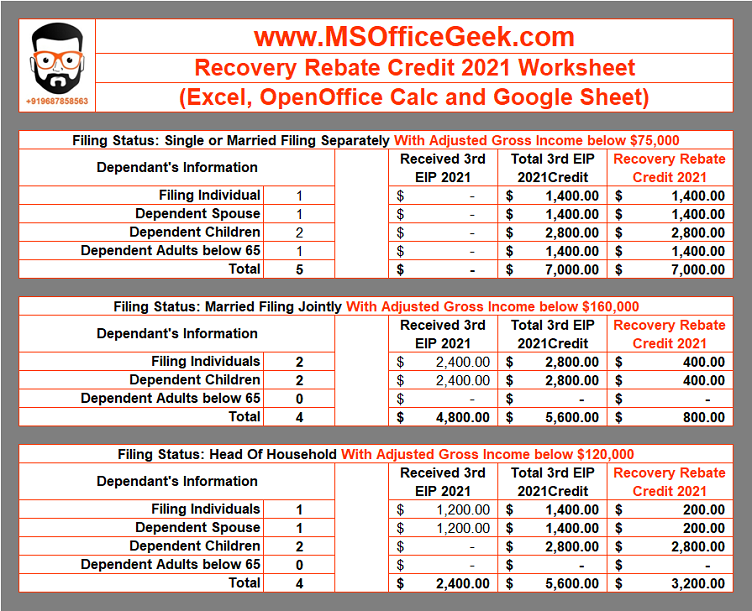

Recovery Rebate Tax Credit Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Rebate Tax Credit

Recovery Rebate Tax Credit

https://msofficegeek.com/wp-content/uploads/2022/01/Recovery-Rebate-Credit-Worksheet-1.png

What Is The Recovery Rebate Credit CD Tax Financial

https://cdtax.com/wp-content/uploads/2021/02/Recovery-Rebate-Worksheet-1-1187x1536.png

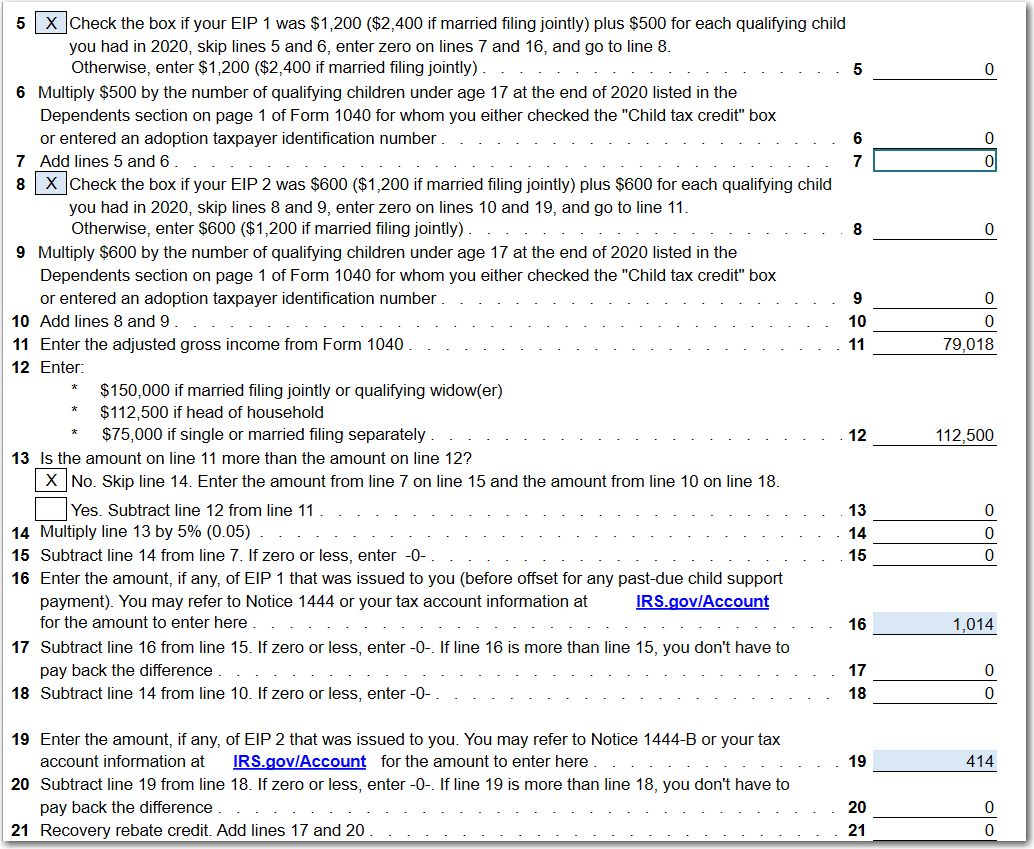

Recovery Rebate Credit Worksheet ATX Line 30 COVID 19 ATX Community

https://www.atxcommunity.com/uploads/monthly_2021_02/2077495236_Line30JF.jpg.5cf61402ed45b71039c02279dc1b0758.jpg

Web 10 d 233 c 2021 nbsp 0183 32 If you didn t get the full first and second Economic Impact Payment you may be eligible to claim the 2020 Recovery Rebate Credit and need to file a 2020 tax return Web 2021 Recovery Rebate Credit Individuals can securely access their online account to view their third Economic Impact Payment amount under their tax records Beginning in late

Web 12 oct 2022 nbsp 0183 32 What s the Recovery Rebate Credit If you didn t get a third stimulus check or you didn t get the full amount you may be able to claim the recovery rebate credit on Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Download Recovery Rebate Tax Credit

More picture related to Recovery Rebate Tax Credit

How Do I Claim The Recovery Rebate Credit On My Ta

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/e3d7f0ce-2b70-4164-b921-f7ef2ca8a52f.default.png

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

A PSA Of Sorts The Recovery Rebate Credit On Your 2020 Tax Return

https://images.dailykos.com/images/912447/story_image/1040.PNG?1612073472

Web 1 d 233 c 2022 nbsp 0183 32 Assuming that all three meet all of the requirements for the credit their maximum 2020Recovery Rebate Credit is 4 700 This is made up of 2 900 1 200 for Alex 1 200 for Samantha 500 for Web 17 ao 251 t 2022 nbsp 0183 32 You could claim a Recovery Rebate Credit when you filed your 2020 and or 2021 taxes if you did not receive your full authorized Economic Impact Payments

Web 30 d 233 c 2020 nbsp 0183 32 Generally you are eligible to claim the Recovery Rebate Credit if you Were a U S citizen or U S resident alien in 2020 Were not claimed as a dependent Have a Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

https://i.pinimg.com/originals/c5/01/7b/c5017b88440e5203d6056b3107d8882f.png

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-questions-an…

Web 13 avr 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Credit Printable Rebate Form

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

Filing Your 2008 Taxes With The Economic Stimulus Recovery Rebate Credit

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Recovery Rebate Credit Worksheet Tax Guru Ker tetter Letter

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

IRS Releases Draft Form 1040 Here s What s New For 2020

Solved Recovery Rebate Credit Error On 1040 Instructions

Recovery Rebate Tax Credit - Web 2021 Recovery Rebate Credit Individuals can securely access their online account to view their third Economic Impact Payment amount under their tax records Beginning in late