Roof Replacement Tax Credit 2022 Verkko The credit rate for property placed in service in 2022 through 2032 is 30 Energy efficient home improvement credit The nonbusiness energy property credit is now

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit Verkko energy efficiency Energy Star roof replacement Tax credit Tax credit for residential energy efficiency has now been extended through December 31 2023 Considering replacement of Columbus roofing

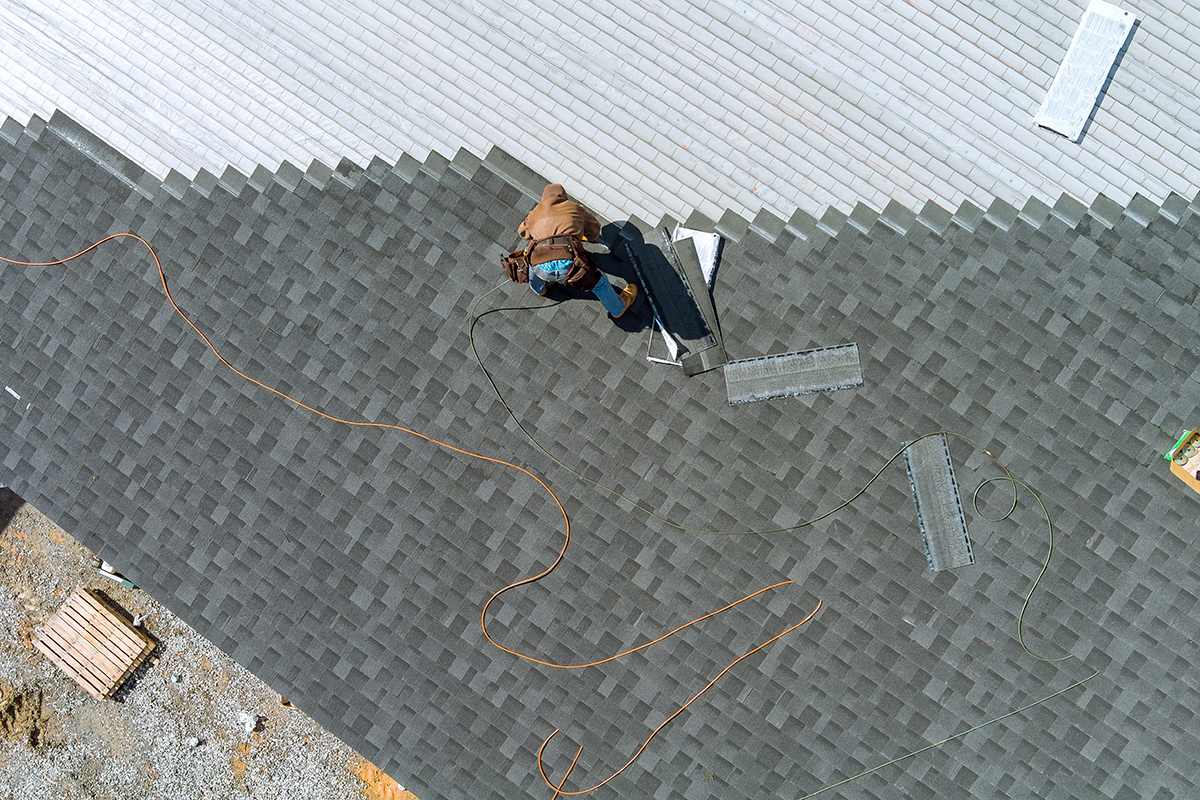

Roof Replacement Tax Credit 2022

Roof Replacement Tax Credit 2022

https://assets.fixr.com/fixr-roof-replacement-tax-basics.jpg

The Solar Tax Credit Explained 2022 YouTube

https://i.ytimg.com/vi/u46G0bvoXlY/maxresdefault.jpg

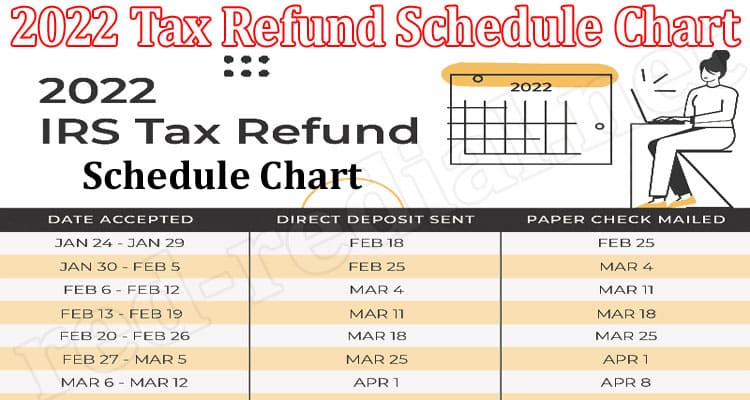

2022 Tax Refund Schedule Chart Mar A Precise Info

https://www.red-redial.net/wp-content/uploads/2022/02/Latest-News-2022-Tax-Refund-Schedule-Chart.jpg

Verkko 22 jouluk 2022 nbsp 0183 32 More information about reliance is available IRS FAQ Page Last Reviewed or Updated 05 Dec 2023 IR 2022 225 December 22 2022 The Internal Verkko 10 jouluk 2023 nbsp 0183 32 OVERVIEW Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded

Verkko If available a roof replacement tax credit can help defray some of the initial investment The rules about which roofing tax credit is available changes periodically and may be dependent on whether you get a full Verkko If you wait too long to schedule a roof replacement you might miss your opportunity for a tax credit Tax rules can change from year to year Be sure to consult a tax

Download Roof Replacement Tax Credit 2022

More picture related to Roof Replacement Tax Credit 2022

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

https://i.ytimg.com/vi/X1SvVe3_JzA/maxresdefault.jpg

Roof Replacement Tax Credit LeafFilter

https://www.leaffilter.com/app/uploads/2016/08/tax-credit-roof-replacement-1120x0-c-center.webp

Roof Replacement Tax Credit LeafFilter Gutter Protection CA

https://www.leaffilter.ca/app/uploads/2016/08/tax-credit-roof-replacement-in-context-600x314-1-1120x0-c-center.webp

Verkko The tax credit for a new roof for 2022 is a great way to save money on your taxes This credit is available for any new roof that is installed on your home This credit is worth Verkko 18 tammik 2021 nbsp 0183 32 Home Improvement amp Your Taxes January 18 2021 Is a new roof tax deductible It depends A residential roof replacement is not tax deductible because the federal government considers it to

Verkko ENERGY STAR certified metal roofs are eligible If you replace your roof with ENERGY STAR certified products Does not apply to a brand new home Reflective roofs are Verkko 21 jouluk 2023 nbsp 0183 32 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate

11 MMajor Tax Changes For 2022 Pearson Co CPAs

https://www.pearsoncocpa.com/wp-content/uploads/2022/05/Screen-Shot-2022-05-17-at-11.22.53-PM.png

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

https://www.irs.gov/instructions/i5695

Verkko The credit rate for property placed in service in 2022 through 2032 is 30 Energy efficient home improvement credit The nonbusiness energy property credit is now

https://www.irs.gov/credits-deductions/energy-efficient-home...

Verkko 1 tammik 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit

Replacement Windows Tax Credit Window Replacement

11 MMajor Tax Changes For 2022 Pearson Co CPAs

11 MMajor Tax Changes For 2022 Pearson Co CPAs

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Homeowner Questions Is Roof Replacement Tax Deductible

Is Roof Replacement Tax Deductible Tax Benefits Explained

Is Roof Replacement Tax Deductible Tax Benefits Explained

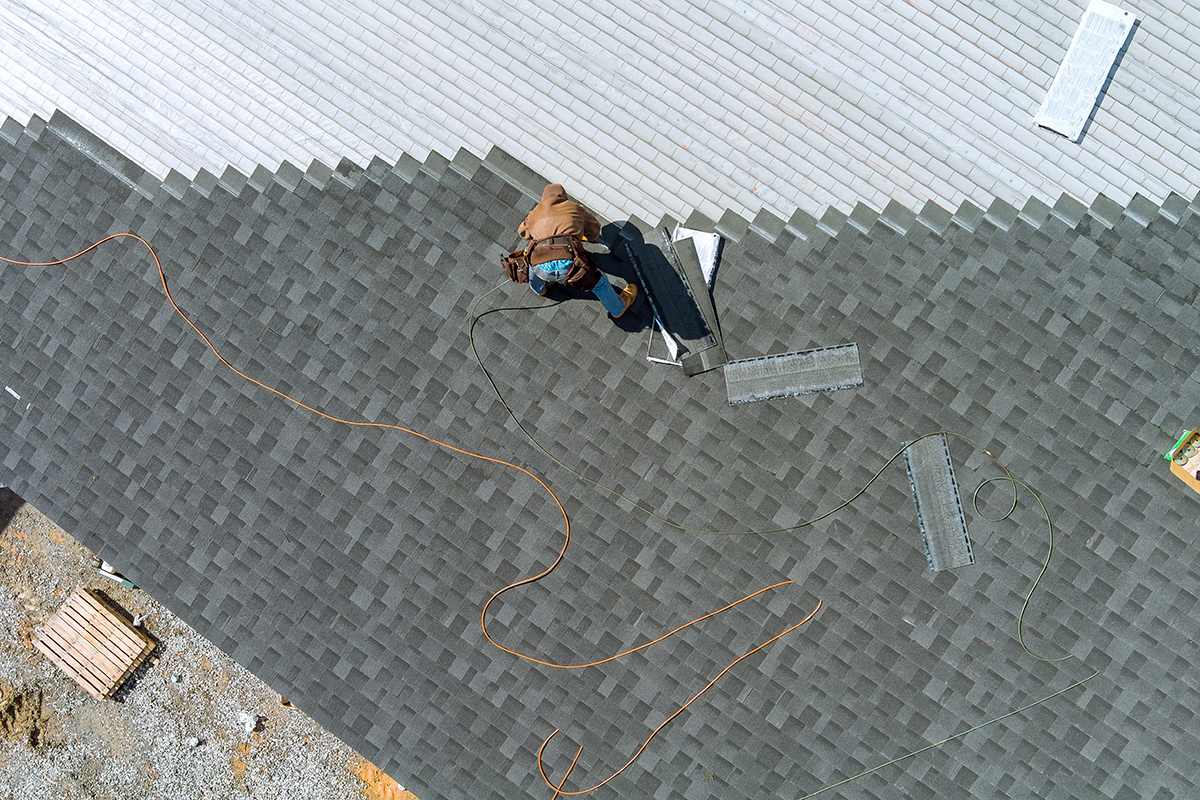

2022 Mo Ptc Tax Credit Fillable Form Fillable Form 2024

New Roof For Solar Panels Encycloall

Free Digital TD1 2024 Form Personal Tax Credits Return

Roof Replacement Tax Credit 2022 - Verkko If available a roof replacement tax credit can help defray some of the initial investment The rules about which roofing tax credit is available changes periodically and may be dependent on whether you get a full