Requirements For Child Care Tax Credit Requirements Who qualifies for the child tax credit Taxpayers can claim the child tax credit when they file their annual tax returns Generally there are seven tests you and

Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify The child and dependent care credit is generally worth 20 to 35 of up to 3 000 for one qualifying dependent or 6 000 for two or more qualifying dependents

Requirements For Child Care Tax Credit

Requirements For Child Care Tax Credit

https://i.etsystatic.com/23403566/r/il/69a95f/3736849799/il_1588xN.3736849799_qvr5.jpg

First Phase Ending For Child Tax Credit A game Changer For Families

https://prescottenews.com/wp-content/uploads/2021/08/Child-Tax-Credit.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/f7133a/3736849859/il_794xN.3736849859_31z4.jpg

To qualify for the child and dependent care credit you must have paid someone such as a daycare provider to care for one or more of the following people a child under age You can usually get Tax Free Childcare if you and your partner if you have one are in work on sick leave or annual leave on shared parental maternity paternity or adoption leave and

Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child spouse or other dependent Find out how the If you re a parent or caretaker of young children disabled dependents or a disabled spouse listen up you may qualify for a special tax credit used for claiming child care expenses and

Download Requirements For Child Care Tax Credit

More picture related to Requirements For Child Care Tax Credit

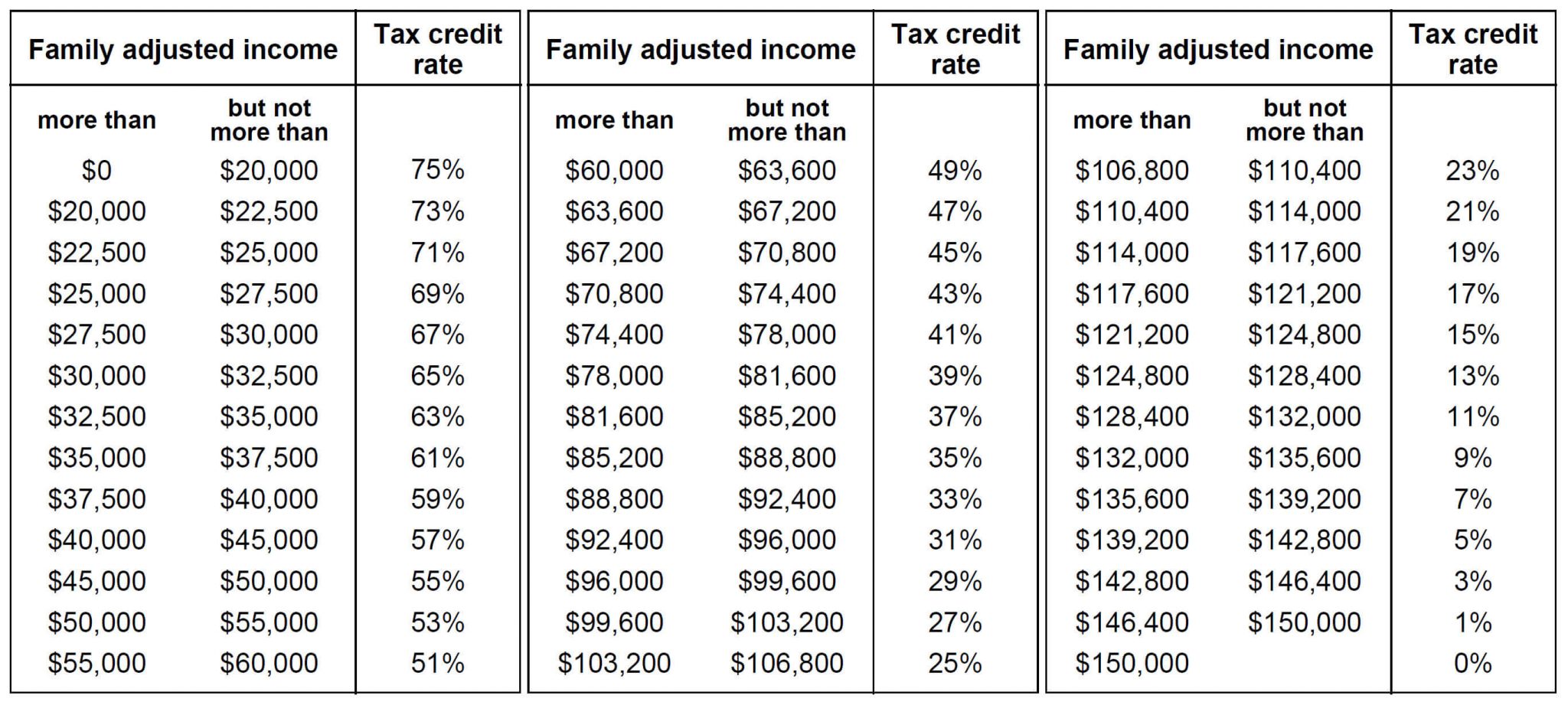

Ontario Childcare Tax Credit Refundable Tax Credit For Low income

https://cdn.taxory.com/wp-content/uploads/2021/01/childcare-access-and-relief-from-expenses-tax-credit-2048x917.jpg

Child Care Tax Credit Dates Librus

https://s-media-cache-ak0.pinimg.com/736x/06/05/27/060527e8a870eabbacbabf70af4b0408.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

https://i.etsystatic.com/23403566/r/il/7a55e3/3981264249/il_1140xN.3981264249_lgte.jpg

Families can claim a child care tax deduction as long as they meet the following three requirements The care must be for a child under the age of 13 Your family must need According to the Internal Revenue Service IRS a qualifying person for the credit is A dependent child who was under age 13 when they received care or A spouse who is

Here s how the FSA compares to the tax credit for dependent care when determining which one could benefit you the most come tax time For tax year 2021 only the exclusion for employer provided dependent care assistance has increased from 5 000 to 10 500 Note If the qualifying child turned 13 during the tax year

DAYCARE TAX STATEMENT Childcare Center Printable End Of The Etsy In

https://i.pinimg.com/originals/32/9e/c2/329ec24df04c77c70081e4a28267c980.jpg

Can I Opt Out Of The Child Tax Credit Payments Here s The Answer Dogwood

https://vadogwood.com/wp-content/uploads/sites/12/2021/07/Child-Tax-Credit1.jpg

https://www.nerdwallet.com/article/taxes/qualify...

Requirements Who qualifies for the child tax credit Taxpayers can claim the child tax credit when they file their annual tax returns Generally there are seven tests you and

https://www.irs.gov/credits-deductions/individuals/...

Do you pay child and dependent care expenses so you can work You may be eligible for a federal income tax credit Find out if you qualify

Is There A Refundable Child Tax Credit For 2023 Leia Aqui How Much Is

DAYCARE TAX STATEMENT Childcare Center Printable End Of The Etsy In

Tax Opportunities Expanded Individual Tax Credits In New Law Blog

FSA Or Tax Credit Which Is Best To Save On Child Care

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Etsy

Dependent And Child Care Credits Tax Policy Center

Your First Look At 2023 Tax Brackets Deductions And Credits 3

What Is The Phase Out For Dependent Care Credit Latest News Update

Requirements For Child Care Tax Credit - If you re a parent or caretaker of young children disabled dependents or a disabled spouse listen up you may qualify for a special tax credit used for claiming child care expenses and