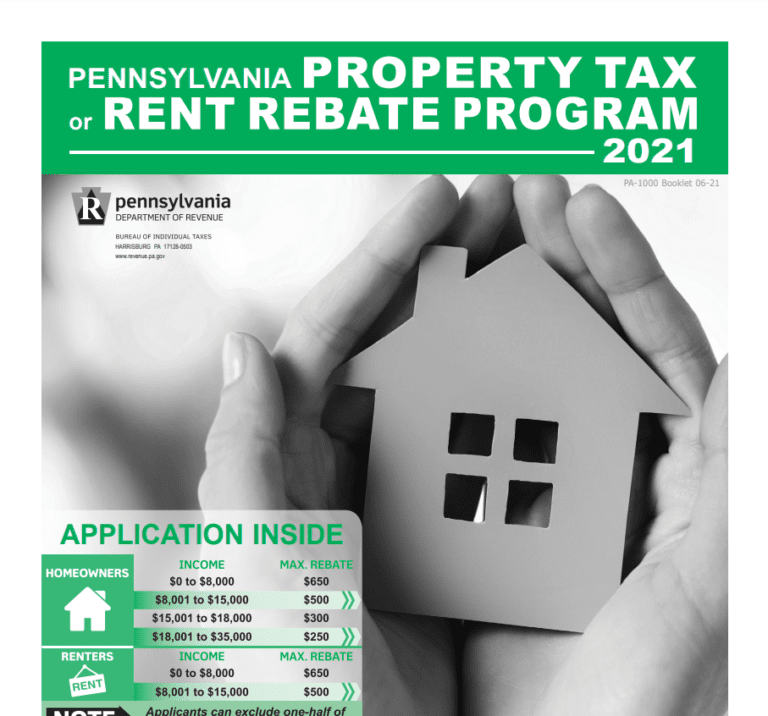

Rent Rebate Form For 2024 Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0 to 8 000 1 000

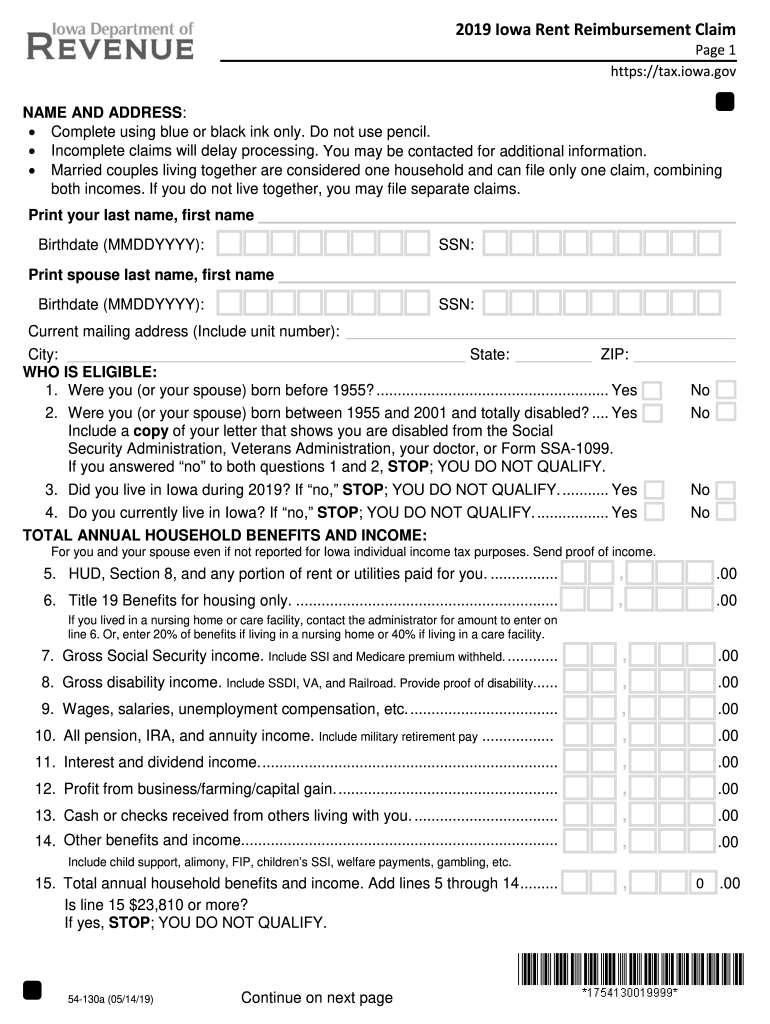

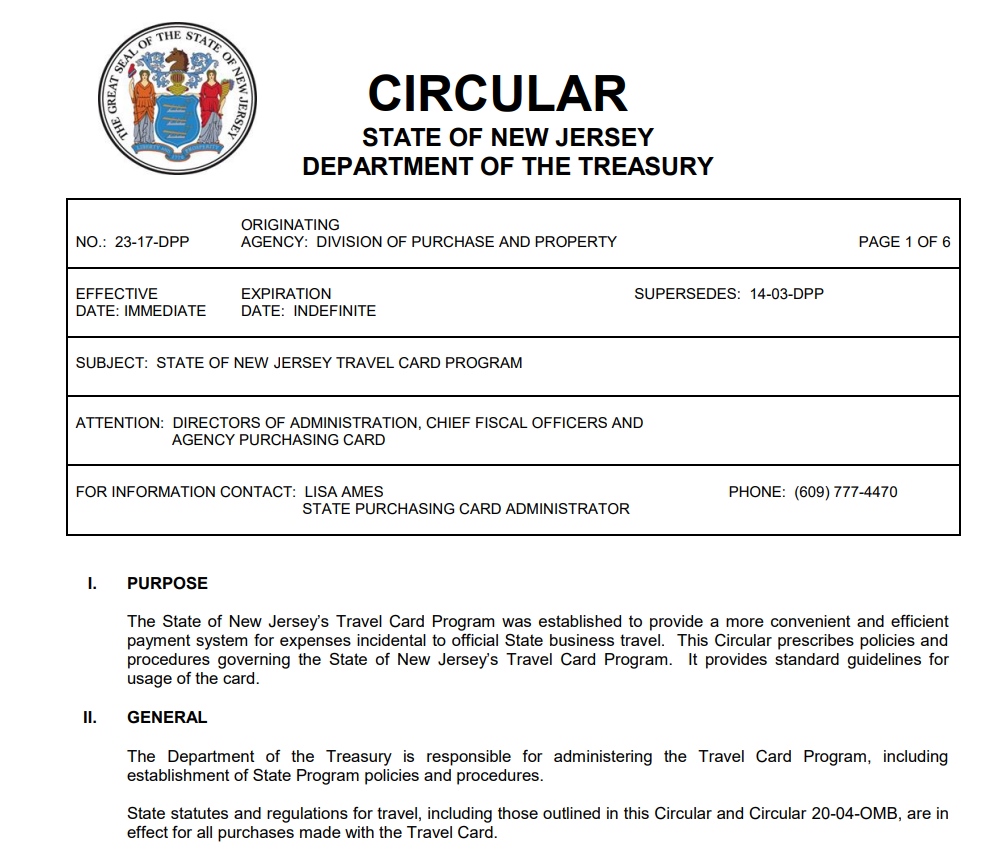

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online You can apply for reimbursement for 2023 and 2022 claims starting Tuesday January 2 2024 at 8 a m using any device that connects to the internet You must meet all of these requirements to be eligible You are 65 years of age or older or disabled and 18 or older Must have rented in Iowa and still live in Iowa now

Rent Rebate Form For 2024

Rent Rebate Form For 2024

https://i0.wp.com/www.rentrebates.net/wp-content/uploads/2023/04/Rent-Rebate-Form-2023-1.jpg?resize=1004%2C730&ssl=1

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

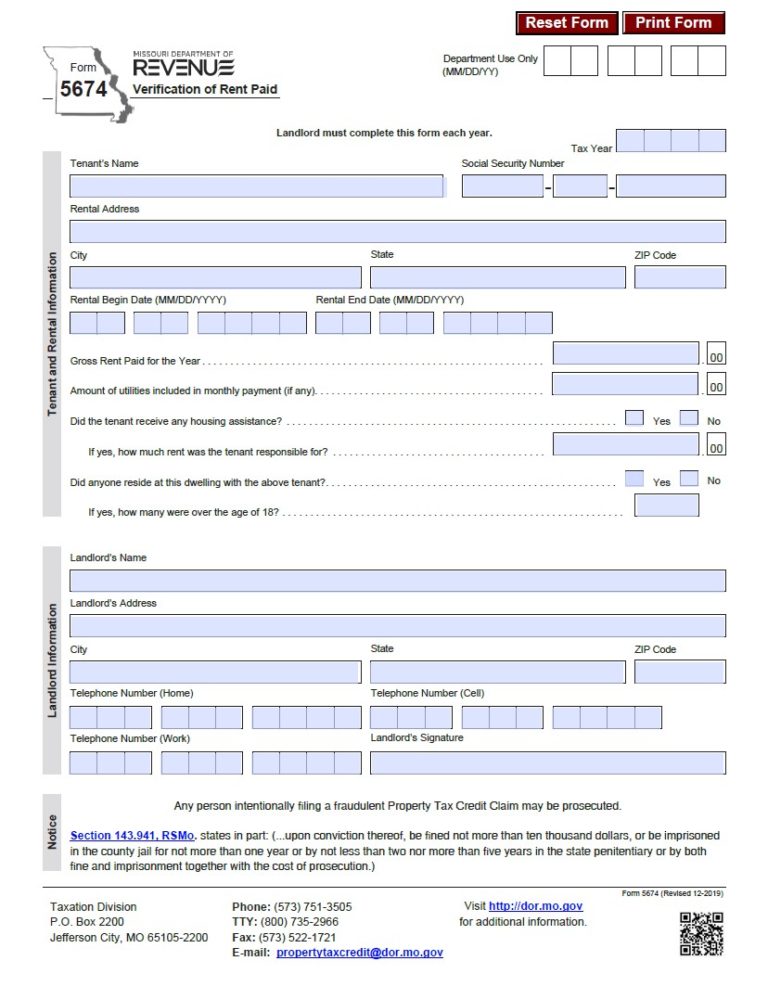

Rent Rebate Tax Form Missouri Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/08/Rent-Rebate-Form-Missouri-2021-768x999.jpg

The maximum standard rebate is now 1 000 up from 650 thanks to bipartisan legislation Governor Shapiro championed and signed into law last year delivering on his promise to cut costs and deliver real relief for Pennsylvania seniors My ofice is available to assist you with Property Tax and Rent Rebate Forms for 2024 The Pennsylvania Property Tax Rent Rebate program is open to state residents 65 or older widows and widowers 50 or older or anyone age 18 and over who is 100 disabled New income limits for 2024 are 45 000 a year for both homeowners and renters

This is the first time the program has been expanded since 2006 The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 for renters Automatically increases the income cap to grow with inflation in years to come Under the expansion crucial updates will be in place when the Department of Revenue in January 2024 opens the filing period to submit applications for property taxes and rent paid in 2023 First the maximum standard rebate will increase from 650 to 1 000

Download Rent Rebate Form For 2024

More picture related to Rent Rebate Form For 2024

Rent Reimbursement 2019 2024 Form Fill Out And Sign Printable PDF Template SignNow

https://www.signnow.com/preview/495/351/495351890/large.png

Where To Mail Pa Property Tax Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/Where-To-Mail-Pa-Property-Tax-Rebate-Form-768x716.png

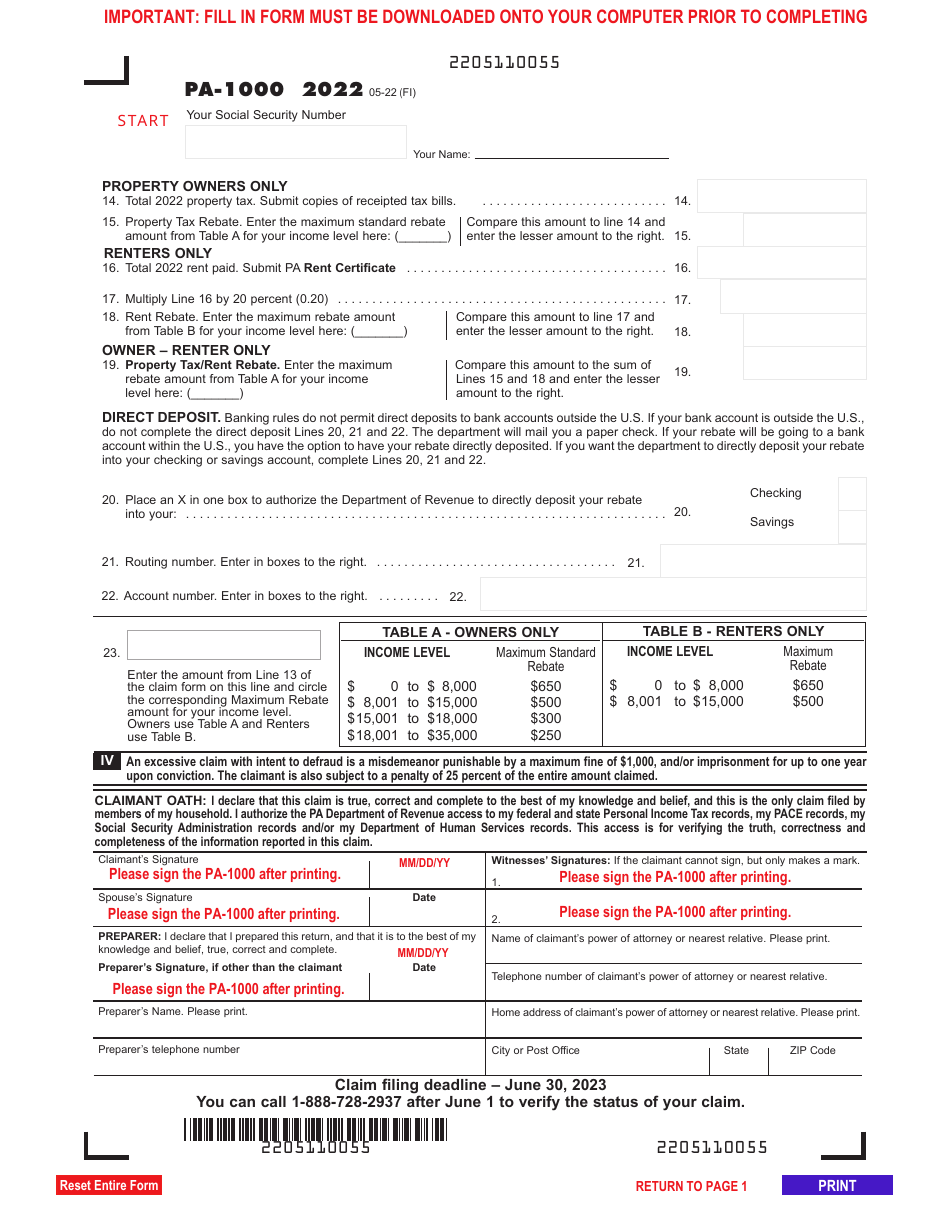

Form PA 1000 Download Fillable PDF Or Fill Online Property Tax Or Rent Rebate Claim 2022

https://data.templateroller.com/pdf_docs_html/2587/25879/2587963/page_2_thumb_950.png

Any rent you received for nonresidential use of your residence was 20 or less of the total rent you received Complete and file Form IT 214 for the year or years that you were eligible as soon as you can but before these dates 2020 May 17 2024 2021 April 15 2025 2022 April 15 2026 Additional information Form IT 214 Claim Enter the total property tax rent paid during the claim year and select Next Provide the personal information for the claimant and spouse in the required fields Select the Verify Address button after entering the claimaint s address Select the County from the drop down menu Indicate whether the rebate should be direct deposited If yes

About the Property Tax Rent Rebate Program 2024 as required by law New or first time filers should anticipate that it will take additional time to review their applications and process By mail download a paper application to print complete and mail the claim form proof of income and other required documentation to PA Department of Revenue Property Tax Rent Rebate Program P O Box 280503 Harrisburg PA 17128 0503 In person The PA Department of Revenue and other organizations are available to support you with your

FREE 7 Sample Rent Rebate Forms In PDF

https://images.sampletemplates.com/wp-content/uploads/2016/04/25123217/Rent-Rebate-Form-PDF1.jpg

2021 Form PA PA 1000 Fill Online Printable Fillable Blank PdfFiller

https://www.pdffiller.com/preview/585/571/585571881/large.png

https://www.revenue.pa.gov/FormsandPublications/FormsforIndividuals/PTRR/Documents/2023_pa-1000_inst.pdf

Rebates begin EARLY JULY 2024 NOTE The department may extend the application deadline if funds are available Applicants can exclude one half of all Social Security income INCOME MAX REBATE 0 to 8 000 1 000 8 001 to 15 000 770 15 001 to 18 000 460 18 001 to 45 000 380 INCOME MAX REBATE 0 to 8 000 1 000

https://www.revenue.pa.gov/IncentivesCreditsPrograms/PropertyTaxRentRebateProgram/Ways-to-Apply

There are three ways to apply for the Property Tax Rent Rebate Program online by mail or in person Applicants are encouraged to apply online for the fastest review process Learn more about your options to ensure your application is submitted correctly by the June 30 2024 filing deadline Apply Online

Missouri Renters Rebate 2024 PrintableRebateForm

FREE 7 Sample Rent Rebate Forms In PDF

NJ Rent Rebate Form Rent Rebates

Residents Can File Property Tax Rent Rebate Program Applications Online Lower Bucks Times

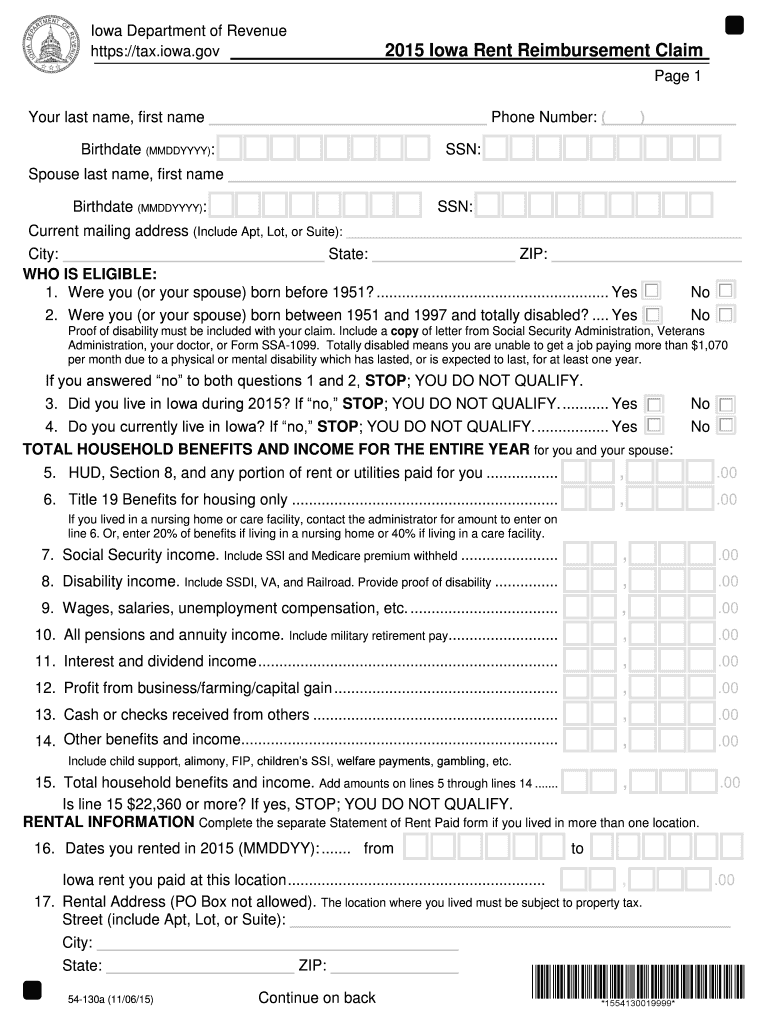

Iowa Rent Reimbursement Fill Out Sign Online DocHub

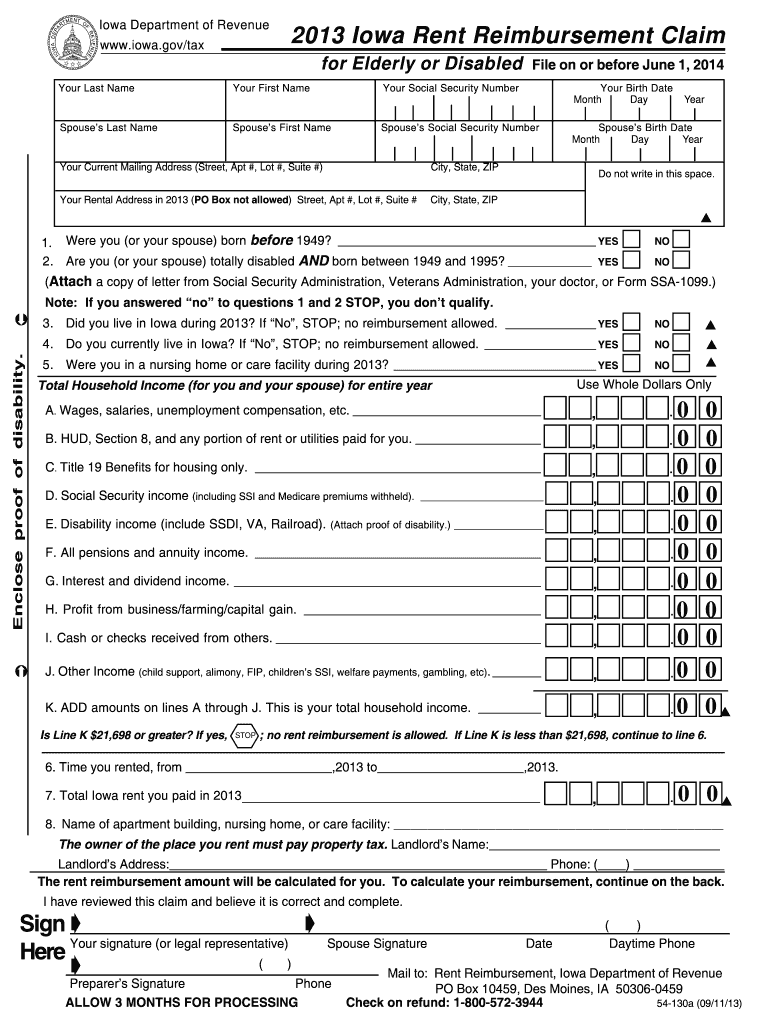

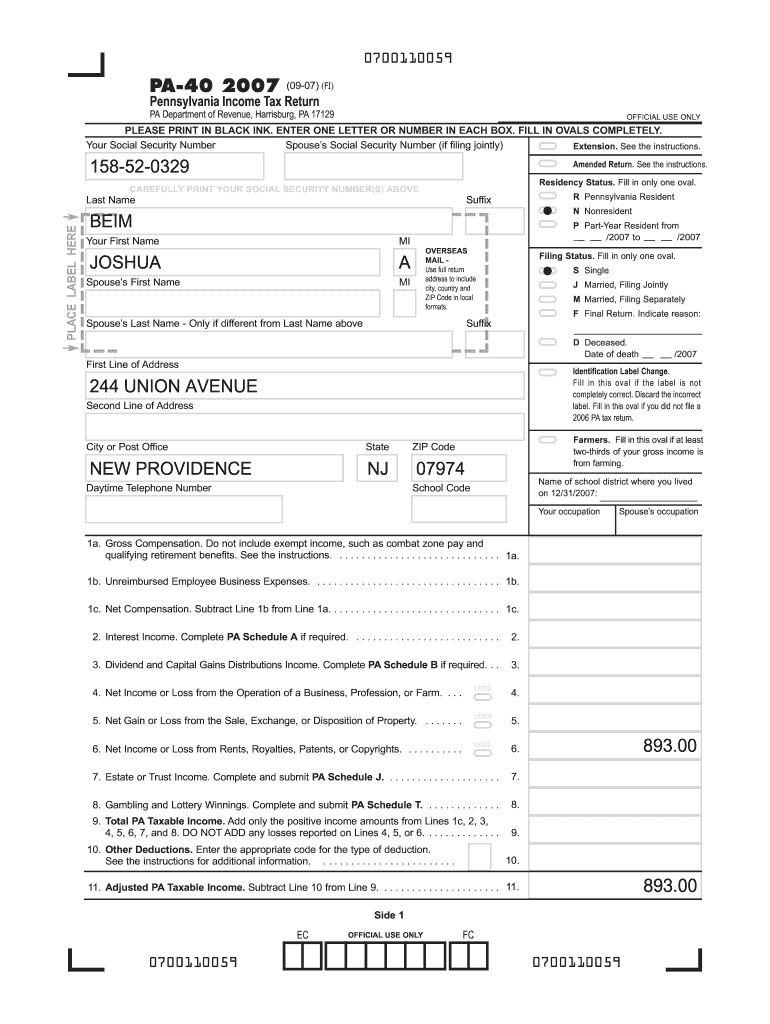

Fillable Pa 40 2019 2024 Form Fill Out And Sign Printable PDF Template SignNow

Fillable Pa 40 2019 2024 Form Fill Out And Sign Printable PDF Template SignNow

All Rebate Forms Available 2023 Printable Rebate Form

Iowa Rent Rebate Form Fill Out And Sign Printable PDF Template SignNow

PA Rent Rebate Form Printable Rebate Form

Rent Rebate Form For 2024 - This is the first time the program has been expanded since 2006 The expansion Increases the maximum standard rebate from 650 to 1 000 Increases the income cap from 35 000 to 45 000 for homeowners Increases the income cap from 15 000 to 45 000 for renters Automatically increases the income cap to grow with inflation in years to come