Rhode Island Ev Tax Credit 2023 DRIVE EV INDIVIDUAL RI residents only Up to 1 500 for qualified new battery and fuel cell electric vehicles BEVs and FCEVs Rebates also available for plug

EV Programs D RI VE EV provides rebates of up to 1500 00 for the purchase or lease of new battery electric vehicles and fuel cell electric vehicles and up Rhode Island offers rebates of up to 1 500 for a used EV and up to 750 for a used plug in hybrid with a purchase price below 40 000 Some low income

Rhode Island Ev Tax Credit 2023

Rhode Island Ev Tax Credit 2023

https://www.carscoops.com/wp-content/uploads/2023/01/EV-PHEV-Tax-Credit-7500-Carscoops-1024x576.jpg

The New Federal Tax Credit For EVs

https://blog.greenenergyconsumers.org/hubfs/Federal Tax Credit Blog header.png

Has Federal EV Tax Credit Been Saved The Green Car Guy

https://thegreencarguy.com/wp-content/uploads/2016/05/GCG-CashandCar-1024x1024.jpg

Providence RI s electric vehicle rebate program to start July 7 by Melanie DaSilva Posted Jun 28 2022 08 57 AM EDT Updated Jun 29 2022 03 42 PM EDT Published on Monday March 14 2022 PROVIDENCE RI Governor Dan McKee joined by Energy Commissioner Nicholas S Ucci announced today the establishment of an

The Federal Investment Tax Credit A tax credit is a dollar for dollar reduction in the taxes that you would otherwise owe the federal government and is based on the total installed The Providence Journal 0 00 0 41 PROVIDENCE The McKee administration is set to reinstate a state rebate that aims to make electric cars more

Download Rhode Island Ev Tax Credit 2023

More picture related to Rhode Island Ev Tax Credit 2023

Rhode Island Rebates For Residential EV Chargers

https://rebates4evchargers.com/assets/img/white-tesla-charging-at-home.jpg

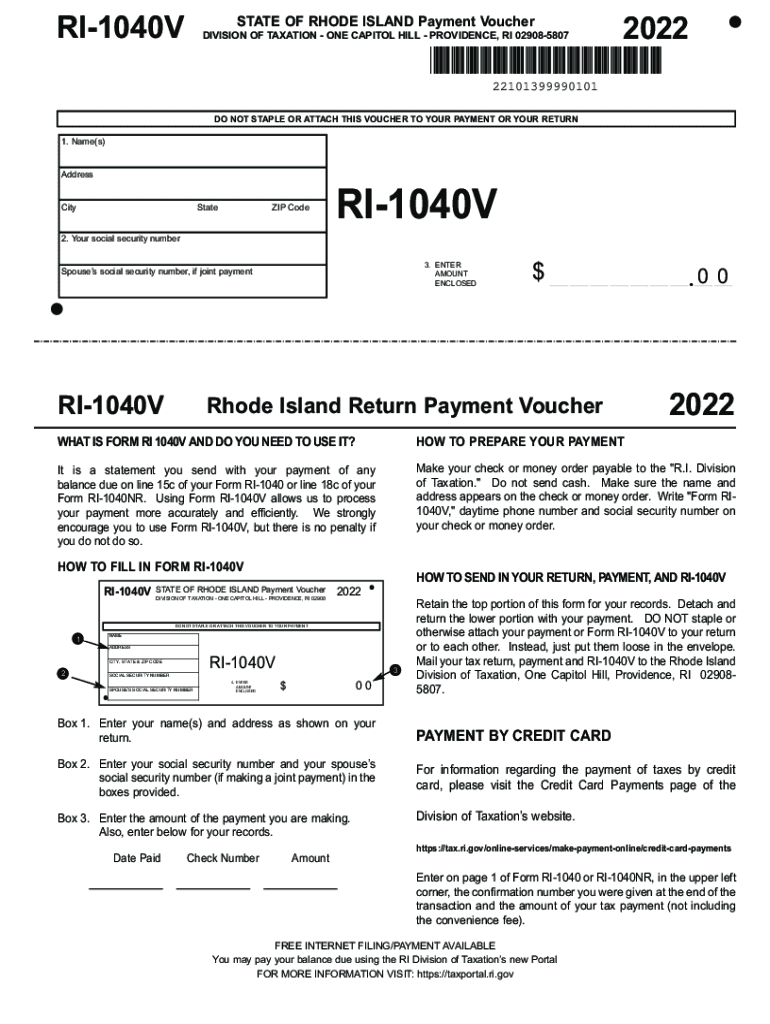

Your Rhode Taxation 2022 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/627/55/627055274/large.png

Revamping The Federal EV Tax Credit Could Help Average Car Buyers

https://theicct.org/wp-content/uploads/2022/06/epv-us-tax-credit-fig-jun22.png

Governor McKee Announces Electric Vehicle Rebate Program Published on Monday March 14 2022 PROVIDENCE RI Governor Dan McKee joined by Energy Rhode Island is introducing a newly expanded EV incentive with a potential total rebate of 4 500 if you meet all of the requirements These incentives were created

The State of Rhode Island provides a one time tax credit through the DriveEVProgram These incentives have an impact on consumers in the market for Driving Rhode Island to Vehicle Electrification DRIVEEVis an electric vehicle EV rebate program administered by the Rhode Island Office of Energy Resources OER to

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Tax Credits ElectricVehicleSolar

https://static.wixstatic.com/media/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png/v1/fit/w_2500,h_1330,al_c/d01121_9abd5528e3d5421198995c9f6da16436~mv2.png

https://drive.ri.gov

DRIVE EV INDIVIDUAL RI residents only Up to 1 500 for qualified new battery and fuel cell electric vehicles BEVs and FCEVs Rebates also available for plug

https://drive.ri.gov/ev-programs

EV Programs D RI VE EV provides rebates of up to 1500 00 for the purchase or lease of new battery electric vehicles and fuel cell electric vehicles and up

Federal Solar Tax Credit What It Is How To Claim It For 2024

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Mary Rice The Truth About The Inflation Reduction Act s Electric

EV Tax Credit 2023 All You Need To Know Electric Vehicle Info

Form 8911 For 2023 Printable Forms Free Online

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

Tesla Warns That 7 500 Tax Credit For Model 3 RWD Will Be Reduced

The New EV Tax Credit In 2023 Everything You Need To Know Updated

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

2022 Form RI RI W 4 Fill Online Printable Fillable Blank PdfFiller

Rhode Island Ev Tax Credit 2023 - Providence RI s electric vehicle rebate program to start July 7 by Melanie DaSilva Posted Jun 28 2022 08 57 AM EDT Updated Jun 29 2022 03 42 PM EDT