Requirement Heat Pump Rebate 2024 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get back is 3 200 year Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item Business Looking for Inflation Reduction Act rebates to go green Get ready to wait Many Inflation Reduction Act rebates on green technology such as heat pumps and induction stoves being

Requirement Heat Pump Rebate 2024

Requirement Heat Pump Rebate 2024

https://i2.wp.com/constanthomecomfort.com/wp-content/uploads/2022/12/Copy-of-How-do-I-find-a-business-idea.jpg

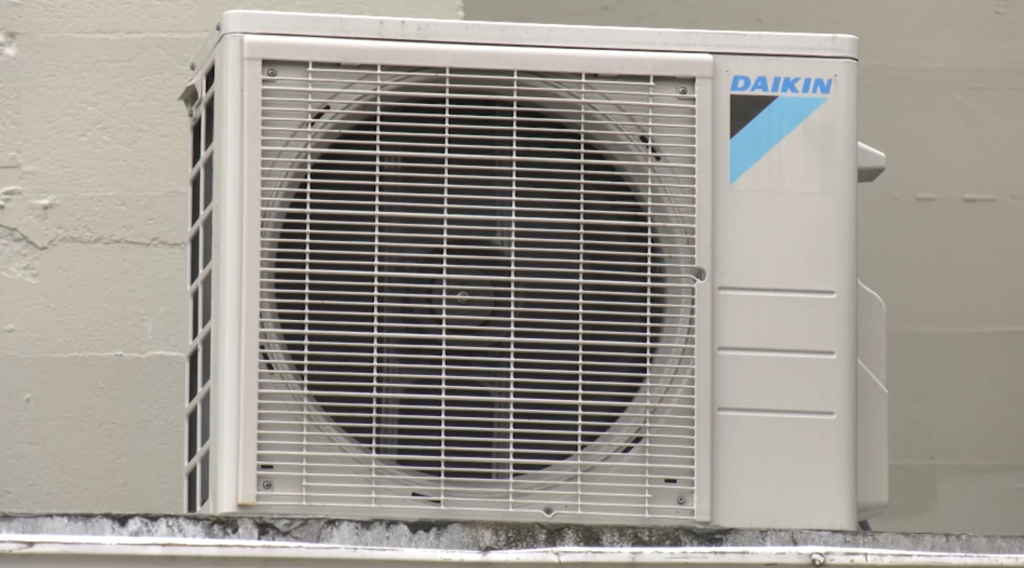

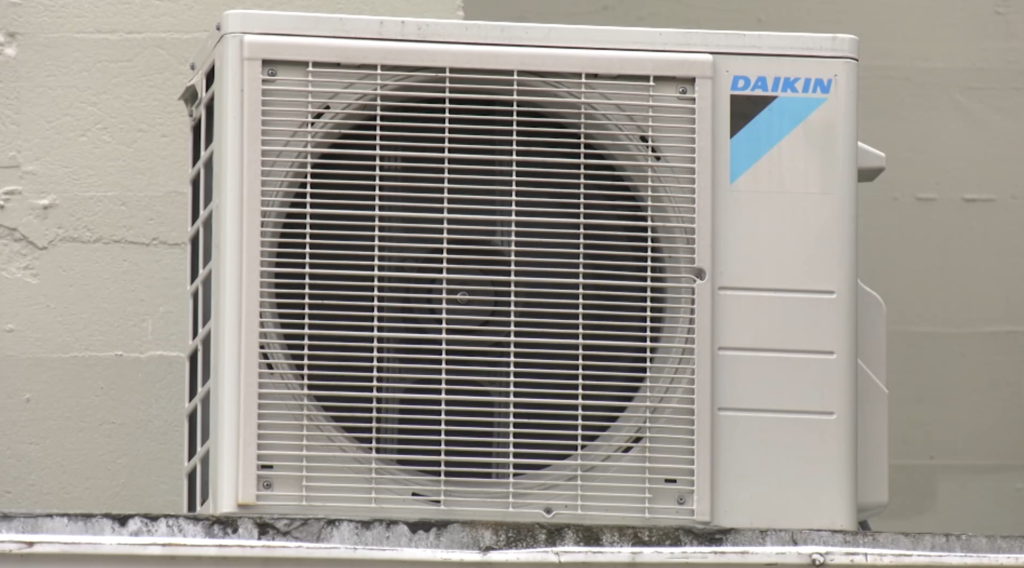

The Impact Proposed Heat Pump Requirement For New Homes TVW

https://tvw.org/wp-content/uploads/2022/10/Heat-Pump-Unit-1024x568.png

Heat Pump Government Grant Or Rebate Aire One

https://aireone.com/wp-content/uploads/2023/06/banner-heat-pump.png

2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no Heat Pump Equipment Requirements Existing Primary Heating Fuel Natural Gas or Electric Propane Oil Heat Pump Other Air Source Heat Pump ASHP Who Qualifies for a Heat Pump Tax Credit or Rebate Any taxpayer would qualify for the federal tax credits For the tax credit program the new incentives will apply to equipment installed on

Roxanne Downer Updated On December 31 2023 Why You Can Trust Us The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Download Requirement Heat Pump Rebate 2024

More picture related to Requirement Heat Pump Rebate 2024

Heat Pump Water Heater Rebate Program La Plata Electric Association

https://lpea.coop/sites/default/files/news/ABC.jpg

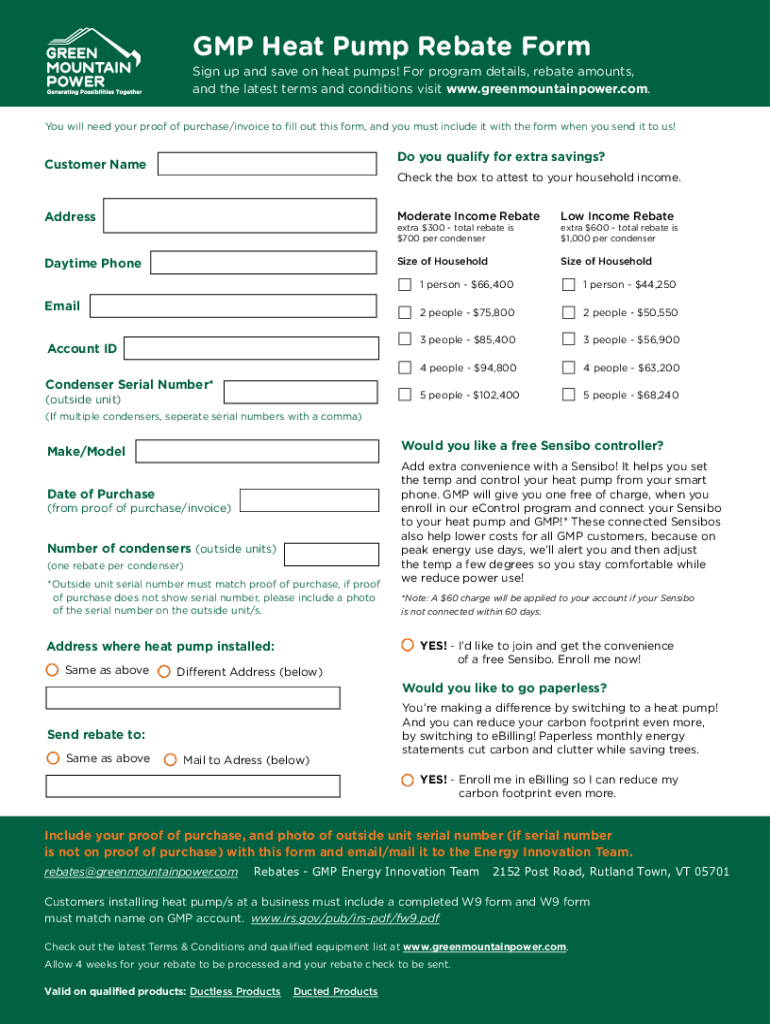

Fillable Online GMP Heat Pump Rebate Form Fax Email Print PdfFiller

https://www.pdffiller.com/preview/652/912/652912720/large.png

Heat Pump Rebate Pge PumpRebate

https://i0.wp.com/www.pumprebate.com/wp-content/uploads/2023/01/heat-pump-rebate-baldwin-emc-1.png?fit=1119%2C659&ssl=1

GENERAL REQUIREMENTS HEAT PUMP WATER HEATER EQUIPMENT REQUIREMENTS 2024 and December 31 2024 Rebate forms must be postmarked by January 31 2025 Rebate Limit Under no circumstances will the total incentive for a single heat pump water heater exceed the offered rebate amount of 750 If the heat pump water heater already PROGRAM REQUIREMENTS APPLICATION INSTRUCTIONS Applications Due by January 31 2025 VERSION 1 1 U S Department of Energy Office of State and Community Energy Programs 1000 Independence Avenue SW Washington DC 20585 July 27 2023 Version 1 October 13 2023 Version 1 1

Air Source Heat Pumps Tax Credit Information updated 12 30 2022 Subscribe to ENERGY STAR s Newsletter for updates on tax credits for energy efficiency and other ways to save energy and money at home See tax credits for 2022 and previous years This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 Equipment Requirements Air source heat pumps and integrated controls must be listed on the Energize Connecticut Heat Pump Qualified Product List Refer to EnergizeCT HPQPL Rebate Form This rebate form must be filled out completely truthfully and accurately

2023 Residential Air Source Heat Pump Energy Optimization Rebate Form Printable Forms Free Online

https://www.star-supply.com/images/content/Heat_Pump_Rebate.PNG

215L Heat Pump Package No VEEC Rebate Australian Energy Initiative

https://energyinitiative.com.au/wp-content/uploads/2021/01/IMG_0333-min.jpg

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

https://airconditionerlab.com/what-hvac-systems-qualify-for-tax-credit/

In 2024 you can claim 30 of the costs for all qualifying HVAC systems installed during the year as tax credits The maximum tax credit amount you can get back is 3 200 year Up to 1 200 for central air conditioners boilers furnaces and natural gas oil and propane water heaters up to 600 per item

Ultimate Guide To Mass Save Rebates 2023 Colt Home Services

2023 Residential Air Source Heat Pump Energy Optimization Rebate Form Printable Forms Free Online

2023 UPDATE Mass Save Residential Rebates Abode Energy Management

Does Xcel Have Rebates For Heat Pumps In 2022 PumpRebate

Heat Pump Rebates In Various Canadian Provinces

Heat Pump Rebates Pennsylvania PumpRebate

Heat Pump Rebates Pennsylvania PumpRebate

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

Federal Rebates For Heat Pumps Save Money And Energy USRebate

Home Efficiency Rebate Plus Save Up To 6 500 With Heat Pump Rebates

Requirement Heat Pump Rebate 2024 - Office of State and Community Energy Programs Home Energy Rebate Programs Requirements and Application Instructions Home Energy Rebate Programs Requirements and Application Instructions Updated October 13 2023 Washington DC 20585 202 586 5000 Sign Up for Email Updates