Recovery Rebate Income Limits Web 10 d 233 c 2021 nbsp 0183 32 The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic Impact

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 13 janv 2022 nbsp 0183 32 If your income is 73 000 or less you can file your federal tax return electronically for free through the IRS Free File Program The fastest way to get your tax

Recovery Rebate Income Limits

Recovery Rebate Income Limits

https://cdn.abcotvs.com/dip/images/9476384_recoery-rebate.jpg?w=1600

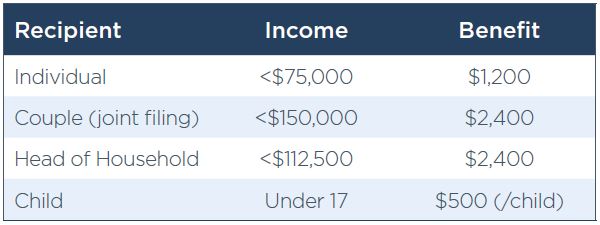

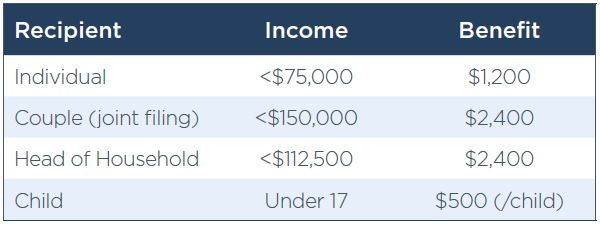

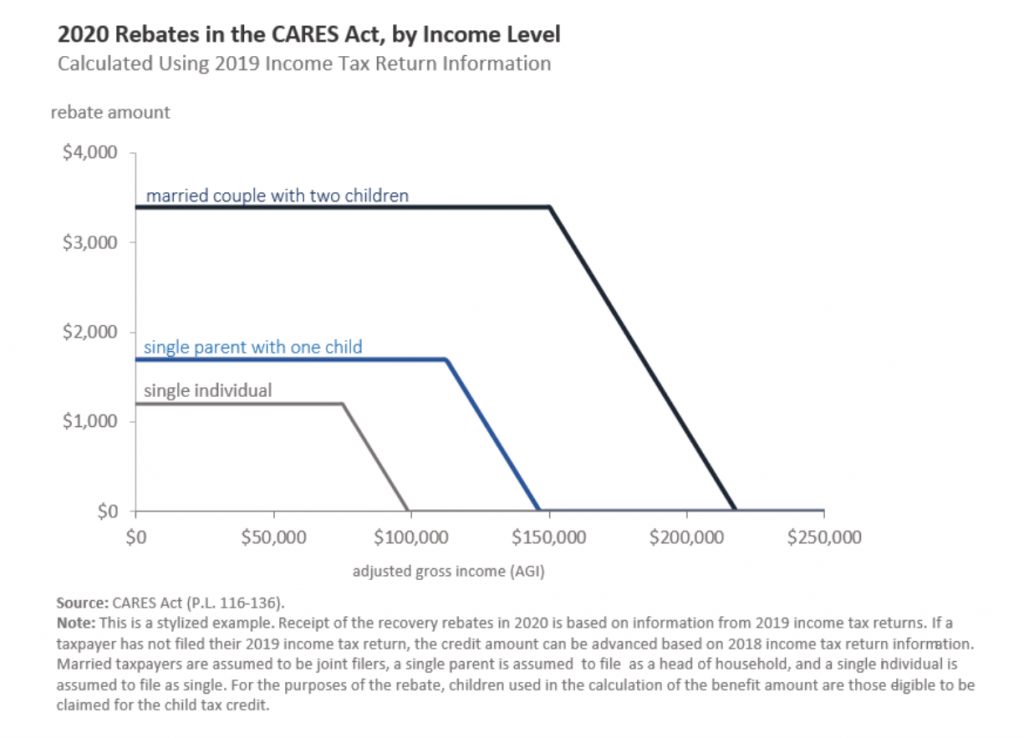

CARES Act What Does It Mean For You Mariner Wealth Advisors

https://www.marinerwealthadvisors.com/wp-content/uploads/2020/05/CARES-Act-Recovery-Rebates.jpg

T20 0114 Senate Republican Recovery Rebate Distribution Of Federal

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0114.gif

Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form Web Individuals who did not qualify for or did not receive the full amount of the third Economic Impact Payment may be eligible to claim the 2021 Recovery Rebate Credit based on

Web 17 ao 251 t 2022 nbsp 0183 32 The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult based on household adjusted gross income AGI plus Web 20 d 233 c 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund You will need the total amount of your third Economic

Download Recovery Rebate Income Limits

More picture related to Recovery Rebate Income Limits

Learn About The Recovery Rebate Credit ATC Income Tax

https://www.atcincometax.com/wp-content/uploads/2021/01/Picture1-1.png

T20 0115 Senate Republican Recovery Rebate Distribution Of Federal

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0115.gif

T08 0033 Individual Income Tax Measures In H R 5140 The Recovery

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/T08-0033.GIF

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for Ethan

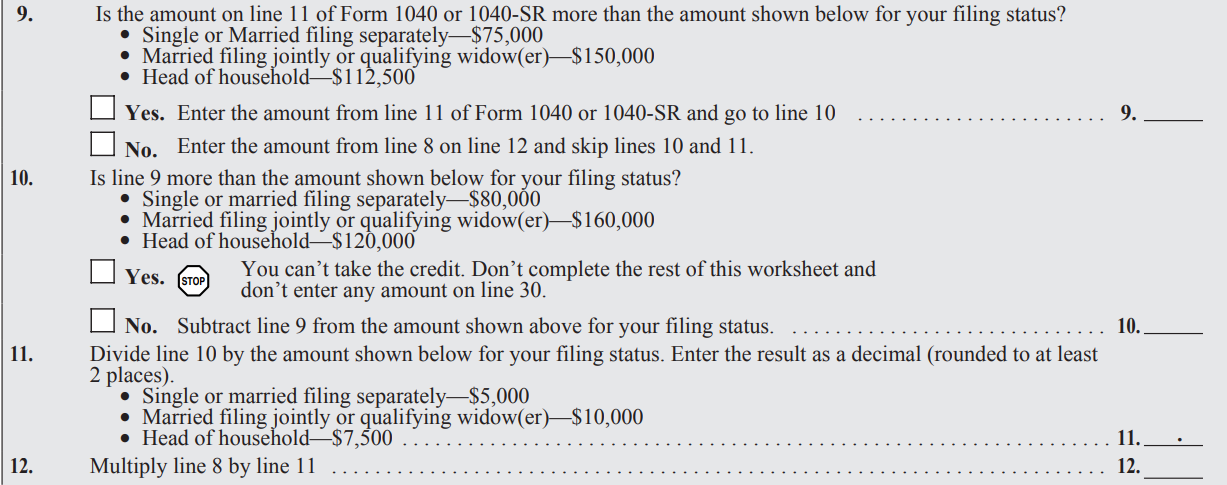

Web 12 mars 2021 nbsp 0183 32 The checks will be a maximum of 1 400 per individual or 2 800 per married couple plus 1 400 per dependent Like past direct payments this third round Web 14 janv 2022 nbsp 0183 32 The 2021 EIP recovery rebate credit has the same income phaseout thresholds as for 2020 75 000 for single filers and 150 000 for married couples filing

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

https://www.taxpolicycenter.org/sites/default/files/styles/full-page-1500x700/public/model-estimates/images/t20-0261_1.gif?itok=NRpj2rAO

T20 0262 Additional 2020 Recovery Rebates For Individuals In The

https://www.taxpolicycenter.org/sites/default/files/model-estimates/images/t20-0262_0.gif

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-topic-b...

Web 10 d 233 c 2021 nbsp 0183 32 The eligibility requirements for the 2020 Recovery Rebate Credit claimed on a 2020 tax return are the same as they were for the first and second Economic Impact

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

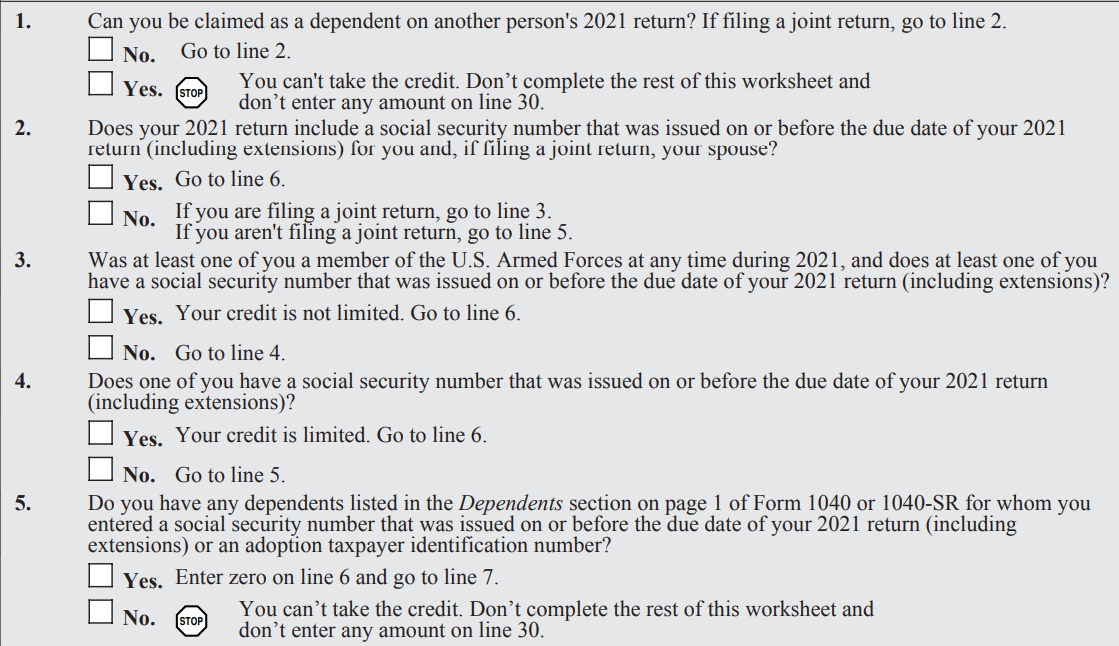

Recovery Rebate Credit Worksheet Explained Support

T20 0261 Additional 2020 Recovery Rebates For Individuals In The

T08 0049 Individual Income Tax Measures In H R 5140 The Recovery

Recovery Rebate Credit Worksheet Explained Support

COVID 19 Economic Impact Payments Will Brownsberger

T08 0033 Individual Income Tax Measures In H R 5140 The Recovery

T08 0033 Individual Income Tax Measures In H R 5140 The Recovery

The Recovery Rebates And Economic Stimulus For The American People Act

T20 0264 Expansion Of Economic Impact Payments And Additional 2020

T08 0035 Individual Income Tax Measures In H R 5140 The Recovery

Recovery Rebate Income Limits - Web 17 ao 251 t 2022 nbsp 0183 32 The CARES Act provided economic relief payments known as Economic Impact Payments or stimulus payments valued at 1 200 per eligible adult based on household adjusted gross income AGI plus