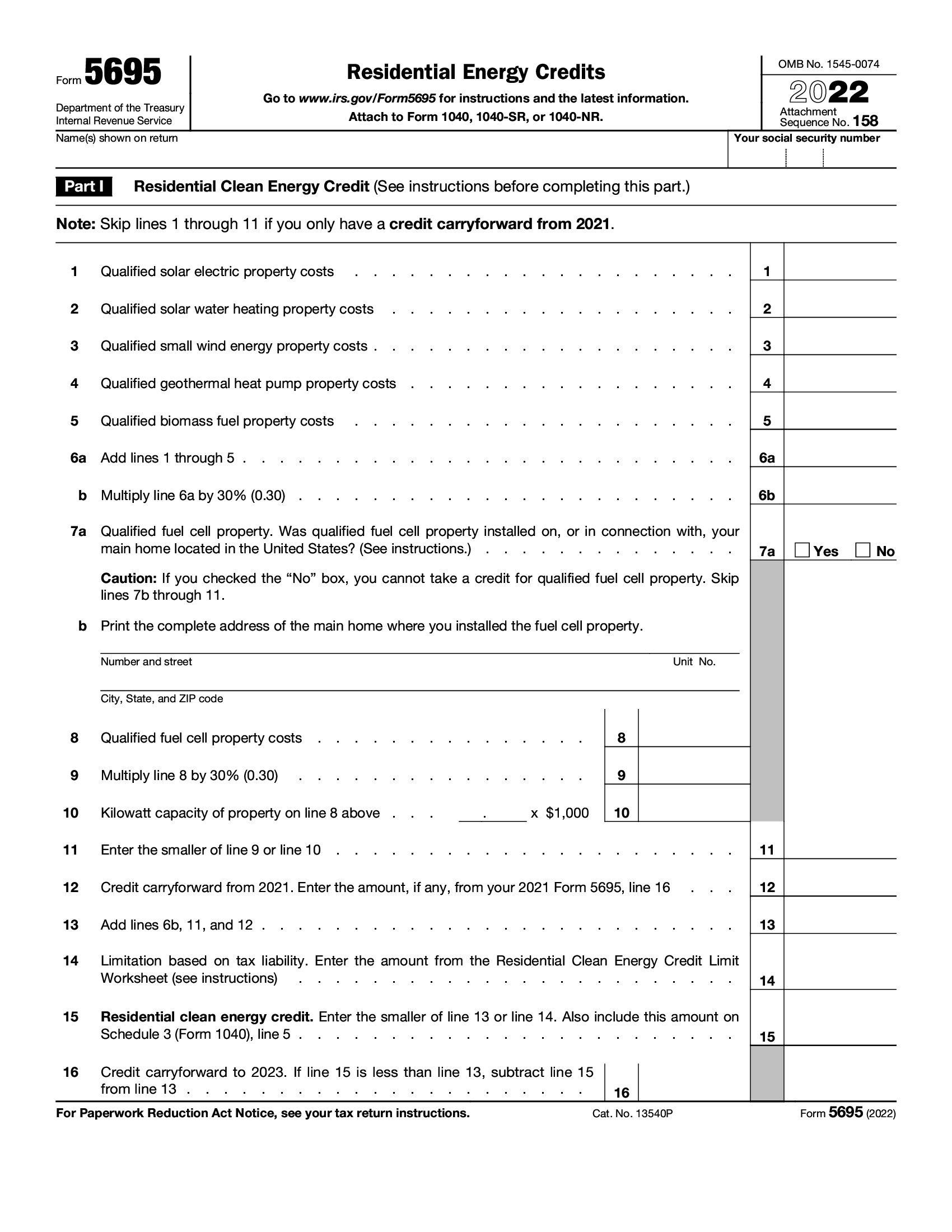

Residential Energy Credit Maximum Rebate Web 10 janv 2023 nbsp 0183 32 There are exceptions where the maximum credit may be up to 3 200 depending on the mix of property installed by the taxpayer during the year In general the credit is equal to 30 of the aggregate

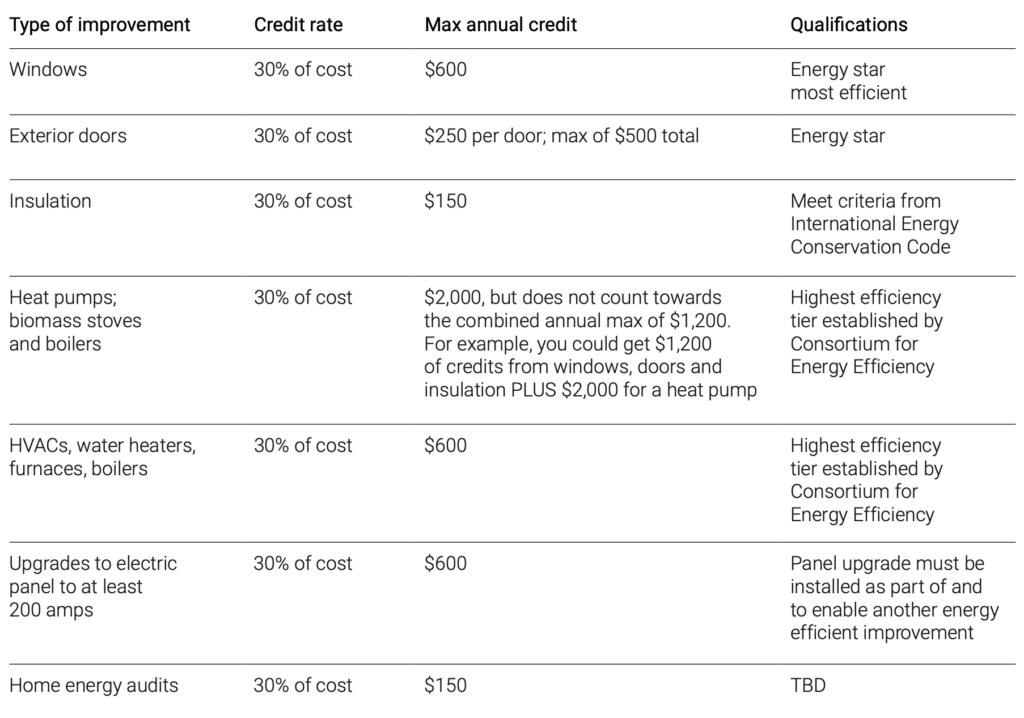

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit Web 22 d 233 c 2022 nbsp 0183 32 Beginning January 1 2023 the amount of the credit is equal to 30 of the sum of amounts paid by the taxpayer for certain qualified expenditures including 1

Residential Energy Credit Maximum Rebate

Residential Energy Credit Maximum Rebate

https://assets.solar.com/wp-content/uploads/2022/08/Schedule-3.png

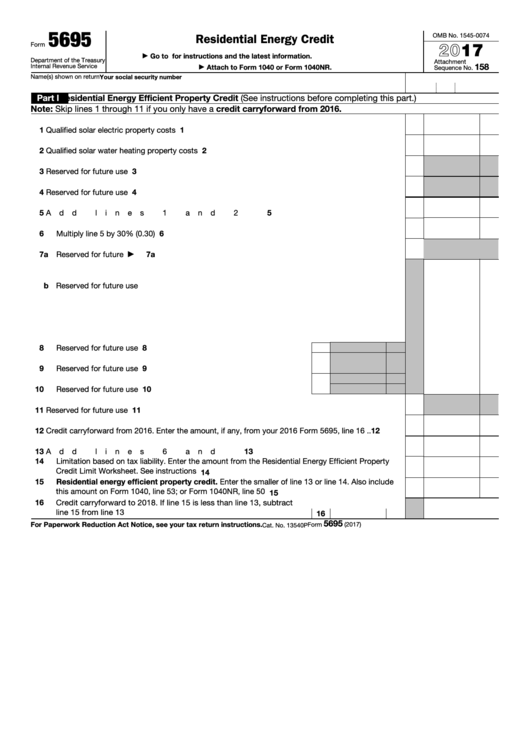

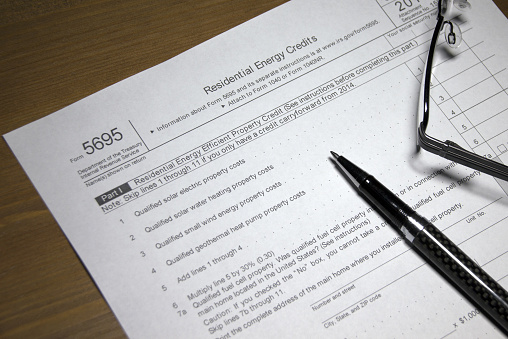

IRS Form 5695 Residential Energy Credits Forms Docs 2023

https://blanker.org/files/images/f5695.png

Form 5695 Residential Energy Credits 2014 Free Download

http://www.formsbirds.com/formimg/more-tax-forms/8036/form-5695-residential-energy-credits-2014-l2.png

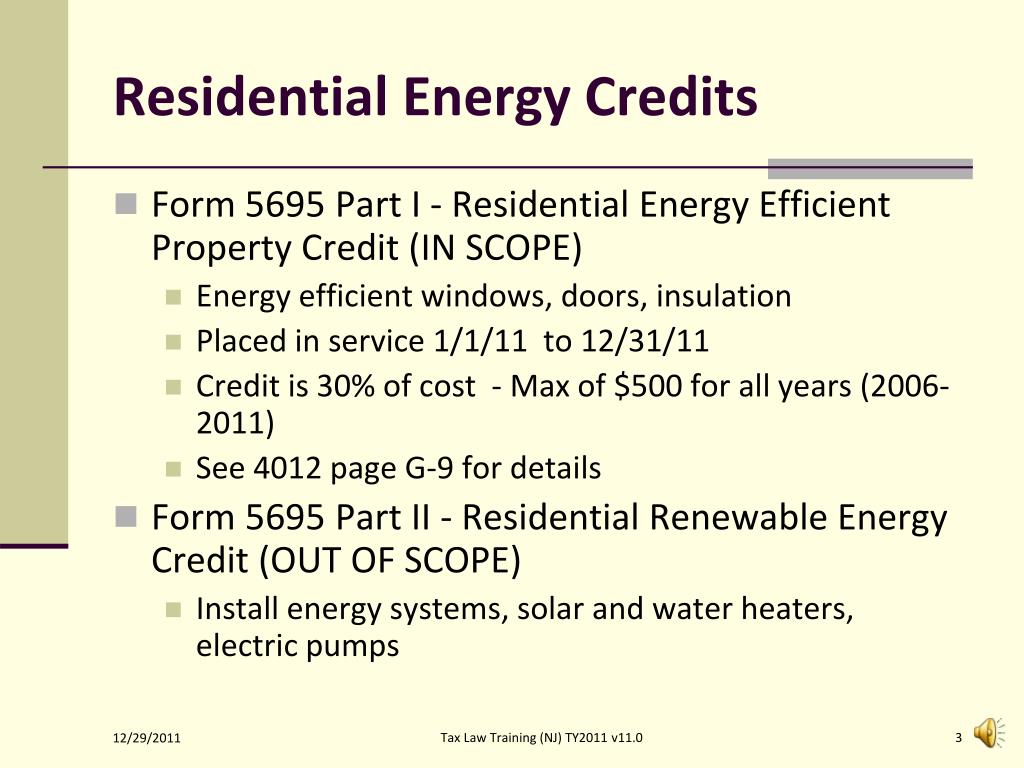

Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the Web Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home

Web 21 nov 2022 nbsp 0183 32 Through 2019 taxpayers could claim a Section 25D credit worth up to 30 of qualifying expenditures The credit s rate was scheduled to be reduced to 26 Web 31 juil 2023 nbsp 0183 32 Improvements made between 2023 and 2032 Annual limit of 1 200 with a separate 2 000 limit for heat pumps heat pump water heaters biomass stoves and

Download Residential Energy Credit Maximum Rebate

More picture related to Residential Energy Credit Maximum Rebate

Fillable Form 5695 Residential Energy Credits 2016 Printable Pdf

https://data.formsbank.com/pdf_docs_html/303/3030/303023/page_1_thumb_big.png

PPT Miscellaneous Credits PowerPoint Presentation Free Download ID

https://image1.slideserve.com/1589404/residential-energy-credits-l.jpg

EV Rebates Valley Clean Energy

https://valleycleanenergy.org/wp-content/uploads/EV-rebate-infographic-english-scaled.jpeg

Web 7 f 233 vr 2023 nbsp 0183 32 The Inflation Reduction Act among many things made significant positive changes for 2022 2023 and future tax years to the 2 popular federal energy tax credits that have been available for over the Web 30 d 233 c 2022 nbsp 0183 32 Federal Income Tax Credits and Incentives for Energy Efficiency The Inflation Reduction Act of 2022 provides federal tax credits and deductions that empower Americans to make homes and buildings

Web Up to 1 200 a year for residential energy property items but there are sub limits for doors 250 per door and 500 total windows 600 and home energy audits 150 Web 16 mars 2023 nbsp 0183 32 This means you can claim a maximum total yearly energy efficient home improvement credit amount up to 3 200 Residential Clean Energy Credit The

Residential Renewable Energy Tax Credit Green Power Green Energy

https://i.pinimg.com/originals/3c/6c/0c/3c6c0c0b89d5593db63424abd8d0f851.png

Form 5695 Residential Energy Credits 2014 Free Download

http://www.formsbirds.com/formimg/more-tax-forms/8036/form-5695-residential-energy-credits-2014-l1.png

https://rsmus.com/insights/tax-alerts/2023/IR…

Web 10 janv 2023 nbsp 0183 32 There are exceptions where the maximum credit may be up to 3 200 depending on the mix of property installed by the taxpayer during the year In general the credit is equal to 30 of the aggregate

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Web 26 juil 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 biomass stoves and boilers have a separate annual credit limit

Residential Energy Credits Form Stock Photo Download Image Now

Residential Renewable Energy Tax Credit Green Power Green Energy

BENNINGTON POOL HEARTH IRS FORM 5695 RESIDENTIAL ENERGY CREDITS

15 Unique Ways How To Calculate Residential Energy Credit

Ouc Energy Rebates Fill Online Printable Fillable Blank PdfFiller

The Residential Renewable Energy Tax Credit Is A Little known

The Residential Renewable Energy Tax Credit Is A Little known

Green Home Improvements Get Tax Credits With Inflation Reduction Act

This Is An Attachment Of Iowa Energy Rebates Printable Rebate Form From

Completed Form 5695 Residential Energy Credit Capital City Solar

Residential Energy Credit Maximum Rebate - Web 20 juin 2023 nbsp 0183 32 Energy efficiency upgrade Annual tax credit limit Home energy audits 150 Exterior doors 250 for one door 500 for all doors Exterior windows and