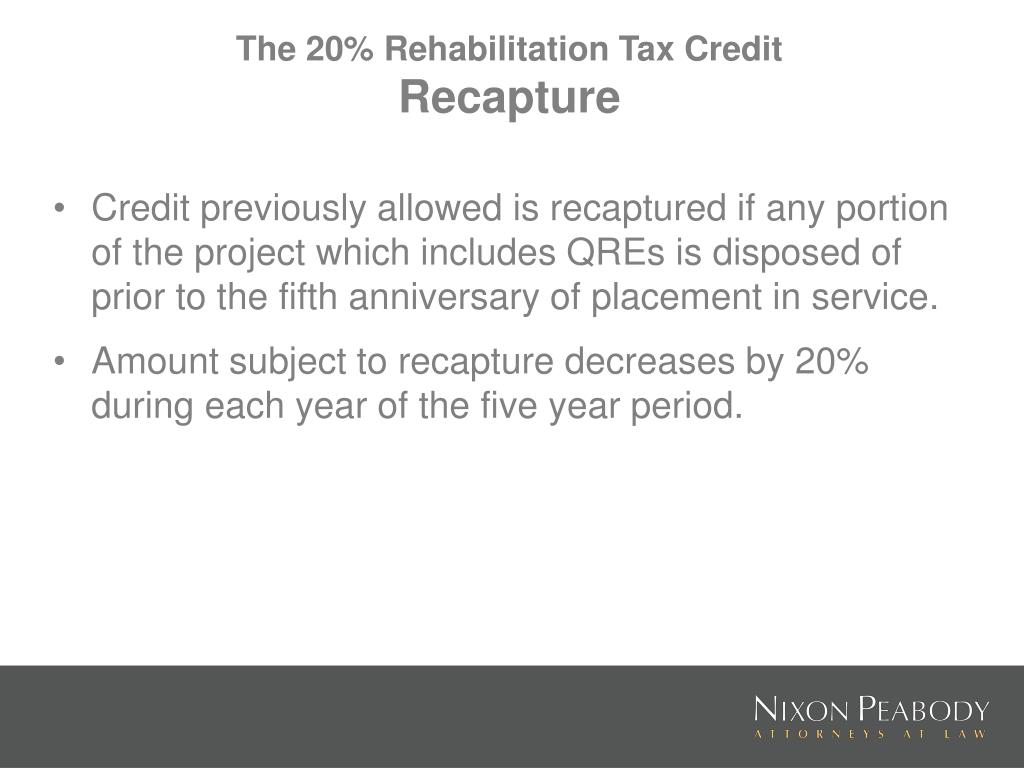

Rehabilitation Tax Credit Recapture Web The credit provides a tax incentive to rehabilitate historic buildings If your rehabilitation and expenses qualify you may claim a tax credit equal to 20 of your qualified

Web The rehabilitation credit is not subject to recapture after the 5 year recapture period even if the property for which the rehabilitation credit was claimed is destroyed by a Web 1 Sept 2020 nbsp 0183 32 On May 22 2020 the IRS published proposed regulations REG 124327 19 regarding the Sec 47 rehabilitation tax credit including rules to coordinate the new

Rehabilitation Tax Credit Recapture

Rehabilitation Tax Credit Recapture

https://www.nksfb.com/wp-content/uploads/2022/12/tax-insights-rhabilitation-tax-credit-1024x687.jpg

Take Advantage Of The Rehabilitation Tax Credit When Altering Or Adding

https://hwco.cpa/wp-content/uploads/2023/04/RehabCredit_article.png

Rent Tax Credit

https://www.finegael.ie/app/uploads/2023/02/RTC_webpage.png

Web If rehabilitation tax credit is destroyed by casualty will this trigger recapture 3 How is the rehabilitation tax credit computed when a portion of the property is not used for Web 1 Feb 2011 nbsp 0183 32 If a recapture event occurs the amount of the recapture is 20 percent of the rehabilitation credit claimed for each anniversary remaining in the five year recapture

Web 6 Dez 2016 nbsp 0183 32 If a recapture event occurs the amount of the recapture is 20 percent of the rehabilitation credit claimed for each year remaining in the five year recapture period Web 28 Mai 2020 nbsp 0183 32 The rehabilitation tax credit is subject to recapture at any time prior to the fifth anniversary of the date that the qualified rehabilitated building is placed in service

Download Rehabilitation Tax Credit Recapture

More picture related to Rehabilitation Tax Credit Recapture

Georgia Port Activity Tax Credit Overview

https://www.taxcredible.com/hubfs/Image 18.png

PPT Earning Historic Tax Credits The Tax Fundamentals PowerPoint

https://image.slideserve.com/293515/the-20-rehabilitation-tax-credit-recapture-l.jpg

How Does The Research And Development Tax Credit Work YouTube

https://i.ytimg.com/vi/Z6-AOMib9do/maxresdefault.jpg

Web Regarding investment credits under IRC Section 50 the final regulations follow the same pre TCJA approach for determining a single rehabilitation credit in applying the IRC Web 1 Feb 2010 nbsp 0183 32 After expiration of the five year credit recapture period the investor typically has an option to put its interest in MT to the developer or an affiliate for a fixed price

Web About the Rehabilitation Credit and Low Income Housing Credit Internal Revenue Code section 47 provides for the Rehabilitation Credit and Internal Revenue Code section 42 Web For more than 42 years the Federal Historic Preservation Tax Incentives1 Program more commonly known as the Historic Tax Credit HTC program has helped revitalize

Income Tax ShareChat Photos And Videos

https://cdn.sharechat.com/2b0d0eef_1588734670621.jpeg

TAX CREDIT PROS ERC EMPLOYMENT RETENTION CREDIT APPLICATION CARES ACT

https://taxcreditprosinc.com/imgs/services-4.png

https://www.irs.gov/.../rehabilitation-credit

Web The credit provides a tax incentive to rehabilitate historic buildings If your rehabilitation and expenses qualify you may claim a tax credit equal to 20 of your qualified

https://www.irs.gov/.../rehabilitation-credit-historic-preservation-faqs

Web The rehabilitation credit is not subject to recapture after the 5 year recapture period even if the property for which the rehabilitation credit was claimed is destroyed by a

500 Rent Tax Credit Earnest Property Agents

Income Tax ShareChat Photos And Videos

Moving Your Business You Might Qualify For The Rehabilitation Tax

Setc Tax Credit Calculator 1099 Expert

Employee Retention Tax Credit AIA Austin TX

Take Advantage Of The Rehabilitation Tax Credit When Altering Or Adding

Take Advantage Of The Rehabilitation Tax Credit When Altering Or Adding

Recapture Limited Edition Oranssi Kierr tysmateriaalista Valmistettu

ADMISSION CRITERIA College Of Rehabilitation Allied Health Sciences

Top Tax Paying Companies

Rehabilitation Tax Credit Recapture - Web If rehabilitation tax credit is destroyed by casualty will this trigger recapture 3 How is the rehabilitation tax credit computed when a portion of the property is not used for