Rrc Recovery Rebate Credit Web 13 avr 2022 nbsp 0183 32 Topic A Claiming the Recovery Rebate Credit if you aren t required to file a 2020 tax return Topic B Eligibility for claiming a Recovery Rebate Credit on a 2020

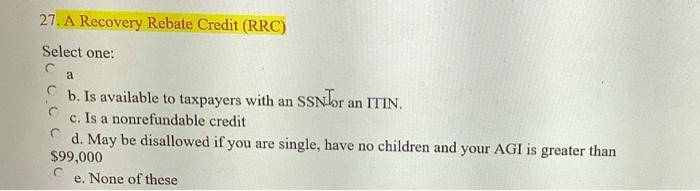

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and Web 2021 Recovery Rebate Credit If you did not receive the full amount of EIP3 before December 31 2021 claim the 2021 Recovery Rebate Credit RRC on your 2021 Form

Rrc Recovery Rebate Credit

Rrc Recovery Rebate Credit

https://media.cheggcdn.com/study/752/75289660-cdd1-4537-bf6c-e686f2968b47/image

Claiming The Recovery Rebate Credit Ona Tax Return IRS Gov rrc PDF

https://imgv2-1-f.scribdassets.com/img/document/572963332/original/10dcefeb3b/1681400610?v=1

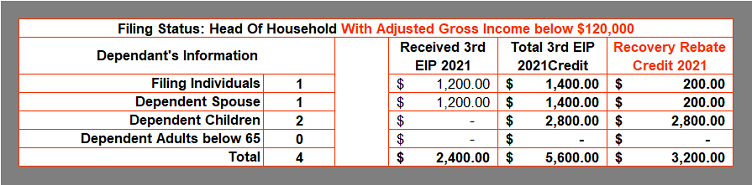

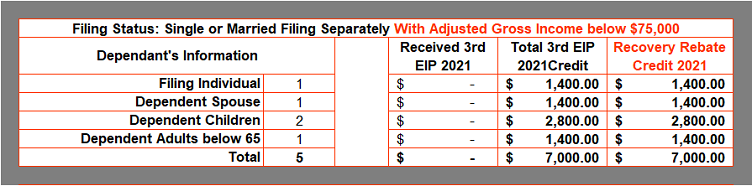

All About Economic Impact Payments EIP Recovery Rebate Credit RRC

https://i.ytimg.com/vi/zUmBXpBoXQ8/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGDkgLCh_MA8=&rs=AOn4CLBlVHoHBALWRtRkh5Ni4h3OtMmdgw

Web 13 janv 2022 nbsp 0183 32 The 2021 Recovery Rebate Credit includes up to an additional 1 400 for each qualifying dependent you claim on your 2021 tax return A qualifying dependent is Web 10 d 233 c 2021 nbsp 0183 32 Also individuals who died prior to January 1 2020 are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return See IRS gov rrc or the

Web The 2020 Recovery Rebate Credit RRC is established under the CARES Act If you didn t receive the full amount of the recovery rebate credit as EIPs you may be able to claim Web 15 avr 2021 nbsp 0183 32 Tax Year 2020 Two EIPs EIP1 and EIP2 were issued to eligible taxpayers during 2020 and early 2021 These EIPs were advanced payments of the Recovery

Download Rrc Recovery Rebate Credit

More picture related to Rrc Recovery Rebate Credit

How To Answer The Recovery Rebate Credit 2020 Answers Recovery Rebates

https://i.pinimg.com/736x/27/ea/7e/27ea7e0c3b8f79acf67e245ad787a706.jpg

10 Recovery Rebate Credit Worksheet Pdf Worksheets Decoomo

https://i2.wp.com/kb.erosupport.com/assets/img_5ffe32d18d56f.png

What If I Did Not Receive Eip Or Rrc Detailed Information

https://stimulusmag.com/wp-content/uploads/2022/12/what-is-the-irs-recovery-rebate-credit.jpg

Web 1 sept 2021 nbsp 0183 32 What is the 2021 Recovery Rebate Credit The Recovery Rebate Credit for 2021 tax returns is a refundable tax credit The amount of credit may vary from Web 27 avr 2023 nbsp 0183 32 59 1 TurboTax Deluxe Learn More On Intuit s Website Federal Filing Fee 54 95 State Filing Fee 39 95 2 TaxSlayer Premium Learn More On TaxSlayer s Website Federal Filing Fee 0 State Filing

Web 17 ao 251 t 2022 nbsp 0183 32 Before claiming a Recovery Rebate Credit you would have had to first determine whether you were due one Generally speaking if you received 1 200 stimulus payments 2 400 if married filing Web 30 d 233 c 2020 nbsp 0183 32 For payments made in 2021 you can claim the Recovery Rebate Credit on your 2021 tax return If you did not receive a first or second stimulus check or received

1040 Recovery Rebate Credit Drake20

https://kb.drakesoftware.com/Site/Uploads/Images/RRC reduction.jpg

The Recovery Rebate Credit Calculator ShauntelRaya Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/05/the-recovery-rebate-credit-calculator-shauntelraya-2.png?resize=768%2C472&ssl=1

https://www.irs.gov/newsroom/2020-recovery-rebate-credit-frequently...

Web 13 avr 2022 nbsp 0183 32 Topic A Claiming the Recovery Rebate Credit if you aren t required to file a 2020 tax return Topic B Eligibility for claiming a Recovery Rebate Credit on a 2020

https://www.irs.gov/newsroom/2021-recovery-rebate-credit-topic-e...

Web 13 janv 2022 nbsp 0183 32 The Recovery Rebate Credit Worksheet in the2021 Form 1040 and Form 1040 SR instructions can also help determine if you are eligible to claim the credit and

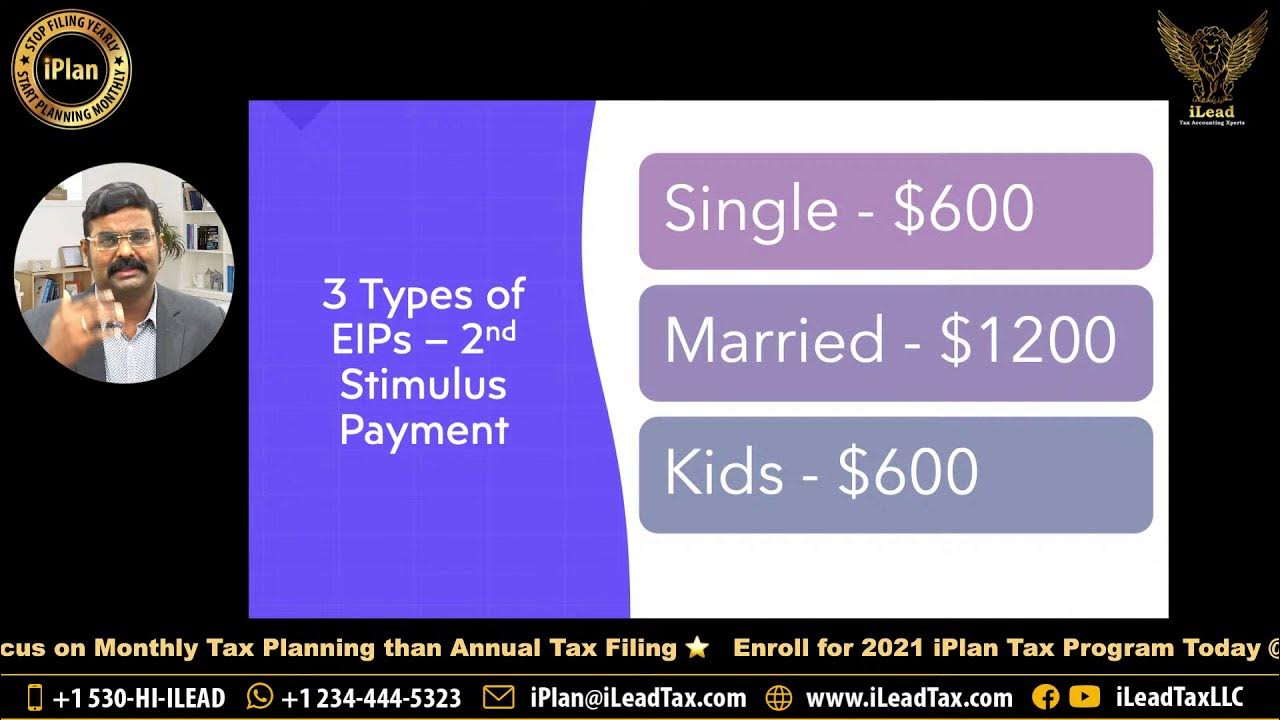

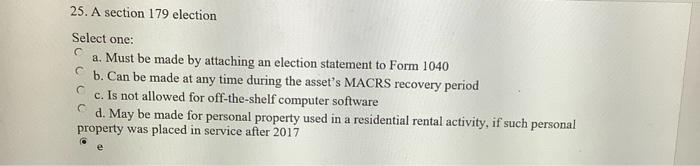

Solved 27 A Recovery Rebate Credit RRC Select One A B Chegg

1040 Recovery Rebate Credit Drake20

Recovery Rebate Credit On 2021 Tax Return Could Help Get Missed COVID

Recovery Rebate Credit Form Printable Rebate Form

Recovery Rebate Credit Worksheet 2020 Ideas 2022

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Mastering The Recovery Rebate Credit Free Printable Worksheet Style

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Calculate Your Recovery Rebate Credit With This Worksheet Pdf Style

Ready To Use Recovery Rebate Credit 2021 Worksheet MSOfficeGeek

Rrc Recovery Rebate Credit - Web 10 d 233 c 2021 nbsp 0183 32 Also individuals who died prior to January 1 2020 are not eligible for the Recovery Rebate Credit claimed on a 2020 tax return See IRS gov rrc or the