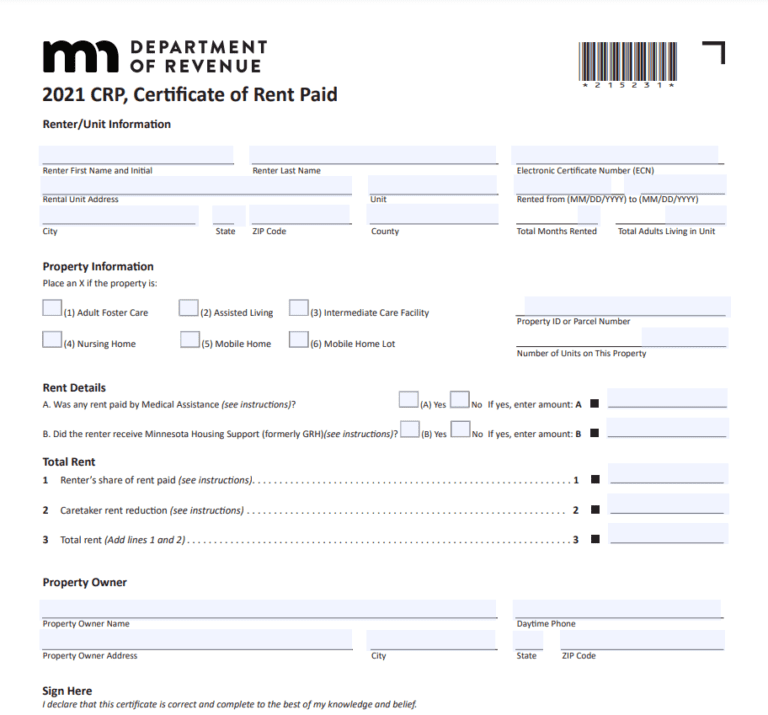

Renters Rebate Mn 2024 You must give each renter a CRP by January 31 2024 Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents

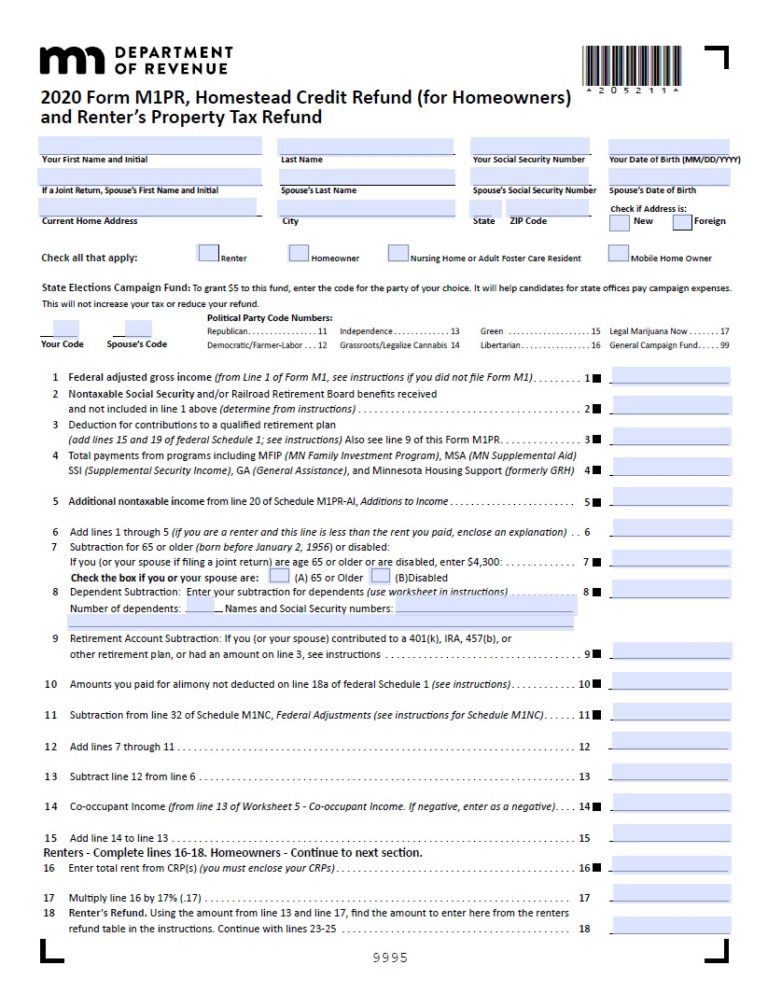

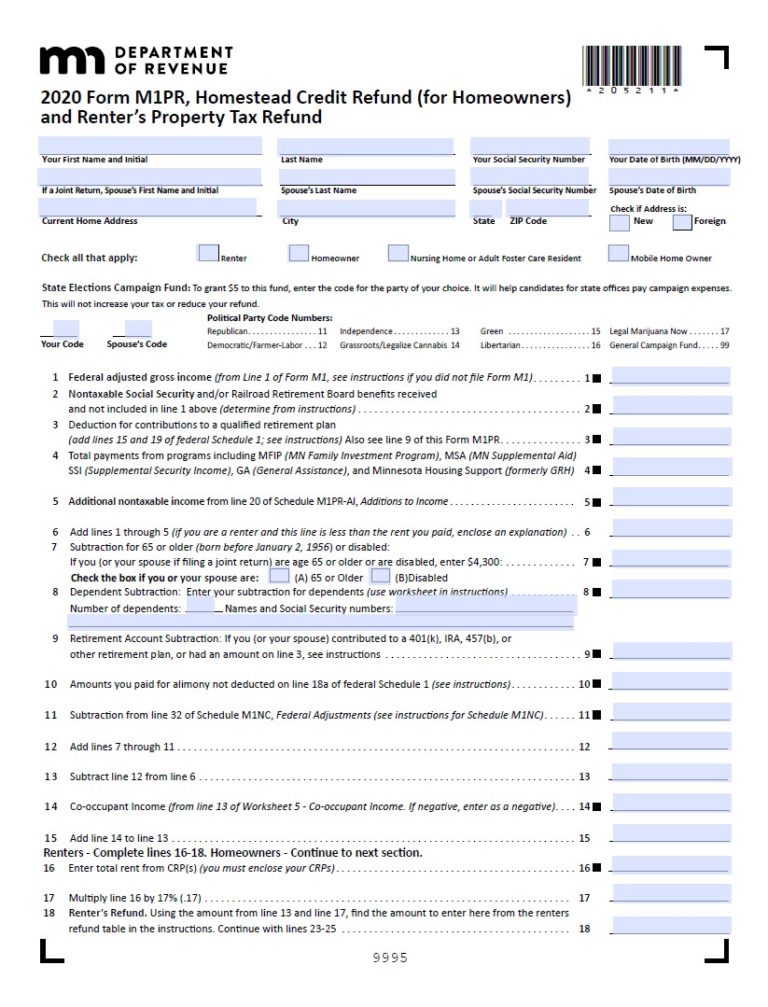

What are the maximums For refund claims filed in 2022 based on rent paid in 2021 and 2021 household income the maximum refund is 2 280 Renters whose income exceeds 64 920 are not eligible for refunds How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR If you rent your landlord must give you a Certificate of Rent Paid CRP by January 31 2024 If you own use your Property Tax Statement Get the tax form called the 2023 Form M 1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund

Renters Rebate Mn 2024

Renters Rebate Mn 2024

https://printablerebateform.net/wp-content/uploads/2021/07/Minnesota-Renters-Rebate-Form-2021-768x1007.jpg

Renters Rebate Program Opens April 1st Connecticut House Democrats

https://www.housedems.ct.gov/sites/default/files/field/image/2021_RentersRebateProgram.png

Renters Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Vermont-Renters-Rebate-Form-2021-784x1024.jpg

1 Can I get a property tax refund if I own my own house Do I have to file my renter s refund with my regular taxes on April 15 Can I file my renter s refund after August 15 LawHelpMN does not collect any personal information when you take this quiz For more information see our privacy policy Enter the total rent paid by the renter in 2023 If there are multiple renters in a unit split the rent evenly between all renters Continued Include the amounts for Line A and Line B on Line 1 For example if 2 000 of rent was paid by Medical Assistance 3 000 was paid by Minnesota Housing Support and 5 000 was paid by the renter enter

The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Made property tax payments to a local government in place of property taxes Renters who are residents of another state but present in Minnesota for more than 183 The renter s property tax refund program sometimes called the renters credit is a state paid refund that provides tax relief to renters whose rent and implicit property taxes are high relative to their incomes Rent constituting property taxes is assumed to equal 17 percent of rent paid

Download Renters Rebate Mn 2024

More picture related to Renters Rebate Mn 2024

New Jersey Renters Rebate 2023 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-Jersey-Renters-Rebate-2023.jpg

Missouri Renters Rebate 2023 Printable Rebate Form

http://printablerebateform.net/wp-content/uploads/2023/02/Missouri-Renters-Rebate-2023.jpg

2023 Renters Rebate Easthartfordct

https://www.easthartfordct.gov/sites/g/files/vyhlif9241/f/bulletins/2023_renters_rebate_10.67_x_5.33_in.png

Minnesota Homestead Credit Refund and Renter s Property Tax Refund e File your 2023 and your 2022 Minnesota Homestead Credit and Renter s Property Tax Refund return Form M1PR 2023 and Jan 2 2024 Property tax increased by more than 12 and at least 100 Full or part year resident of Minnesota during 2023 Cannot be a dependent The bill s provisions would be effective for tax year 2023 or for refunds based on rent paid in 2023 meaning the first credits calculated as part of the income tax return would be claimed during the 2024 filing period On Wednesday the House Property Tax Division laid the bill over for possible inclusion in its division report

Changes to Tenant Landlord Law for 2024 CLE December 7 2023 9 00am 3 00pm CLE Code 494852 What is HOME Line HOME Line is a statewide nonprofit organization providing free legal educational and advocacy services to Minnesota renters We have advised over 300 000 renters since 1992 That permanent change would be effective for property taxes payable in 2024 but the bill would beef up the refund program even more on a onetime basis For refunds on taxes payable in 2023 the increase in property taxes would only need to be 6 and the maximum refund would be 2 500 Minnesota House of Representatives 100 Rev Dr

Form For Renters Rebate RentersRebate

https://i0.wp.com/www.rentersrebate.net/wp-content/uploads/2022/10/rent-rebate-form-1-free-templates-in-pdf-word-excel-download-15.png?fit=768%2C1024&ssl=1

2022 Renters Rebate Mn Instructions RentersRebate

https://www.rentersrebate.net/wp-content/uploads/2023/05/pa-renters-rebate-form-2022-rentersrebate-72.jpg

https://www.careproviders.org/CPM/ACTION/Vol39/Ed03/ZP05.aspx

You must give each renter a CRP by January 31 2024 Renters will need the CRP to apply for the Renter s Property Tax Refund The Minnesota Department of Revenue has expanded access to their CRP system in e Services and you will be able to create CRPs using e Services by January 1 2024 all residential property owners and managing agents

https://www.house.mn.gov/hrd/pubs/ss/ssrptrp.pdf

What are the maximums For refund claims filed in 2022 based on rent paid in 2021 and 2021 household income the maximum refund is 2 280 Renters whose income exceeds 64 920 are not eligible for refunds How are claims filed Refund claims are filed using Minnesota Department of Revenue DOR Schedule M1PR

Maine Renters Rebate 2023 PrintableRebateForm

Form For Renters Rebate RentersRebate

Connecticut Renters Rebate 2023 Printable Rebate Form

New Hampshire Renters Rebate 2023 Printable Rebate Form

New Mexico Renters Rebate 2023 Printable Rebate Form

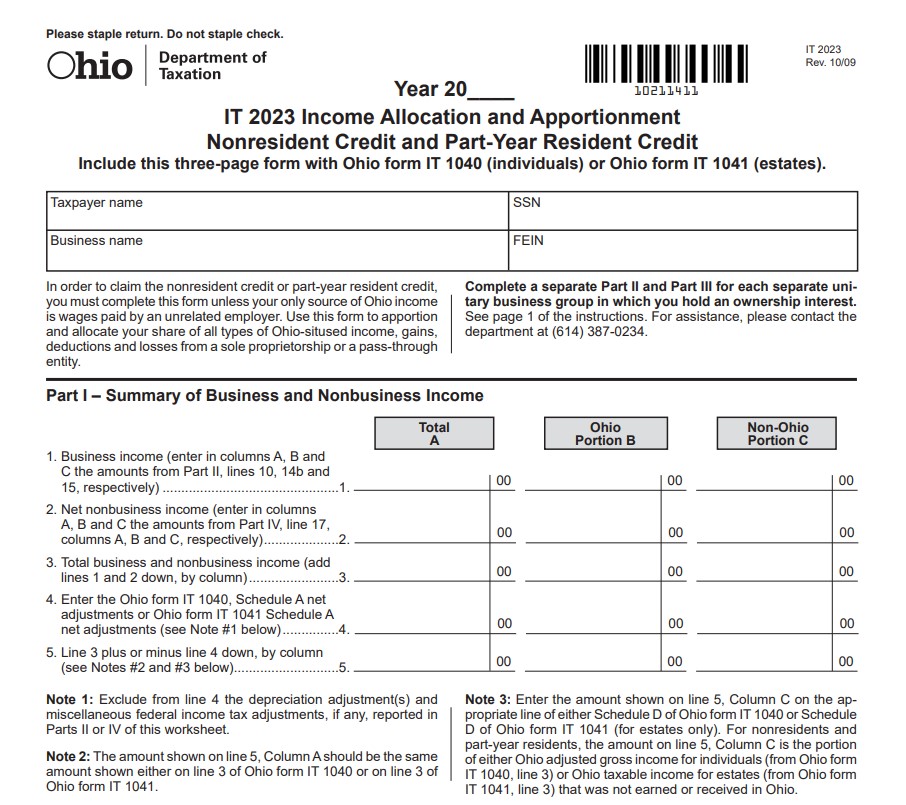

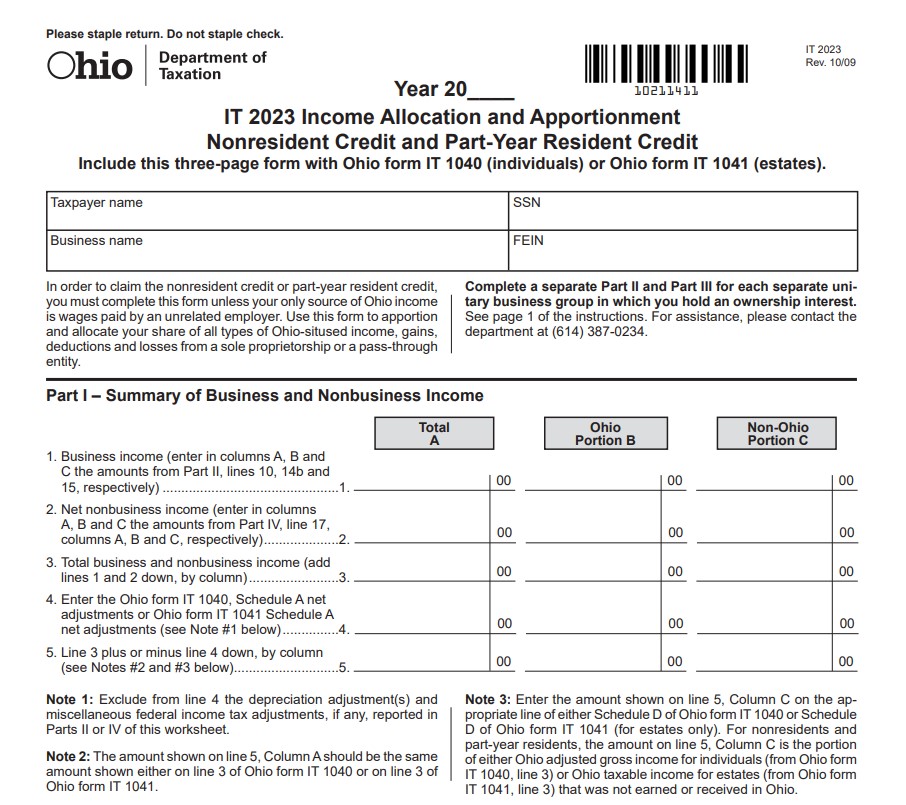

Ohio Renters Rebate 2023 Printable Rebate Form

Ohio Renters Rebate 2023 Printable Rebate Form

How To Fill Out Renters Rebate Mn RentersRebate

Florida Renters Rebate 2023 PrintableRebateForm

MN Renters Printable Rebate Form

Renters Rebate Mn 2024 - The increase was at least 100 Renters with household income of less than 73 270 can claim a refund up to 2 570 You must have lived in a building where the owner of the building Made property tax payments to a local government in place of property taxes Renters who are residents of another state but present in Minnesota for more than 183