Retirement Annuity Tax Deduction When you invest in a retirement annuity you lower your taxable income for the year which could result in a tax refund from SARS Use the calculator below to see how increasing your retirement annuity contribution can lower the amount of income tax you pay

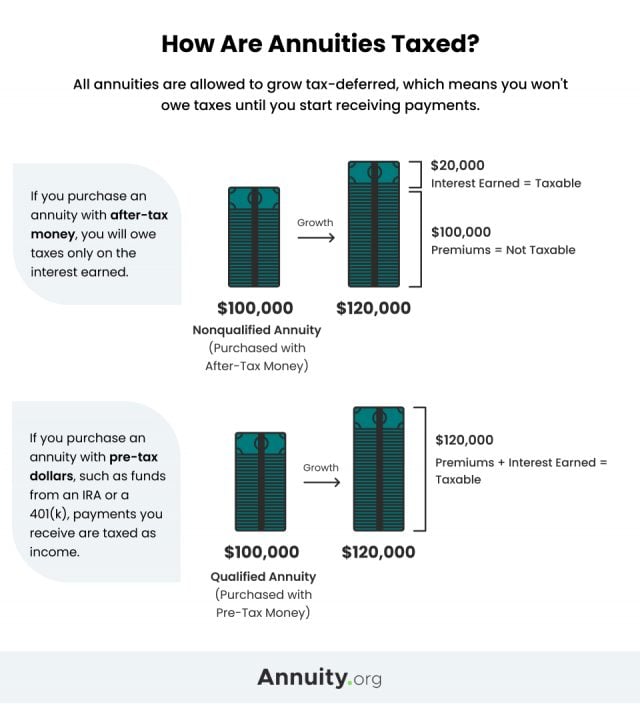

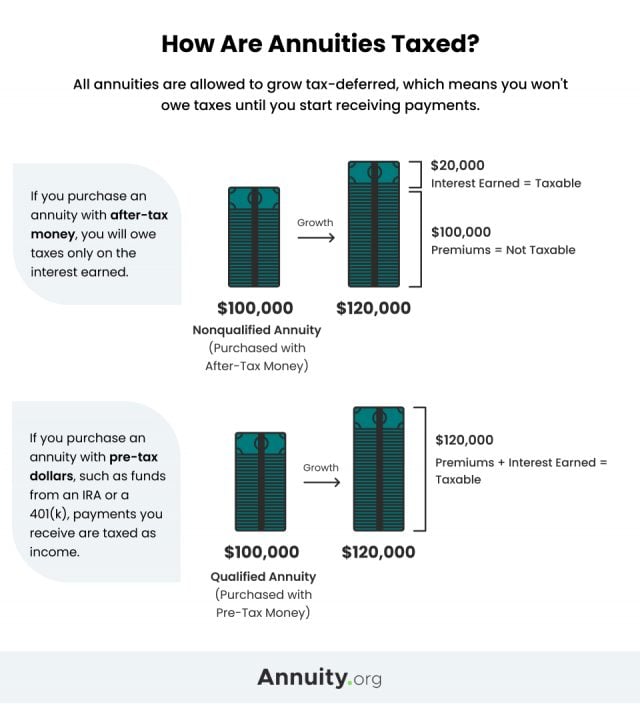

Contributions paid into a qualified annuity might be tax deductible Money taken out of a qualified annuity is subject to ordinary marginal tax rates rather than long term capital gains If you receive retirement benefits in the form of pension or annuity payments from a qualified employer retirement plan all or some portion of the amounts you receive may be taxable unless the payment is a qualified distribution from a designated Roth account

Retirement Annuity Tax Deduction

Retirement Annuity Tax Deduction

https://www.zeeliepasa.co.za/img/blog/249/pension.jpg

Learn About Paying Employee Bonuses And What The Tax Implications Are

https://i.pinimg.com/originals/dc/53/0c/dc530c9cbab3fabe544326a424333f57.jpg

Qualified Vs Non Qualified Annuities Taxation And Distribution

https://www.annuity.org/wp-content/uploads/key-features-of-qualifies-and-non-qualified-annuities.jpg

It doesn t matter whether you have a pension provident or retirement annuity RA fund or even a combination of all three you ll qualify for a tax deduction of up to 27 5 of your taxable income up to a maximum of R350 000 per year This limit applies to the total contributions you made into all funds for the whole year Tax treatment of annuity income As indicated above the two thirds of the retirement interest from a pension pension preservation or retirement annuity fund is received in the form of an annuity a regular pension If the income from your annuity exceeds the tax threshold tax is payable on the amount The tax thresholds are as follows

Contributions to retirement funds are tax deductible within certain limits The maximum tax deduction you may make in a tax year is limited to the greater of 27 5 of taxable income or remuneration from your employer subject to an annual ceiling of R350 000 19 January 2022 Where a pensioner has one source of income during a tax year our employees tax PAYE deduction system ensures the correct PAYE deductions from their pension or annuity

Download Retirement Annuity Tax Deduction

More picture related to Retirement Annuity Tax Deduction

How Federal Employee Retirement Benefits Are Taxed By The IRS Part I

https://stwserve.com/wp-content/uploads/2022/05/how-federal-employee-retirement-benefits-are-taxed-1.jpg

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

How To Quickly Calculate The Tax Deduction Based On Your Retirement

https://media.licdn.com/dms/image/C5612AQGNQ5GghCWmAQ/article-cover_image-shrink_600_2000/0/1559220842582?e=2147483647&v=beta&t=rM6HSlQCLZK_vkhUDWjRFfX-IugABogqtxhIx03F3Uw

Generally pension and annuity payments are subject to Federal income tax withholding The withholding rules apply to the taxable part of payments or distributions from an employer pension annuity profit sharing stock bonus or other deferred compensation plan Income withdrawn from all types of deferred annuities is taxed as ordinary income not long term capital gain income This tax treatment applies to fixed rate fixed indexed variable and

Annuities are tax deferred retirement investments you won t owe taxes until you withdraw money or receive payments Principal and or earnings may be taxed depending on the type of Retirement savings products often boast tax perks that make them attractive to certain types of individuals This guide highlights how annuities are taxed

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

How Federal Employee Retirement Benefits Are Taxed By The IRS Part I

https://stwserve.com/wp-content/uploads/2022/05/how-federal-employee-retirement-benefits-are-taxed-2.jpg

https://www.10x.co.za/tax-tips?calculator=true

When you invest in a retirement annuity you lower your taxable income for the year which could result in a tax refund from SARS Use the calculator below to see how increasing your retirement annuity contribution can lower the amount of income tax you pay

https://www.forbes.com/advisor/retirement/annuity-taxes

Contributions paid into a qualified annuity might be tax deductible Money taken out of a qualified annuity is subject to ordinary marginal tax rates rather than long term capital gains

Tax Deductions For Pension Retirement And Provident Funds Simplified

What Will My Tax Deduction Savings Look Like The Motley Fool

How To Fully Maximize Your 1099 Tax Deductions Steady

The Sequence Of The Tax Deduction For Voluntary Contributions And

Recover Market Losses With This Annuity Annuity Straight Talk

Tax Deferral How Do Tax Deferred Products Work

Tax Deferral How Do Tax Deferred Products Work

Charitable Gift Annuity Tax Deduction Wai Tiller

Maximising Tax Benefits Your Guide To Claiming A Rental Property

New Tax Laws Business Deduction Changes You Need To Know About

Retirement Annuity Tax Deduction - Tax treatment of annuity income As indicated above the two thirds of the retirement interest from a pension pension preservation or retirement annuity fund is received in the form of an annuity a regular pension If the income from your annuity exceeds the tax threshold tax is payable on the amount The tax thresholds are as follows