Recovery Rebate Number Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 FAQs about eligibility for claiming the Recovery Rebate Credit These updated FAQs were released to the public in Fact Sheet 2022 27PDF April 13 2022 Web Letter 6475 The IRS issued Letter 6475 Economic Impact Payment EIP 3 End of Year in January 2022 This letter helps EIP recipients determine if they re eligible to claim the

Recovery Rebate Number

Recovery Rebate Number

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

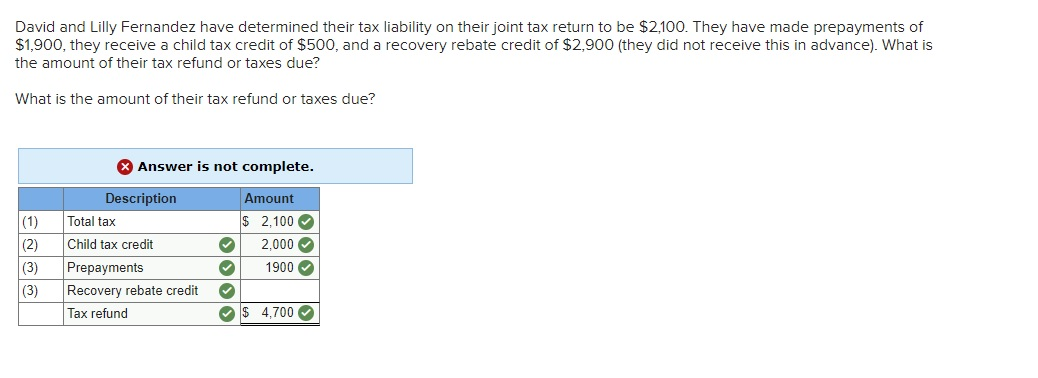

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

Recovery Rebate Credit Phone Number Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/form-ct-651-download-printable-pdf-or-fill-online-recovery-tax-credit-5.png

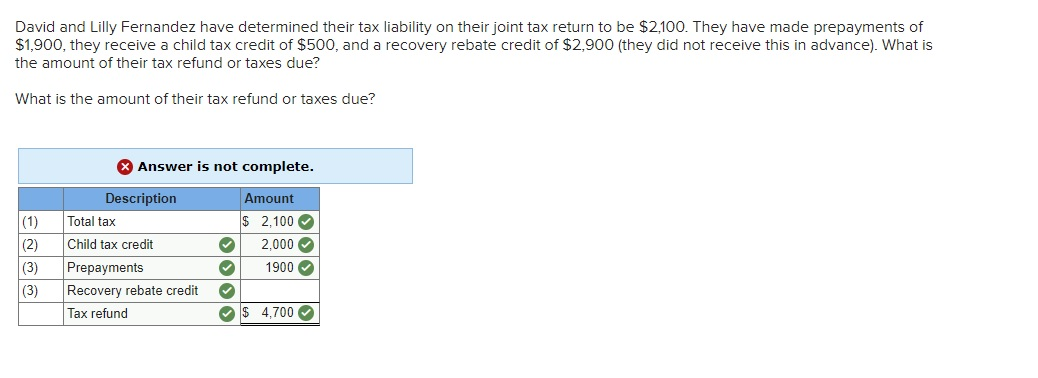

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on Web 27 avr 2023 nbsp 0183 32 Recovery Rebate Credit Contact Number April 27 2023 by tamble Recovery Rebate Credit Contact Number The Recovery Rebate offers taxpayers the

Web 27 avr 2023 nbsp 0183 32 How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable Web Background If you didn t get the full amount of the third Economic Impact Payment you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax

Download Recovery Rebate Number

More picture related to Recovery Rebate Number

Irs Recovery Rebate Phone Number Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2022/11/form-8038-r-request-for-recovery-of-overpayments-under-arbitrage-rebate-2.png

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

Recovery Rebate Credit 2022 What Is It Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/recovery-credit-printable-rebate-form-1.jpg

Web 17 ao 251 t 2022 nbsp 0183 32 Key Takeaways The Recovery Rebate Credit allowed certain taxpayers to lower their taxes via a credit for the full Economic Impact Payment if it was not received for some reason in 2020 and or Web 10 sept 2022 nbsp 0183 32 The Recovery Rebate is available for federal income tax returns through 2021 Each tax dependent can be qualified for up to 1400 married couples with 2

Web 27 nov 2022 nbsp 0183 32 Recovery Rebate Credit Phone Number Recovery Rebate November 27 2022 by tamble Recovery Rebate Credit Phone Number A Recovery Rebate gives Web 3 oct 2022 nbsp 0183 32 The Recovery Rebate can be applied to federal income tax returns that are filed up to 2021 You can receive as much as 1 400 for each tax dependent that is

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

The Recovery Rebate Credit Calculator MollieAilie

https://support.taxslayer.com/hc/article_attachments/4415858470797/mceclip3.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-c...

Web 13 janv 2022 nbsp 0183 32 FAQs about eligibility for claiming the Recovery Rebate Credit These updated FAQs were released to the public in Fact Sheet 2022 27PDF April 13 2022

The Recovery Rebate Credit Calculator MollieAilie

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator MollieAilie

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

How To Calculate Recovery Rebate Credit 2023 Rebate2022

How To Calculate Recovery Rebate Credit 2023 Rebate2022

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Recovery Rebate Credit 2020 Calculator KwameDawson

Recovery Rebate Credit Worksheet Example Studying Worksheets

Recovery Rebate Number - Web 4 oct 2022 nbsp 0183 32 Menu Home Recovery Rebate Credit Number November 17 2022October 4 2022by tamble Recovery Rebate Credit Number A Recovery Rebate gives