Rrsp Contribution And Tax Return 9 rowsTurboTax s free RRSP tax calculator Estimate your 2023 income tax savings

For 2024 the RRSP contribution limit is 31 560 Contributions to an RRSP reduce the amount of income tax individuals must pay each year so the Canada Revenue Agency With an RRSP your contributions may be tax deductible meaning that you can possibly claim a tax deduction for the amount you contribute and potentially reduce taxable

Rrsp Contribution And Tax Return

Rrsp Contribution And Tax Return

http://www.peterwatsoninvestments.com/wp-content/uploads/2017/03/RRSP.jpg

What Is A Group RRSP And How Does It Work Blog Avalon Accounting

https://uploads-ssl.webflow.com/61e09d67f0dcf4552c951a3a/62e1621b537ab7b4f97a56f2_hkSryA9HKu07Z-nZV4n2BbPt2ihL1tH1Q_5muUOseKJpzbS5QJ1wu37KofBZwJPEL2qoQM1WPPi5U0hXTkPtsYjnyenTOrBbnLzQYkktsv5UiEqO3dNelYilf6LLuVw9A1VgIplSsK56dCoPVgMgIA.png

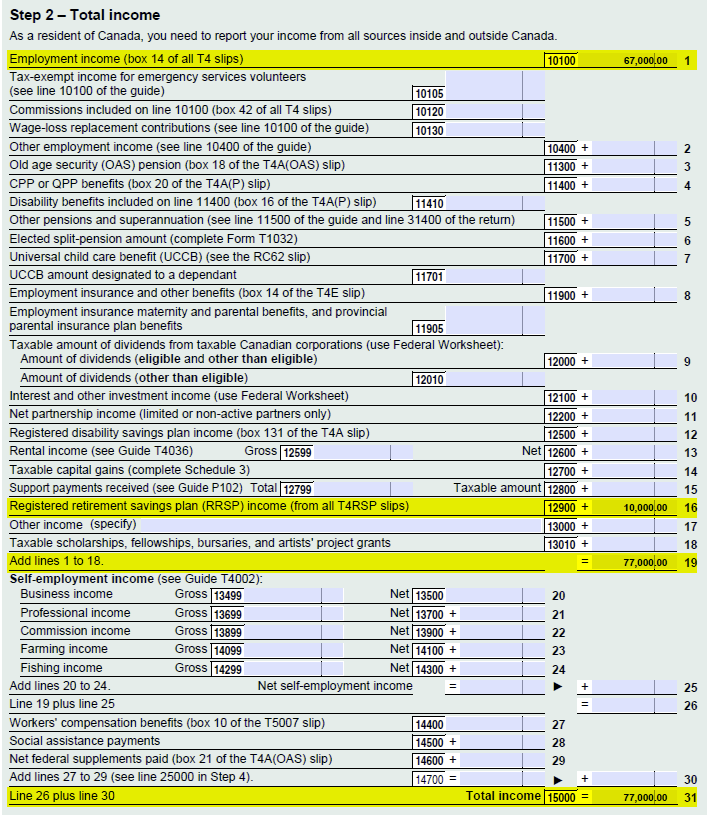

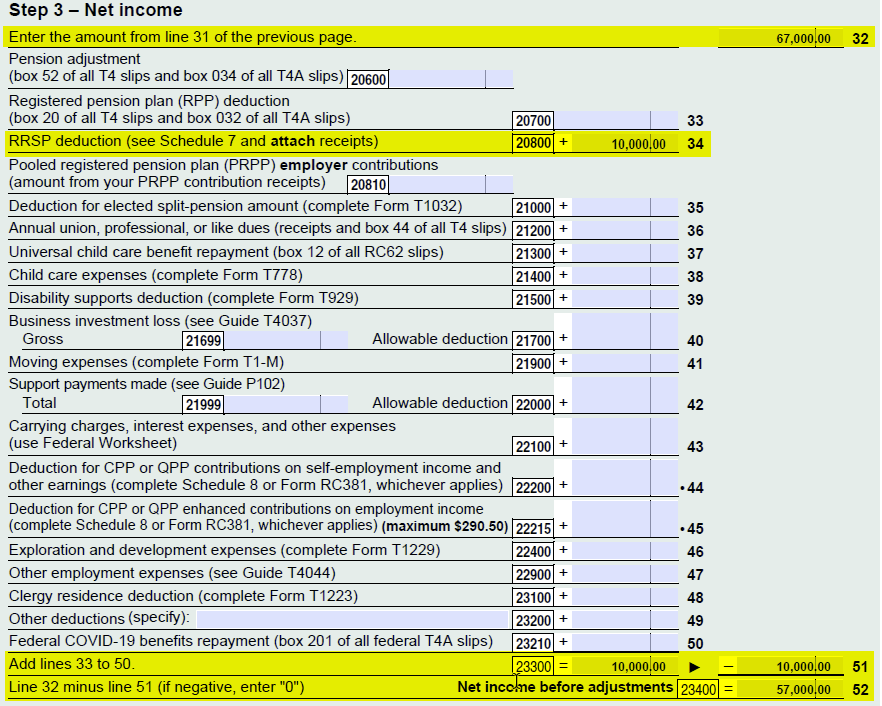

RRSP Withdrawal On Tax Return Example PlanEasy PlanEasy

https://www.planeasy.ca/wp-content/uploads/2022/04/RRSP-Withdrawal-on-Tax-Return-Example-PlanEasy.png

Calculate the tax savings your RRSP contribution generates in each province and territory Reflects known rates as of December 1 2022 Taxable Income RRSP Contribution RRSP contributions are deductible and can reduce your taxes Deduct them on line 20800 of your tax return There is a maximum annual limit on how much you can

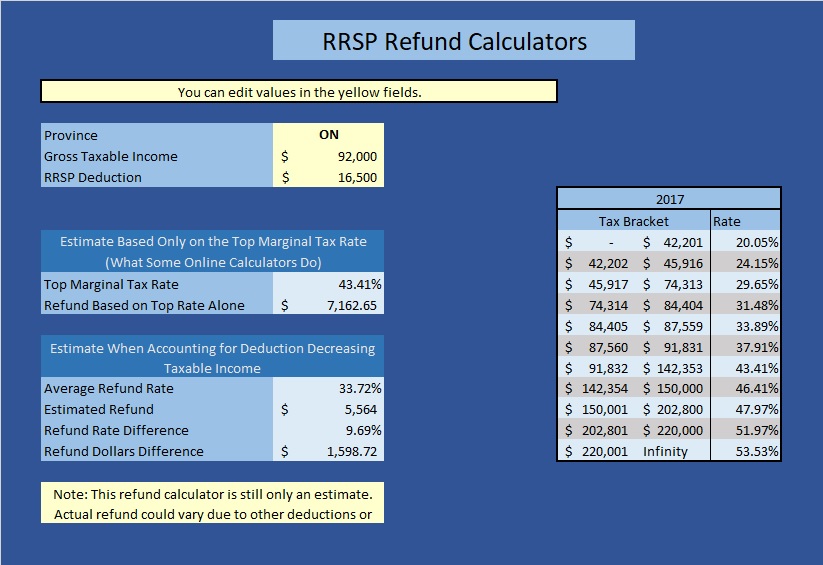

You may get anywhere from 20 per cent to 50 per cent of your RRSP contributions back as an income tax refund based on your marginal tax rate Use the RRSP Tax Refund Our RRSP contribution calculator will let you know how much you can contribute to your RRSP It will also provide an estimate of how much your RRSP will be worth in the

Download Rrsp Contribution And Tax Return

More picture related to Rrsp Contribution And Tax Return

The So Wealth Management Group RRSP Contribution VS Deduction Limit

https://ca.rbcwealthmanagement.com/documents/868682/868696/NOA+example+RSP.jpg/e75bce35-f7cf-41c3-b275-168b7d515f10?t=1647291707920

RRSP Contributions How To Avoid Paying Taxes Qopia Financial

https://qopiafinancial.ca/wp-content/uploads/2022/02/RRSP-spelled-out-1080x675.jpg

Understanding RRSP Contributions Deductions And Over Contributions

https://wellington-altus.ca/wp-content/uploads/2021/02/Picture1.png

RRSP contributions are tax deductible to a specified limit every year normally 18 of the pre tax earnings from the previous calendar year or the limit set Calculate the tax savings your RRSP contribution generates in each province and territory Reflects known rates as of June 15 2021 Taxable Income RRSP Contribution

How does it work You can contribute to your RRSP every year to save for your retirement while lowering your tax payable RRSPs aren t tax free but they are tax Easily calculate the tax return for the current year and discover the maximum authorized contribution to your RRSP Our calculator helps you optimize your tax returns and plan

Tax Changes In Canada For 2023 RRSP TFSA FHSA And More Blog

https://uploads-ssl.webflow.com/61e09d67f0dcf4552c951a3a/63a201c1db6474168259c4db_IbzTCukXNbmjgqx0uf9CgcA9_4x9M47j8Ry_R9Fwa3960_W7MlQrIPqGpQgtyGnc8K0D65wcQMvWufjUsiHhN-MuTZoioZH5yvvkVXCtWqWm9Uwem4UsFIa2By26HYvzi4LC2HCSqq_RbMzQPV26FWu0oKXJAKbCuxAa29FFkjvn4hckssM3jBxj5He-bQ.png

RRSP Contribution Deduction On Tax Return Example PlanEasy PlanEasy

https://www.planeasy.ca/wp-content/uploads/2022/04/RRSP-Contribution-Deduction-on-Tax-Return-Example-PlanEasy.png

https://turbotax.intuit.ca/tax-resources/canada-rrsp-calculator.jsp

9 rowsTurboTax s free RRSP tax calculator Estimate your 2023 income tax savings

https://www.wealthsimple.com/en-ca/learn/rrsp-contribution-deduction-limit

For 2024 the RRSP contribution limit is 31 560 Contributions to an RRSP reduce the amount of income tax individuals must pay each year so the Canada Revenue Agency

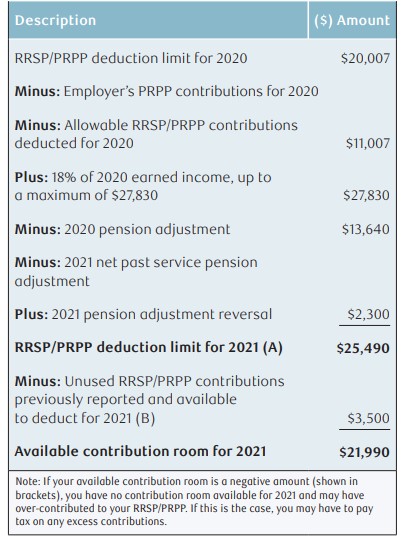

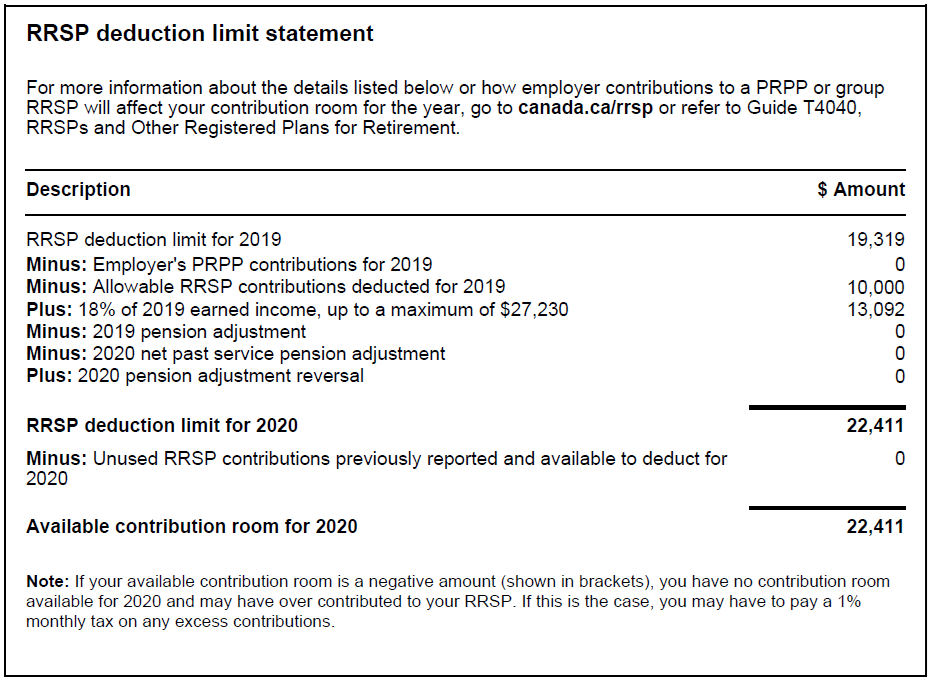

How Much Can I Contribute To My RRSP Common Wealth

Tax Changes In Canada For 2023 RRSP TFSA FHSA And More Blog

How To Increase RESP By Using Tax Return From RRSP Contribution YouTube

Optimizing Your RRSP Contribution Strategy To Build Your Retirement

Calculate RRSP Contribution And Deduction Limit HomeEquity Bank

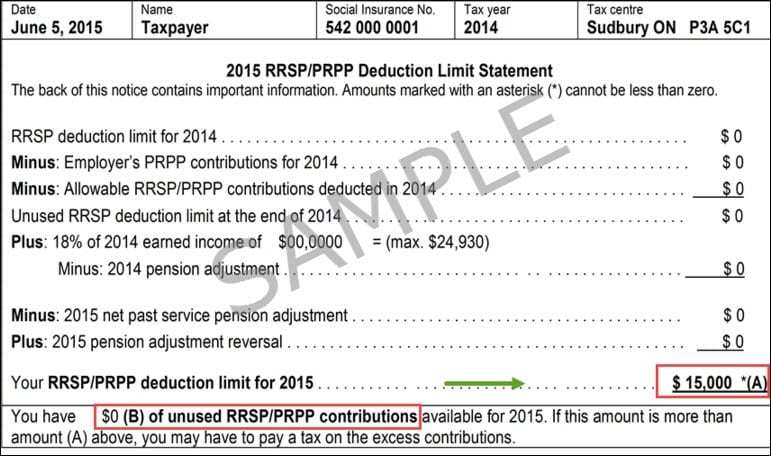

2024 RRSP Guide RRSP Deadlines Contribution Limits And More

2024 RRSP Guide RRSP Deadlines Contribution Limits And More

RRSP Refund Tricks And Traps Physician Finance Canada

What Is My RRSP Contribution Limit In Canada For 2019 2020

5 Smart Ways To Invest Your Tax Refund Techlifetoday

Rrsp Contribution And Tax Return - Calculate the tax savings your RRSP contribution generates in each province and territory Reflects known rates as of December 1 2022 Taxable Income RRSP Contribution