Rules Of Income Tax Deduction From Salary Find out the income tax basics for salaried individuals on income from salary how to save income tax retirement benefits take home salary from CTC etc

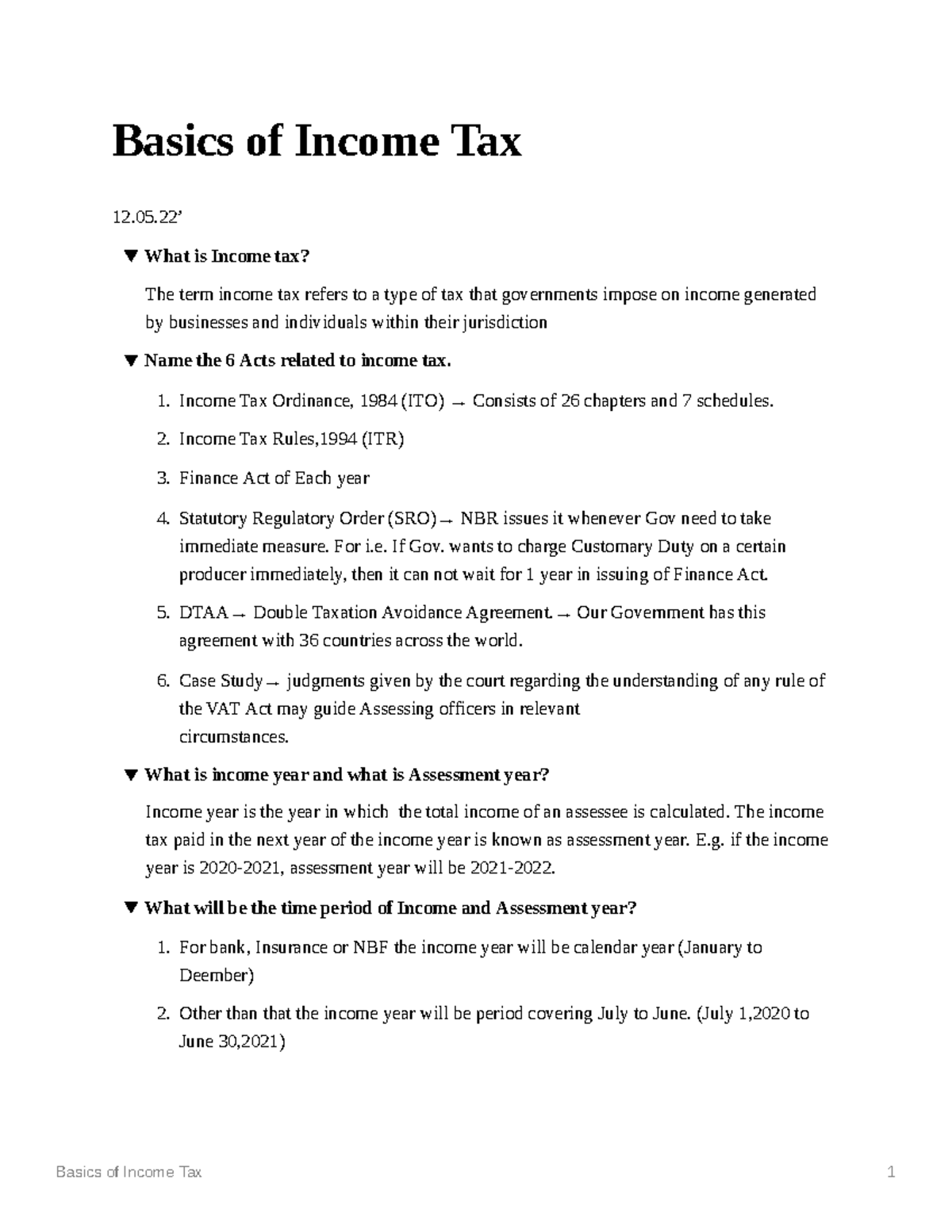

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for investments section 80D for medical expenses section 24 for home loan interest and section 80E for education loan Income tax Act allows three deductions from the salary income i e Standard Deduction Deduction for Entertainment Allowance and Deduction for Professional Tax Standard Deduction is allowed to every employee whose income is taxable under the head salary

Rules Of Income Tax Deduction From Salary

Rules Of Income Tax Deduction From Salary

https://i.pinimg.com/736x/44/ae/9c/44ae9ce35dc58909cb61b8d410ca02dd.jpg

How Does Tax Deduction Work In India Tax Walls

https://img.etimg.com/photo/msid-62914500/resident_gti_25l_salary-std-ded.jpg

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

You can claim a standard deduction of Rs 50 000 from your gross salary income to calculate your net salary income How much is the standard deduction in income tax As per the Income Tax Rules you can claim a standard deduction of Rs 50 000 under the old tax regime and Rs 75 000 under the new tax regime How to Calculate Income Tax on Salary Generally tax is calculated by multiplying the applicable tax rate with the taxable income Though it seems simple it consists of several steps including calculating gross salary calculating deductions and exemptions calculating tax payable deducting tax already paid etc

Low income Americans pay less in taxes meaning tax cuts do not benefit them as much as they do high earners Another wild card is how she would approach the state and local tax deduction In this comprehensive guide we will delve into the concepts of income tax on salary income and explore various deductions allowed under the Indian tax laws Additionally we will provide illustrative examples to help you grasp the practical aspects of income tax and deductions

Download Rules Of Income Tax Deduction From Salary

More picture related to Rules Of Income Tax Deduction From Salary

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

Everything To Know About Section 194Q Of The Income Tax Act

https://cms.ezylegal.in/wp-content/uploads/2022/10/section-194q-of-Income-Tax-.webp

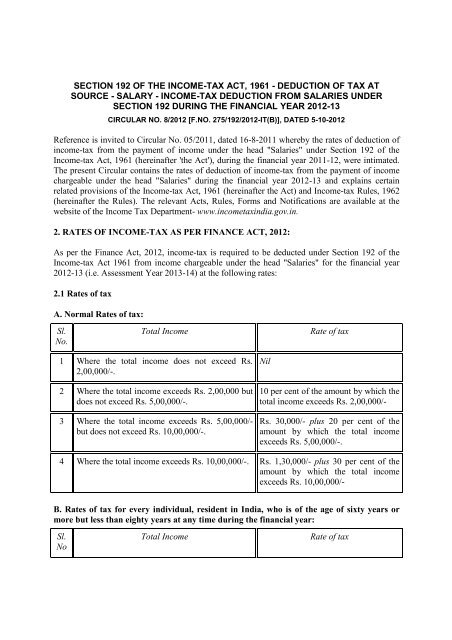

Income tax Deduction From Salaries Under Section

https://img.yumpu.com/40816774/1/500x640/income-tax-deduction-from-salaries-under-section.jpg

Under current rules personal pensions can be passed to your beneficiaries free of tax if you die before the age of 75 If you die after 75 beneficiaries will pay income tax on money withdrawn at TDS or Tax Deduction at Source is the sum employers deduct from employees salaries and transfer to the government As per the Income Tax Act employers must deduct TDS on salary income

[desc-10] [desc-11]

Income Tax Deduction

http://www.trutax.in/blog/wp-content/uploads/2018/02/income-tax-deduction.png

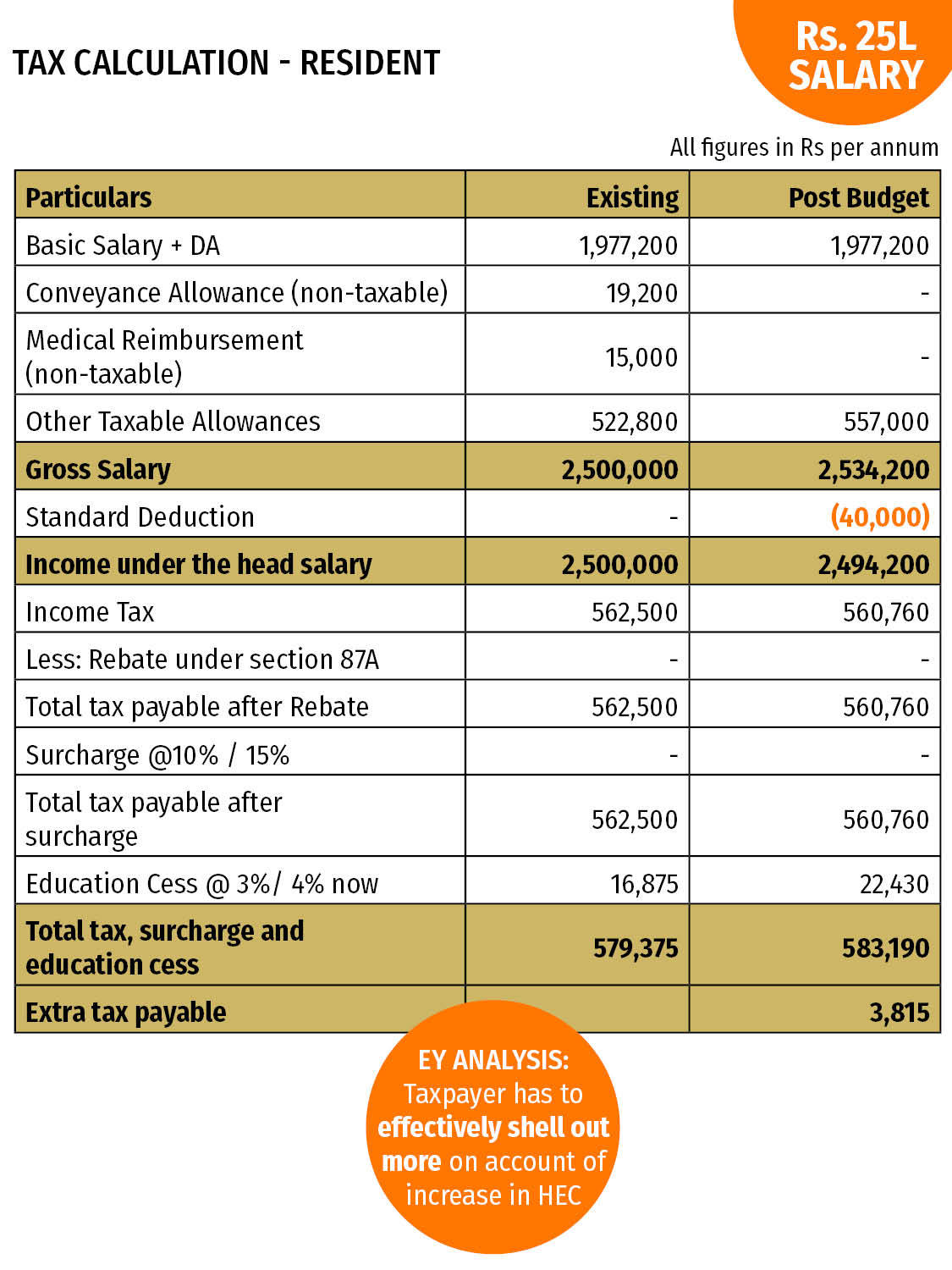

Basics Of Income Tax Basics Of Income Tax 12 What Is Income Tax The

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/fefc6351c3007eb5e2efad420f14b0e7/thumb_1200_1553.png

https://cleartax.in › salary-income

Find out the income tax basics for salaried individuals on income from salary how to save income tax retirement benefits take home salary from CTC etc

https://cleartax.in › income-tax-allowances-and-deductions

Salaried employees have significant income tax deduction opportunities Major deductions include HRA standard deduction LTA books and periodicals and gratuity Other savings avenues include section 80C for investments section 80D for medical expenses section 24 for home loan interest and section 80E for education loan

Understanding Income Tax Dramming News

Income Tax Deduction

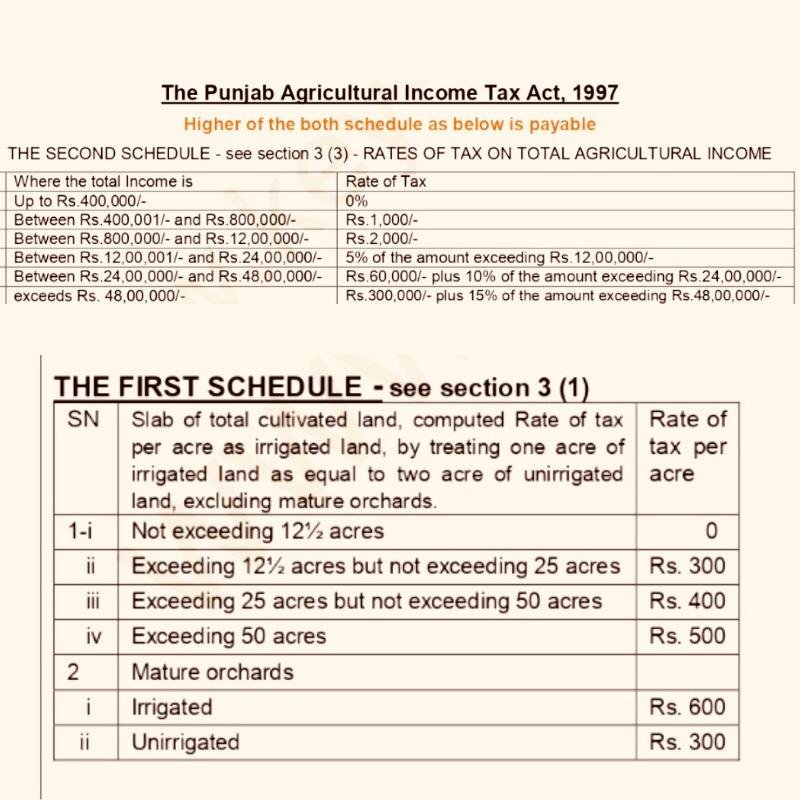

Tax On Agricultural Income In Pakistan 2022 Easy Latest Tax

How Is Tax Deducted From Salary In Ghana TAX

Decision To Increase Income Tax Deduction To Rs 5 Lakh Kalvi Kalanjiyam

Petiwala Books Income Tax Ordinance 2001 With Income Tax Rules 2002

Petiwala Books Income Tax Ordinance 2001 With Income Tax Rules 2002

Salary Reduction Letter 2024 Company Salaries

China s Income Tax Deduction Goes Digital CGTN

Number Of People Paying Income Tax Surges By 4 5m Under Tories

Rules Of Income Tax Deduction From Salary - [desc-12]