Refund Of Income Tax Meaning Refunds of corporate income tax This means that the corporation has paid 2 000 more than necessary The corporation should receive 2 000 as a refund of prepayments However they have unpaid VAT The corporation should have paid 1 000 in VAT by 12 August The Tax Administration uses the refund to pay the VAT and its late payment

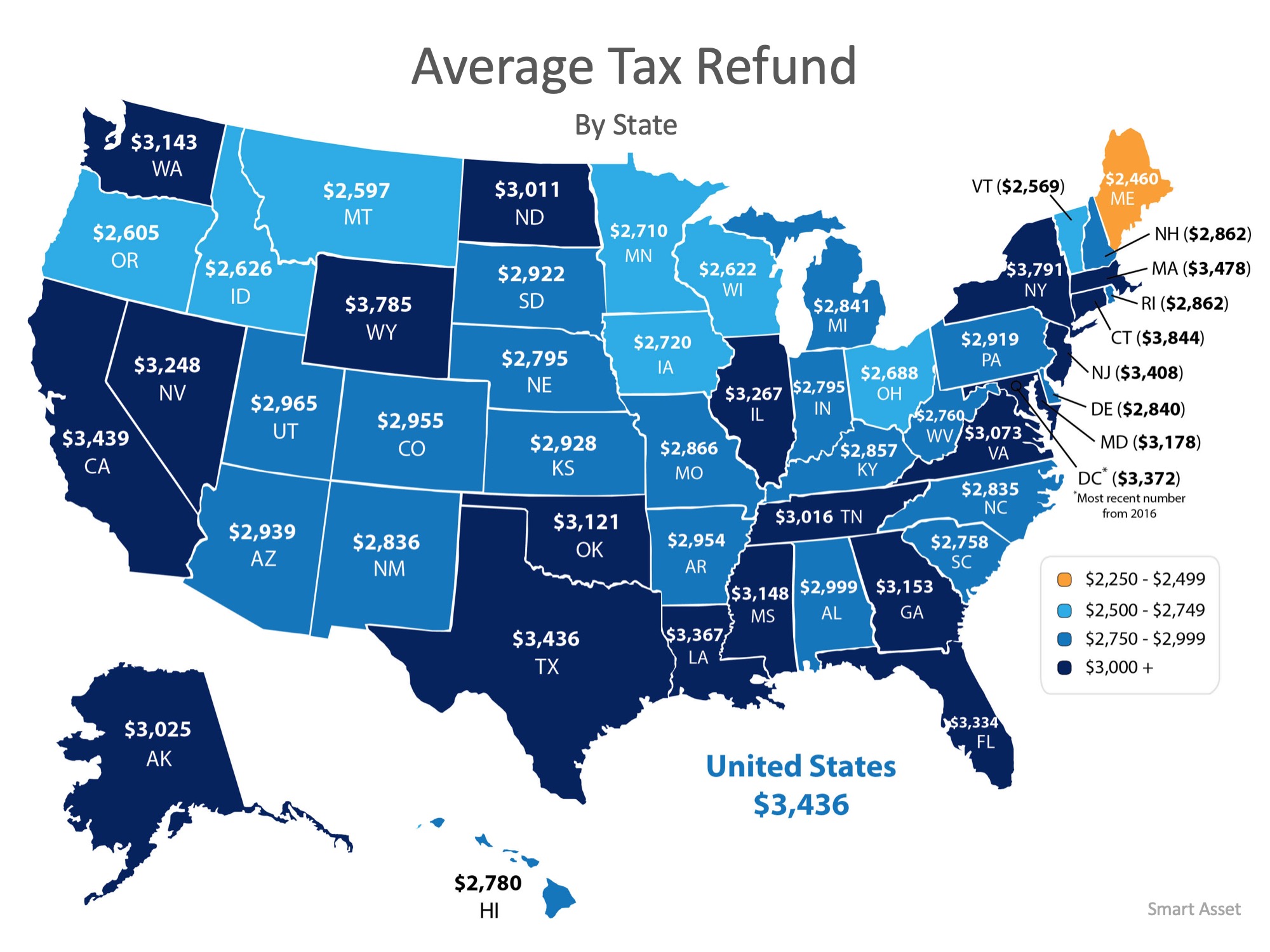

A refund is a reimbursement from a government of taxes that were paid above the amount that was due The average refund for an American taxpayer for the tax year 2020 was 2 815 Refunds A tax refund is a reimbursement a taxpayer receives after overpaying taxes to the government in a tax year usually due to an employer withholding too much in taxes from the employee s paychecks The taxpayer often receives the overpayment via direct deposit or a paper check For example Jasmine works a salaried position as a digital

Refund Of Income Tax Meaning

Refund Of Income Tax Meaning

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

Income Tax Refund Awaited Meaning Refund Awaited In ITR ITR

https://i.ytimg.com/vi/mf8RhqAtkFg/maxresdefault.jpg

Your Tax Refund Is The Key To Homeownership

https://files.mykcm.com/2019/03/25075643/20190325-MEM-ENG.jpeg

A tax refund is the difference between taxes paid and taxes owed Each year or each quarter in some cases a taxpayer submits a tax return that calculates his or her federal income taxes owed The taxpayer then submits the tax return electronically or via mail and the IRS reviews the information United States According to the Internal Revenue Service 77 of tax returns filed in 2004 resulted in a refund check with the average refund check being 2 100 1 In 2011 the average tax refund was 2 913 2 3 For the 2017 tax year the average refund was 2 035 and for 2018 it was 8 less at 1 865 reflecting the changes brought by

While taxpayers usually forfeit their tax credits when they owe nothing you may qualify for a tax refund Here are the four biggest tax credits that could end up providing you with a refund Child tax credits For 2023 and 2024 the child tax credit is worth a maximum of 2 000 per dependent A tax return consists of the form s you file with the government to report your filing status dependents income deductions credits and tax payments As you get ready to file your tax

Download Refund Of Income Tax Meaning

More picture related to Refund Of Income Tax Meaning

Section 194A Of Income Tax Act Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/blogimg2.png

From Refunds To Filing Here Are Tax Tips You Need To Know ABC Columbia

https://www.abccolumbia.com/content/uploads/2020/01/tax_refund_2_.58ad2540b4575.5e306c8f8554a.png

From withholding Tax To adjusted Gross Income Tax Season Terms For

https://cdn.abcotvs.com/dip/images/3251535_032318-ss-taxes-img.jpg?w=1600

Check how to claim a tax refund You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job Phone help Where s My Refund has the latest information on your return If you don t have internet access you may call the automated refund hotline at 800 829 1954 for a current year refund or 866 464 2050 for an amended return If you think we made a mistake with your refund check Where s My Refund or your online account for details

Income tax refund arises when you have paid taxes higher than your actual tax liability The tax paid could be advance tax self assessment tax and TDS You can claim such tax refund by filing your income tax return and verifying it within 120 days of filing it What is an Income Tax refund A taxpayer may get back some of the tax paid by him her during a certain financial year if he she has paid more tax than what he she actually owes for that financial year This is an income tax refund and can be claimed under Section 237 of the Income Tax Act 1961

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

What Is Income Tax And How Are Different Types Calculated Basic

https://chatt-r-bug.com/81d4e4f4/https/44f162/www.investopedia.com/thmb/vmecxtzh3YtlhkIY783GtuYo7Ds=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg

Income Tax Refund Reissue Refund Not Received IndiaFilings

https://www.indiafilings.com/learn/wp-content/uploads/2018/08/Income-Tax-Refund-Reissue.jpg

https://www.vero.fi/en/businesses-and-corporations/...

Refunds of corporate income tax This means that the corporation has paid 2 000 more than necessary The corporation should receive 2 000 as a refund of prepayments However they have unpaid VAT The corporation should have paid 1 000 in VAT by 12 August The Tax Administration uses the refund to pay the VAT and its late payment

https://www.investopedia.com/terms/r/refund.asp

A refund is a reimbursement from a government of taxes that were paid above the amount that was due The average refund for an American taxpayer for the tax year 2020 was 2 815 Refunds

How Long To Get My Tax Refund From HMRC Swift Refunds

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

What Is Income Tax And How Are Different Types Calculated Basic

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

Step To Check Income Tax Refund Status Reasons For Delay Chandan

Claim Your Income Tax Refund In Malaysia 5 Important Things To Know

Early Access To Your Income Tax Refund Debt ca

Early Access To Your Income Tax Refund Debt ca

Income Tax Refund ITR Refund Status Check Through NSDL IndiaFilings

Why Is My Federal Refund Lower Than Last Year The Daily CPA

Corporate Tax Definition And Meaning Market Business News

Refund Of Income Tax Meaning - Go to the View Returns Forms tab On this page look for the Select An Option and then click on Income tax Returns in the drop down menu Fill in the assessment year and then submit Click on the relevant ITR acknowledgment number to check your ITR refund status