Reimbursement Vs Deduction When an employer reimburses an employee pursuant to an accountable plan the reimbursement won t count as wages or income to the employee Often an employer will be able to deduct those

The Earnings and Deductions Quick Reference includes a complete list of the earnings and deductions that are provided in the payroll application For details on setting up earnings 2 DCIT vs Zee Entertainment Enterprises Ltd Bombay High Court 3 Section 194C 194J 194DA 194EE 194F 194 IA 194 IC and 194LA 4 Circular No 715 dated 8 August 1995

Reimbursement Vs Deduction

Reimbursement Vs Deduction

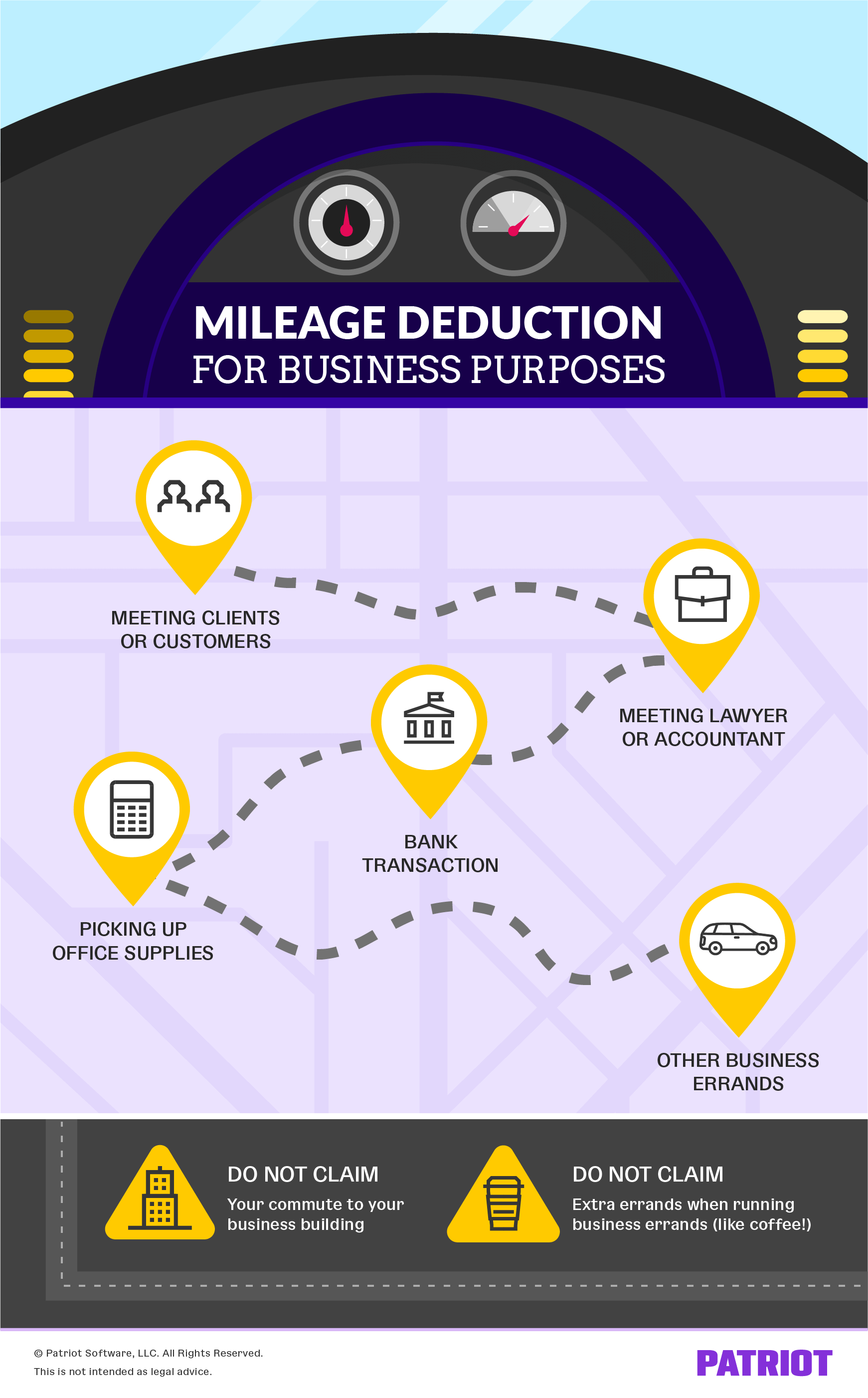

https://www.patriotsoftware.com/wp-content/uploads/2019/04/mileage_reimbursement-03.png

Mileage Tax Deduction Vs Reimbursement For Automobile Expenses

https://img-aws.ehowcdn.com/600x600p/photos.demandstudios.com/getty/article/56/210/78035155_XS.jpg

Can Your Business Claim A Super Deduction North Devon Accounts

https://northdevonaccounts.co.uk/wp-content/uploads/2022/07/Super-deduction-1080x675.png

Therefore if you are paid 50 000 a year with 5 000 allowance your total taxable income is 55 000 However while it adds to your total taxable income you can still claim a Depending on the type of plan an organization uses expense reimbursements may be considered taxable income for the employee and the employer may be required to report it on the employee s W 2

If you are entitled to a reimbursement from your employer but you don t claim it you can t claim a deduction for the expenses to which that unclaimed reimbursement applies This type of deduction is The first question is whether it is actually a reimbursement or is it an allowance Reimbursements are payments made to an employee for actual expenses already

Download Reimbursement Vs Deduction

More picture related to Reimbursement Vs Deduction

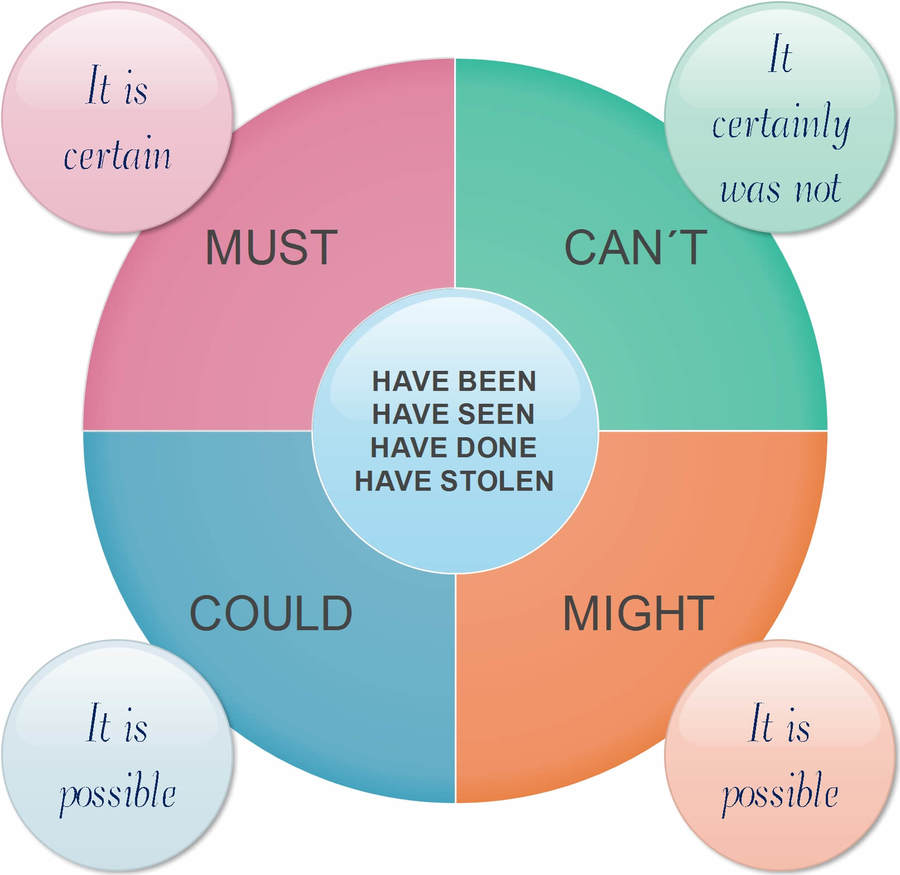

Modal Verbs Of Deduction And Speculation Quizizz

https://quizizz.com/media/resource/gs/quizizz-media/quizzes/bfbeb00c-78f9-4c8f-af7c-002c44d91b5f

Itemized Vs Standard Tax Deductions Pros And Cons 2023

https://cdn.ramseysolutions.net/media/blog/taxes/personal-taxes/itemizing-vs-standard-deduction.png

Reimbursement

https://uploads-ssl.webflow.com/62f1307825e801c7b111bb1b/6324a8af134c6e6a188803fc_MIMOSA SEO.png

1 Deducting Mileage vs Gas Receipts for Business Expenses 2 How to Enter Mileage Reimbursements for Taxes 3 How to Calculate Car and Truck Expenses and An employee expense reimbursement policy should define which expenses will be reimbursed and offer information on how to go about receiving funds via an online form or the submission of receipts A well

Reimbursements are payments made to a worker for actual expenses already incurred and the employer may be subject to fringe benefits tax FBT If the The federal tax implications of a settlement or judgment which can be significant often are overlooked For both the payer and the recipient the terms of a

2021 Mileage Reimbursement Calculator

https://www.irstaxapp.com/wp-content/uploads/2021/01/2021-mileage-reimbursement-calculator-1.png

ACLA Low Reimbursement Jeopardizes Monkeypox Lab Testing Effort G2

https://www.g2intelligence.com/wp-content/uploads/2022/10/Oct19-2022.News_.MonkeypoxTestReimbursement-iStock-1800x1250-1.jpg

https://www.justworks.com/blog/expenses-101...

When an employer reimburses an employee pursuant to an accountable plan the reimbursement won t count as wages or income to the employee Often an employer will be able to deduct those

https://support.adp.com/adp_payroll/content/hybrid/...

The Earnings and Deductions Quick Reference includes a complete list of the earnings and deductions that are provided in the payroll application For details on setting up earnings

Reimbursement Nextherapy

2021 Mileage Reimbursement Calculator

Long Term Care Indemnity Vs Reimbursement A Basic Explanation YouTube

Regulatory Changes Affecting Radiology Reimbursement In 2018

Reimbursement Invoice Format Under Gst Prosecution2012

Reimbursement Submit Fill Online Printable Fillable Blank PdfFiller

Reimbursement Submit Fill Online Printable Fillable Blank PdfFiller

Surrogacy Reimbursement Vs Base Compensation What s The Difference

Reimbursement Recovery SellerBench FAQ

Tax Deductions You Can Deduct What Napkin Finance

Reimbursement Vs Deduction - Therefore if you are paid 50 000 a year with 5 000 allowance your total taxable income is 55 000 However while it adds to your total taxable income you can still claim a