Rs 2500 Rebate In Income Tax Web 28 ao 251 t 2019 nbsp 0183 32 577 6 96 25 20 SI VI Ship 51 84 8 64 20 VMS Indus 29 86

Web 25 ao 251 t 2020 nbsp 0183 32 What is an income tax rebate As per the amendments to Section 87A if your annual taxable income is INR 5 00 000 or lower you can avail the tax rebate The Web 14 sept 2019 nbsp 0183 32 Under Budget 2023 the government announced that any individual opting for the new tax regime and having taxable income up to Rs 7 lakh will be eligible for a

Rs 2500 Rebate In Income Tax

Rs 2500 Rebate In Income Tax

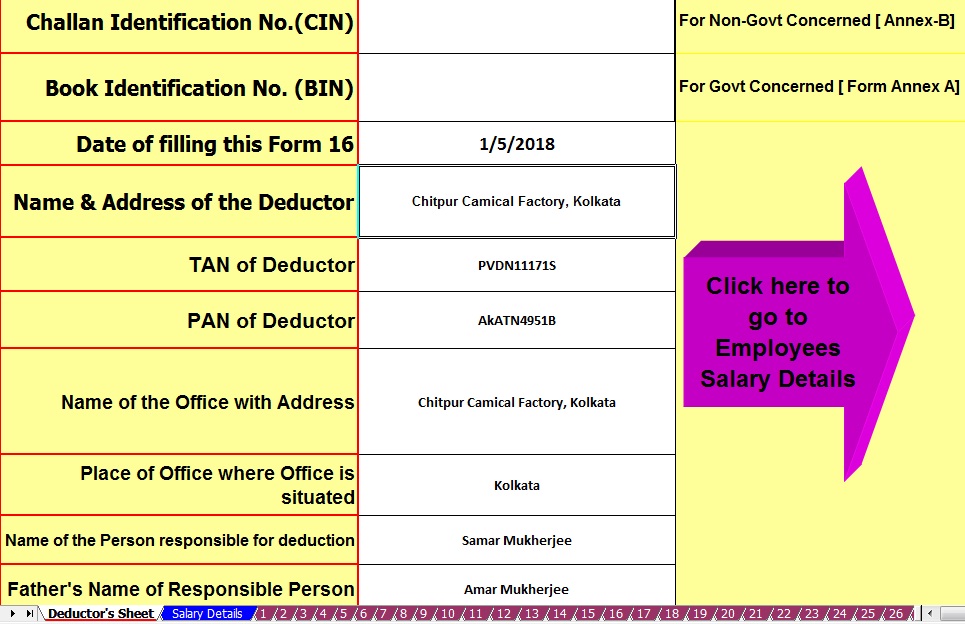

https://tdstax.files.wordpress.com/2018/05/a5511-1002bemployees2bmaster2bof2bform2b162bpart2ba2526b2bpage2b1.jpg

Solved Janice Morgan Age 24 Is Single And Has No Chegg

https://media.cheggcdn.com/media/5f4/5f446443-3876-4bdf-af30-bd53ed6ed3da/phpQaHDkw

Download Automated All In One TDS On Salary For West Bengal Govt

https://2.bp.blogspot.com/-MLBWDjPvYf8/WeK9d3Zq1gI/AAAAAAAAFm4/nn4jY1sdLfIGhTRoRIaLDxhJFsuLJLh4wCLcBGAs/s1600/Tax%2BSlab%2Bfor%2BF.Y.17-18.jpg

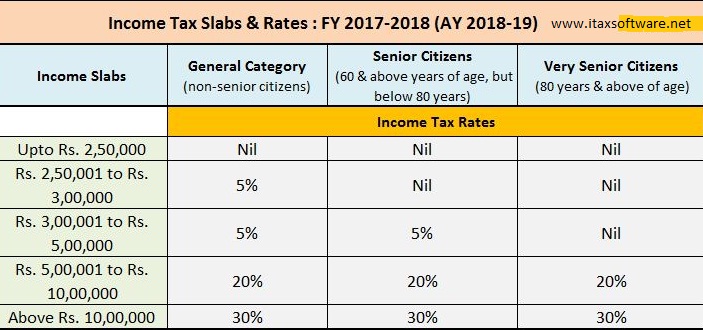

Web 23 juin 2018 nbsp 0183 32 The amount of income tax rebate available under section 87A of the Income Tax Act 1961 will be lower of the following 100 of the Income Tax Liability or Rs Web 28 ao 251 t 2020 nbsp 0183 32 1 Assessee must be a Resident Individual Note Please note that Non Resident are not eligible for tax rebate and this rebate is only available to Individual

Web 3 f 233 vr 2023 nbsp 0183 32 This mean tax relief of Rs 12 500 for those in this bracket In Budget 2023 the rebate under the new tax regime has gone up to Rs 25 000 in line with the hike in eligible income limit Web As Section 87A provides for Income Tax Rebate the taxpayer will first compute the Total Tax Payable and then reduce Rs 2 500 from this Tax payable provided his Total

Download Rs 2500 Rebate In Income Tax

More picture related to Rs 2500 Rebate In Income Tax

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs

https://myinvestmentideas.com/wp-content/uploads/2019/02/Tax-Rebate-under-section-87A-for-Rs-5-Lakhs-Taxable-Income-Illustration-3-rev.jpg

Difference Between Income Tax Exemption Vs Tax Deduction Vs Rebate

https://www.relakhs.com/wp-content/uploads/2019/03/Difference-between-Income-Tax-Exemption-Vs-Tax-Deduction-Income-Tax-Rebate-TDS-Tax-Relief-Tax-Benefit-pic.jpg

Budget 2019 Income Tax Rebate Hiked For Income Up To Rs 5 Lakh Here

https://www.firstpost.com/wp-content/uploads/large_file_plugin/2019/02/1549021404_Salarytable.jpg

Web 2 d 233 c 2017 nbsp 0183 32 As the Taxable Net Eligible Income is Less than Rs 3 50 000 apply Tax Rebate u s 87A upto a Max of Rs 2 500 Hence Tax is Rs 4 000 Rs 2 500 Rs 1 500 Add Education Cess Higher and Secondary Web 1 avr 2017 nbsp 0183 32 Tax rebate is reduced to Rs 2 500 from Rs 5 000 per year for taxpayers with income up to Rs 3 5 lakh earlier Rs 5 lakh Due to the combined effect of change in tax rate and rebate an individual with

Web Claiming Refund under Section 87A of the Income Tax Act 1961 A rebate under this section is allowed to taxpayers being a resident individual whose net total income is Web 30 ao 251 t 2019 nbsp 0183 32 A rebate is allowed under Section 87A of the income tax law for taxpayers having total income up to Rs 3 5 lakh A rebate of Rs 2 500 is allowed against the

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

https://www.coursehero.com/qa/attachment/24027424/

Pol cia Tis c Bal k How To Calculate Rebate Ob iansky V a ok Vlastn k

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/dfa3db5ca69b9aab296dae9f4c821aa6/thumb_1200_1698.png

https://www.financialexpress.com/money/income-tax-income-tax-return...

Web 28 ao 251 t 2019 nbsp 0183 32 577 6 96 25 20 SI VI Ship 51 84 8 64 20 VMS Indus 29 86

https://help.myitreturn.com/hc/en-us/articles/360001631852-What-is...

Web 25 ao 251 t 2020 nbsp 0183 32 What is an income tax rebate As per the amendments to Section 87A if your annual taxable income is INR 5 00 000 or lower you can avail the tax rebate The

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Jenis jenis Pemasukan Objek Pajak Penghasilan Ajaib

Rebate Allowable Under Section 87A Of Income Tax Act TaxGuru

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

What Is Income Tax Limit For Property Tax And Insurance

How To Claim Missing Stimulus Money On Your 2020 Tax Return In 2021

What Is Rebate In Income Tax Nirmala Sitaraman Gives Big Relief To

Rs 2500 Rebate In Income Tax - Web 23 juin 2018 nbsp 0183 32 The amount of income tax rebate available under section 87A of the Income Tax Act 1961 will be lower of the following 100 of the Income Tax Liability or Rs