Redundancy Pay And Child Tax Credits Verkko 12 toukok 2007 nbsp 0183 32 The first 163 30 000 redunancy pay is non taxable Therefore if your lumpsum payment is 163 45 000 you only have to declare 163 15 000 This would be

Verkko Universal Credit replaces 6 existing benefits and tax credits Child Tax Credit Working Tax Credit Housing Benefit Income Support Income based Jobseeker s Allowance Verkko 6 huhtik 2023 nbsp 0183 32 If your redundancy payment is made before you leave your job and before your employer issues you with form P45 any taxable amounts such as unpaid wages and any part of a redundancy

Redundancy Pay And Child Tax Credits

Redundancy Pay And Child Tax Credits

https://www.ssgmi.com/cm/dpl/images/articles/536/c_childtaxcredit-increase-ARP__1_.jpeg

Can Both Parents Claim Child Tax Credits All You Need To Know

https://www.the-sun.com/wp-content/uploads/sites/6/2022/10/child-tax-credit-written-paper-754134886.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Verkko Will my redundancy pay or other lump sum payment affect my benefits Backdated lump sum payments from DWP Which benefits are affected by savings The main Verkko 28 marrask 2019 nbsp 0183 32 Child Tax Credits and Redundancy MoneySavingExpert Forum Home Benefits amp tax credits Child Tax Credits and Redundancy too much debt

Verkko If you live in Northern Ireland you need to tell your Jobs amp Benefits office You also need to notify HMRC You might be fined up to 163 300 if you don t tell the HMRC Tax Credits Verkko You should apply as soon as you can if you re only waiting for redundancy pay because it doesn t count as income Redundancy pay won t affect how much you ll get in your

Download Redundancy Pay And Child Tax Credits

More picture related to Redundancy Pay And Child Tax Credits

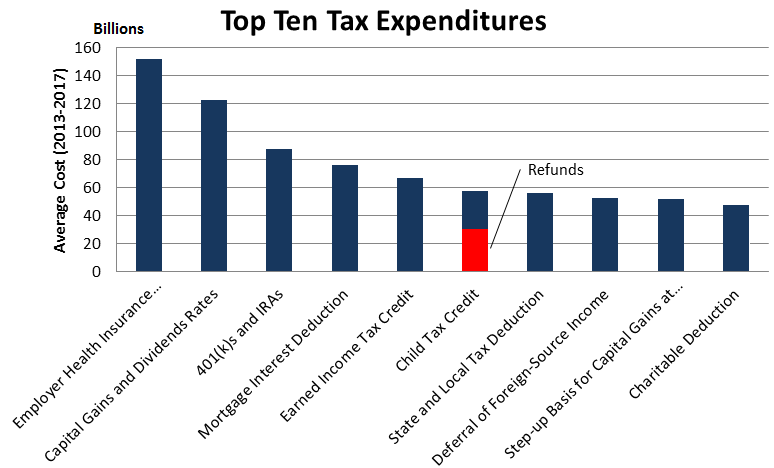

The Tax Break Down Child Tax Credit 2013 08 29

https://crfb.org/sites/default/files/toptentes-ctc.png

Child Tax Credits Student Loan Forgiveness More Cut Through The

https://onedegreeadvisors.com/wp-content/uploads/2021/08/YT-thumb.jpg

Families With Newborns Qualify For 3 600 Child Tax Credit As Next

https://www.the-sun.com/wp-content/uploads/sites/6/2021/07/NINTCHDBPICT000665941857.jpg?strip=all&quality=100&w=1920&h=1080&crop=1

Verkko 13 maalisk 2019 nbsp 0183 32 You must report that you have lost your job and declare any redundancy pay you get if you re getting tax credits Universal Credit other Verkko Statutory redundancy pay under 163 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment Previous

Verkko 25 tammik 2010 nbsp 0183 32 Child Tax Credits amp Redundancy Pay 5 answers Last post 26 01 2010 at 3 17 am Anonymous 25 01 2010 at 3 00 pm Hi my dh has been made Verkko If you have children and have just been made redundant be sure and claim it You need all the financial help you can get In fact the chances are you would have been eligible

Some Households May Have To REPAY Child Tax Credit Here s How It Will

https://www.the-sun.com/wp-content/uploads/sites/6/2021/06/OFFPLAT-RD-STIMULUS.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

Redundancy Calculator How Much Are Employees Entitled To Factorial

https://factorialhr.co.uk/wp-content/uploads/2022/04/27174159/InfographicRedundancyPay.-scaled.jpg

https://forums.moneysavingexpert.com/discussion/451445/redundancy-p…

Verkko 12 toukok 2007 nbsp 0183 32 The first 163 30 000 redunancy pay is non taxable Therefore if your lumpsum payment is 163 45 000 you only have to declare 163 15 000 This would be

https://workingfamilies.org.uk/articles/benefits-you-can-claim-if-you...

Verkko Universal Credit replaces 6 existing benefits and tax credits Child Tax Credit Working Tax Credit Housing Benefit Income Support Income based Jobseeker s Allowance

New Child Tax Credit Could Raise Issues For Divorced Parents

Some Households May Have To REPAY Child Tax Credit Here s How It Will

Who Will Get An Expanded Child Tax Credit This Year

Minnesota Tax Credits For Workers And Families

.jpg)

Child Tax Credit Stimulus Payments Here s What To Expect The

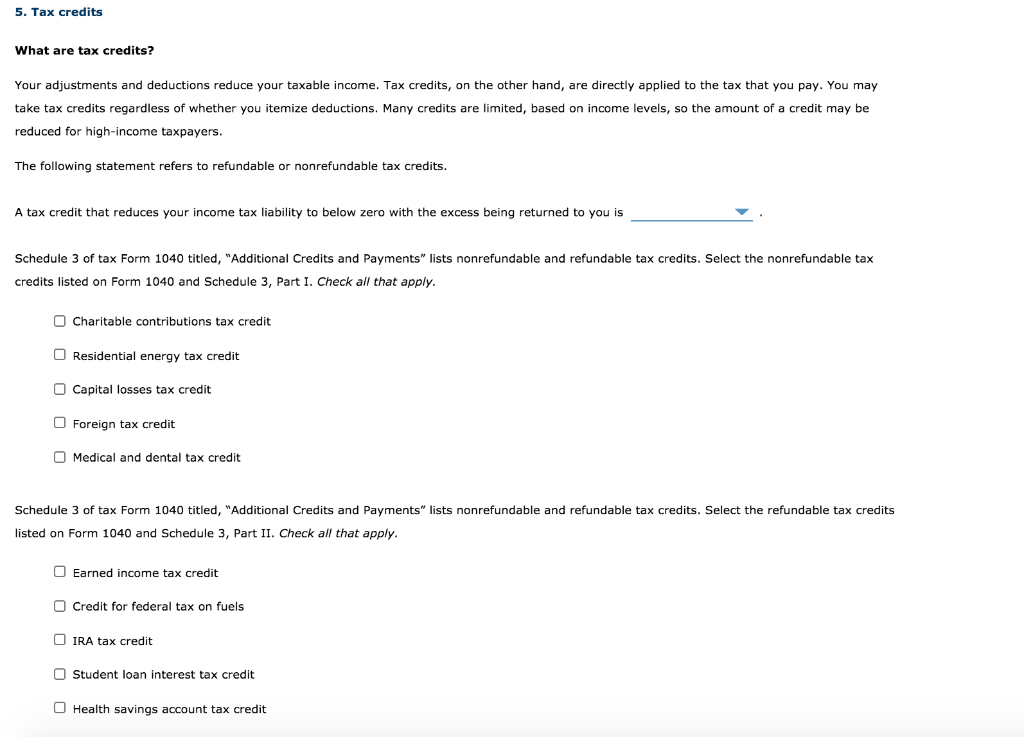

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

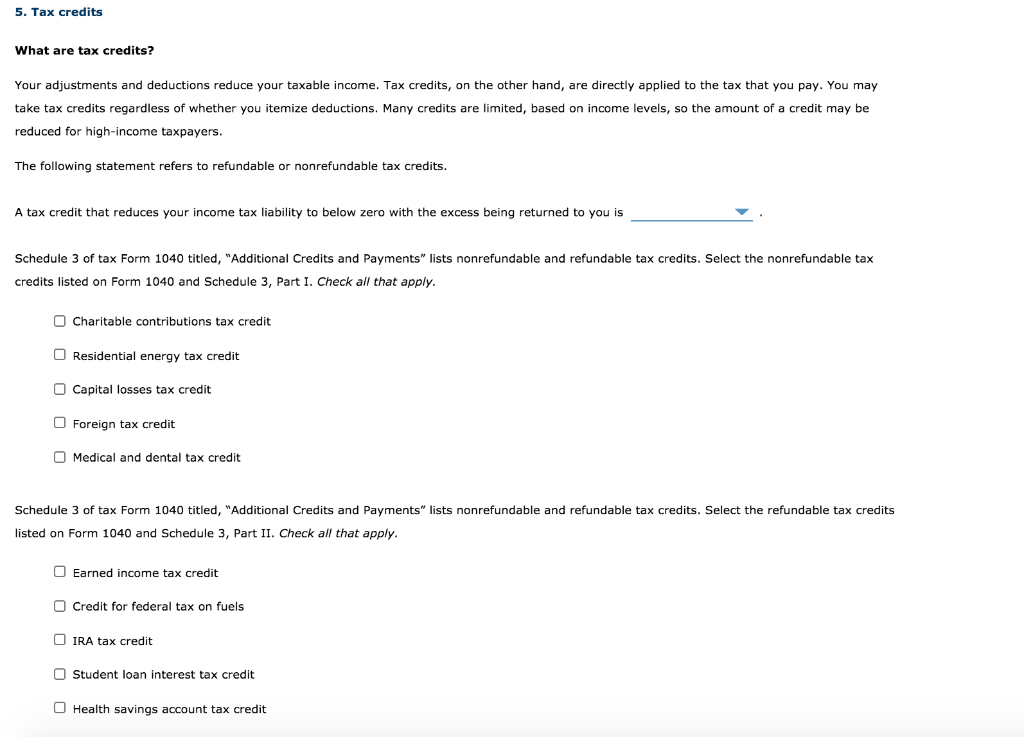

Solved 5 Tax Credits What Are Tax Credits Your Adjustments Chegg

Is There A Difference Between Child Tax Credit And Additional Child Tax

Georgia Tax Credits For Workers And Families

Child Tax Credit Update Here s Three Reasons You Should Opt Out Of

Redundancy Pay And Child Tax Credits - Verkko If you live in Northern Ireland you need to tell your Jobs amp Benefits office You also need to notify HMRC You might be fined up to 163 300 if you don t tell the HMRC Tax Credits