Rent Rebate 2024 Status There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

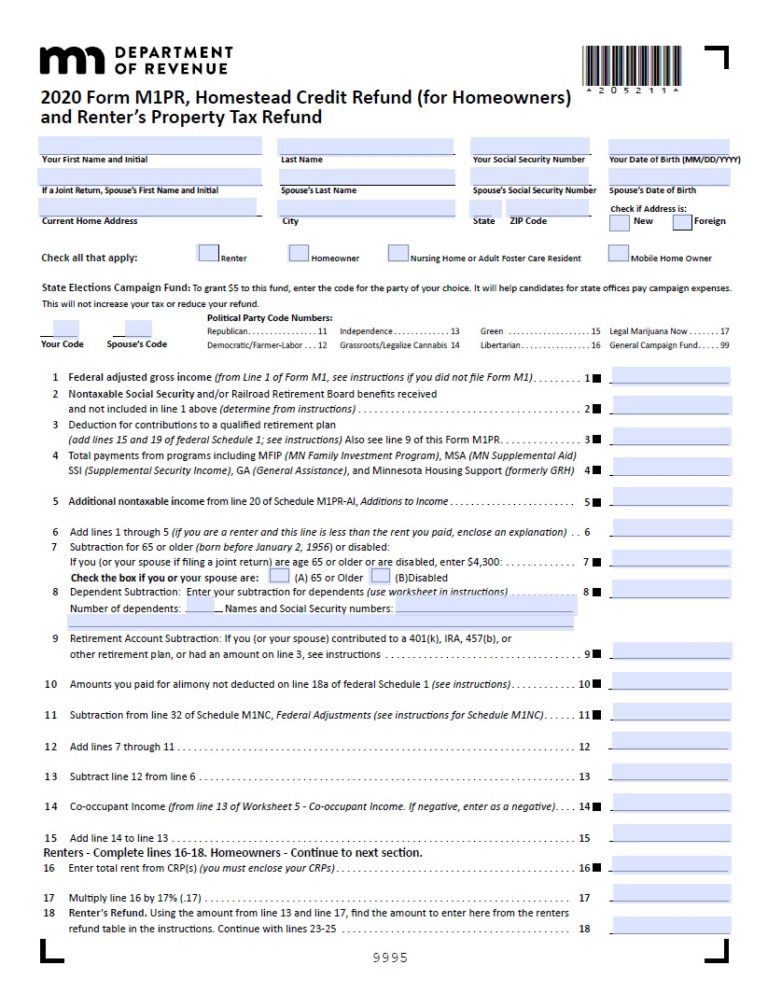

You may check the status of a Property Tax Rent rebate you filed on myPATH You can also call the automated toll free number 1 888 PA TAXES 728 2937 if you filed a paper form Please be prepared to provide your Social Security number the claim year and your date of birth Checking Rebate Status Denied Applications Resources What s New Coming Soon for 2023 Claim Year House Bill 1100 signed August 2023 Maximum Eligibility Income increased to 45 000 Maximum Standard Rebate increased to 1 000 Future years will see increase based on annual inflation New Eligibility Table Supplemental Rebates for 2023

Rent Rebate 2024 Status

Rent Rebate 2024 Status

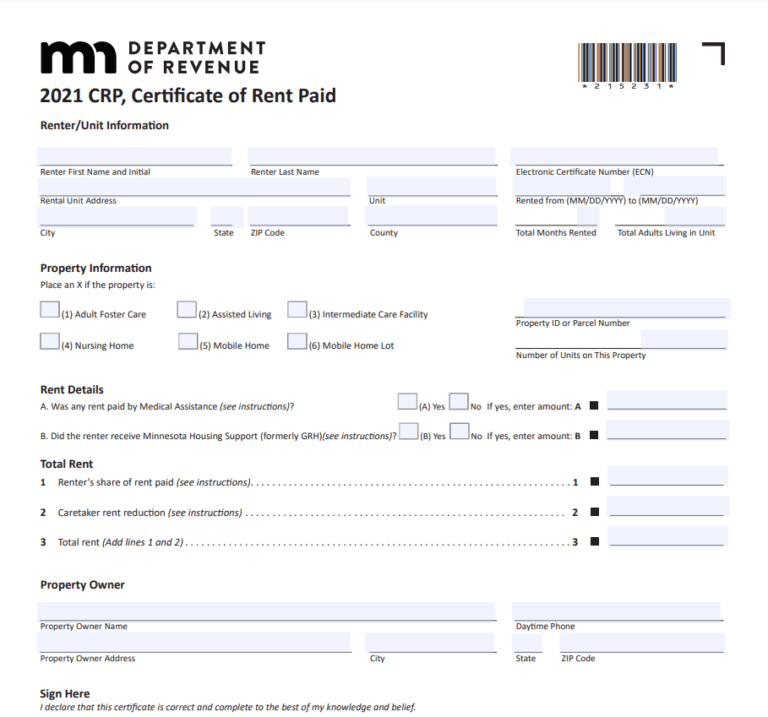

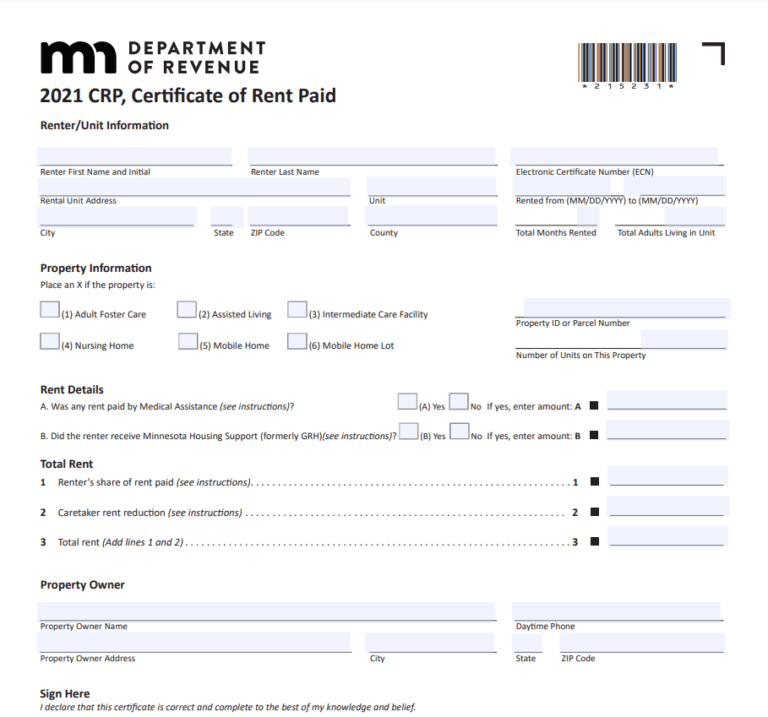

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/04/Rent-Rebate-2023.jpg

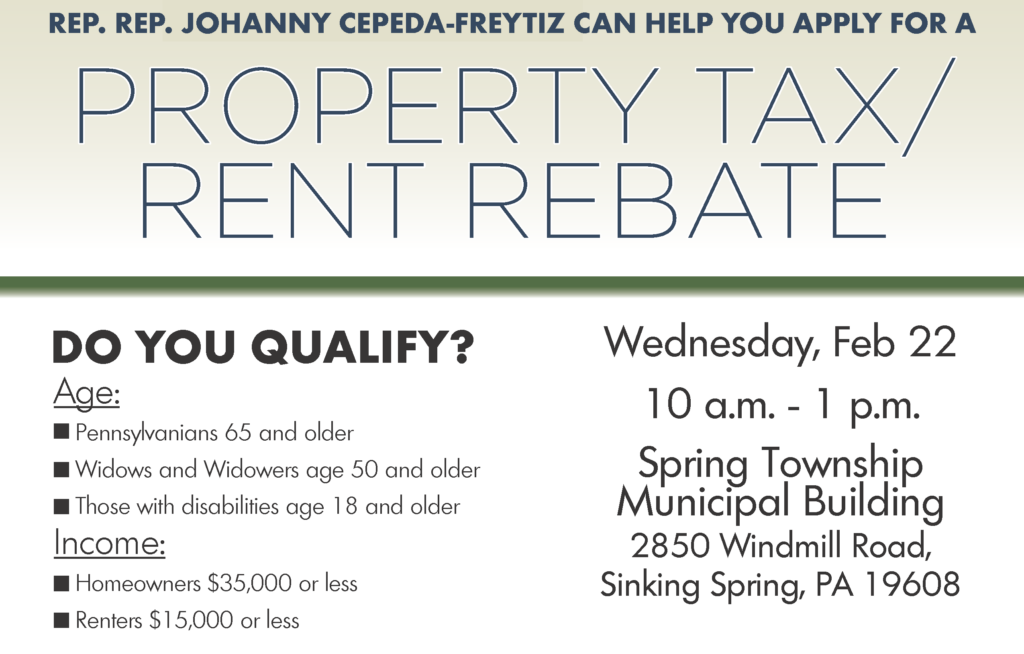

Property Tax Rent Rebate Flyer Township Of Spring

https://www.springtwpberks.org/wp-content/uploads/2023/02/Property-Tax-Rent-Rebate-Flyer-1024x654.png

Pa Rent Rebate 2021 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/PA-Rent-Rebate-Form-2021-768x993.jpg

About the Property Tax Rent Rebate Program Rebates will be distributed beginning July 1 2024 as required by law New or first time filers should anticipate that it will take additional time to review their applications and process their rebates The deadline to apply is June 30 2024 This is the first time the program has been expanded since 2006 The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 for renters Automatically increases the income cap to grow with inflation in years to come

Enter the total property tax rent paid during the claim year and select Next Provide the personal information for the claimant and spouse in the required fields Select the Verify Address button after entering the claimaint s address Select the County from the drop down menu Indicate whether the rebate should be direct deposited If yes Property Tax Rent Rebate Program P O Box 280503 Harrisburg PA 17128 0503 In person The PA Department of Revenue and other organizations are available to support you with your application Help is available at regional Department of Revenue offices located across Pennsylvania Applicants are urged to call ahead to schedule an appointment

Download Rent Rebate 2024 Status

More picture related to Rent Rebate 2024 Status

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

Pennsylvania Rent Rebate Certificate Rent Rebates

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/pa-property-tax-rent-rebate-apply-by-12-31-2022-new-1-time-bonus-55.jpg?resize=1583%2C2048&ssl=1

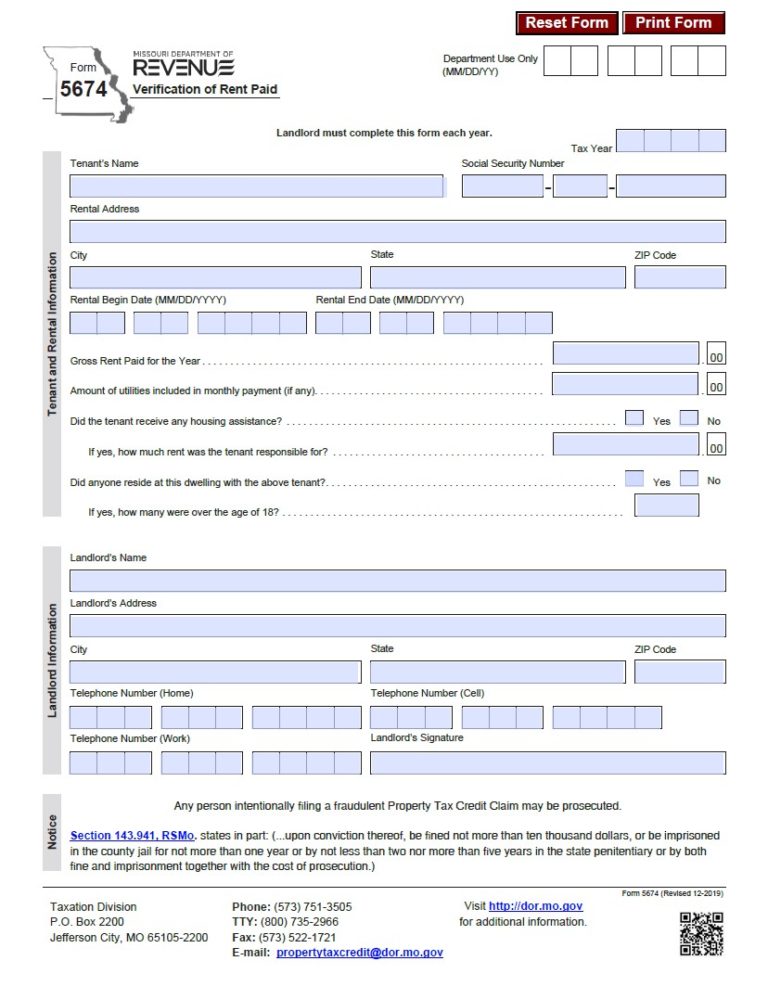

Missouri Renters Rebate 2024 PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to Starting in 2024 the maximum standard rebate will increase from 650 to 1 000 Also in 2024 the household income limit for property tax rebates will increase to 45 000 up from the current 35 000 limit The household income limit for rent rebates will also increase to 45 000 up from 15 000 Half of Social Security income is excluded

Applicants can access forms and other information about the program at revenue pa gov ptrr and can call 1 888 222 9190 for assistance In person and mail options are available in addition to the Markets today HARRISBURG KDKA Hundreds of thousands of older adults and those with disabilities are now able to apply for rebates of up to 1 000 Pennsylvania s Property Tax Rent Rebate

How To Fill Out Rent Rebate Form Direct Deposit Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/How-To-Fill-Out-Rent-Rebate-Form-768x717.png

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Ways-to-Apply

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

https://revenue-pa.custhelp.com/app/answers/detail/a_id/2503/~/wheres-my-property-tax%2Frent-rebate-rebate%3F

You may check the status of a Property Tax Rent rebate you filed on myPATH You can also call the automated toll free number 1 888 PA TAXES 728 2937 if you filed a paper form Please be prepared to provide your Social Security number the claim year and your date of birth

New Jersey Rent Rebate Printable Rebate Form

How To Fill Out Rent Rebate Form Direct Deposit Printable Rebate Form

Rent Rebate Tax Form Missouri Printable Rebate Form

2023 Rent Rebate Form Printable Forms Free Online

Renters Rebate Form Printable Rebate Form

Property Tax Rebate Pennsylvania LatestRebate

Property Tax Rebate Pennsylvania LatestRebate

Connecticut Rent Rebate Printable Rebate Form

Enews Updates January 20 2022 Senator Langerholc

Rent Rebate 2023 Pa Printable Rebate Form

Rent Rebate 2024 Status - With the filing season now open for the Property Tax Rent Rebate program the Department of Revenue encourages Spanish speaking applicants to apply online for a rebate in Spanish using myPATH the