Recovery Rebate Tracker Web 20 d 233 c 2022 nbsp 0183 32 It was issued starting in March 2021 and continued through December 2021 Individuals should review the information below to determine their eligibility to claim a

Web 8 f 233 vr 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two Web 13 janv 2022 nbsp 0183 32 Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund If your income is 73 000 or less you can file your federal

Recovery Rebate Tracker

Recovery Rebate Tracker

https://i2.wp.com/www.legacytaxresolutionservices.com/2255lega/250w/cp11r-2page001.png

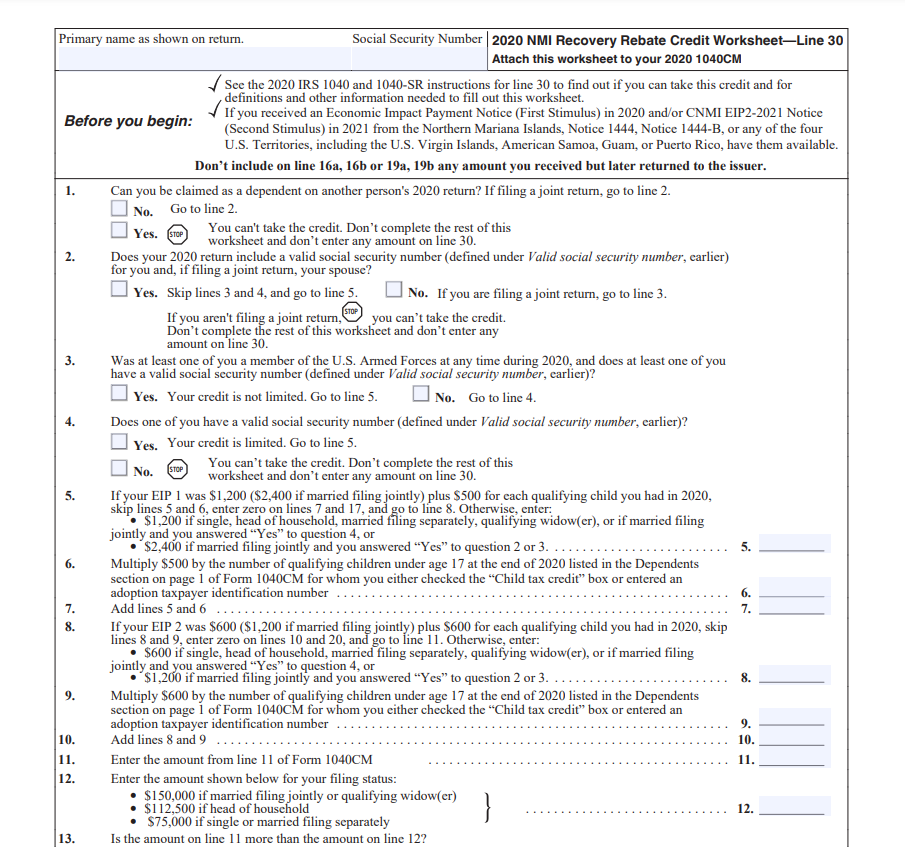

What Does The Recovery Rebate Form Look Like Bears Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/What-Does-The-Recovery-Rebate-Form-Look-Like.png

Recovery Rebate Credit Worksheet Example Studying Worksheets

https://kb.erosupport.com/assets/img_5ffe2fbd7513d.png

Web 17 f 233 vr 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the 2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit The Web 27 mai 2021 nbsp 0183 32 We ll explain how to request an IRS payment trace or file for a recovery rebate credit even if you don t normally file taxes If you filed your 2020 tax return and

Web 17 juin 2021 nbsp 0183 32 IRS Get My Payment How to use the online tracker tool To get an update on your third stimulus check using Get My Payment enter your Social Security number date of birth street address and ZIP Web 15 avr 2021 nbsp 0183 32 Recovery Rebate Credit Online Photo Dan Kitwood Getty Image First you need to file an updated 2020 tax return IRS will base the money they send out on your tax returns information As you update it

Download Recovery Rebate Tracker

More picture related to Recovery Rebate Tracker

Track Your Recovery Rebate With This Worksheet Style Worksheets

https://i1.wp.com/wisepiggybank.com/wp-content/uploads/2021/03/Screen-Shot-2021-03-17-at-4.22.28-PM.png?w=1046&ssl=1

If The Income On The Return Is Over The Applicable Phase out

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

The Recovery Rebate Credit Calculator MollieAilie

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/af2544cc-cc99-4803-9277-be1c0c86ef28.default.PNG

Web 12 oct 2022 nbsp 0183 32 last updated October 12 2022 In March 2021 President Biden signed the American Rescue Plan Act which authorized a third round of federal stimulus checks Web 13 avr 2021 nbsp 0183 32 A Recovery Rebate Credit is a special one time benefit for people who did not receive the right amount of their stimulus check because their circumstances have

Web 30 mars 2022 nbsp 0183 32 The IRS recently released updated information on the Recovery Rebate Credit people may file for this year in order to recoup any of the money from those one Web 10 mars 2021 nbsp 0183 32 If you believe you are eligible and didn t receive one or received less than you qualify for then you will claim a Recovery Rebate Credit on your 2020 tax return

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/02/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-recovery-rebate-3.png?w=530&ssl=1

Recovery Rebate Credit 2020 Calculator KwameDawson

https://www.legacytaxresolutionservices.com/2255lega/250w/cp12renglishpage001.png

https://www.irs.gov/newsroom/recovery-rebate-credit

Web 20 d 233 c 2022 nbsp 0183 32 It was issued starting in March 2021 and continued through December 2021 Individuals should review the information below to determine their eligibility to claim a

https://www.irs.gov/newsroom/check-your-recovery-rebate-credit-eligibi…

Web 8 f 233 vr 2021 nbsp 0183 32 Check your Recovery Rebate Credit eligibility February 8 2021 Most people who are eligible for the Recovery Rebate Credit already received it in advance as two

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

How To Claim Recovery Rebate Credit Turbotax Romainedesign Recovery

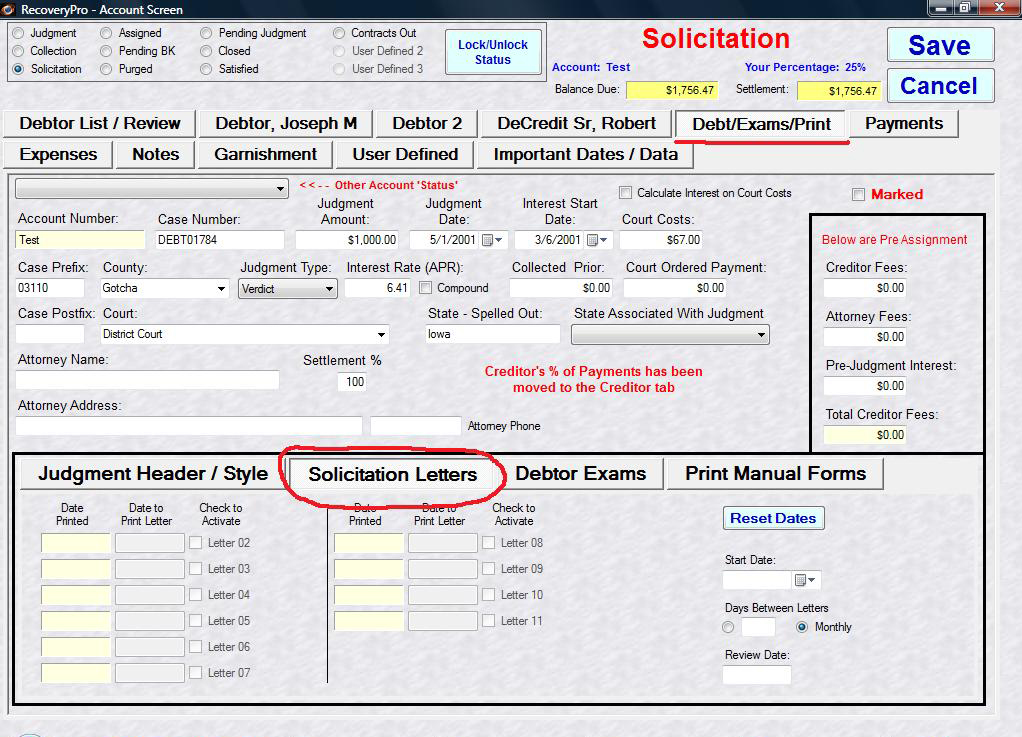

Free Personalized Rebate Tracking Form

Recovery Rebate Credit Worksheet For Non Filers

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator ShauntelRaya

The Recovery Rebate Credit Calculator ShauntelRaya

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Tracker - Web 17 juin 2021 nbsp 0183 32 IRS Get My Payment How to use the online tracker tool To get an update on your third stimulus check using Get My Payment enter your Social Security number date of birth street address and ZIP