Recovery Rebate Refund Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

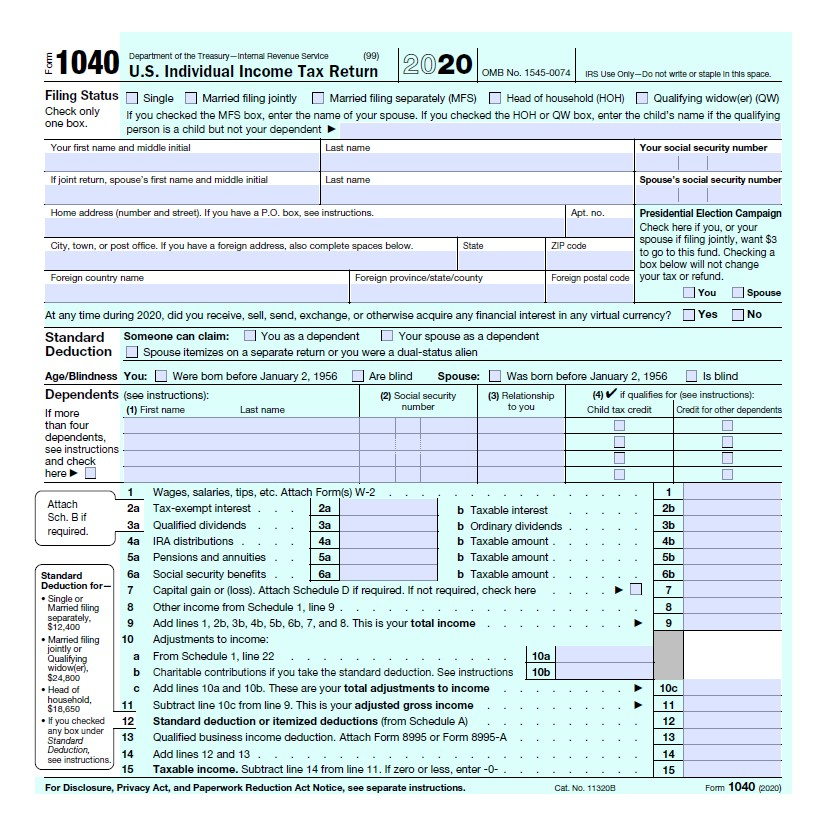

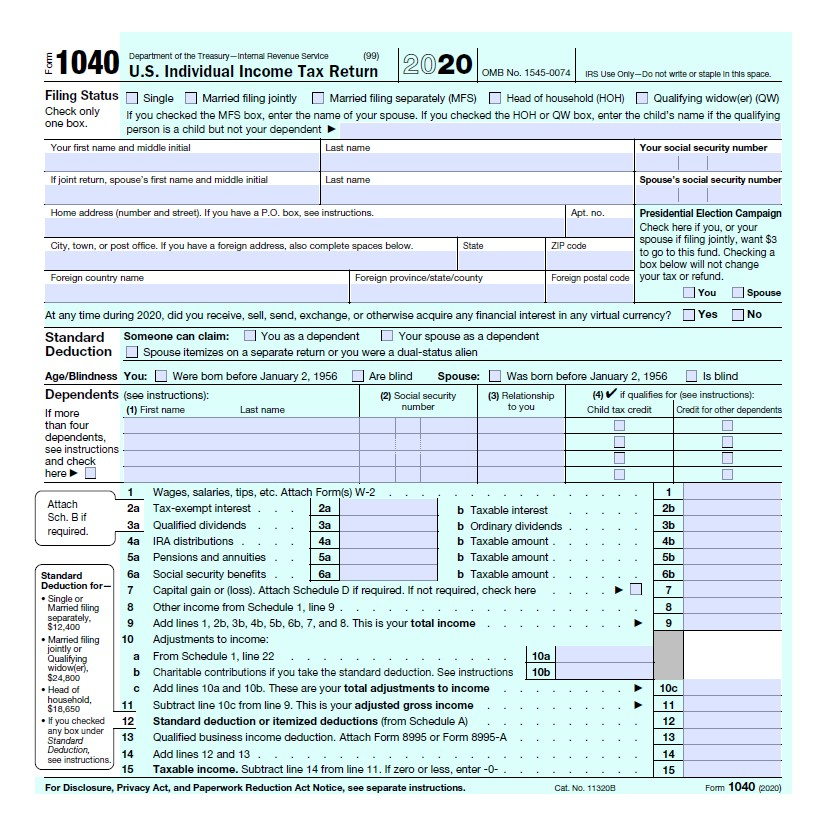

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your Web 10 d 233 c 2021 nbsp 0183 32 To claim the 2020 Recovery Rebate Credit you will need to Compute the 2020 Recovery Rebate Credit amount using the line 30 worksheet found in 2020 Form

Recovery Rebate Refund

Recovery Rebate Refund

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/how-to-claim-recovery-rebate-credit-turbotax-romainedesign-3.png?fit=633%2C623&ssl=1

Will Recovery Rebate Delay My Refund Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/where-is-my-refund-2021-refund-delay-explained-by-irs-enrolled-agent.jpg?fit=1280%2C720&ssl=1

Tax Refund Adjusted Recovery Rebate Credit Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/adjusted-refunds-due-to-recovery-rebate-credit-carrie-houchins-witt-1.jpg?resize=1024%2C390&ssl=1

Web 27 avr 2023 nbsp 0183 32 How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable Web 30 d 233 c 2020 nbsp 0183 32 Generally the credit can increase your refund amount or lower the taxes you may owe When the IRS processes your 2020 tax return if you are claiming the

Web 17 ao 251 t 2022 nbsp 0183 32 If you were eligible for a credit and did not owe taxes the credit would have provided a tax refund The Internal Revenue Service IRS issued more than 5 million faulty math error notices Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on

Download Recovery Rebate Refund

More picture related to Recovery Rebate Refund

6 Tips What Is A Recovery Rebate Credit 2021 Alprojectalproject

https://i1.wp.com/lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/2a696912-02a3-4d66-8e1c-7e0b97b75688.default.png

What Is A Recovery Refund Useful Tips

https://stimulusmag.com/wp-content/uploads/2022/12/who-gets-recovery-rebate-credit.jpg

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

Web 19 janv 2022 nbsp 0183 32 The IRS states that your recovery rebate credit will reduce any tax you owe for 2021 or be included in your tax refund This means you will either shave off the top Web 15 avr 2021 nbsp 0183 32 If you are eligible for a refund of your 2020 income tax then the amount you receive for the Recovery Rebate Credit will be included as part of your 2020 tax refund

Web 1 d 233 c 2022 nbsp 0183 32 What is the 2020 Recovery Rebate Credit The 2020 Recovery Rebate Credit is part of the Coronavirus Aid Relief and Economic Security CARES Act that Web 13 f 233 vr 2022 nbsp 0183 32 2021 Recovery Rebate Credit Topic D Claiming the 2021 Recovery Rebate Credit Q1 Q2 Q6 2021 Recovery Rebate Credit Topic F Receiving the

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-and...

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your

What Is A Recovery Refund Useful Tips

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

When To Anticipate My Tax Refund The 2023 Refund Calendar MicroTechr

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

Still Haven T Received My Tax Refund 2022 TaxProAdvice Recovery Rebate

Recovery Rebate Credit 2022 What Is It Rebate2022

Recovery Rebate Credit 2022 What Is It Rebate2022

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Refund Claim

1040 Recovery Rebate Credit Drake20

Recovery Rebate Refund - Web 27 avr 2023 nbsp 0183 32 How To Claim the Recovery Rebate Credit on a Tax Return You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return whichever is applicable