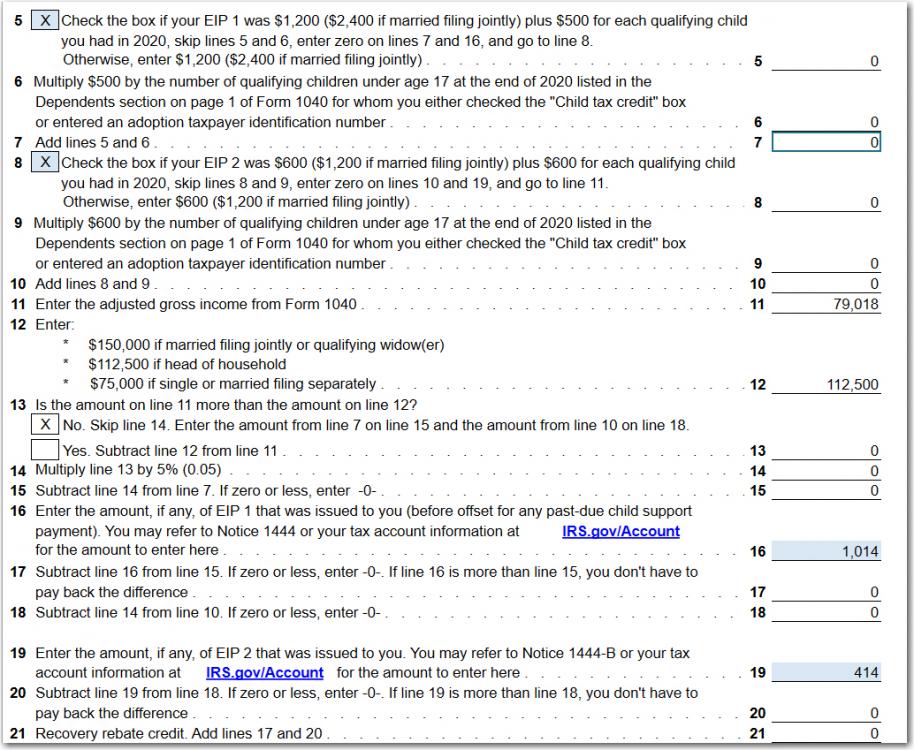

How To Use The Recovery Rebate Credit Worksheet TY2020 Print View

What Is The Recovery Rebate Credit CD Tax Financial

What Is The Recovery Rebate Credit CD Tax Financial

Recovery Rebate Credit 2020 Calculator KwameDawson

The Recovery Rebate Credit Calculator MollieAilie

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Recovery Rebate Credit - Web 12 oct 2022 nbsp 0183 32 As a result after subtracting the amount of their third stimulus payment the recovery rebate credit they report on Line 30 of their 2021 tax return is equal to 840