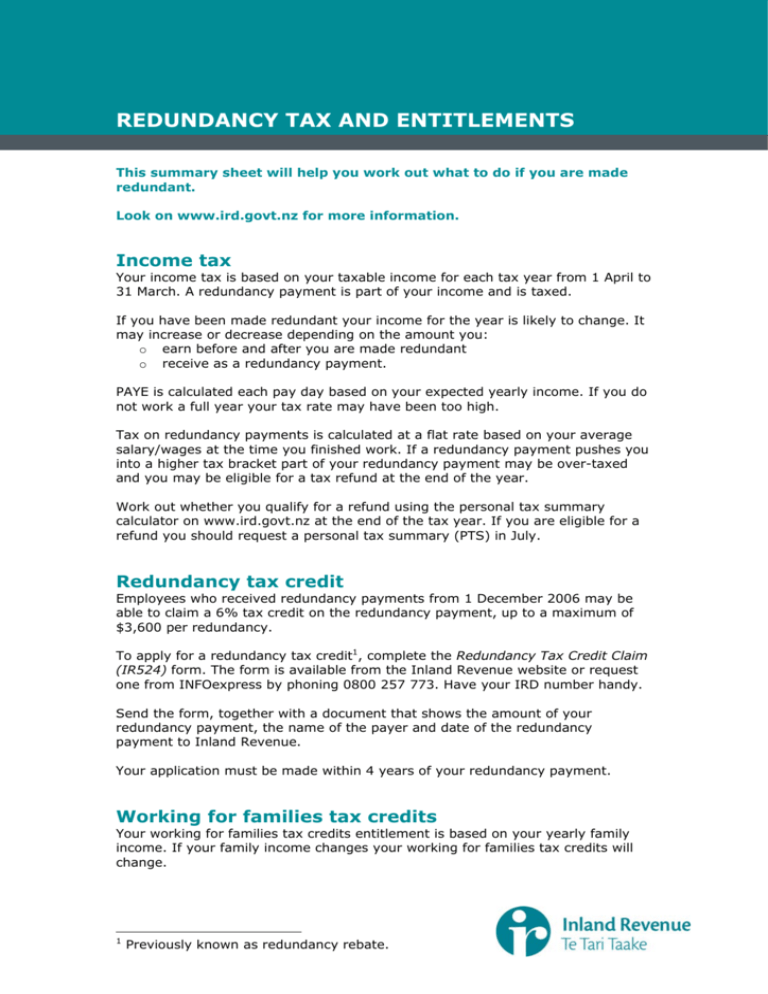

Redundancy Payments Tax Exemption Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of notice will be

The legislation ensures that statutory redundancy payments remain exempt from Income Tax up to the 30 000 threshold Termination Payments are generally completely exempt from employee NICs even if the termination payment exceeds 30 000 However the amount of the Termination

Redundancy Payments Tax Exemption

Redundancy Payments Tax Exemption

https://1.bp.blogspot.com/-prJpam_lFnI/XMdpYfbdIII/AAAAAAAABM4/sCP3PZywJyUQi6p7PqKutMirNe426OKGACLcBGAs/s1600/tax-exemption.jpg

Tax On Redundancy Payments Davis Grant

https://www.davisgrant.co.uk/wp-content/uploads/2020/06/redundancies-blog-featured-image-880x360.jpg

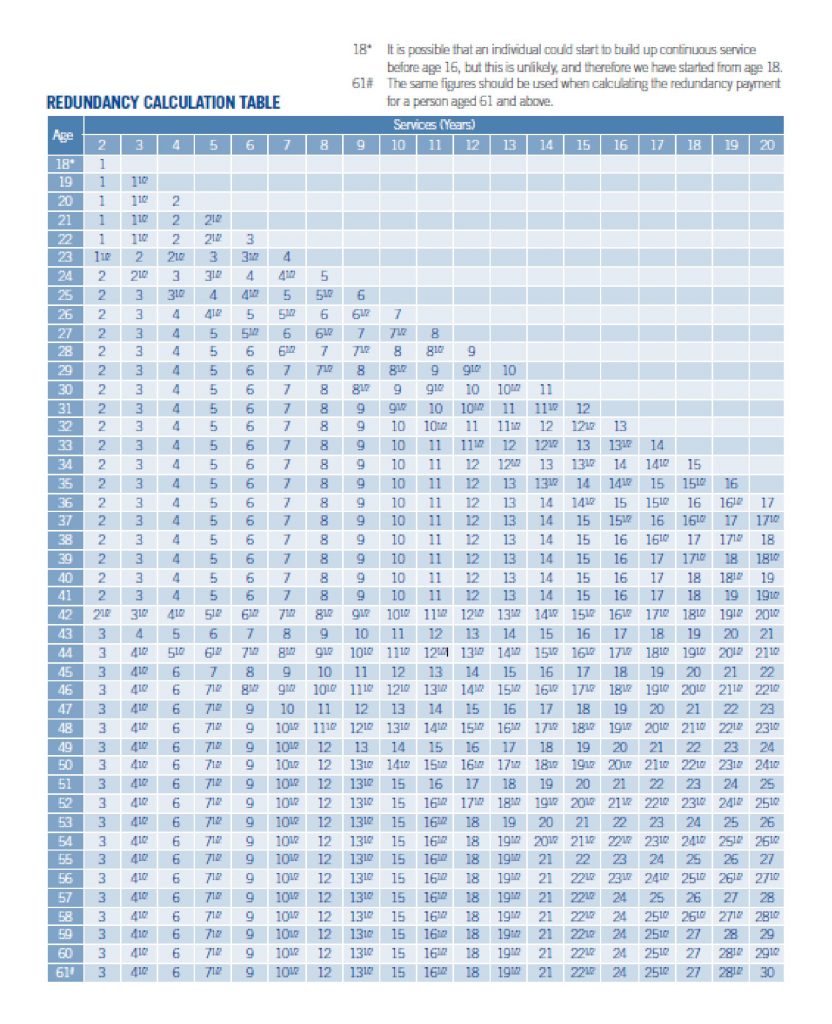

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Statutory redundancy pay under 30 000 is not taxable What you ll pay tax and National Insurance on depends on what s included in your termination payment By itself statutory redundancy pay is unlikely to exceed 30 000 but it must be included with any other qualifying payments when applying this threshold Certain types of

A termination payment often comprises different elements some of which are contractual e g payment in lieu of notice or gardening leave payments some statutory e g You will be taxed on the redundancy payment in the tax year that you get it even if you were made redundant in an earlier tax year The 30 000 limit applies to one particular job

Download Redundancy Payments Tax Exemption

More picture related to Redundancy Payments Tax Exemption

What Tax Do I Pay On Redundancy Payments CruseBurke

https://cruseburke.co.uk/wp-content/uploads/2022/12/tax-on-redundancy-payments-768x509.png

HOW REDUNDANCY PAYMENTS ARE TAXED

https://s3.studylib.net/store/data/008235229_1-43bc4650635de2de8c53ef7caa1696a0-768x994.png

Redundancy Payments PDF Pension Tax Exemption

https://imgv2-2-f.scribdassets.com/img/document/505429617/original/21c17b2f91/1667578999?v=1

The first 30000 00 of the redundancy payment is tax free Anything over this sum is shown in box 5 of SA101 page Ai2 The guidance advises This includes redundancy The taxation treatment of a termination payment can vary depending on the circumstances or the payment and can be either fully liable to income tax and national insurance or taxable

With effect from 6 April 2018 some termination payments and benefits are chargeable to income tax as general earnings and do not benefit from the 30 000 threshold available in section 403 Statutory Redundancy Payments An employee who has two years qualifying service has a statutory right to a redundancy payment if he is genuinely made redundant The amount of the

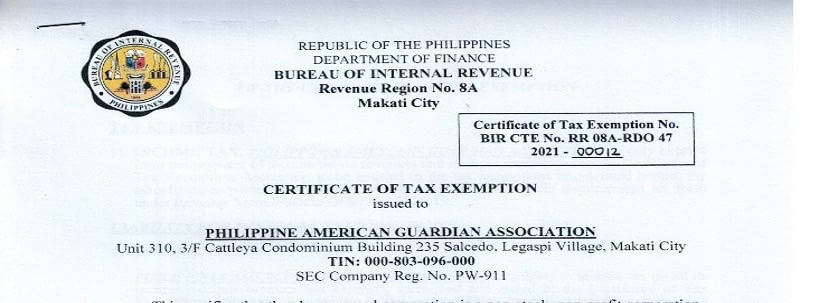

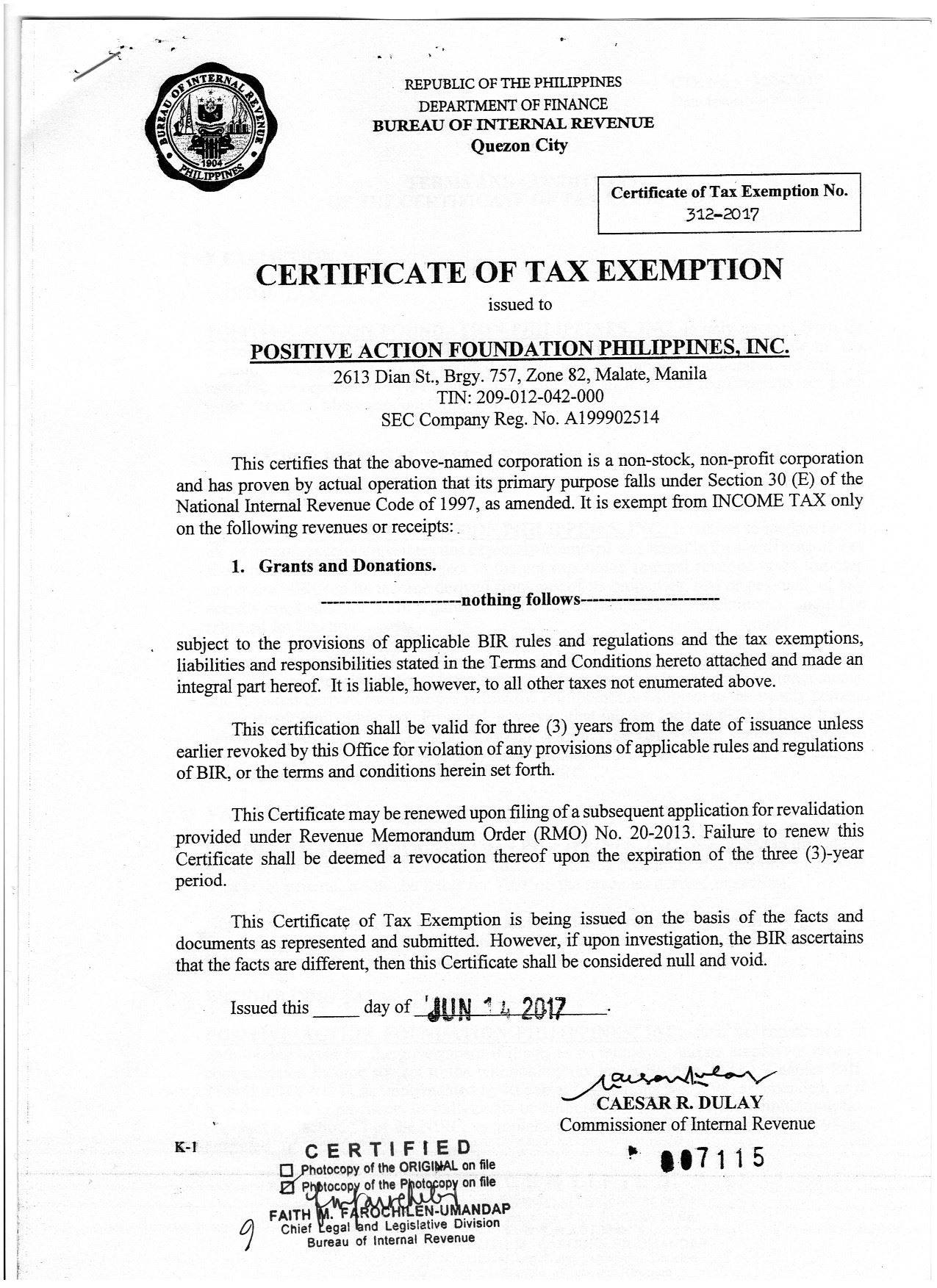

BIR Certificate Of Tax Exemption PAGA

https://mldxg0t9jgcn.i.optimole.com/w:813/h:303/q:auto/https://www.paga.ph/wp-content/uploads/2021/11/bir-tax-exemption.jpg

Suspension Of Employer s Obligation On Redundancy Payments Lifted

https://www.crowe.com/ie/-/media/Crowe/Firms/Europe/ie/Crowe-Ireland/Images/Posts/Redundancy-payments.jpg?h=521&w=750&la=en-GB&modified=20211005083413&hash=549BAB541337142C297F7FD1003D1A24CC78C7A6

https://www.moneyhelper.org.uk/en/work/losing-your...

Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of notice will be

https://www.gov.uk/government/publications/income...

The legislation ensures that statutory redundancy payments remain exempt from Income Tax up to the 30 000 threshold

Invoice Payment Free Stock Photo Public Domain Pictures

BIR Certificate Of Tax Exemption PAGA

Best Instant Personal Loan App In India SmartCoin

What Tax Do I Pay On Redundancy Payments Accounting Firms

Employment Termination Payments I Michael Law Group

Deloitte Tax hand

Deloitte Tax hand

2017 PAFPI Certificate of TAX Exemption Certificate Of

Payments Awaiting Authorisation Scribe Accounts

Redundancy Payments Tax Minimisation Money To The Masses

Redundancy Payments Tax Exemption - You will be taxed on the redundancy payment in the tax year that you receive it even if you were made redundant in an earlier tax year The 30 000 limit applies to one job