Repayment Of Education Loan Income Tax Rebate Web 31 ao 251 t 2023 nbsp 0183 32 With a starting debt balance of 26 946 the average among borrowers when they graduate according to the National Center for Education Statistics you would pay

Web 23 f 233 vr 2018 nbsp 0183 32 There is no upper limit 3 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is Web 7 sept 2023 nbsp 0183 32 Over 40 of federal student loan borrowers don t know if they re eligible for an income driven repayment of Education has access to their tax information

Repayment Of Education Loan Income Tax Rebate

Repayment Of Education Loan Income Tax Rebate

https://pbs.twimg.com/media/Dc5zw1RXUAMEbYB.jpg

What Does Income Based Repayment For Student Loans Cost

https://s3.amazonaws.com/newamericadotorg/original_images/income-based-repayment-cost_image.jpeg

What Is An Income based Repayment IBR Student Loan Repayment Plan

https://d3tc5xafqqxqk8.cloudfront.net/wp-content/uploads/2020/11/25180439/image4-2-768x402.png

Web 12 avr 2019 nbsp 0183 32 Under Section 80E of the Income Tax Act the interest part of the loan is eligible for tax benefit Banks offer a moratorium period for repayment of the loan after Web What is section 80E Section 80E of the Income tax act allows you to claim a deduction for the education loan taken from any financial institution or approved charitable institution Under this section you can only take a

Web The easiest and the quickest way to calculate your education loan income tax benefits as per the latest budget FY 20 21 How long is your course in months Total Loan Amount Rate of interest for the loan in Will you Web Il y a 1 jour nbsp 0183 32 The end of a three year pause on student loan repayments could affect President Joe Biden s vision for the economy and is likely to disproportionately impact

Download Repayment Of Education Loan Income Tax Rebate

More picture related to Repayment Of Education Loan Income Tax Rebate

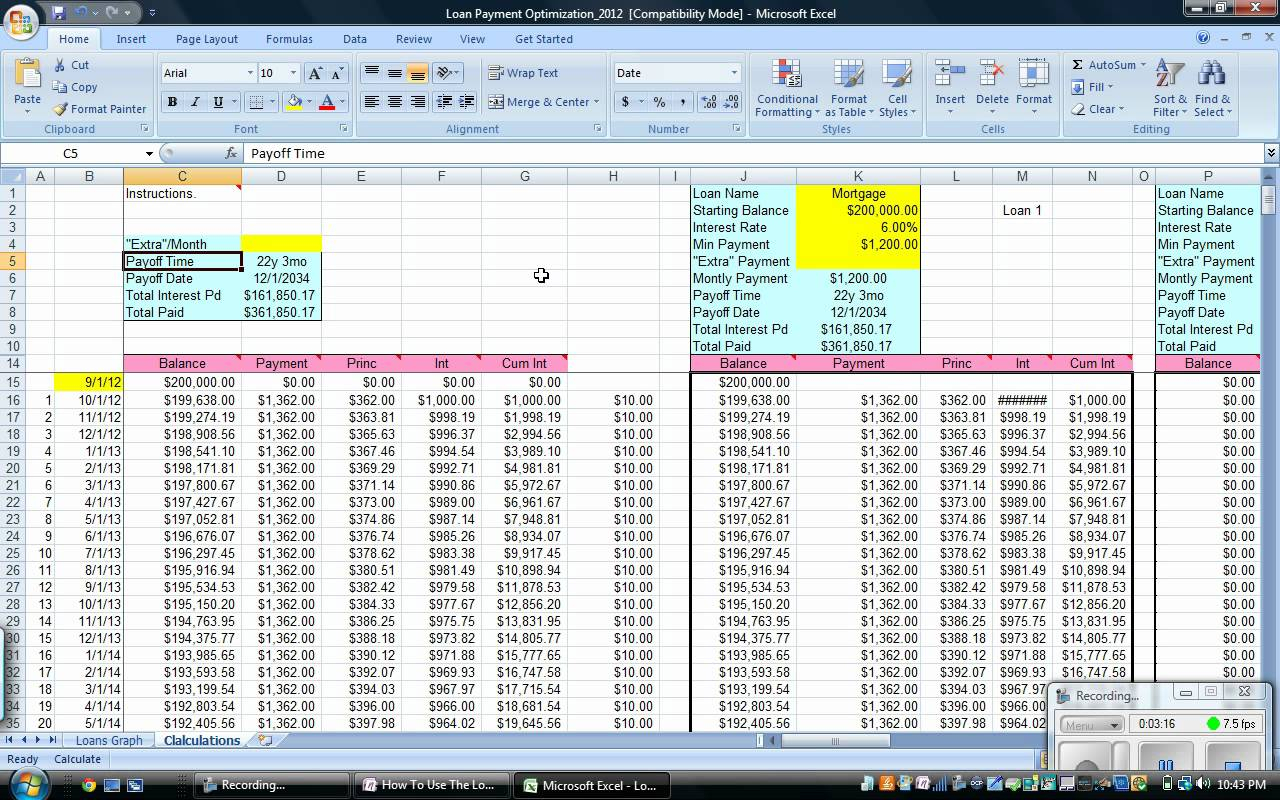

Student Loan Excel Sheet Studentqw

https://db-excel.com/wp-content/uploads/2019/01/student-loan-repayment-spreadsheet-intended-for-student-loan-excel-spreadsheet-samplebusinessresume.jpg

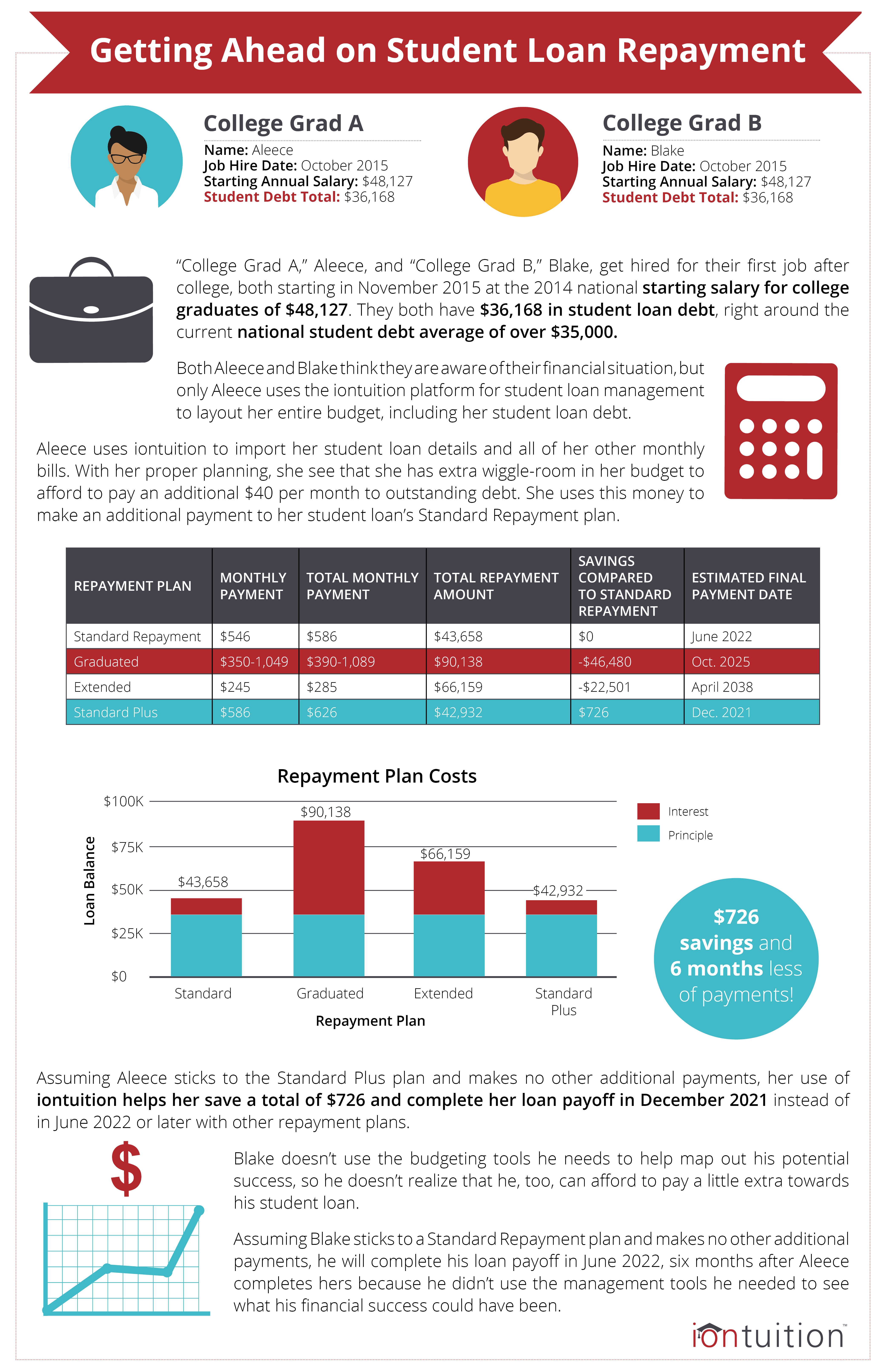

Student Loan Repayment Scenario infographic IonTuition Student Loan

https://s28637.pcdn.co/wp-content/uploads/2016/02/Student-Loan-Repayment-Scenario_infographic.png

Simulated Loan Repayment Schedule Of Education And Home Loan In State

https://www.researchgate.net/profile/Geetha-Rani/publication/273461842/figure/tbl8/AS:614252092080132@1523460519472/Simulated-Loan-Repayment-Schedule-of-Education-and-Home-Loan-in-State-Bank-of-India.png

Web Receive tax free treatment of a canceled student loan Receive tax free student loan repayment assistance Deduct higher education expenses on your income tax return as for example a business expense and Web Only an Individual can claim deduction under Section 80E for the Repayment of Interest on Education Loan provided that the Loan was taken for the Higher Education of Self or Spouse or Children or the

Web 25 ao 251 t 2022 nbsp 0183 32 The income tax rebate on education loan is available only for the repayment of the interest component of the loan No tax benefits are available for the Web 16 f 233 vr 2023 nbsp 0183 32 Frais de scolarit 233 au coll 232 ge au lyc 233 e 233 tudiant quel avantage fiscal pour la d 233 claration de revenus 2023 Une r 233 duction d imp 244 t pour frais de scolarit 233 est accord 233 e

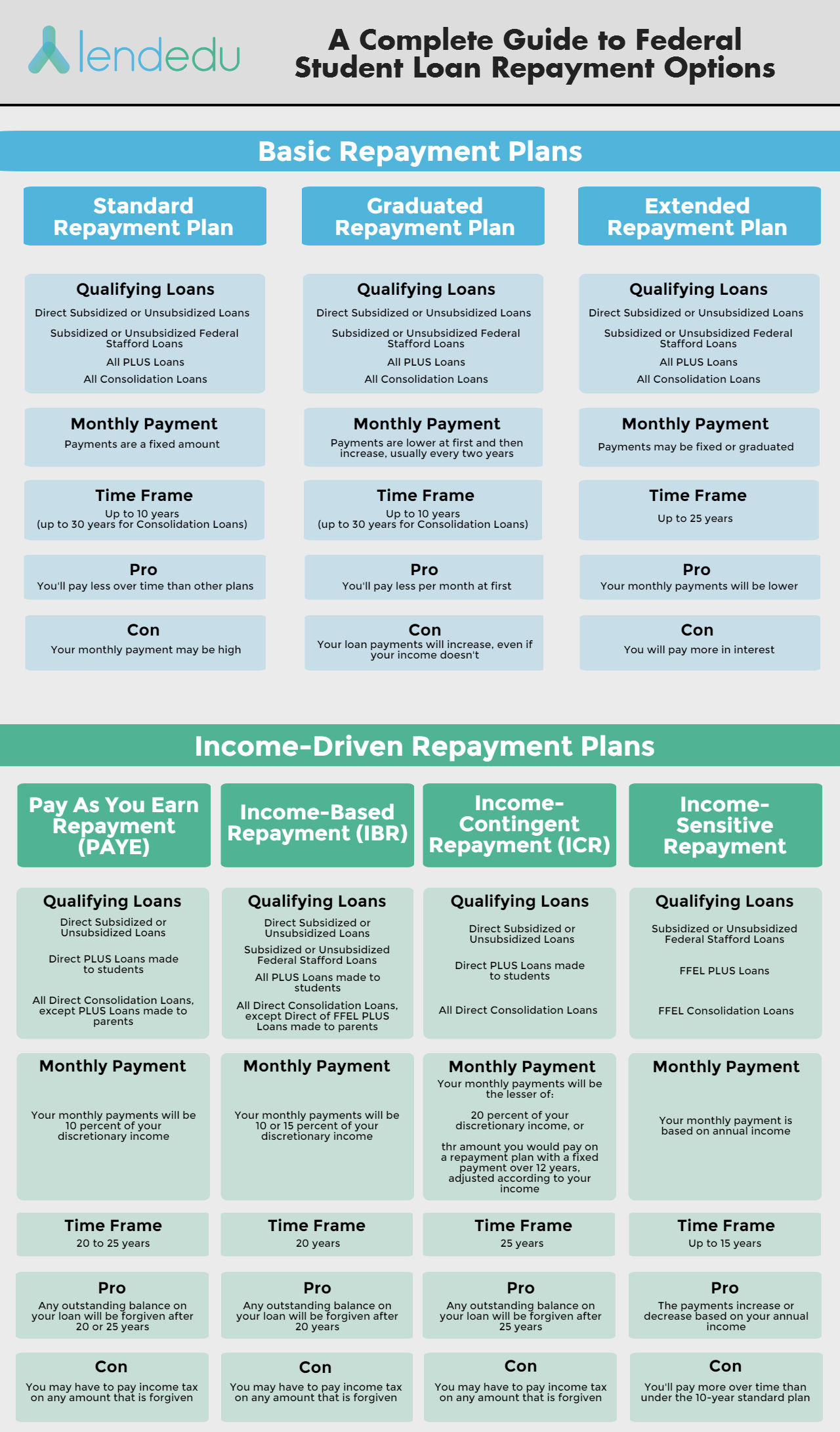

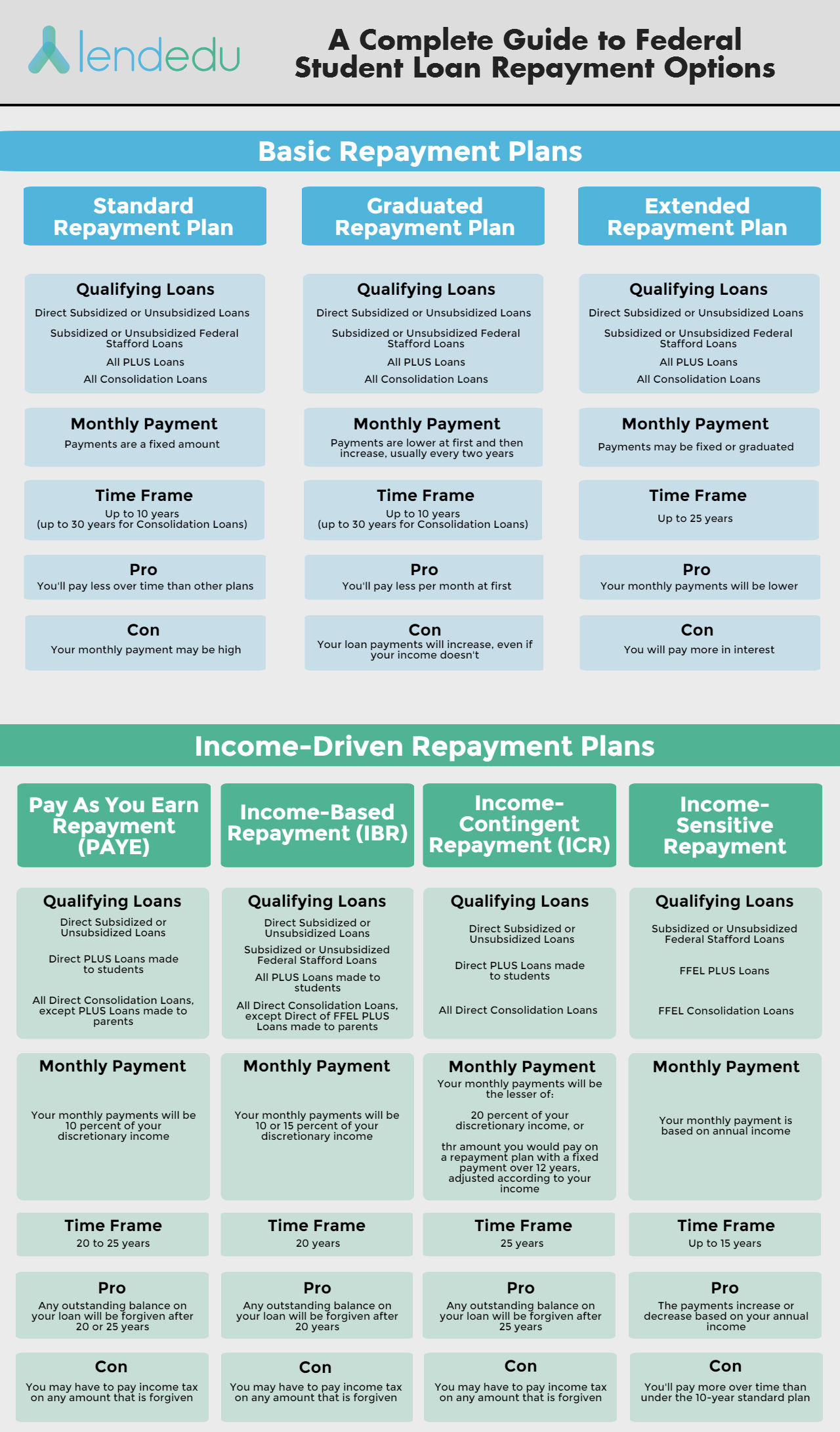

A Complete Guide To Federal Student Loan Repayment Options LendEDU

https://lendedu.com/wp-content/uploads/2016/03/federal-student-loan-repayment-options-1.png

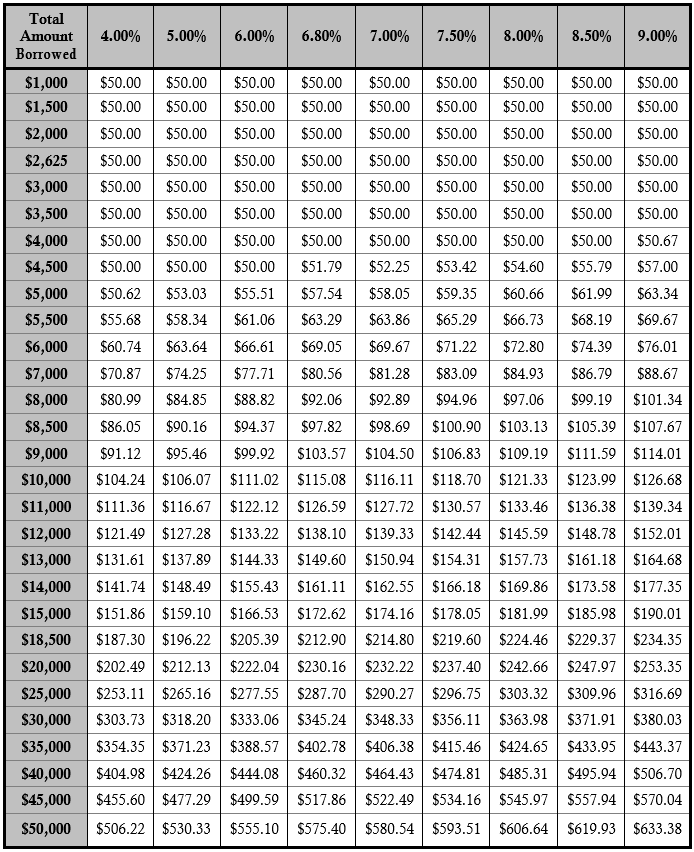

Calculating Your Student Loan Payments In 2023 Funaya Park

https://i2.wp.com/www.studentloanplanner.com/wp-content/uploads/2017/01/student-loan-payment-calculator-image-1.jpg

https://www.cnbc.com/2023/08/31/save-student-debt-repayment-plan-pros...

Web 31 ao 251 t 2023 nbsp 0183 32 With a starting debt balance of 26 946 the average among borrowers when they graduate according to the National Center for Education Statistics you would pay

https://www.ndtv.com/business/income-tax-benefit-on-education-loan...

Web 23 f 233 vr 2018 nbsp 0183 32 There is no upper limit 3 The income tax deduction on education loan is only available for up to eight years or until the payment of interest in full whichever is

Tax Benefits On Repayment Of Education Loan Under Section 80E Kartik

A Complete Guide To Federal Student Loan Repayment Options LendEDU

Student Loan Excel Spreadsheet Template HQ Printable Documents

Financial Wellness Financial Aid Great Falls College MSU

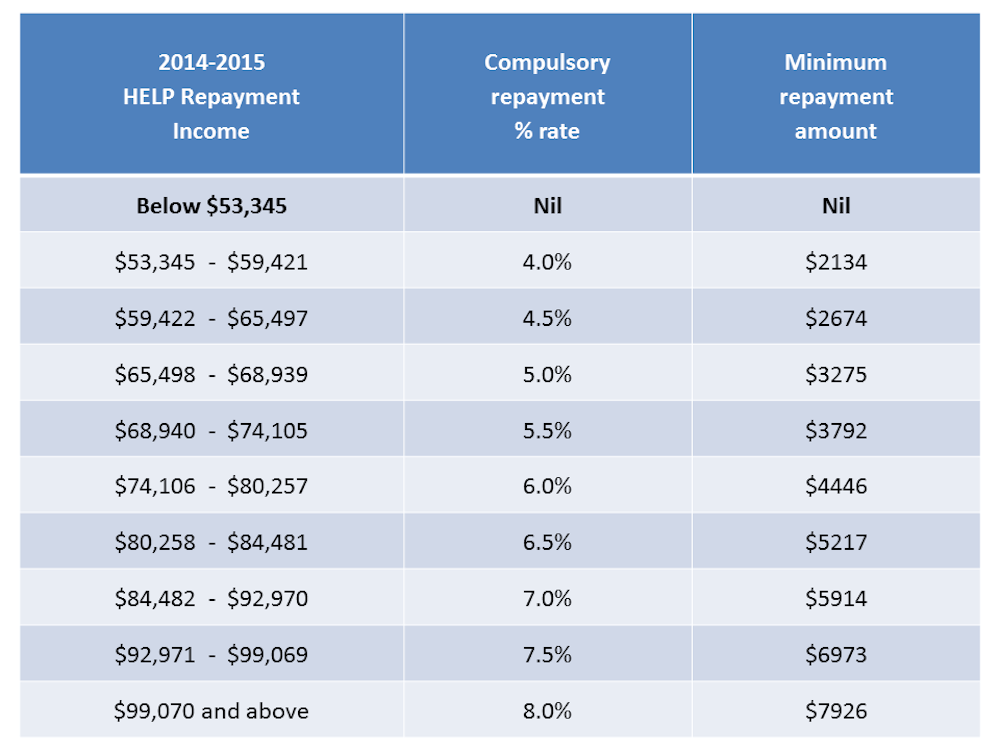

Use Super Contributions To Repay Student Loans

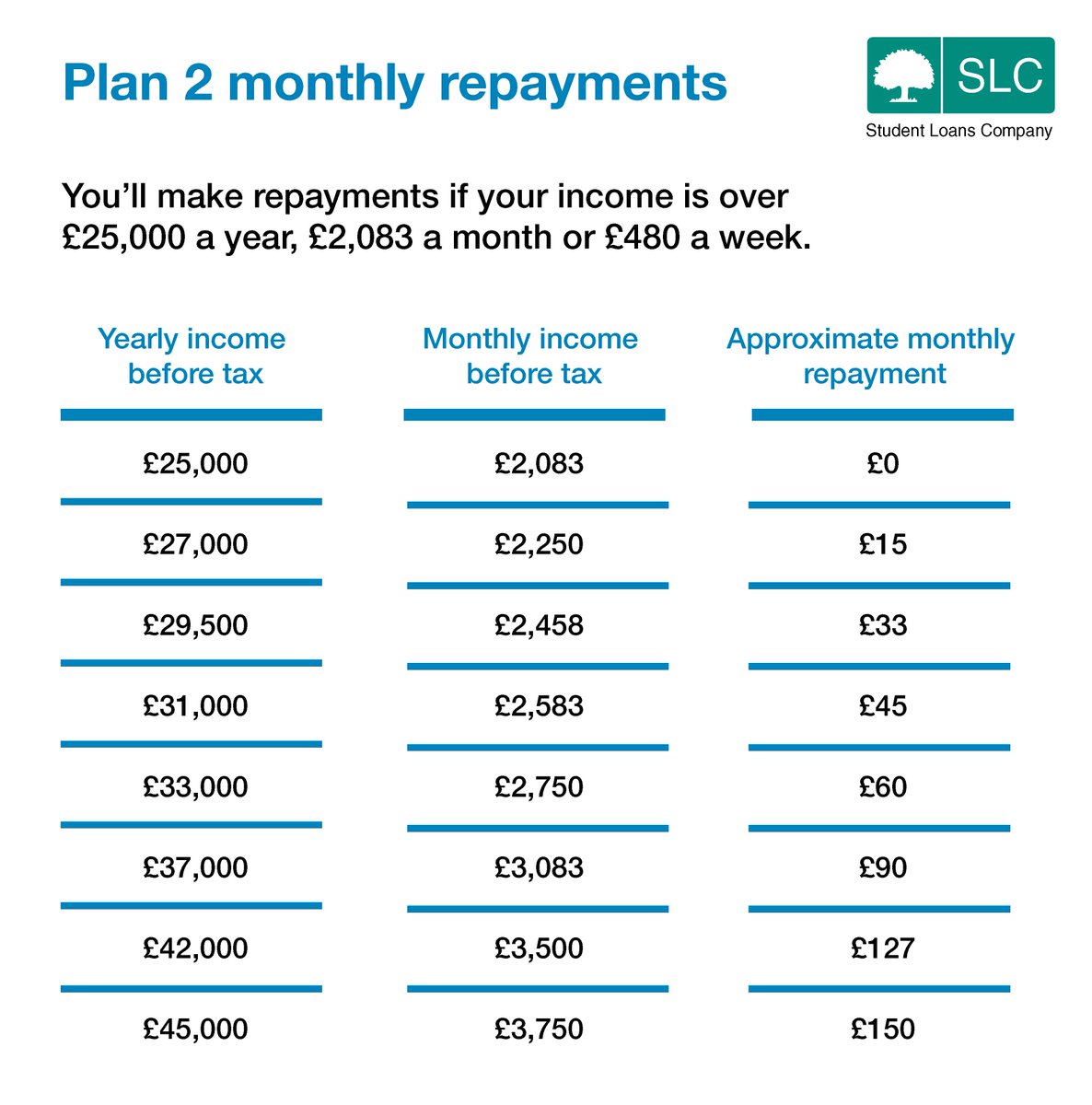

Student Loan Repayment Options Can You Make Repayments During Your

Student Loan Repayment Options Can You Make Repayments During Your

Education Student Loans How Repayments Are Calculated Science Education

Income Based Plans Take The Bite Out Of Student Loan Repayment Hope

What Does Income Based Repayment For Student Loans Cost

Repayment Of Education Loan Income Tax Rebate - Web 27 juin 2023 nbsp 0183 32 An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well If you have taken an education loan and are repaying the