Risk Allowance Exemption In Income Tax Risk allowance is exempt upto max 1300 PM us 10 14 ii of IT act Also known as Hazard or special hazard pay to military personnels is taxable For details Refer

According to my knowledge risk allowance is not given for compensating employees for expenditure incurred for performance of duties so I don t think so that it will be exempt u s 10 14 of the Income Tax Act Learn about the common exemptions available on salary components allowances and perquisites for salaried persons in India Find out the eligibility conditions and limits for each exemption and how to claim them in your tax return

Risk Allowance Exemption In Income Tax

Risk Allowance Exemption In Income Tax

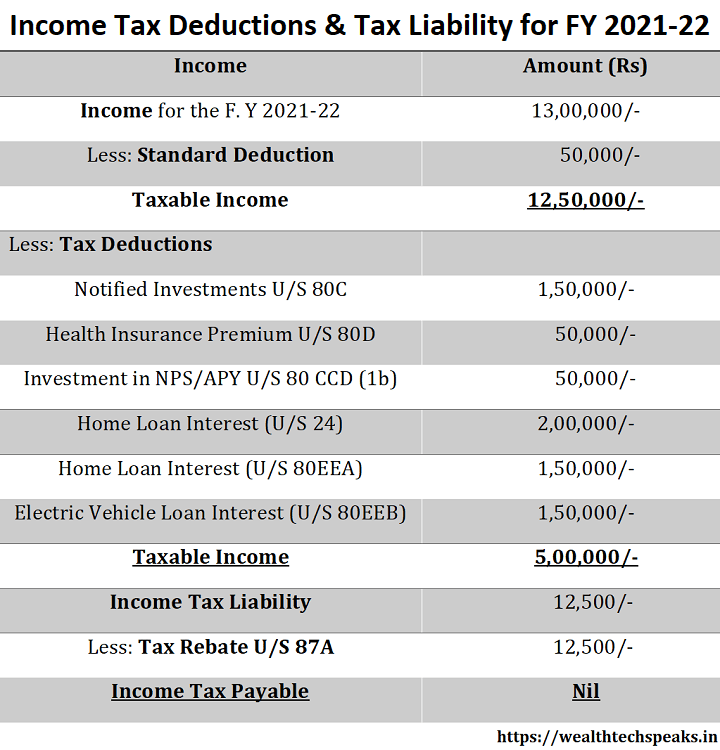

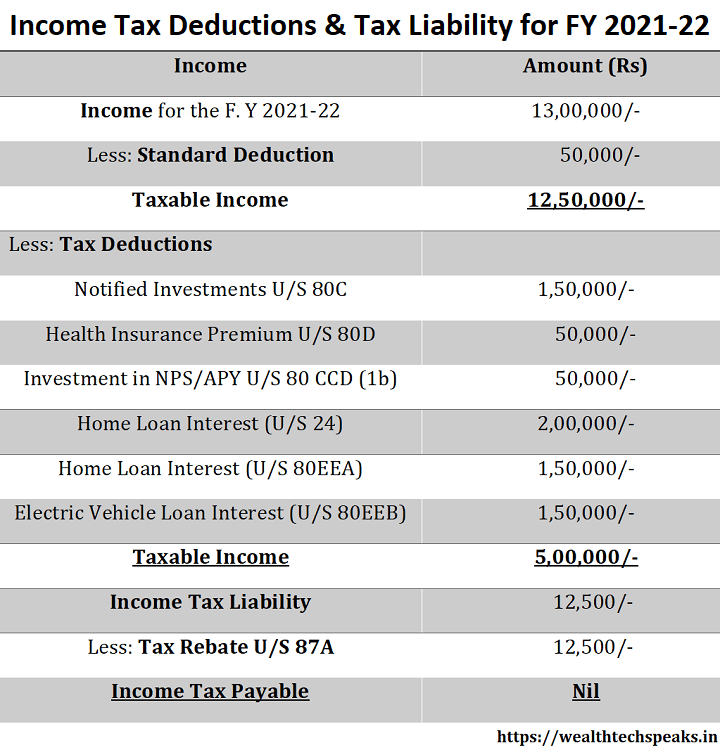

https://wealthtechspeaks.in/wp-content/uploads/2021/03/Tax-Deduction-Calculation.png

All About Allowances Income Tax Exemption CA Rajput Jain

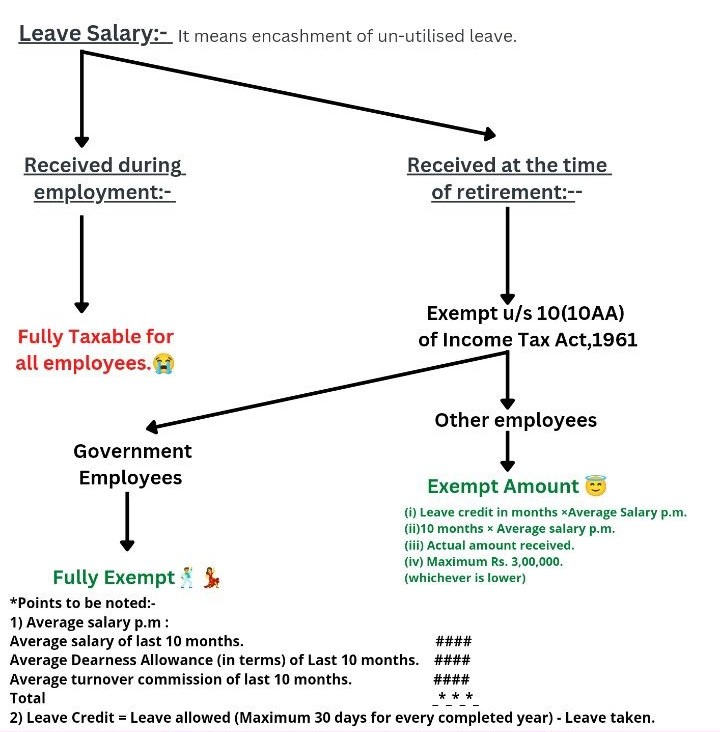

https://carajput.com/blog/wp-content/uploads/2020/10/Leave-salary-taxation-.jpg

House Rent Allowance What Is HRA HRA Exemptions Deductions Tax2win

https://emailer.tax2win.in/assets/guides/hra/available_tax_exemptions.png

Under Section 10 13A of the Income Tax Act the following types of expenses are covered under House Rent Allowance HRA for exemption from income tax Rent paid The actual rent paid by the taxpayer for the residential accommodation they occupy Learn how income tax is calculated for individuals in Ethiopia including employment income fringe benefits capital gains dividends interest and rental income Find out which income items are exempt from tax such as medical expenses travel expenses and food and beverages

Section 10 14 ii of the Income Tax Act 1961 provides tax exemptions for various allowances granted to employees to cover personal expenses related to their employment conditions like living in remote or high altitude areas or working in adverse climates Learn about the eligibility tax exemption and rates of hardship allowance for teachers and IAS officers under the 7th pay commission Find out how to calculate the hardship allowance using the risk and hardship matrix provided by the govt

Download Risk Allowance Exemption In Income Tax

More picture related to Risk Allowance Exemption In Income Tax

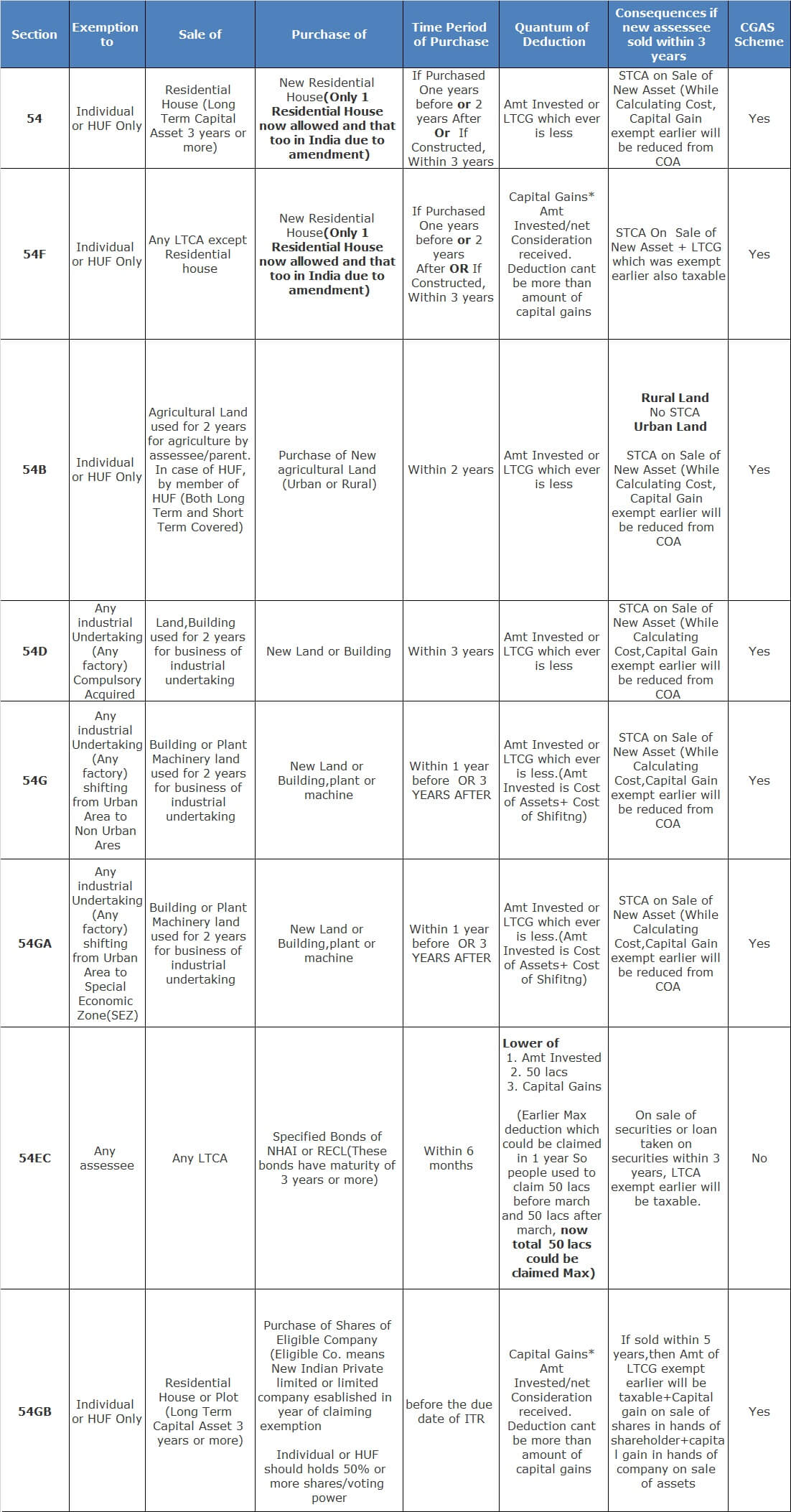

Section 54 Income Tax Act Capital Gains Exemption Chart Teachoo

https://d1avenlh0i1xmr.cloudfront.net/576b54f6-1ee4-4666-afef-508fe3b1808d/section-54-income-tax-act---capital-gain-chart.jpg

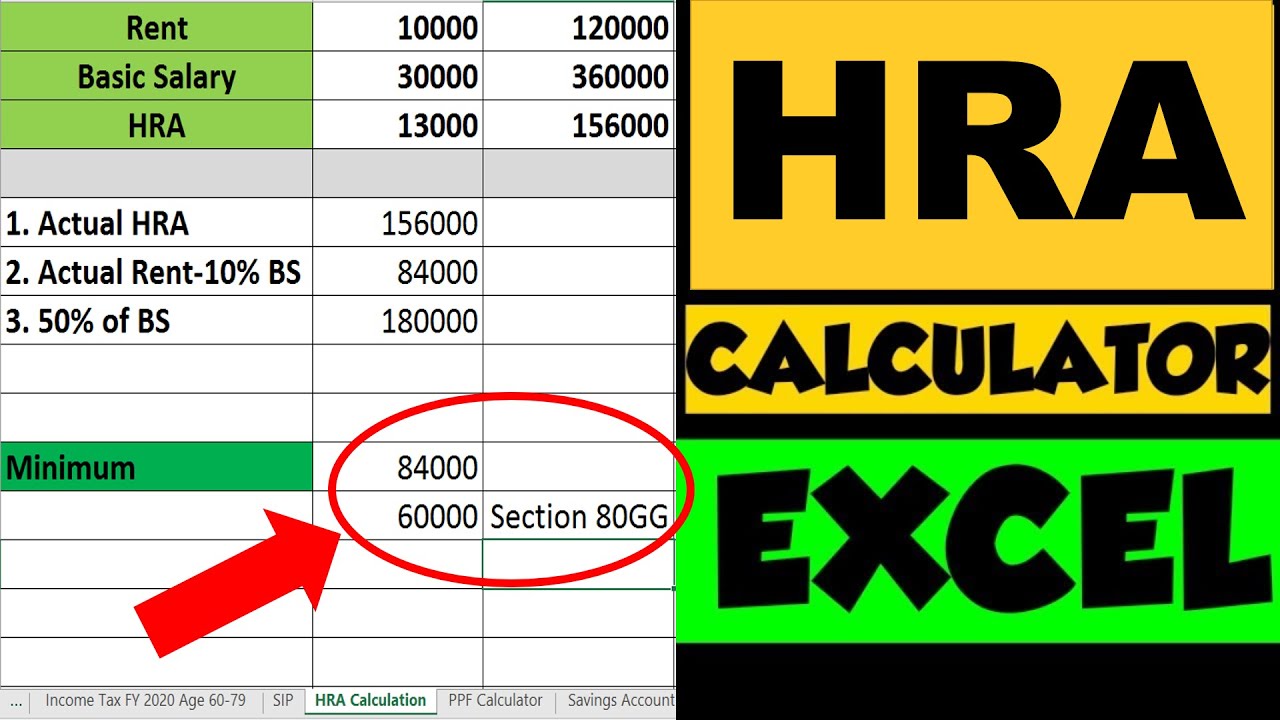

HRA Exemption Excel Calculator For Salaried Employees House Rent

https://i.ytimg.com/vi/8nnBiRzYQzI/maxresdefault.jpg

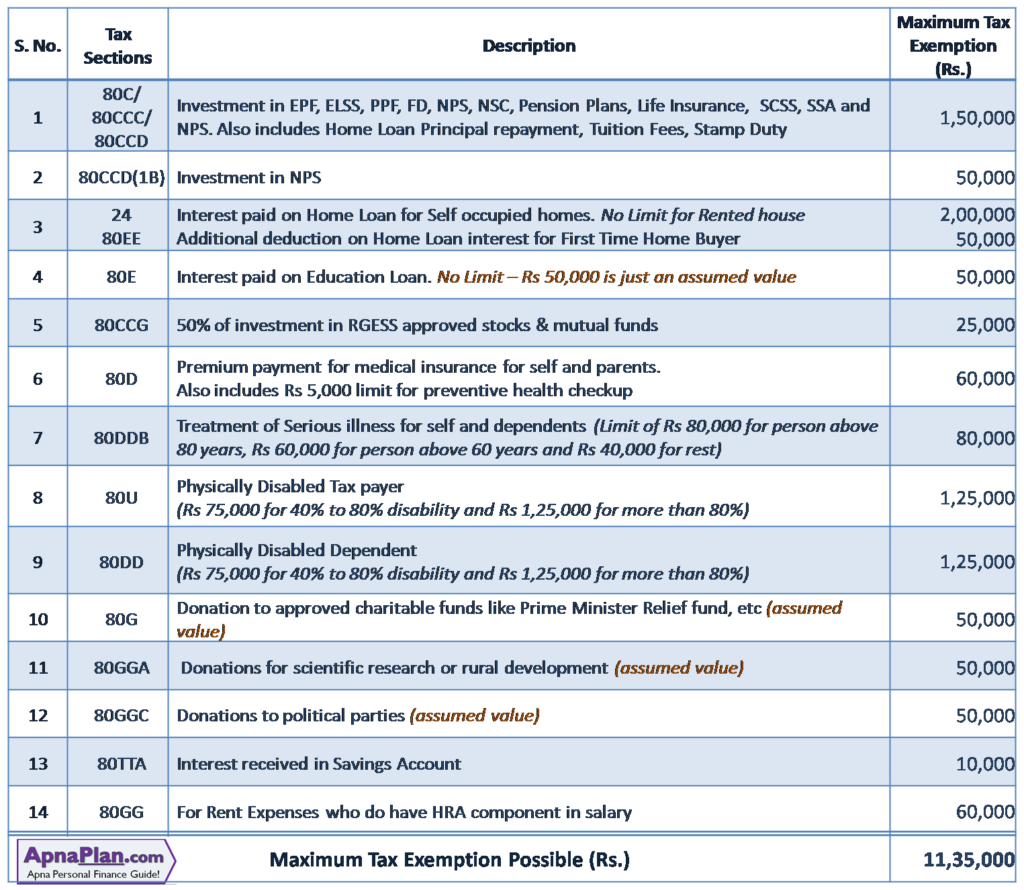

Maximum Income Tax You Can Save For FY 2016 17

https://www.apnaplan.com/wp-content/uploads/2017/01/Maximum-Income-Tax-Exemption-Limit-in-India-for-FY-2016-17-1024x890.png

Learn about the income tax exemptions on allowances and benefits granted to employees under section 10 14 of the Income Tax Act Find out the list of allowances conditions and limits prescribed by rule 2BB for section 10 14 i and ii Learn about the tax exemptions on allowances paid to salaried people working in different areas under section 10 14 of income tax act Find out the amount conditions and locations of various allowances such as special compensatory allowance border area allowance island duty allowance and more

[desc-10] [desc-11]

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

http://1.bp.blogspot.com/-A4xTxMi1MRk/TwR-tA5SwlI/AAAAAAAAAww/odnb2pSJxmo/s1600/HRA.JPG

How HRA Tax Exemption Is Calculated U s 10 13A Calculation Guide

https://financialcontrol.in/wp-content/uploads/2018/08/HRA-House-Rent-Allowance-us-10-13A-exemption.png

https://www.caclubindia.com › forum

Risk allowance is exempt upto max 1300 PM us 10 14 ii of IT act Also known as Hazard or special hazard pay to military personnels is taxable For details Refer

https://www.cgemployee.com › is-risk-allowance-given-to-crpf.html

According to my knowledge risk allowance is not given for compensating employees for expenditure incurred for performance of duties so I don t think so that it will be exempt u s 10 14 of the Income Tax Act

LTA Leave Travel Allowance Calculation And Income Tax Exemption How

How To Calculate HRA House Rent Allowance Exemption U s 10 13A As

Section 10 Of Income Tax Act Deductions And Allowances

Employees Can Claim Tax Exemption On Conveyance Travel Allowance Under

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates

Income Tax Deductions For FY 2018 19 And AY 2019 20 Sid Associates

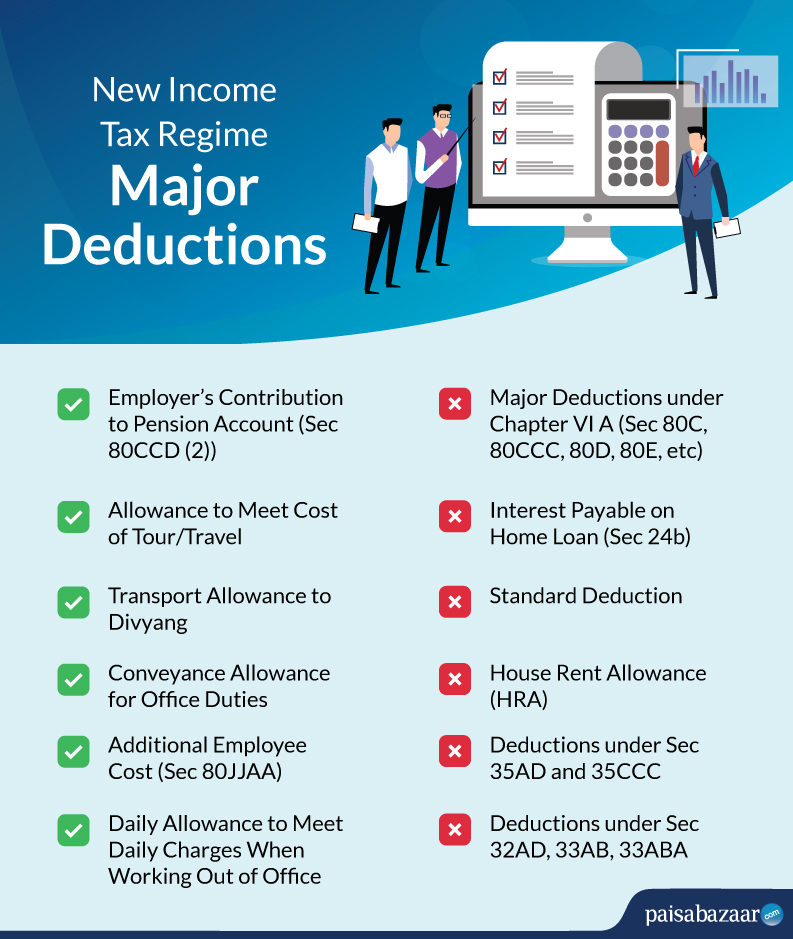

Deductions Allowed Under The New Income Tax Regime Paisabazaar

House Rent Allowance HRA Tax Exemption HRA Calculation Rules

Hra Exemption Calculation As Per Income Tax Act TAXP

Risk Allowance Exemption In Income Tax - Learn about the eligibility tax exemption and rates of hardship allowance for teachers and IAS officers under the 7th pay commission Find out how to calculate the hardship allowance using the risk and hardship matrix provided by the govt