Room Rent Exemption In Income Tax However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption If you

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim Income Tax Department has made PAN card mandatory for HRA Exemption Find out what to do in case your landlord doesn t have PAN

Room Rent Exemption In Income Tax

Room Rent Exemption In Income Tax

https://wp.sqrrl.in/wp-content/uploads/2019/08/FOR-ANAND-3-1024x796.png

HRA Exemption House Rent Exemption U S 10 13A

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2019/01/House-Rent-Exemption-Under-Section-1013A.jpg

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Rent a room relief gives an exemption from income tax on profits of up to 7 500 to individuals who let furnished accommodation in their only or main residence HRA or house rent allowance is a benefit provided by employers to their employees to help the latter cover their accommodation expenses or the cost of renting

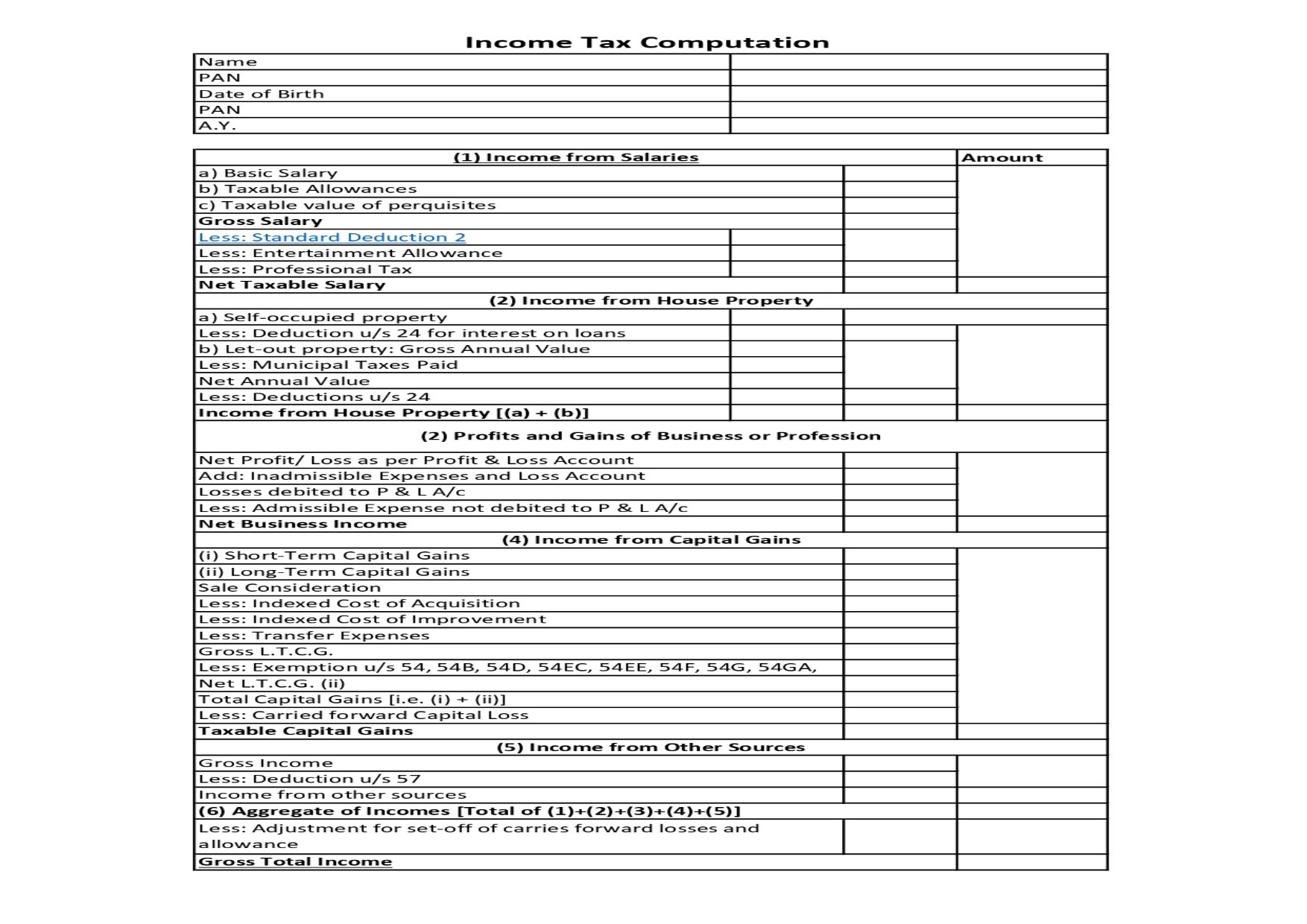

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes This benefit applies to both Key Points Salaried people residing in rental housing are eligible to claim the HRA tax exemption HRA exemption is calculated based on multiple things like the actual rent paid the base pay or salary

Download Room Rent Exemption In Income Tax

More picture related to Room Rent Exemption In Income Tax

CALCULATION OF HOUSE RENT ALLOWANCE Allowance Kids Education Excel

https://i.pinimg.com/originals/cd/bf/52/cdbf5266dd5ee6d50226e5e607a73e23.png

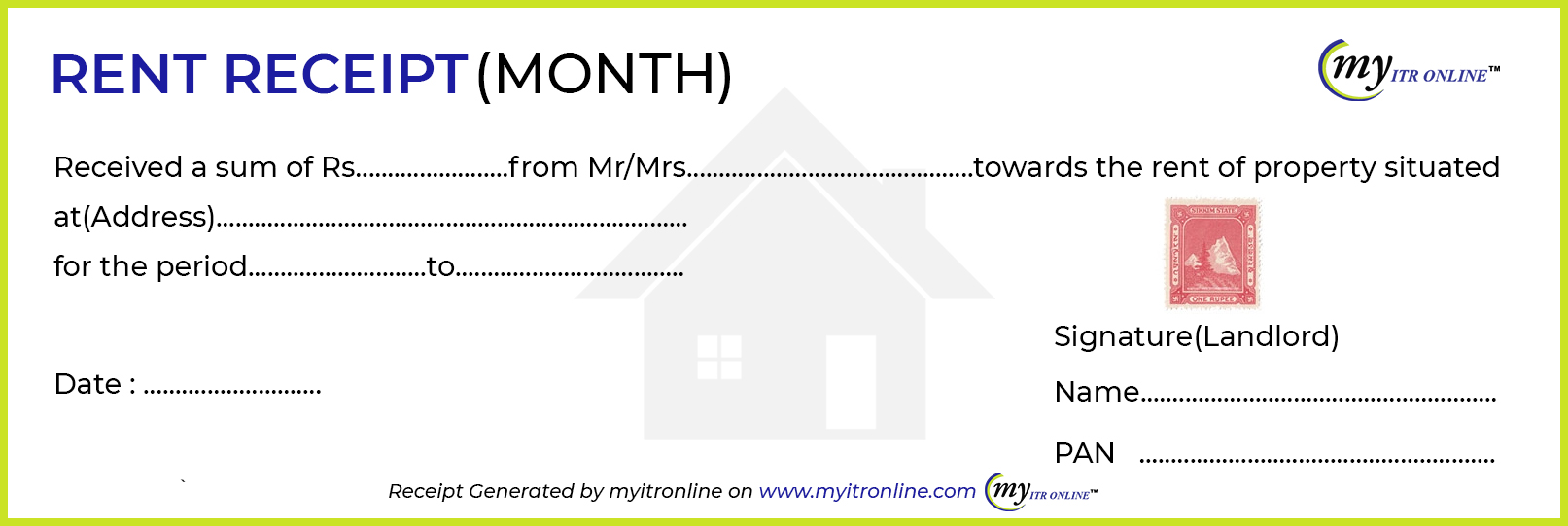

House Rent Receipt Format PDF Download

https://captainsclerk.com/18790bfb/https/34a049/geod.in/wp-content/uploads/2021/07/Receipt-of-House-Rent.jpg

-compressed.jpg)

How To Claim House Rent Allowance Exemption In Income Tax

https://assets-global.website-files.com/637f7c161a14232e2ea8473d/64c5e3202eeddaa057523550_Copy of Blog Thumbnails (2)-compressed.jpg

No HRA is an allowance and is exempt from Salary Income u s 10 13A of the Income Tax Act Can HRA exemption be claimed if living parents A taxpayer can If rent a room income exceeds 7 500 in TaxCalc please follow the steps below In HMRC Forms Mode Go to UK Property page 2 In box 20 Total rents and

The house rent allowance exemption calculator will help determine how much tax you need to pay in a financial year HRA slabs also depend on the city you stay in For example if Subject to certain conditions a part of HRA is exempted under Section 10 13A of the Income tax Act 1961 Amount of HRA tax exemption is deductible from the

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/497/332/497332566/large.png

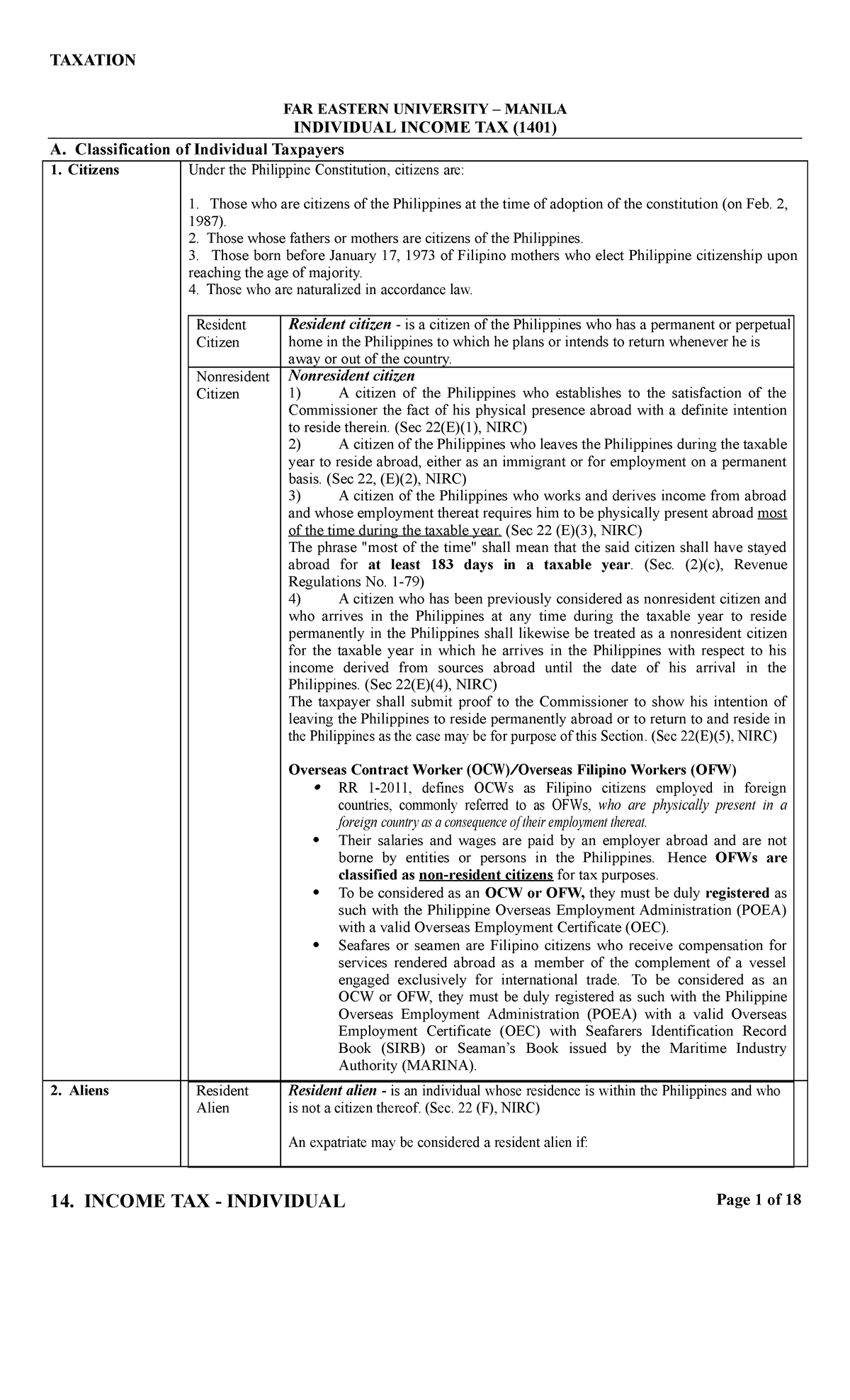

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

https://cleartax.in/s/hra-house-rent-allowa…

However if you live in a rented accommodation you can claim a tax exemption either partially or wholly under Section 10 13A of the Income Tax Act This is popularly known as HRA exemption If you

https://cleartax.in/s/claim-deduction-under...

What is section 80GG If you do not receive HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by you for your own residence you can claim

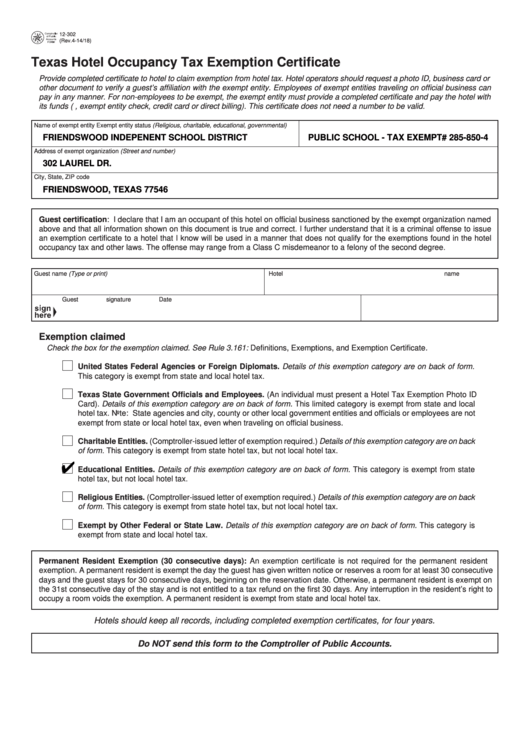

Fillable Texas Hotel Occupancy Tax Exemption Certificate Printable Pdf

Sample Letter Tax Exemption Form Fill Out And Sign Printable PDF

House Rent Allowance Income Tax Act Ideas Of Europedias

Income Tax Computation Format PDF A Comprehensive Guide

House Rent Receipt India

Taxpayers Salaried Class May Get Relief In Income Tax Under New Tax

Taxpayers Salaried Class May Get Relief In Income Tax Under New Tax

A Receipt Form For A House Rent

House Rent Allowance HRA Exemption Rules Its Tax Benefits

The Provisions Of Section 50C Of The Income Tax Act Do Not Apply To

Room Rent Exemption In Income Tax - Our HRA exemption calculator will help you calculate what portion of the HRA you receive from your employer is exempt from tax and how much is taxable If you don t live in a