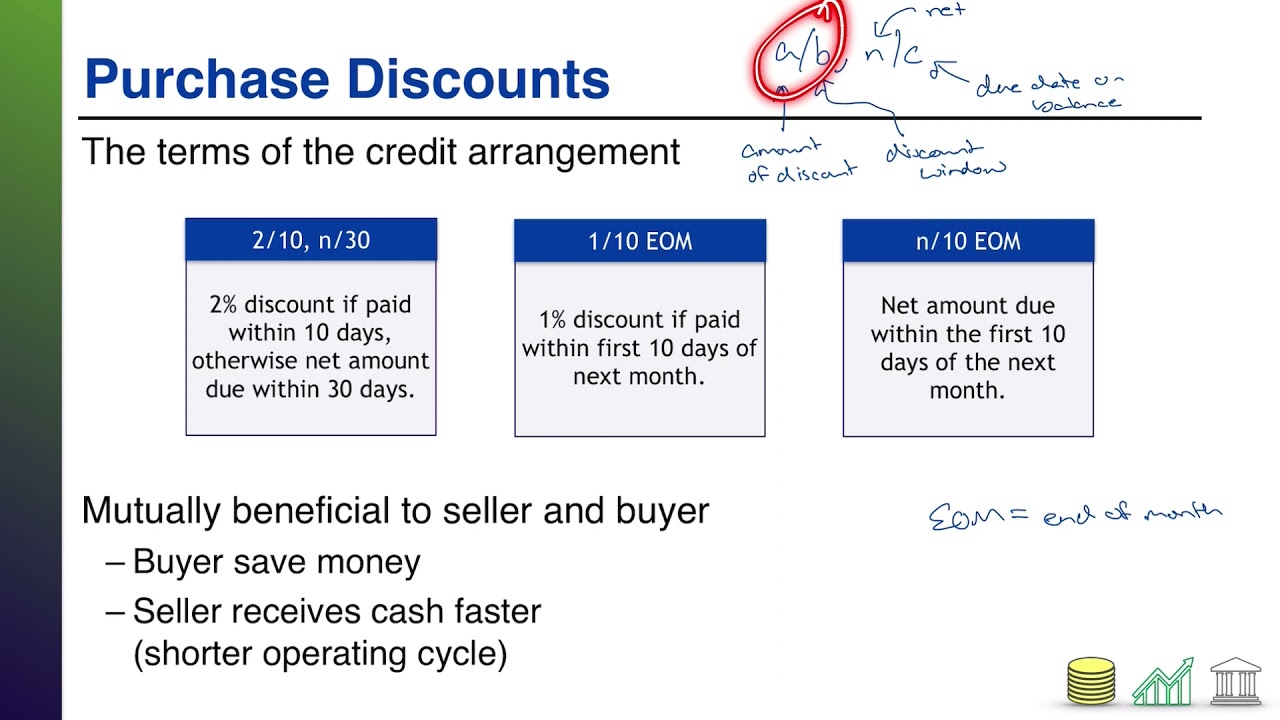

Sales Discount Accounting Entry A sales discount is given by a business to encourage early settlement of sales invoices by customers The discount is a percentage

How to Account for Sales Discounts An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice Sales discounts are a seller s deductions from the invoice amount of goods or services provided They are usually given to customers as an incentive for early payment or to

Sales Discount Accounting Entry

Sales Discount Accounting Entry

https://learn.financestrategists.com/wp-content/uploads/2018/11/Cash-discounts-journal-entry.png

What Does Discounts Received Allowed Mean Online Accounting

https://online-accounting.net/wp-content/uploads/2020/10/image-cx31DeZ9YgpioMrS.png

Purchase Discounts In A Perpetual Inventory System YouTube

https://i.ytimg.com/vi/Rwi7734IHPo/maxresdefault.jpg

A sales discount is a reduction taken by a customer from the invoiced price of goods or services in exchange for early payment to the seller The seller usually In this article we cover the accounting for sales discounts This includes the journal entry for sales discounts with or without allowance for sales discount account

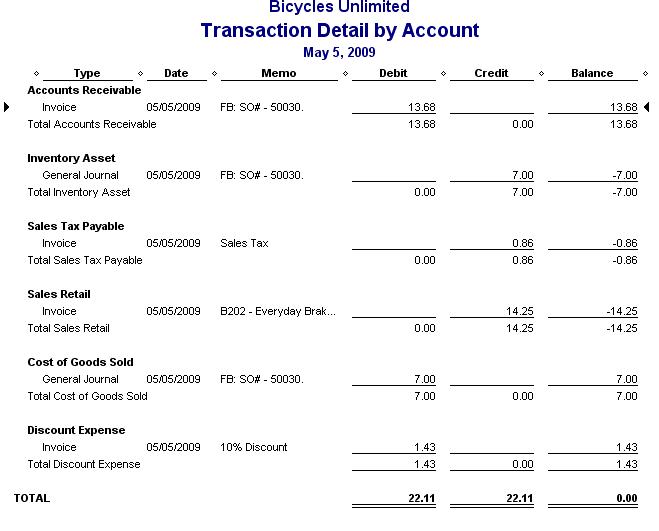

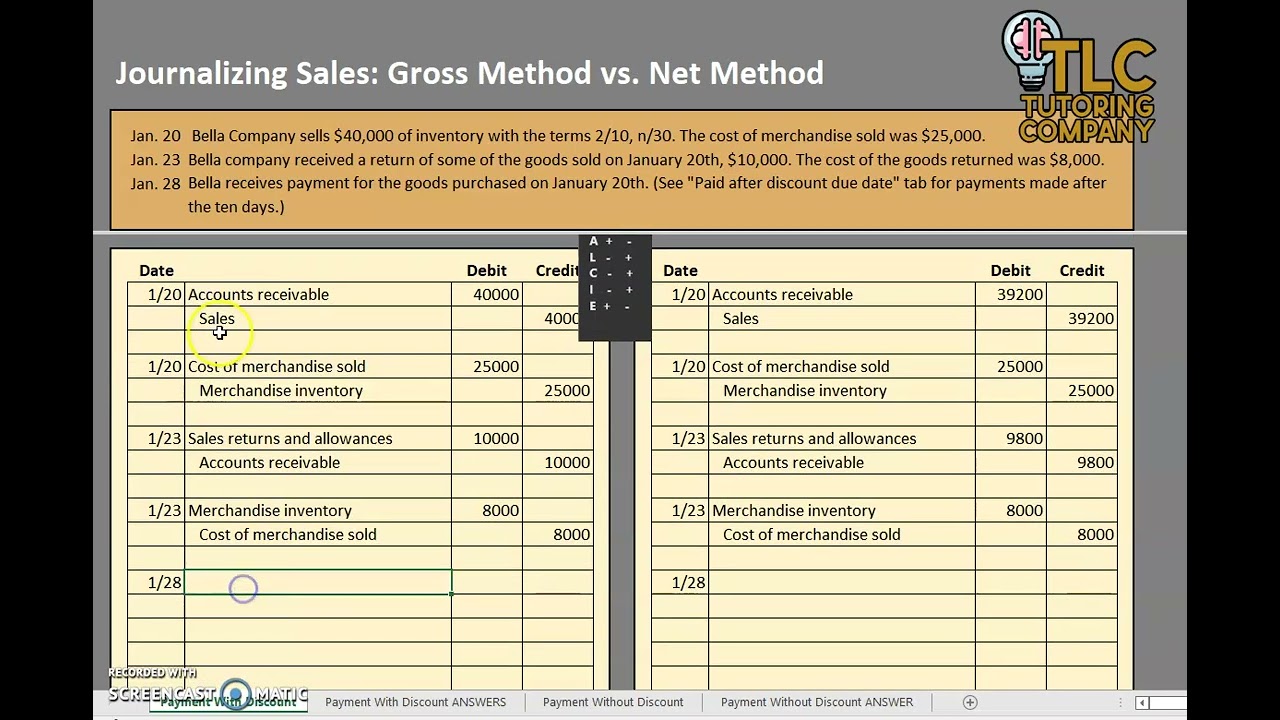

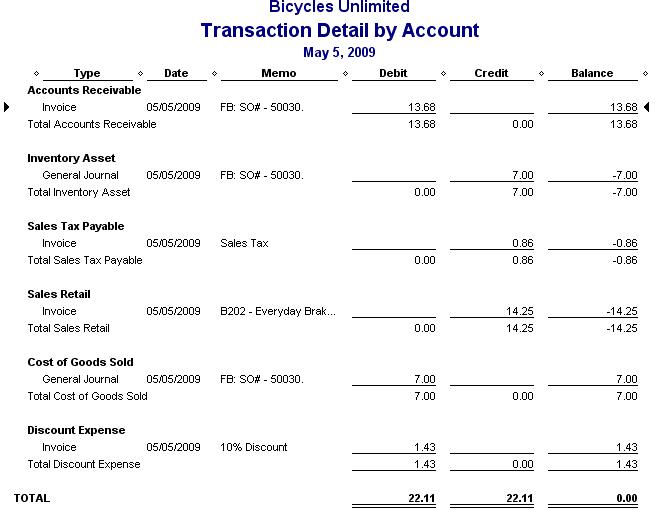

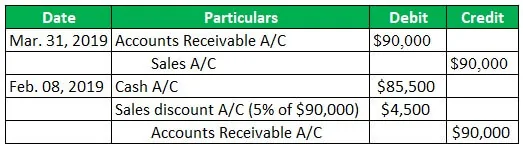

The journal entry to record a sales discount typically involves two accounts Sales Discounts and Accounts Receivable When a customer takes advantage of a The best practice to record a sales entry is debiting the accounts receivable with full invoice and credit the revenue account with the same amount For example XYZ a

Download Sales Discount Accounting Entry

More picture related to Sales Discount Accounting Entry

Accounting For Sales Discounts Gross And Net Methods Under IFRS And

https://i.ytimg.com/vi/qwKLX5sZ-sM/maxresdefault.jpg

Gross Method Vs Net Method Recording Journal Entries For Sales YouTube

https://i.ytimg.com/vi/gol9h7T2xdY/maxresdefault.jpg

Accounting For Sales Discounts

https://www.greenback.com/assets/f/blogs/accounting-for-discounts/hdr.png

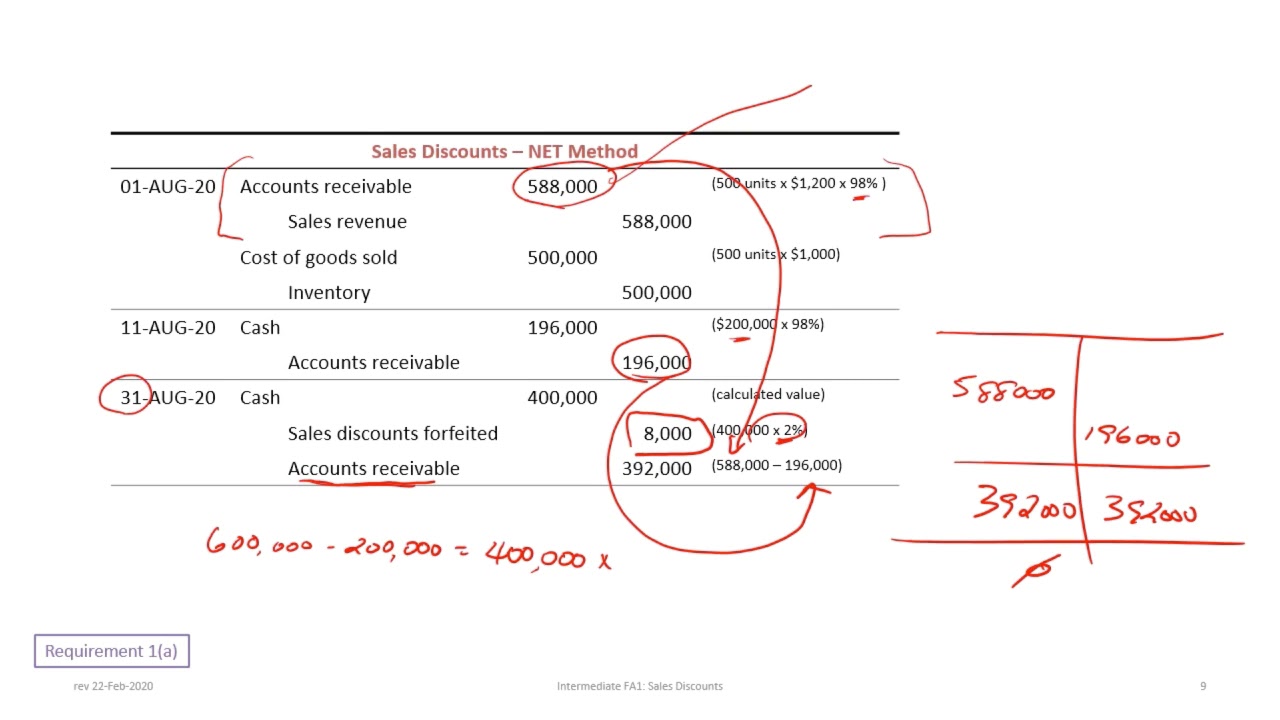

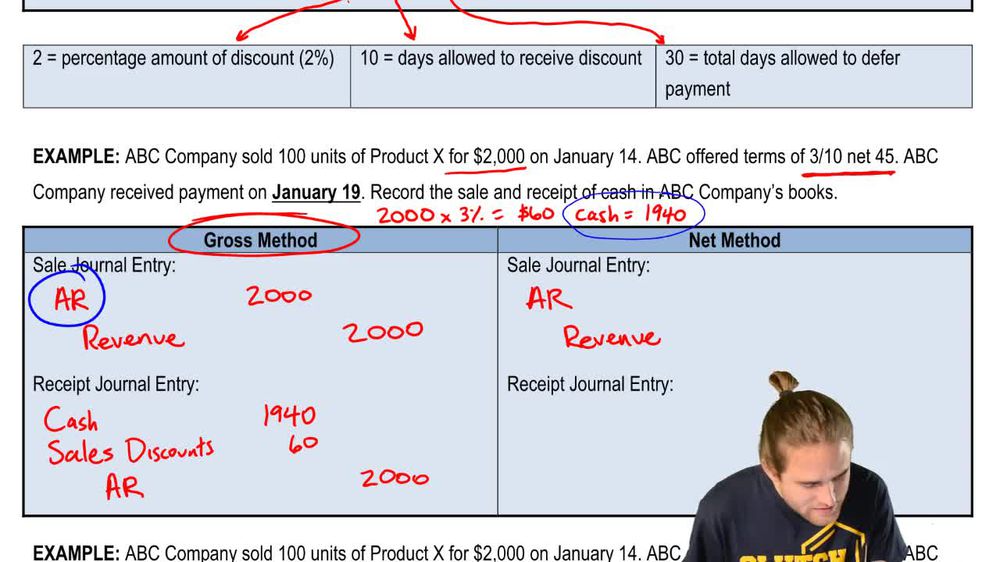

Sales discounts are cash reductions offered to the customer in an attempt to ensure that they make prompt payments on their trade accounts Sales discounts appear as a reduction in the price for a There are two methods an entity can use when accounting for discounts The first is to create a contra revenue account and the second is to simply net the discount

The company can make sale discount journal entry by debiting cash account and sales discounts account and crediting accounts receivable Sales discounts is a contra Sales Discount Journal Entry Explained Accounting Documents What is a Sales Discount Sales Discount is referred to as a discount that is extended to the customer in

Cash Discounts Gross Vs Net YouTube

https://i.ytimg.com/vi/3Xt47xHF2oE/maxresdefault.jpg

Discount Allowed Double Entry

https://keydifferences.com/wp-content/uploads/2014/12/journal-entry1.jpg

https://www.double-entry-bookkeeping.c…

A sales discount is given by a business to encourage early settlement of sales invoices by customers The discount is a percentage

https://www.accountingtools.com/articles/what-is...

How to Account for Sales Discounts An example of a sales discount is for the buyer to take a 1 discount in exchange for paying within 10 days of the invoice

Net Sales Sales Discount Forfeited Gross Method Channels For Pearson

Cash Discounts Gross Vs Net YouTube

Accounting For Sales Discounts Examples Journal Entries

Accounting For Sales Return Journal Entry Example Accountinguide

Purchases With Discount gross Principlesofaccounting

Returns Outwards Finance Strategists

Returns Outwards Finance Strategists

What Is The Net Method Of Recording Purchase Discounts

Cash Discounts Net Method Of Accounting YouTube

Asiento De Diario Para Descuento Permitido Y Recibido Barcelona Geeks

Sales Discount Accounting Entry - Learn how to effectively manage and record sales discounts in accounting to optimize financial reporting and business performance